Euro drops broadly today following sharp decline in Germany ZEW economic sentiment. Swiss Franc is following down closely too. On the other hand, New Zealand Dollar remains the strongest on RBNZ rate speculations while Australian Dollar follows as support by RBA tapering. Yen and Dollar are mixed, together with Sterling. European stocks are trading mildly lower while US futures point to mixed open.

Technically, EUR/JPY’s break of 131.21 minor support suggests that deeper fall is ongoing towards 130.02 support. The selling follows EUR/AUD’s break of 1.5699 support level today. Now, focuses are on 0.8529 support in EUR/GBP and and 1.1806 support in EUR/USD. Break of these levels could further spillover Euro selling to other pairs.

In Europe, at the time of writing, FTSE is down -0.19%. DAX is down -0.31%. CAC is down -0.26%. Germany 10-year yield is down -0.014 at -0.221. Earlier in Asian, Nikkei rose 0.16%. Hong Kong HSI dropped -0.25%. China Shanghai SSE dropped -0.11%. Singapore Strait Times rose 1.58%. Japan 10-year JGB yield rose 0.0104 to 0.046.

Germany ZEW dropped to 63.3, but current situation soared to 21.9

Germany ZEW Economic Sentiment tumbled to 63.3 in July, down from 79.8, below expectation of 75.4. Though, Current Situation index jumped to 21.9, up from -9.1, above expectation of 5.0. Eurozone ZEW Economic Sentiment also dropped to 61.2, down from 81.3, below expectation of 84.4. Eurozone Current Situation rose 30.4 pts to 6.0.

“The economic development continues to normalise. In the meantime, the situation indicator for Germany has clearly overcome the coronavirus-related decline. Although the ZEW Indicator of Economic Sentiment has once again fallen significantly, it is still at a very high level. The financial market experts therefore expect the overall economic situation to be extraordinarily positive in the coming six months,” comments ZEW President Professor Achim Wambach on current expectations.

Eurozone retail sales rose 4.6% mom in May, EU also up 4.6% mom

Eurozone retail sales rose 4.6% mom in May, above expectation of 4.1% mom. Volume of retail trade increased by 8.8% for non-food products and by 8.1% for automotive fuels, while it decreased by -0.2% for food, drinks and tobacco.

EU retail sales rose 4.6% mom. Among Member States for which data are available, the highest monthly increases in total retail trade were registered in France (+9.9%), the Netherlands (+9.3%) and Estonia (+8.1%). Decreases were observed in Latvia (-3.9%), Finland (-3.3%) and Luxembourg (-0.7%).

UK PMI construction rose to 24-yr high at 66.3, but positive sentiment eased

UK PMI Construction rose to 66.3 in June, up from 64.2, above expectation of 63.5. That’s also the highest level in exactly 24 years. Markit said the recovery was led by house building and commercial work. Supplier delivery times lengthened to the greatest extent on record. Input price inflation also reached the highest since survey began in April 1997.

Tim Moore, Economics Director at IHS Markit: “June data signalled another rapid increase in UK construction output as housing, commercial and civil engineering activity all expanded at a brisk pace…. Supply chains once again struggled to keep up with demand for construction products and materials… Purchasing prices and sub-contractor charges both increased at a survey-record pace in June, fuelled by supply shortages across the construction sector. Escalating cost pressures and concerns about labour availability appear to have constrained business optimism at some building firms. The degree of positive sentiment towards the year ahead growth outlook remained high, but eased to its lowest since the start of 2021.”

RBA moves to AUD 4B per week bond purchase, until at least mid-Nov

RBA decided to keep cash rate target at 0.10% as widely expected. The central bank will continue with bond purchase program after the current one ends in September. But the purchase target will be changed to AUD 4B per week, until at least mid-November. April 2024 bond is kept as the bond for yield target at 0.10%. The central bank said the expectation that condition for rate hike “will not be met before 2024”. Also, “meeting it will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently.”

In a post meeting speech, RBA Governor Philip Lowe said “the situation today is quite different from that in March last year,” when the 3-year yield target was introduced. “We are no longer looking over a cliff but instead transitioning from recovery to expansion,” he added. “This improvement has widened the range of plausible scenarios for the cash rate.” The central scenario is still that condition for rate hike “will not be met until 2024″. But he added, ” there are alternative plausible scenarios as well”.

On extending asset purchases to AUD 4B a week until just November, Lowe said it “strikes the right balance”. ” It allows the possibility of a timely recalibration of the Bank’s bond purchases in either direction…” and, “we are not locked into any particular path and bond purchases could be scaled up again if economic conditions warrant.”

Suggested readings on RBA:

- RBA to Begin QE Tapering in September

- RBA Tapers Weekly Purchases of Bonds to $4 Billion from $5 Billion

- RBA Reduces Stimulus And Boosts AUDUSD

- (RBA) Statement by Philip Lowe, Governor: Monetary Policy Decision

NZD jumps as markets now sees Nov RBNZ hike

New Zealand Dollar jumps broadly today as economists pull head their expectation on RBNZ rate hike. The change in forecasts came after strong NZIER Quarterly Survey of Business Opinion, which shows a sharp improvement in both business confidence and demand in firms’ own business.

General business confidence jumped to 10.1 in Q2, from Q1’s -7.9. Trading activity in the past three months rose to 25.6, from -0.4. Trading activity for the next three months rose to 27.6, from 7.8.

ASB Bank now predicts a rate hike from historical low at 0.25% in November. BNZ quickly followed in expecting a hike this November. Markets are indeed now pricing in 70% chance of that happening.

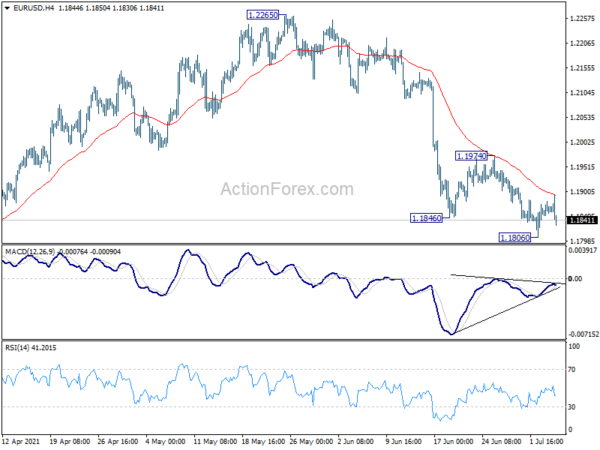

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1849; (P) 1.1865; (R1) 1.1878; More…

EUR/USD was rejected by 4 hour 55 EMA but stays above 1.1806 temporary low. Intraday bias remains neutral first. Further fall is still in favor as long as 1.1974 resistance holds. Break of 1.1806 will resume the decline from 1.2265, as the third leg of the consolidation pattern from 1.2348, to 1.1703 support. On the upside, break of 1.1974 resistance will turn bias back to the upside for 1.2265 resistance.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair. However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y May | 1.90% | 2.10% | 1.40% | |

| 23:30 | JPY | Overall Household Spending Y/Y May | 11.60% | 10.90% | 13.00% | |

| 4:30 | AUD | RBA Rate Decision | 0.10% | 0.10% | 0.10% | |

| 6:00 | EUR | Germany Factory Orders M/M May | -3.70% | 1.30% | -0.20% | 1.20% |

| 8:30 | GBP | Construction PMI Jun | 66.3 | 63.5 | 64.2 | |

| 9:00 | EUR | Germany ZEW Economic Sentiment Jul | 63.3 | 75.4 | 79.8 | |

| 9:00 | EUR | Germany ZEW Current Situation Jul | 21.9 | 5 | -9.1 | |

| 9:00 | EUR | Eurozone ZEW Economic Sentiment Jul | 61.2 | 84.4 | 81.3 | |

| 9:00 | EUR | Eurozone Retail Sales M/M May | 4.60% | 4.10% | -3.10% | -3.90% |

| 13:45 | USD | Services PMI Jun F | 64.8 | 64.8 | ||

| 14:00 | USD | ISM Services PMI Jun | 63.5 | 64 |