Notable buying is seen in Dollar as markets enter into US session. There is no apparent reason for the rally, except that some traders could be adjusting positions ahead of the high profile G7 summit. Resilience in the Swiss Franc is affirm this pre-emptive risk aversion. Meanwhile, Sterling is also firm after solid GDP data. On the other hand, New Zealand Dollar and Australian Dollar are under some renewed selling pressure, together with Euro.

In Europe, at the time of writing, FTSE is up 0.59%. DAX is up 0.54%. CAC is up 0.77%. Germany 10-year yield is down -0.0132 at -0.266. Earlier in Asia, Nikkei dropped -0.03%. Hong Kong HSI rose 0.36%. China Shanghai SSE dropped -0.58%. Singapore Strait Times dropped -0.14%. Japan 10-year JGB yield dropped -0.0194 to 0.030.

UK NIESR projects 1.5% GDP growth in May, 0.9% in Jun

NIESR said retail and hospitality would contribute significantly to UK growth in May. It forecasts monthly GDP growth of 1.5% in May and 0.9% in June. But it also warned that “Postponing the last step of re-opening may delay the recovery in arts and recreation by a few weeks but, if it helps avoid a third wave of infections, it could contribute to sustained recovery in the second half of the year.”

“Like March, April was a month of rapid growth in services output, as anticipated, driven by the re-opening of non-essential retail, outdoor hospitality and near-full attendance in schools. May will follow a similar pattern, as further restrictions are lifted, as will June if the final step of the roadmap goes to plan. But falls in construction and production, which were less affected by the 2021 lockdown, remind us that our focus should now be on the prospects for the economy in the second half of the year, after temporary re-opening effects have ceased to provide strong monthly increases.” Rory Macqueen Principal Economist – Macroeconomic Modelling and Forecasting.

UK GDP grew 2.3% mom in Apr, back above initial recovery peak

UK GDP grew 2.3% mom in April, slightly below expectation of 2.4% mom. That’s still the fastest monthly growth since July 2020, as pandemic restrictions eased. Services grew solidly by 3.4% mom. But production dropped -1.3% mom, first fall since January. Construction also contracted by -2.0% mom. Overall, GDP remains -3.7% below pre-pandemic levels seen in February 2020, but was 1.2% above initial recovery peak in October 2020.

Also released, industrial production came in at -1.3% mom, 27.5% yoy in April, versus expectation of 1.2% mom, 30.2% yoy. Manufacturing production came in at -0.3% mom, 39.7% yoy, versus expectation of 1.5% mom, 42.0% yoy. Goods trade deficit narrowed slightly to GBP -11.0B.

Bundesbank upgrades German GDP forecast, at beginning of strong upswing

Bundesbank upgraded Germany GDP growth forecast to 3.7% (from 3.0%) in 2021, 5.2% in 2022 (from 4.5%). Growth is expected to slow to 1.7% in 2023. It said that “the German economy is overcoming the pandemic-related crisis and is at the beginning of a strong upswing”. The economy is expected to reach pre crisis level again “this summer”.

Inflation to also projected to accelerate to 2.6% yoy this year (upgraded from 1.8%). For 2022, inflation forecast is upgraded to 1.8% (from 1.3%), and for 2023 at 1.7% (from 1.6%). It added, “the exceptionally high inflation rates, by German standards, projected for the second half of 2021 could ultimately shift economic agents’ inflation perceptions and expectations,”

“As a result, wage and price-setting behavior could change and exert further inflationary pressure. This would especially be the case if headline price inflation in the near future were to be even higher than estimated here”, the report added.

ECB Knot: Structurally larger role for fiscal policy needed

ECB Governing Council member Klass Knot said “as the current low interest rate environment is likely to persist, we need a structurally larger role for fiscal policy in macroeconomic stabilization for the foreseeable future.”

He hailed that the EUR 800B recovery fund was a “big step in the right direction”. “If it becomes a tangible success, it would of course set a precedent, with the promise of more to come.”

New Zealand BusinessNZ manufacturing rose to 0.3, upward pressure on input prices

New Zealand BusinessNZ manufacturing PMI rose 0.3 to 58.6 in May. Looking at some details, production rose from 64. to 65.3. Employment dropped from 52.2 to 51.5. New orders rose from 61.0 to 63.7. Finished stocks dropped from 54.7 to 52.4. Deliveries rose from 52.6 to 53.5.

BusinessNZ’s executive director for manufacturing Catherine Beard said: “Globally, manufacturing activity continues to expand at a robust pace, culminating in an 11-year high for May. However, this has led to upwards pressure on input prices across most countries, including New Zealand, given comments from respondents outlining increased costs of raw materials.”

EUR/USD Mid-Day Outlook

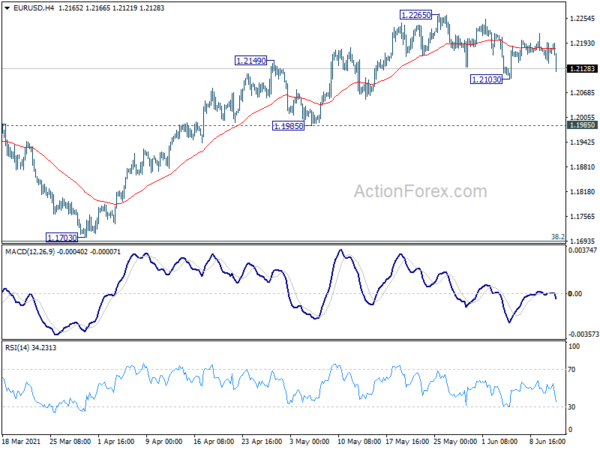

Daily Pivots: (S1) 1.2148; (P) 1.2171; (R1) 1.2199; More…

EUR/USD drops notably today after failing to sustain above 4 hour 55 EMA, but stays above 1.2103 support. Intraday bias remains neutral first. On the downside, below 1.2103 will target 1.1985 support. Break there will confirm that consolidation pattern from 1.2348 has started the third leg. Deeper fall would then be seen back to 1.1703 support. On the upside, above 1.2265 will resume the rise from 1.1703 to retest 1.2348 high.

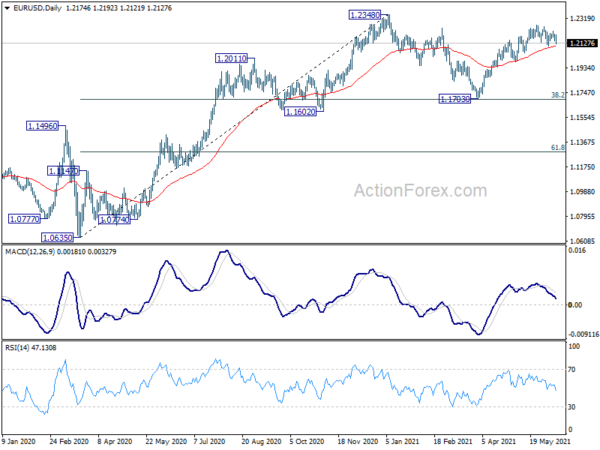

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing Index May | 58.6 | 58.4 | 58.3 | |

| 23:50 | JPY | BSI Large Manufacturing Index Q2 | -1.4 | 1.6 | ||

| 06:00 | GBP | GDP M/M Apr | 2.30% | 2.40% | 2.10% | |

| 06:00 | GBP | Industrial Production M/M Apr | -1.30% | 1.20% | 1.80% | |

| 06:00 | GBP | Industrial Production Y/Y Apr | 27.50% | 30.20% | 3.60% | |

| 06:00 | GBP | Manufacturing Production M/M Apr | -0.30% | 1.50% | 2.10% | |

| 06:00 | GBP | Manufacturing Production Y/Y Apr | 39.70% | 42.00% | 4.80% | |

| 06:00 | GBP | Index of Services 3M/3M Apr | 1.40% | -2% | ||

| 06:00 | GBP | Goods Trade Balance (GBP) Apr | -11.0B | -11.8B | -11.7B | |

| 12:30 | CAD | Capacity Utilization Q1 | 81.70% | 80.50% | 79.20% | |

| 12:32 | GBP | NIESR GDP Estimate May | 3.80% | 1.30% | 1.50% | |

| 14:00 | USD | Michigan Consumer Sentiment Index Jun P | 84 | 82.9 |