Markets are mixed in a quiet Asian session today, with little reaction to China’s trade data. Dollar is consolidating last week’s late lost but there is no apparent momentum for a rebound. On the other hand, Yen is mildly higher on sluggish stock markets in the region. Gold is struggling below 1900 handle as the current rebound loses some upside momentum. WTI crude oil also retreats just head of 70 handle.

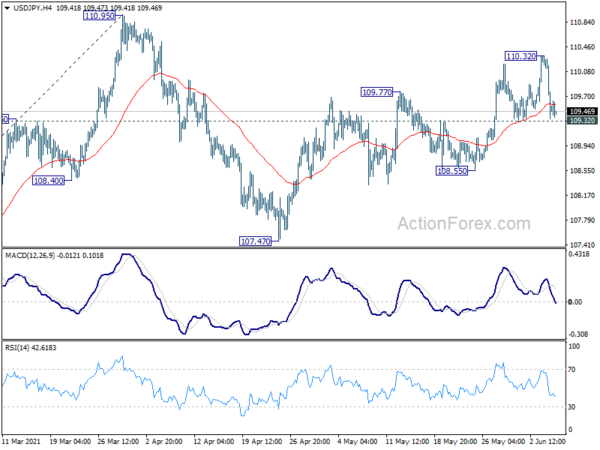

Technically, 109.32 support in USD/JPY will be a focus for today. Break there will suggest completion of choppy rebound from 107.47. Deeper fall would then be seen to 108.55 support and below. The could be accompanied by more broad based selloff in Dollar, or Yen crosses, or both.

In Asia, at the time of writing, Nikkei is up 0.34%. Hong Kong HSI is down -0.75%. China Shanghai SSE is down -0.14%. Singapore Strait Times is up 0.83%. Japan 10-year JGB yield is down -0.0103 at 0.075.

S&P maintains Australia’s AAA rating, upgrades outlook to stable

S&P Global Ratings maintained Australia’s sovereign rating at AAA, and up graded the outlook from “negative” to “stable”. It said, “the government’s policy response and strong economic rebound have reduced downside risks to our economic and fiscal outlook for Australia.”

“We expect the budget to be supported by steady revenue growth, aided by robust commodity prices and expenditure restraint,” the agency added. “We believe Australia’s external accounts are likely to remain stronger than in the past and be resilient during potential crises.”

Australian Treasurer Josh Frydenberg welcomed the upgrade in the outlook outlook. He described that as a “resounding expression of confidence” in the government’s policies.

Australia AiG services rose to 61.2, highest since 2003

Australia AiG Performance of Services Index rose 0.2 pts to 61.2 in May. That’s the highest monthly result since October 2003, indicating a stronger expansion. Four of the five services sectors indicated expansion while the other was broadly stable. Four of the five activity indicators, sales, ne orders, employment and deliveries, showed positive results.

Ai Group Chief Executive, Innes Willox, said: “Australia’s services sector maintained its momentum in May…. With existing capacity well utilised, and with reports of labour shortages becoming more common, conditions were in place for a substantial lift in investment in the sector.”

China’s import rose 51.5% yoy in May, exports rose 27.9% yoy

In USD term, in May, China’s total trade rose 37.4% yoy to USD 482.3B. Export grew 27.9% yoy to USD 263.9B, slowed from prior month’s 32.3% yoy. Imports rose 51.5% yoy to USD 218.4B, accelerated from April’s 43.1% yoy. Trade surplus widened to USD 45.5B, up from USD 42.9B, but missed expectation of USD 50.5B. The import growth rate was fastest since January 2011.

From January to May, total trade rose 38.1% yoy to USD 2271.8B. Exports rose 40.2% yoy to USD 1237.6B. Imports rose 35.6% yoy to USD 1034.B. Trade surplus for the period was at USD 203.5B.

US Yellen: Higher interest rate environment is a plus for society and Fed

US Treasury Janet Yellen said in a Bloomberg interview that the USD 4T spending plan would be good even if it results in higher inflation and interest rates. “If we ended up with a slightly higher interest rate environment it would actually be a plus for society’s point of view and the Fed’s point of view,” she added.

“We’ve been fighting inflation that’s too low and interest rates that are too low now for a decade,” the former Federal Reserve chair said, adding that “we want them to go back to” a normal interest rate environment, “and if this helps a little bit to alleviate things then that’s not a bad thing — that’s a good thing.”

BoC and ECB to meet this week

Two central banks will meet this week. BoC is generally expected to keep monetary policy unchanged. Back in April, BoC has tapered its weekly bond purchases from CAD 4B to CAD 3B already. While the economic outlook since then appeared to improved further, the central bank will refrain from have any changes for now. Also, it would maintain the indication interest rate could be lifted in second half of next year, not earlier.

ECB will keep the policy rates unchanged this week for sure. The biggest question is what the Governing Council would do after significantly stepped up the pace of asset purchases this quarter. For now, it looks premature for the central bank to taper the purchases, given that the economy is still not totally out of the pandemic. Also, treasury yields look rather ready for a rise if ECB does indicate allowing them to rise. But any hints that ECB is ready to taper could give Euro a strong lift.

Here are some highlights for the week:

- Monday: Australia AiG services, China trade balance; Japan leading indicators; Swiss unemployment rate, CPI, foreign currency reserves; Germany factory orders; Eurozone Sentix investor confidence.

- Tuesday: Japan average cash earnings, bank lending, current account, GDP final, Economy Watchers sentiment; Australia NAB business confidence; Germany industrial production, ZEW economic sentiment; France trade balance; Italy retail sales’ Eurozone GDP revision; Canada trade balance; US trade balance.

- Wednesday: New Zealand manufacturing sales, ANZ business confidence; Australia Westpac consumer sentiment; China CPI, PPI; Germany trade balance; BoC rate decision.

- Thursday: Japan PPI; UK RICS house price balance; France industrial production; Italy industrial production; ECB rate decision; US CPI, jobless claims.

- Friday: Japan BSI manufacturing index; New Zealand BusinessNZ manufacturing index; UK GDP, production, trade balance, NIESR GDP estimate; Canada capacity utilization; US U of Michigan consumer sentiment.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7682; (P) 0.7713; (R1) 0.7776; More…

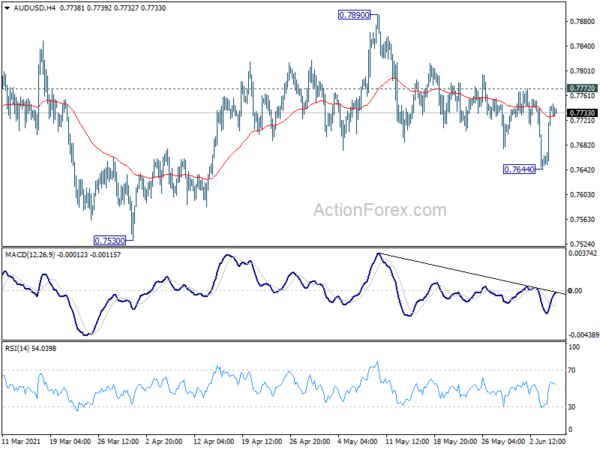

Intraday bias in AUD/USD remains neutral first. On the upside, break of 0.7772 resistance will suggest that pull back from 0.7890 has completed. Intraday bias will be turned back to the upside for 0.7890 resistance next. On the downside, though, break of 0.7664 will resume the fall from 0.7890 to 0.7530 support.

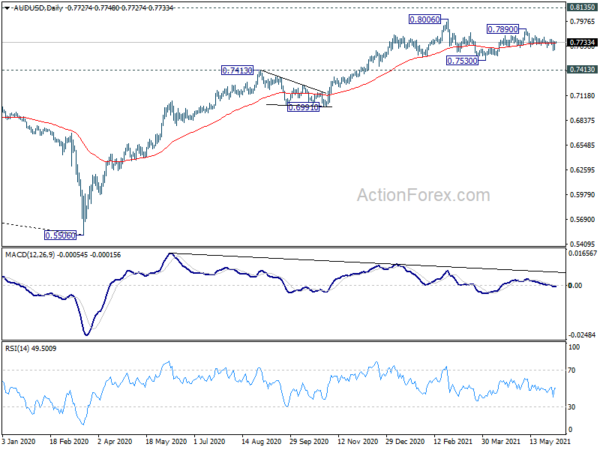

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Services Index May | 61.2 | 61 | ||

| 3:00 | CNY | Trade Balance (USD) May | 45.5B | 50.5B | 42.9B | |

| 3:00 | CNY | Exports (USD) Y/Y May | 27.90% | 41.60% | 32.30% | |

| 3:00 | CNY | Imports (USD) Y/Y May | 51.10% | 51.50% | 43.10% | |

| 3:00 | CNY | Trade Balance (CNY) May | 296B | 266B | 277B | |

| 3:40 | CNY | Exports (CNY) Y/Y May | 18.10% | 22.20% | ||

| 3:40 | CNY | Imports (CNY) Y/Y May | 39.50% | 32.10% | 32.20% | |

| 5:00 | JPY | Leading Economic Index Apr P | 103 | 102.9 | 102.5 | |

| 5:45 | CHF | Unemployment Rate May | 3.10% | 3.10% | ||

| 6:00 | EUR | Germany Factory Orders M/M Apr | 0.40% | 3.00% | ||

| 6:30 | CHF | CPI M/M May | 0.30% | 0.20% | ||

| 6:30 | CHF | CPI Y/Y May | 0.60% | 0.30% | ||

| 7:00 | CHF | Foreign Currency Reserves (CHF) May | 914B | |||

| 8:30 | EUR | Eurozone Sentix Investor Confidence Jun | 26 | 21 |