Global financial markets are generally treading water this week so far. Trading in the forex markets is also subdued. Canadian Dollar is currently leading other commodity currencies lower, awaiting BoC policy decision today. On the other hand, Swiss Franc is the strongest one, lifting Euro higher too. In other markets, Gold is still struggling to stand above 1900 handle for now. But WTI crude oil has taken out 70 handle with another rally.

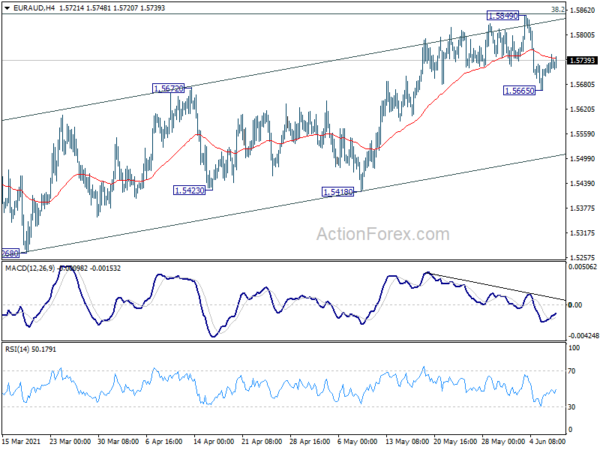

Technically, there has been no follow through buying in Aussie after last week’s late rally. But it should be about time the buying is back if the rally is to sustain. Particular focuses will be on 0.7772 resistance in AUD/USD 1.5665 temporary low in EUR/AUD today. Break of these levels will indicate that underlying upside momentum in Aussie in building up again.

In Asia, at the time of writing, Nikkei is down -0.33%. Hong Kong HSI is down -0.07%. China Shanghai SSE is up 0.31%. Singapore Strait Times is down -0.28%. Japan 10-year JGB yield is down -0.003 at 0.072. Overnight, DOW dropped -0.09%. S&P 500 rose 0.02%. NASDAQ rose 0.31%. 10-year yield dropped -0.041 to 1.528.

RBA Kent: There are good prospects for growth and increase in wages and inflation

RBA Assistant Governor Christopher Kent said in a speech that “the improvement in the economic outlook globally and in Australia has contributed to a rise in sovereign bond yields to around pre-pandemic levels.” There has been increase in inflation expectations to be “more in line with central banks’ targets”. Also expectations of short term interest rates have “increased a bit”.

But households and business continue to “benefit from record low interest rates” and their balance sheets are “in good shape”. The economy is “benefiting from supportive fiscal policy. He added, “there are good prospects for growth and an eventual increase in wages and inflation”. But the process will be “gradual” and inflation is unlikely to be sustainably within target rate “until 2024 at the earliest”.

Australia Westpac consumer confidence dropped -5.2% on concerns around Melbourne lockdown

Australia Westpac consumer confidence dropped -5.2% to 107.2 in June. The index has now fallen by -9.7% over the last two months. Westpac said the latest fall is “almost certainly due to concerns around the two-week lockdown in Melbourne.” There was a fall of -7.5% in Victoria, -4% in Queensland, -9% in Western Australia, and -10.9% in South Australia. New South Wales dropped only -1.1%.

Westpac expects RBA to decide against extending the Yield Curve Targeting from April 2024 bond to November 2024 bond. Also, RBA could announce a more flexible approach to QE, with a weekly target of AUD 5B.

New Zealand ANZ business confidence dropped to -0.4, inflation expectations rose further

In the preliminary read, New Zealand ANZ business confidence dropped to -0.4 in June, down from May’s 1.8. Own activity outlook rose from 27.1 to 29.1. Looking at some more details, export intentions rose from 12.2 to 13.9. Investment intentions rose from 18.9 to 25.3. Employment intentions dropped from 20.5 to 19.6. Pricing intentions rose from 57.4 to 62.8. Inflation expectations rose further from 2.22 to 2.33.

ANZ said: “Shipping disruptions, rising global commodity prices, the higher minimum wage, labour shortages due to both the closed border and uneven sector growth are creating a perfect storm for the supply side of the economy at the same time as demand is holding up much more than firms (or economists!) had anticipated.

“Headline inflation is set to jump over the next six months as a result, but it’s best to focus on wage growth and inflation expectations for clues regarding when the Reserve Bank might conclude they can no longer look through inflation pressure and simply wait for temporary pressures to subside, necessitating a higher OCR.”

Also released, manufacturing sales rose 2.1% in Q1.

CAD/JPY losing upside momentum as BoC is in focus

BoC is widely expected to keep monetary policy unchanged today. Overnight rate will be held at 0.25%. Asset purchase was already tapered from CAD 4B per week to CAD 3B, and thus no change is expected for now. While employment and GDP grow data were disappointing, there were upbeat developments from stronger oil prices and vaccination. All in all, BoC would likely maintain the upbeat tone.

Some previews on BoC:

- BOC Preview – Policymakers to Keep Upbeat Tone Despite Softening Growth

- Bank Of Canada Preview: To Taper Or Not To Taper

- Bank of Canada to Stay on Tapering Path But No New Action This Week

CAD/JPY has been clearly losing upside momentum as seen in daily MACD. It’s also in proximity to 91.62 long term resistance. Hence, upside potential could be limited even though another rise cannot be ruled out yet. On the other hand, break of 89.55 support will be a strong sign of medium term topping. In this case, deeper fall would likely be seen through 55 day EMA to 85.40/88.06 support zone, as a correction to rise from 77.91. It’s a bit early to tell, but that could also be a correction to the whole up trend from 73.80 low, as a five-wave sequence is then completed.

Elsewhere

Japan M2 rose 7.9% yoy in May, below expectation of 8.4% yoy. China CPI jumped to 1.3% yoy in May but missed expectation of 1.6% yoy. China PPI rose to 9.0% yoy, above expectation of 8.5% yoy. Germany trade balance and US wholesales inventories will be released today.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.4119; (P) 1.4152; (R1) 1.4184; More…

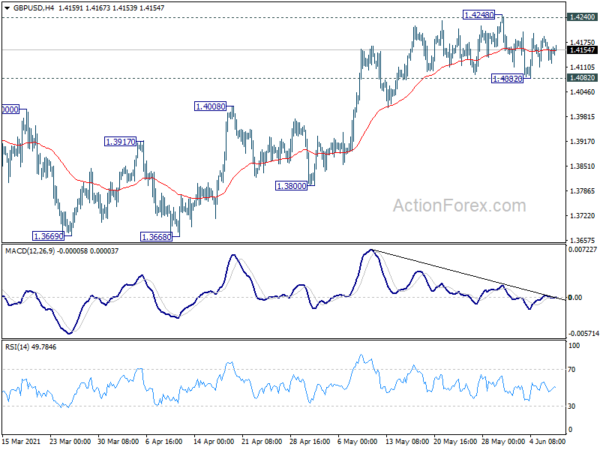

Intraday bias in GBP/USD remains neutral as sideway trading continues. Outlook stays mildly bullish for further rally with 1.4082 support intact. On the upside, sustained break of 1.4240 will resume larger up trend from 1.1409, for 1.4376 key resistance next. On the downside, however, firm break of 1.4082 will extend the consolidation from 1.4240 with another falling leg. Intraday bias will be turned back to the downside for 1.4008 resistance turned support first.

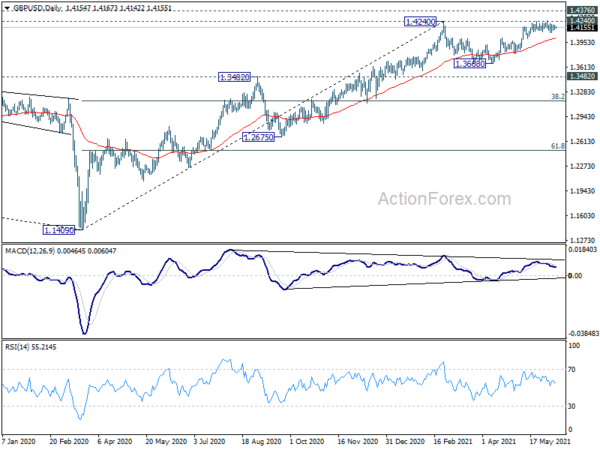

In the bigger picture, as long as 1.3482 resistance turned support holds, up trend from 1.1409 should still continue. Decisive break of 1.4376 resistance will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. However, firm break of 1.3482 support will argue that the rise from 1.1409 has completed and bring deeper fall to 1.2675 support and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Manufacturing Sales Q1 | 2.10% | -0.60% | -0.20% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y May | 7.90% | 8.40% | 9.20% | |

| 0:30 | AUD | Westpac Consumer Confidence Jun | -5.20% | -4.80% | ||

| 1:00 | NZD | ANZ Business Confidence Jun P | -0.4 | 1.8 | ||

| 1:30 | CNY | CPI Y/Y May | 1.30% | 1.60% | 0.90% | |

| 1:30 | CNY | PPI Y/Y May | 9.00% | 8.50% | 6.80% | |

| 6:00 | EUR | Germany Trade Balance (EUR) Apr | 15.7B | 14.3B | ||

| 14:00 | USD | Wholesale Inventories Apr | 0.80% | |||

| 14:00 | CAD | BoC Interest Rate Decision | 0.25% | 0.25% | ||

| 14:30 | USD | Crude Oil Inventories | -5.1M |