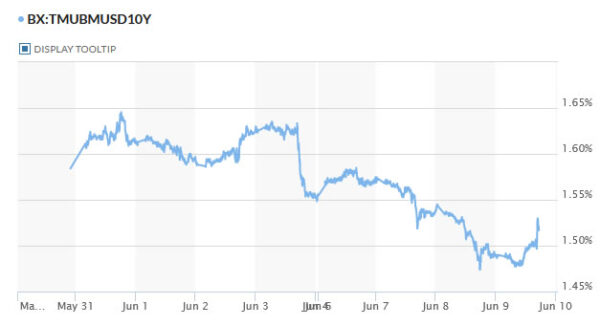

There are heavy weights event for Euro and Dollar today, but reactions are so far mild. ECB said it will continue the PEPP purchases at “significantly higher” pace in Q3. Yet, it also upgraded both growth in and inflation forecast for this year and next. Dollar shrug off very strong consumer inflation, as well as continuous improvement in job data. Instead, Yen is stealing the show with some selloff, together with rebound in treasury yields.

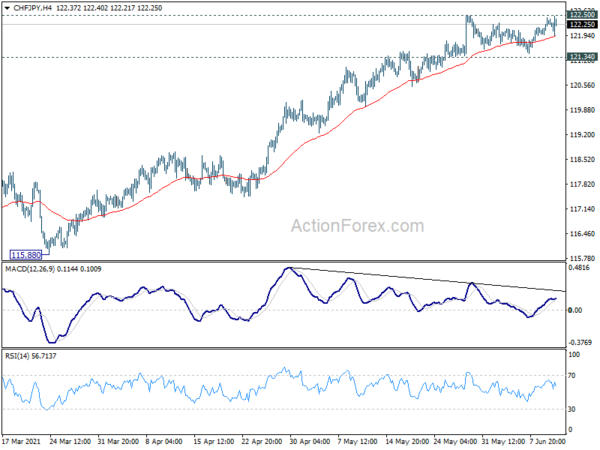

Technically, now, focus is turning to some Yen crosses before weekly close. In particular, levels to watch include 134.11 resistance in EUR/JPY, 156.05 resistance in GBP/JPY and 91.16 resistance in CAD/JPY. Break of these levels will confirm up trend resumption. Also, CHF/JPY might lead the way by breaking through 122.50 resistance to resume recent rally too.

In Europe at the time of writing, FTSE is up 0.32%. DAX is up 0.11%. CAC is down -0.17%. Germany 10-year yield is up 0.13 at -0.228. Earlier in Asia, Nikkei rose 0.34%. Hong Kong HSI dropped -0.01%. China Shanghai SSE rose 0.54%. Singapore Strait Times rose 0.29%. Japan 10-year JGB yield dropped -0.0216 to 0.050. US 10-year yield is up 0.027 at 1.517, back above 1.5 handle.

US CPI jumped to 5% yoy, core CPI up to 3.8% yoy

US CPI rose 0.6% mom in May, above expectation of 0.4% mom. Over the last 12 months, CPI accelerated sharply to 5.0% yoy, up from 4.2% yoy, above expectation of 4.6% yoy. That’s also the highest annual inflation since August 2008. The index has also bee trending up ever month since January.

Core CPI, all items less food and energy, rose 0.7% mom, versus expectation of 0.4% mom. Over the last 12-months, core CPI accelerated to 3.8% yoy, up from 3.0% yoy, above expectation of 3.4% yoy. That’s the largest annual increase since June 1992.

US initial claims dropped to 376k, continuing claims below 3.5m

US initial jobless claims dropped -9k to 376k in the week ending June 5, slightly above expectation of 368k. Four-week moving average of initial claims dropped -25.5k to 402.5k. Both were the lowest level since March 14, 2020.

Continuing claims dropped -258k to 3499k in the week ending May 29, lowest since March 21, 2020. Four-week moving average of continuing claims dropped -35k to 3651k, lowest since March 28, 2020.

ECB announces to continue PEPP at significantly higher pace, upgrades growth and inflation forecasts for 2021 and 2022

ECB left main refinancing rate at 0.00% today, while marginal lending rate and deposit rate are held at 0.25% and -0.50% respectively. It maintained that interest rates will “remain at their present or lower levels” until inflation outlook robustly converge to price target of close to but below 2%.

The pandemic emergency purchase programme will continue with a total envelope of EUR 1850B, “until at least the end of March 2022”. More importantly, purchases will be conducted over the coming quarter at a “significantly higher pace” than during the first months of the year.

In the post meeting press conference, ECB President Christine Lagarde said, business and consumer surveys and high-frequency indicators point to a “sizeable improvement” in activity in Q2. Business surveys indicate a “strong recovery in services” while manufacturing production “remains robust”. Consumer confidence are “strengthening”, suggesting a strong rebound in private consumption in the period ahead. Business investments shows “resilience”.

According to the baseline scenario, ECB upgraded real GDP growth forecast in 2021 to 4.6% (up from 4.0%) , in 2022 to 4.7% (up from 4.1%). 2023 growth forecast was unchanged at 2.1%. Annual inflation is projected to be at 1.9% in 2021 (up from 1.5%), 1.5% in 2022 (up from 1.2%) and 1.4% in 2023 (unchanged).

Also released from Eurozone, France industrial output dropped -0.1% mom in April, versus expectation of 0.5% mom. Italy industrial output rose 1.8% mom in April, above expectation of 0.3% mom.

Japan PPI jumped to 4.9% yoy in May, highest since 2008

Japan PPI accelerated to 4.9% yoy in May, up sharply from April’s 3.8% yoy, above expectation of 4.5% yoy. That’s also the largest annual rise since September 2008. Oil and coal prices jumped 53.5% yoy. Nonferrous meals were up 41.6% yoy. Wood and lumber prices were also up 9.7% yoy.

Shigeru Shimizu, head of the BoJ’s price statistics division, said, “rising commodities prices reflecting the global economic recovery is pushing up wholesale prices for a broad range of goods.”

“The data shows companies are starting to pass on rising costs, though the gain in wholesale prices is driven more by external factors rather than domestic demand,” he said.

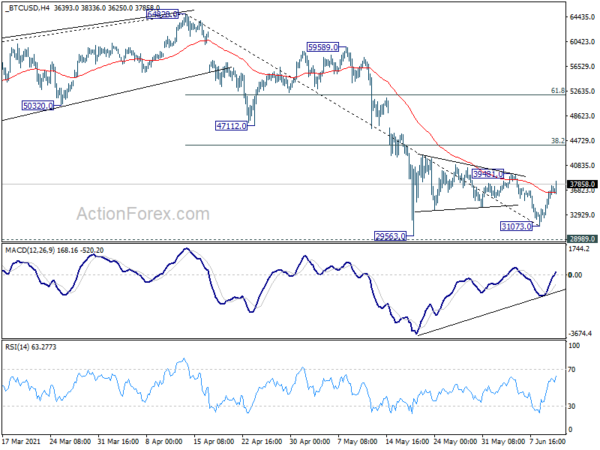

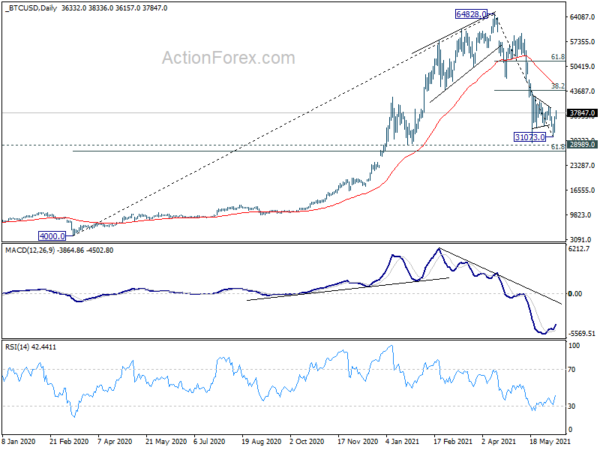

Bitcoin finished near term decline, heading back to 44k and then 52k

In a consultation paper, Basel Committee on Banking Supervision said that “while the cryptoasset market remains small relative to the size of the global financial system, and banks’ exposures to cryptoassets are currently limited, its absolute size is meaningful and there continues to be rapid developments, with increased attention from a broad range of stakeholders.” And, “cryptoassets have given rise to a range of concerns including consumer protection, money laundering and terrorist financing, and their carbon footprint.

It proposed that a “group 1” cryptoassets, like stablecoins, would be assigned a smaller risk weighting in line with stocks. On the other hand, a “group 2” crypto assets like bitcoin would be assigned a risk weight of 1250%. That is, banks will have to hold capital at least equal in value to their group 2 exposures. “The capital will be sufficient to absorb a full write-off of the cryptoasset exposures without exposing depositors and other senior creditors of the banks to a loss,” it added.

Bitcoin is having a notable rebound in the past two days. The development now argues that the near term decline from 64828 might have completed with a failure fifth wave at 31073 already. Immediate focus is now on 39481 resistance. Break there will affirm our view. Bitcoin should then target 38.2% retracement of 64828 to 31073 at 43967 at least. There is also enough prospect for further rise to 61.8% retracement at 51933 indeed.

EUR/USD Mid-Day Outlook

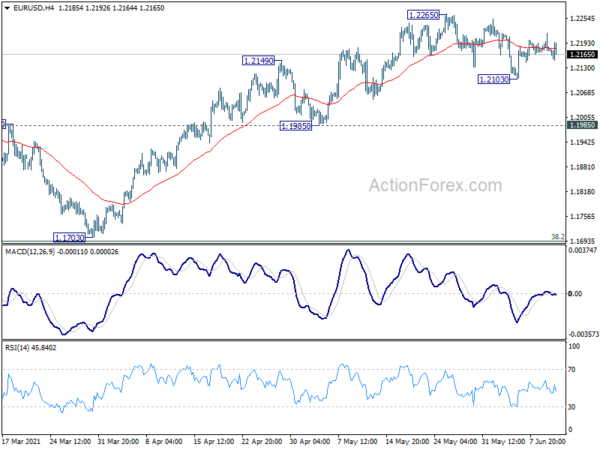

Daily Pivots: (S1) 1.2161; (P) 1.2189; (R1) 1.2208; More…

EUR/USD is still bounded in range of 1.2103/2265 and intraday bias remains neutral first. On the upside, above 1.2265 will resume the rise from 1.1703 to retest 1.2348 high. On the downside, below 1.2103 will target 1.1985 support. Break there will confirm that consolidation pattern from 1.2348 has started the third leg. Deeper fall would then be seen back to 1.1703 support.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance May | 83% | 76% | 75% | 76% |

| 23:50 | JPY | PPI Y/Y May | 4.90% | 4.50% | 3.60% | 3.80% |

| 01:00 | AUD | Consumer Inflation Expectations Jun | 4.40% | 3.50% | ||

| 06:45 | EUR | France Industrial Output M/M Apr | -0.10% | 0.50% | 0.80% | |

| 08:00 | EUR | Italy Industrial Output M/M Apr | 1.80% | 0.30% | -0.10% | 0.30% |

| 11:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | 0.00% | |

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Initial Jobless Claims (Jun 4) | 376K | 368K | 385K | |

| 12:30 | USD | CPI M/M May | 0.60% | 0.40% | 0.80% | |

| 12:30 | USD | CPI Y/Y May | 5.00% | 4.60% | 4.20% | |

| 12:30 | USD | CPI Core M/M May | 0.70% | 0.40% | 0.90% | |

| 12:30 | USD | CPI Core Y/Y May | 3.80% | 3.40% | 3.00% | |

| 14:30 | USD | Natural Gas Storage | 99B | 98B |