Trading is generally subdued in Asian session today, with little reactions to the G7 summit. Also, China and Hong Kong are on a one-day holiday. Commodity currencies are mildly firmer while Swiss Franc and Yen are softer. But all major pairs and crosses are stuck inside Friday’s range. Instead, more volatility is seen in oil, gold, and also bitcoin. Markets will keenly look into this week’s FOMC statement and projections for more guidance.

Technically, directions in the forex markets are not too clear for most pairs and crosses. One question remains on whether Dollar is in for a more sustainable rebound. But some levels needed to be taken out first to give us more confidence on it. The levels include 1.4072 support in GBP/USD, 0.7644 support in AUD/USD, 0.9052 resistance in USD/CHF and 1.2201 resistance in USD/CAD.

In Asia, at the time of writing, Nikkei is up 0.65%. Singapore Strait Times is down -0.06%. Japan 10-year JGB yield is up 0.0144 at 0.045.

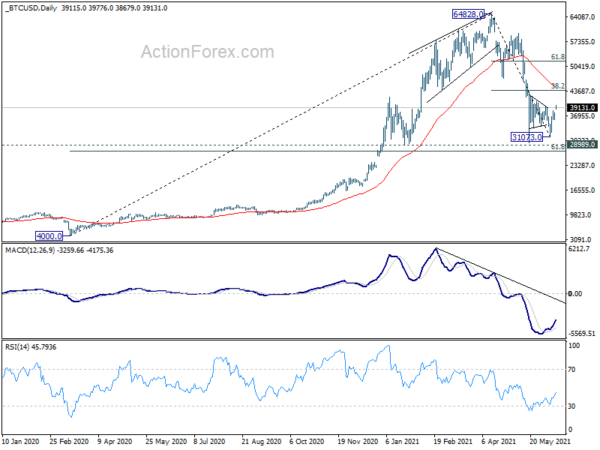

Bitcoin extending rebound, on track to 43967 target

Bitcoin jumped over the weekend and breached 39481 resistance today. The strong support from 4 hour 55 EMA affirms near term bullishness. The development also affirms our view that whole decline from 64828 has completed with five waves down to 31073 (with the last as a failure fifth).

Near term outlook will now stay bullish as long as 35816 support holds. Next target is 38.2% retracement of 64828 to 31073 at 43967 at least. It’s a bit early. But we’d pencil in the prospect for further rise to 61.8% retracement at 51933.

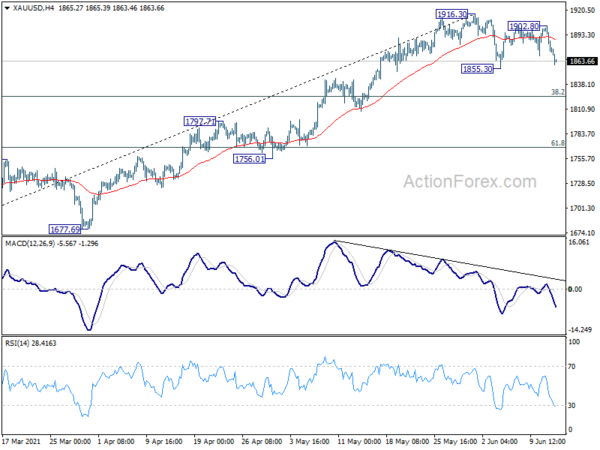

Gold heading to 1855 and below as consolidation extends

Much volatility was seen in Gold last week but overall outlook is unchanged. We’re viewing price actions from 1916.30 as developing into a corrective pattern, that’s still in progress. Today’s fall suggests that it’s already in the third leg. Break of 1855.30 support will target 55 day EMA (now at 1838.82) and possibly below.

At this point, we’re still viewing larger correction from 2075.18 as completed with three waves down to 1676.65. Hence, we’d expect strong support from 38.2% retracement of 1676.65 to 1916.30 at 1824.75 to contain downside, and bring rise resumption. We’d expect rise from 1676.65 to resume at a later stage, to retest 2075.18 high.

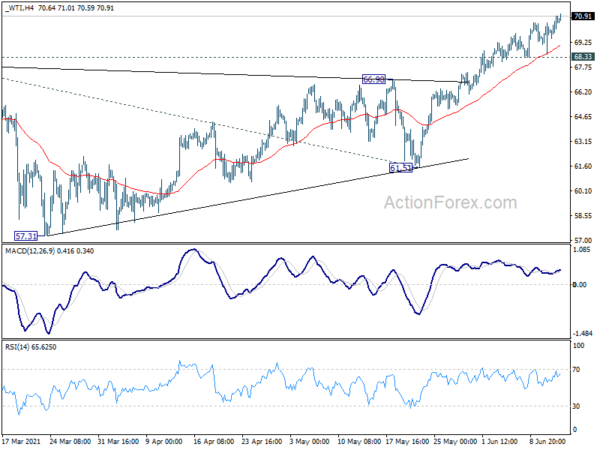

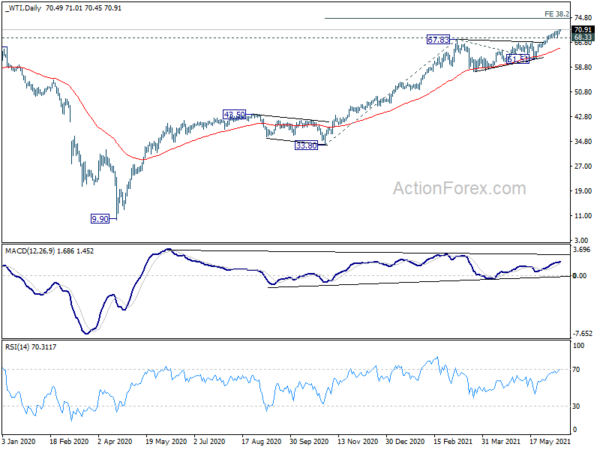

WTI breaches 71 handle, on track to 74.5 target

WTI crude oil’s up trend continues today and breaches 71 handle. There are some concerns that OPEC might not be able to raise the pace of production increase to meet the rebound in demand later this year. Indeed, the Paris-based IEA urged on Friday, “OPEC+ needs to open the taps to keep the world oil markets adequately supplied”.

Overall, the medium term up trend in WTI crude oil looks healthy, with notable support form 55 day EMA. Outlook remains bullish as long as 68.33 support holds. Current rise is on track to 38.2% projection of 33.80 to 67.83 from 61.51 at 74.50.

ECB Lagarde: We’re heading firmly towards a return to pre-COVID-19 level

ECB President Christine Lagarde said in a Politco interview, “you don’t remove the crutches from a patient unless and until the muscles have started rebuilding sufficiently so that the patient can walk on his or her own two legs. ”

“The same applies to the economy,” She added. “We are at a turning point where, bearing in mind alternative variants, we are on that recovery path, heading firmly towards a return to the pre-COVID-19 level.

She also reiterated that ECB has indicated the PEPP program will continue “until at least March 2022 and, in any case, until the Governing Council judges that the pandemic crisis phase is over.” Eurozone seems to be “heading in the right decision”. But it’s “far too early to debate” ending the PEPP program.

NZIER upgrades New Zealand growth outlook for next two years

NZIER said near term growth outlook for New Zealand has been revised up. Annual average growth in GDP is expected to reach 5% level in March 2022. Also, on average, annual growth is expected to reach 2.6% by March 2024. Inflation outlook is also revised up, reflecting that effects of cost increases are expected to persist over the coming years.

RBNZ has indicated that it would likely start raising interest rate in the second half of 2022. NZIER said it’s in line with forecasts for the 90-day bank bill rate. Also, expectation of higher inflation globally have driven up long-term interest rates. Outlook for long-term bond yields has also been revised up.

Fed to be scrutinized on tapering, inflation and rate expectations

Fed is widely expected to keep monetary policy unchanged this week. Officials have been clear that it’s time for talking about talking about tapering at best. Yet, focus will still be on whether Fed would loosen up it’s statement regarding the pace of asset purchases, at USD 80B per month on treasuries and USD 40B of MBS. Additionally, the new Summary of Economic Projections would reveal firstly, how “transitory” the current pick up in inflation policymakers are viewing. Secondly, back in March, 11 of 18 officials penciled in no change in interest rate through 2023. As economic outlook improved, more officials could pull ahead their expectation on rate hikes.

BoJ and SNB will also meet this week. BoJ should keep policy unchanged, and extend the pandemic aid-schemes. SNB will also keep policy unchanged, and maintain that it’s necessary to keep negative rates and intervention. RBA will also release meeting minutes.

Here are some highlights for the week:

- Monday: Swiss PPI; Eurozone industrial production; Canada manufacturing sales.

- Tuesday: RBA minutes, Australia house price index; Japan tertiary industry index; Germany CPI final; UK employment; Swiss ECO economic forecasts; Eurozone trade balance; Canada housing starts; US retail sales, PPI, Empire state manufacturing, industrial production, business inventories, NAHB housing index.

- Wednesday: Japan trade balance, machine orders; China fixed asset investment, industrial production, retail sales; UK CPI, PPI; Canada CPI, wholesales; US building permits and housing starts, import prices, FOMC rate decision.

- Thursday: New Zealand GDP; Australia employment; Swiss trade balance, SNB rate decision; Italy trade balance; Eurozone CPI final; US Philly Fed manufacturing, jobless claims.

- Friday: Japan CPI, BoJ rate decision; Eurozone current account.

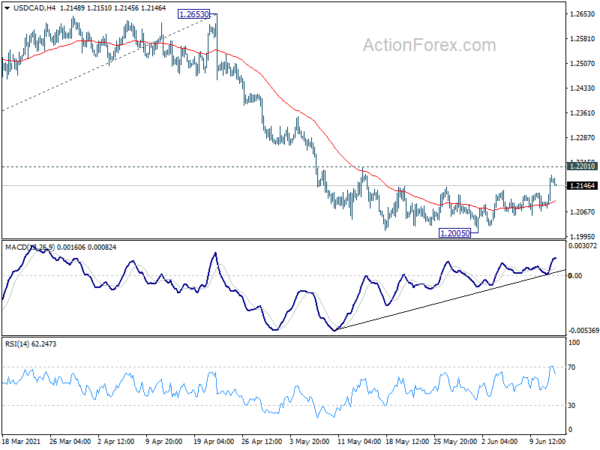

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2105; (P) 1.2141; (R1) 1.2202; More…

Intraday bias in USD/CAD remains neutral for the moment. Outlook is unchanged and we’d stay cautious on strong support from 1.2048/61 to bring reversal. On the upside, firm break of 1.2201 resistance will indicate short term bottoming and turn bias to the upside for stronger rebound, to 1.2363 support turned resistance first. However, sustained break of 1.2048/61 will carry larger bearish implications. Next near term target will be 161.8% projection of 1.2880 to 1.2363 from 1.2653 at 1.1816.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). We’d look for strong support from 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048 to bring rebound. Nevertheless, sustained break of 1.2363 support turned resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound. Also, sustained break of 1.2061 will pave the way to 61.8% retracement of 0.9406 to 1.4689 at 1.1424.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | Industrial Production M/M Apr F | 2.90% | 2.50% | 2.50% | |

| 06:30 | CHF | Producer and Import Prices M/M May | 0.20% | 0.70% | ||

| 06:30 | CHF | Producer and Import Prices Y/Y May | 2.80% | 1.80% | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Apr | 0.40% | 0.10% | ||

| 12:30 | CAD | Manufacturing Sales M/M Apr | 3.00% | 3.50% |