Dollar is trying to recover in early US session but upside is limited so far. Overall market sentiments stabilized as US stocks might have regained footing for another take on new records. Also, traders are turning a little bit more cautious ahead of FOMC statement and press conference. Overall picture for the week is unchanged for now, as European majors and Yen are the better performers while commodity currencies are the weaker ones.

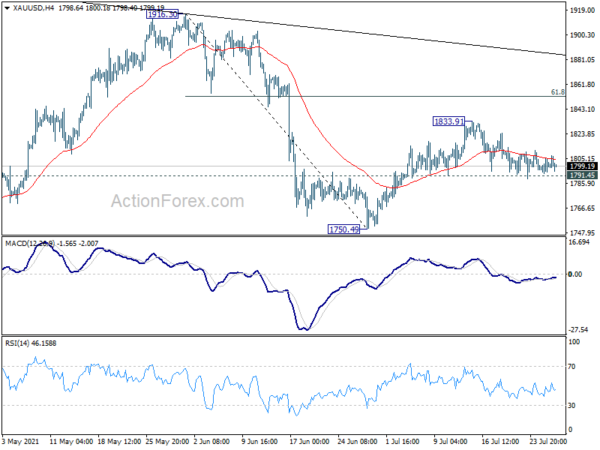

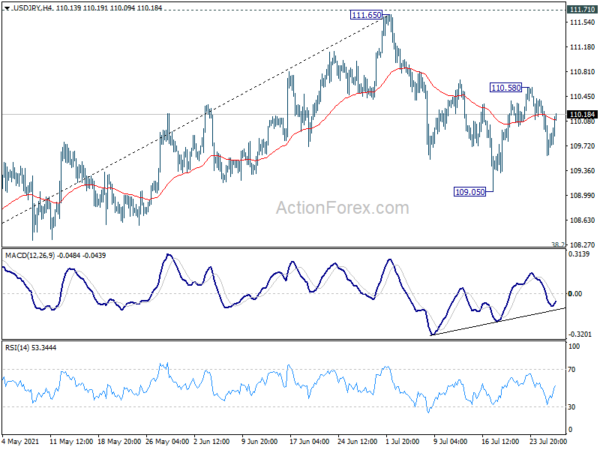

Technically, we’d pay much attention to Dollar pairs’ development to gauge the reaction to FOMC. For Dollar weakness, GBP/USD will need to break through 1.3908 resistance while EUR/USD should break 1.1880 resistance too. As for Dollar strength, USD/JPY will need to break 110.58 resistance while EUR/USD should break 1.1751 low. Gold is also a gauge as it needs to break through 1791.45 support firmly to indicate Dollar buying.

In Europe, at the time of writing, FTSE is up 0.11%. DAX is up 0.20%. CAC is up 0.76%. Germany 10-year yield is up 0.0005 at -0.439. Earlier in Asia, Nikkei dropped -1.39%. Hong Kong HSI rose 1.54%. China Shanghai SSE dropped -0.58%. Singapore Strait Times rose 0.09%. Japan 10-year JGB yield dropped -0.0039 to 0.016.

Fed to hold the cards of tapering to chest

FOMC is widely expected to keep monetary policy unchanged today. Without new economic projections, the focus will be on the policy statement and press conference. In particular, Fed Chari Jerome Powell would likely just reiterate that the Committee is in talks of QE tapering. Yet, it is premature to make any conclusion.

Also, more information about policy changes will be revealed at the Jackson Hole symposium in late August, followed by the September meeting. The formal announcement of tapering could indeed be made in December.

Some suggested readings on Fed:

- FOMC Preview – Policy Stance to Stay Intact Despite Surging Inflation

- FOMC Meeting Preview: Taper So Close, Yet So Far Away

- Fed Meeting: Slowly Getting the Taper Ball Rolling

- July Flashlight for the FOMC Blackout Period

US goods trade deficit widened to USD -91.2B in Jun

US International goods trade deficit was at USD -91.2B in June, widened from USD -88.2B, larger than expectation of USD -88.0B. Export of goods rose USD 0.5B to USD 145.5B. Import of goods rose USD 3.5B to USD 236.7B. Wholesale inventories rose 0.8% mom to USD 715B.

Canada CPI slowed to 3.1% yoy in Jun

Canada CPI slowed to 3.1% yoy in June, down from May’s 3.6% yoy, below expectation of 3.5% yoy. Excluding gasoline, CPI rose 2.2% yoy. CPI common dropped to 1.7% yoy, down from 1.8% yoy, below expectation of 1.9% yoy. CPI median was unchanged at 2.4% yoy, above expectation of 2.3% yoy. CPI trimmed slowed to 2.6% yoy, down from 2.7% yoy, matched expectations.

Germany Gfk consumer sentiment unchanged at -0.3, slowing vaccinations limit improvement

Germany GFk consumer sentiment for August was unchanged at -0.3. In July, economic expectations dropped from 58.4 to 54.6. Income expectations dropped from 34.1 to 29.0. Propensity to buy rose from 13.4 to 14.8. .

Rolf Bürkl, a GfK consumer expert commented on this observation: “The phase where the decrease of COVID-19 incidence of infection has come to an end and those figures are again on the rise. In addition, the momentum for vaccination has recently slowed down considerably, despite there being sufficient quantities of the vaccine available. This is currently preventing any further significant increase as it pertains to consumer sentiment.”

Also released, Swiss ZEW expectation dropped to 42.8 in July, down from 51.3.

BoJ opinions: Important not to tighten prematurely

In the Summary of Opinions of July 15-16 meeting, BoJ noted that it should “continue to support financing, mainly of firms, and maintain stability in financial markets by conducting monetary easing through the three measures”

Even though core CPI is likely to increase on the back of rise in commodity prices, there is “a long way to go” to achieve target in a stable manner. Hence, it is “important not to tighten monetary policy prematurely”. Also, the “deflationary mindset is strongly entrenched in Japan”.

Australia CPI rose 0.8% qoq, 3.8% yoy in Q2

Australia CPI rose 0.8% in Q2, slightly above expectation of 0.7% qoq. Annual rate accelerated to 3.8% yoy, up from 1.1% yoy, matched expectations. RBA trimmed mean CPI came in at 0.5% qoq, 1.6% yoy. RBA weighted mean CPI was at 0.5% qoq, 1.7% yoy.

Head of Prices Statistics at the ABS, Michelle Marquardt said: “Rising fuel prices accounted for much of the increase in the June quarter CPI, with prices surpassing pre-pandemic levels”.

“The annual CPI movement was significantly influenced by COVID-19 related price changes from this time last year… These ‘base effects’ led to a sharp increase in the annual CPI movement”, she added. “In situations such as this, it is useful to consider underlying inflation measures such as the trimmed mean, which are designed to remove large, one-off price impacts”.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.47; (P) 109.93; (R1) 110.28; More…

Intraday bias in USD/JPY is turned neutral again with today’s recovery. On the upside, break of 110.58 will resume the rebound from 109.05, for retesting 111.65 high. On the downside, break of 109.05 will resume the fall from 111.65 to 38.2% retracement of 102.58 to 111.65 at 108.18.

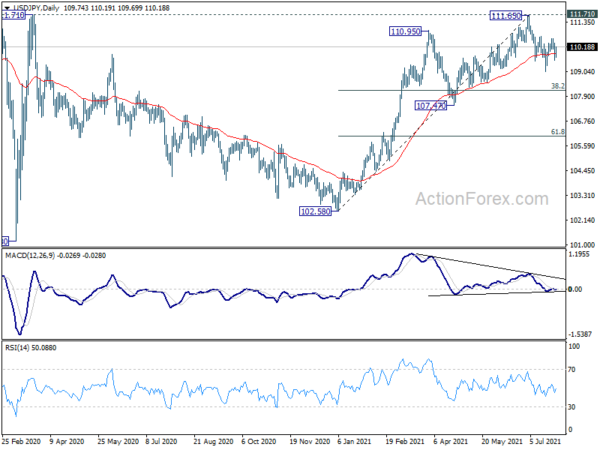

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. The pattern from 101.18 could still extend with another falling leg. Sustained trading below 55 day EMA will bring deeper fall to 107.47 support and below. For now, outlook won’t turn bullish as long as 111.71 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Shop Price Index Y/Y Jun | -1.20% | -0.70% | ||

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 01:30 | AUD | CPI Q/Q Q2 | 0.80% | 0.70% | 0.60% | |

| 01:30 | AUD | CPI Y/Y Q2 | 3.80% | 3.80% | 1.10% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Q/Q Q2 | 0.50% | 0.50% | 0.30% | 0.40% |

| 01:30 | AUD | RBA Trimmed Mean CPI Y/Y Q2 | 1.60% | 1.60% | 1.10% | |

| 06:00 | EUR | Germany Gfk Consumer Confidence Aug | -0.3 | 0.9 | -0.3 | |

| 08:00 | CHF | ZEW Expectations Jul | 42.8 | 51.3 | ||

| 12:30 | USD | Goods Trade Balance (USD) Jun P | -91.2B | -88.0B | -88.1B | |

| 12:30 | USD | Wholesale Inventories Jun P | 0.80% | 1.20% | 1.30% | |

| 12:30 | CAD | CPI M/M Jun | 0.30% | 0.40% | 0.50% | |

| 12:30 | CAD | CPI Y/Y Jun | 3.10% | 3.50% | 3.60% | |

| 12:30 | CAD | CPI Common Y/Y Jun | 1.70% | 1.90% | 1.80% | |

| 12:30 | CAD | CPI Median Y/Y Jun | 2.40% | 2.30% | 2.40% | |

| 12:30 | CAD | CPI Trimmed Y/Y Jun | 2.60% | 2.60% | 2.70% | |

| 14:30 | USD | Crude Oil Inventories | -2.6M | 2.1M | ||

| 18:00 | USD | Fed Rate Decision | 0.25% | 0.25% | ||

| 18:30 | USD | FOMC Press Conference |