Sterling rises broadly today despite dovish comments from a BoE policymaker. Sentiment towards the Pound is likely support by declining trend in delta variant infections. Other European majors are also firm together with Yen. On the other hand. Dollar is currently the weakest one, followed by commodity currencies. Traders are turning more cautious on the greenback ahead of FOMC meeting later in the week. Aussie and Kiwi are weighed down by heavy selloff in China stocks.

Technically, GBP/JPY’s rebound from 148.43 resumed after brief retreat and it’s heading back to 153.46 resistance. Similarly GBP/USD’s rebound has resumed and could be heading back to 1.3908 resistance. Break there will argue that whole decline from 1.4248 has completed at 1.3570 and pave the way to retest 1.4248 high. We’ll see if Sterling could sustain current upside momentum.

In Europe, at the time of writing, FTSE is down -0.03%. DAX is down -0.23%. CAC is up 0.07%. Germany 10-year yield is up 0.004 at -0.414. Earlier in Asia, Nikkei rose 1.04%. Hong Kong HSI dropped -4.13%. China Shanghai SSE dropped -2.34%> Singapore Strait Times dropped -0.57%. Japan 10-year JGB yield rose 0.0009 to 0.017.

BoE Vlieghe: Appropriate to keep current stimulus in place for several quarters at least

BoE MPC member Gertjan Vlieghe reiterated in a speech that the current inflation peak is “likely to be temporary”. The supply bottlenecks and base effects are “set to wane next year”.

Also, the UK is “not out of the woods yet” in terms of the virus and the impact of the economy. He added that most recent data indicated that economy remains “an average recession away from full employment”. The delta variant is “still causing health and economic damage”.

Also, various government support schemes are “coming to an end”, he said, “I would want to see how the economy copes with that, before adding monetary tightening on top of fiscal tightening”.

Hence, he said, “it will remain appropriate to keep the current monetary stimulus in place for several quarters at least, and probably longer”. “When tightening does become appropriate, I suspect not much of it will be needed, given the low level of the neutral rate.”

Germany Ifo dropped to 100.8, supply bottlenecks and infections weigh

Germany Ifo Business Climate dropped to 100.8 pts in July, down slightly from 101.7, below expectation of 102.1. Current Assessment index rose to 100.4, up from 99.7. Expectations index dropped to 101.2, down from 103.7.

Looking at some details, manufacturing index dropped from 28.5 to 27.4. Services dropped from 28.5 to 27.4. Trade dropped from 17.8 to 15.8. Construction rose from 4.2 to 5.7.

Ifo said: “Companies evaluated their current business situations as somewhat better, but their expectations for the coming months were significantly less optimistic. Supply bottlenecks and concerns over newly rising infection numbers are weighing on the German economy.”

Japan PMI manufacturing dropped to 52.2, services dropped to 46.4

Japan PMI Manufacturing dropped slightly from 52.4 to 52.2 in July, below expectation of 53.1. PMI Services dropped from 48.0 to 46.4. PMI Composite dropped from 48.9 to 47.7.

Usamah Bhatti, Economist at IHS Markit, said: “Flash PMI data indicated that Japanese private sector businesses saw a faster reduction in activity during July. Output fell at the quickest pace for six months, while the contraction in new business inflows was the fastest since February. Survey members attributed the deterioration in business conditions to persistent rises in COVID-19 cases and state of emergency measures which dampened activity and demand.”

New Zealand goods exports rose 17% yoy in June, imports rose 24% yoy

New Zealand goods exports rose 17% yoy to NZD 6.0B in June. Goods imports rose 24% yoy to NZD 5.7B. Monthly trade balance reported NZD 261m surplus, slightly below expectation of NZD 297m.

Exports to all top trading partners were up, including China (40%), EU (21%), Australia (9.5%), Japan (13%) and US (2.9%). Imports from all top trading partners were up too, including EU (51%), China (17%), Japan (69%), USA (52%) and AU (18%).

GBP/USD Mid-Day Outlook

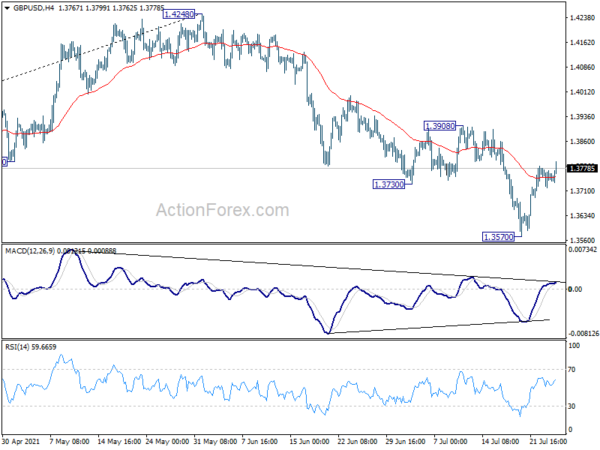

Daily Pivots: (S1) 1.3718; (P) 1.3749; (R1) 1.3778; More….

GBP/USD’s rebound from 1.3570 resumes today but stays below 1.3908 resistance. Intraday bias remains neutral first. As long as 1.3908 holds, another decline is still in favor. On the downside, break of 1.3570 will resume the fall from 1.4248 to 1.3482 resistance turned support first. Decisive break there will target 38.2% retracement of 1.1409 to 1.4248 at 1.3164. On the upside, break of 1.3908 resistance will turn bias back to the upside for retesting 1.4248 high instead.

In the bigger picture, as long as 1.3482 resistance turned support holds, up trend from 1.1409 should still continue. Decisive break of 1.4376 resistance will carry larger bullish implications. However, firm break of 1.3482 support will argue that the rise from 1.1409 has completed. GBP/USD would then be seen in another leg of long term range pattern between 1.1409 and 1.4376. Deeper fall could then be seen to 61.8% retracement of 1.1409 to 1.4248 at 1.2493, and even below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Jun | 261M | 469M | 489M | |

| 0:30 | JPY | Manufacturing PMI Jul P | 52.2 | 53.1 | 52.4 | |

| 8:00 | EUR | Germany IFO Business Climate Jul | 100.8 | 102.1 | 101.8 | 101.7 |

| 8:00 | EUR | Germany IFO Current Assessment Jul | 100.4 | 101.6 | 99.6 | 99.7 |

| 8:00 | EUR | Germany IFO Expectations Jul | 101.2 | 103.3 | 104 | 103.7 |

| 14:00 | USD | New Home Sales Jun | 800K | 769K |