Trading remains relatively subdued in Asian session today. Aussie firmed up slightly, but lost momentum after RBA delivered no surprise to the markets. Sterling is also trying to break through a key near term resistance against Dollar, but there is no follow through buying yet. The greenback, on the other hand, is turning softer, but there is no clear committed upside momentum in Euro. Overall, the markets are still awaiting breakout from the near term ranges.

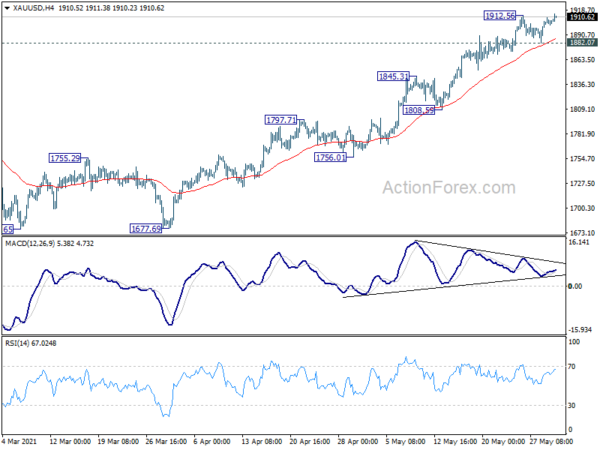

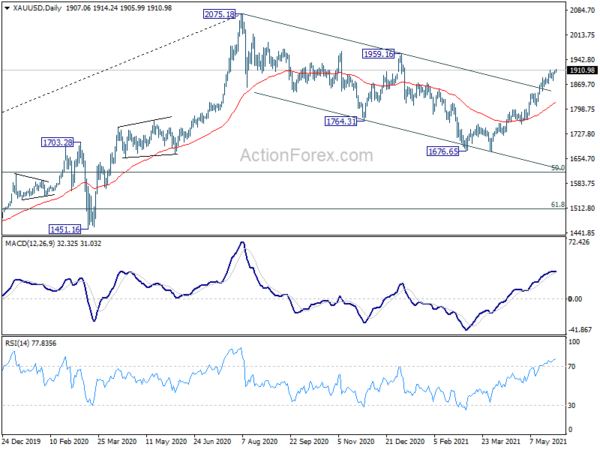

Technically, gold breaches 1912.56 temporary top and looks ready to resume the rise from 1676.65. Focus will now be on any sign of upside acceleration above 1912.56, towards 1959.16 resistance. Firm break of 1959.16 will raise the chance of long term up trend resumption through 2075.18 high. That, if happens, could be accompanied by renewed selling in Dollar. But break of 1882.07 support will suggest short term topping and bring deeper pull back. Dollar could then be rebounding more strongly in this case.

In Asia, at the time of writing, Nikkei is down -0.18%. Hong Kong HSI is up 0.35%. China Shanghai SSE is down -0.08%. Singapore Strait Times is up 0.18%. Japan 10-year JGB yield is down -0.001% at 0.079.

RBA stands pat, no rate hike expected until 2024 earliest

RBA left monetary policy unchanged as widely expected. Cash rate target and 3-year AGB yield target are both kept at 0.10%. Parameters of asset purchases are kept unchanged too. It maintained the pledge to keep “highly supportive monetary conditions” to support return to full employment and inflation consistent with target. Also, the conditions for rate hike are unlikely to be matched “until 2024 at the earliest.

The central bank said economic recovery is “stronger than earlier expected and is forecast to continue”. The central scenario is for GDP to grow 4.75% this year and 3.50% next. Progress in reducing unemployment “has been faster than expected”. Further decline is unemployment rate to 5% by year end is expected. Inflation and wage pressures are “subdued”.

At the July meeting, RBA will consider whether to move the target bond for the 3-year yield target to November 2024 bond. It will also decide then whether to extend the government bond purchase program after September.

Australia AiG manufacturing rose to 61.8, rapid pace of expansion maintained

Australia AiG Performance of Manufacturing rose 0.1 pt to 61.8 in May. That’s the eighth consecutive month of recovery for the MI, and the highest result since March 2018. It’s also the fourth highest reading on record. Six of seven activity indicators expanded, while only the exports active index indicated a contraction.

Ai Group Chief Executive Innes Willox said: “Australia’s manufacturing sector maintained its rapid pace of expansion in May fuelled by strong demand from the construction sector, a pick-up in business investment and healthy demand from households…While the new Victorian lockdown will dampen enthusiasm somewhat, these conditions are likely to be setting the stage for a lift in investment by manufacturers.”

Also from Australia, current account surplus widened to AUD 18.3B in Q1, above expectation of AUD 17.8B. Company gross operating profits dropped -0.3% qoq in Q1, versus expectation of 3.6% qoq rise. Building permits dropped -8.6% mom in April, versus expectation of -10.1% mom. From New Zealand, building permits rose 4..8% mom in April.

Japan PMI manufacturing finalized at 53.0, sustained improvement

Japan PMI Manufacturing was finalized at 53.0 in May, down from April’s 53.6. That signaled a softer but still moderate improvement in the health of the sector. There were further expansions in output and new orders, and second successive rise in employment levels. Positive sentiment remained elevated.

Usamah Bhatti, Economist at IHS Markit, said: “May data marked a sustained improvement in the health of the Japanese manufacturing sector, as the latest Manufacturing PMI painted a different picture to 12 months ago. A continued recovery from pandemic-related disruption has now extended to four months…. Japanese goods producers remained optimistic in the year ahead outlook for activity. Firms were hopeful that the pandemic would subside and induce a broad recovery in demand across the sector. IHS Markit estimates that industrial production will rise by 8.8% in 2021.”

Also released, capital spending dropped -7.8% in Q1, versus expectation of -9.0%.

China Caixin PMI manufacturing rose to 52.0, recovery kept momentum

China Caixin PMI Manufacturing rose to 52.0 in May, up from 51.9, above expectation of 51.7. Caixin said that total new business rose solidly, supported by stronger export sales. Production growth softened slightly due to supply chain strain. Staffing levels were broadly stable as companies faced steep rise in costs.

Wang Zhe, Senior Economist at Caixin Insight Group said: “To sum up, manufacturing expanded in May as the post-epidemic economic recovery kept its momentum. Both domestic and overseas demand were strong and supply recovered steadily. The job market remained stable. Manufacturers stayed confident about the business outlook as the gauge for future output expectations was higher than the long-term average. Inflation was still a crucial concern as prices continued rising.”

SNB Zurbruegg: Franc is still high, expansionary monetary policy remains appropriate

Swiss National Bank, Vice Chairman Fritz Zurbruegg, said in a Corriere del Ticino interview that, “we believe the franc is still high.” “If we look at inflation, it is still very low and GDP is not yet at the pre-crisis levels,” he said. “That is why we are convinced that our expansionary monetary policy remains appropriate.”

“We have to bear in mind that in a small and open country like ours, the exchange rate has a major impact on both inflation and economic growth,” he said. “For this reason, it is important to maintain the instrument of foreign exchange interventions alongside the classic interest rate instrument.”

“Without this expansionary policy, we would have a much stronger franc, lower growth and inflation and higher unemployment,” he said. “So the average Swiss citizen is better off thanks to our policy.”

Looking ahead

Swiss retail sales, GDP, and PMI will be featured in European session. Eurozone will release PMI manufacturing final, unemployment rate and CPI. Germany will release unemployment. UK will release PMI manufacturing final.

Later in the day, Canada will release GDP, PMI manufacturing. US will release ISM manufacturing and construction spending.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7708; (P) 0.7725; (R1) 0.7748; More…

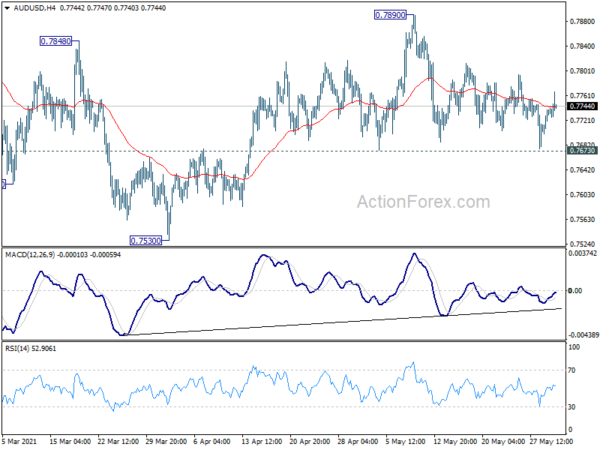

AUD/USD is staying in range of 0.7673/7890 and intraday bias remains neutral at this point. Further rise is in favor with 0.7673 support intact. On the upside, break of 0.7890 will resume the rise from 0.7530 to retest 0.8006 high. However, on the downside, firm break of 0.7673 will suggest that correction from 0.8006 is extending with another falling leg. Intraday bias will be turned back to the downside for 0.7530 support and possibly below.

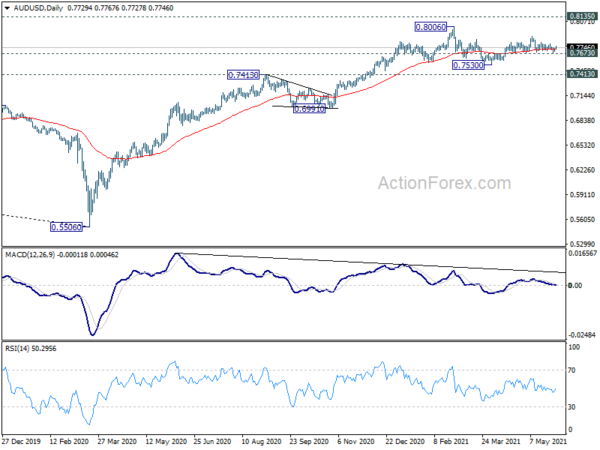

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Manufacturing May | 61.8 | 61.7 | ||

| 22:45 | NZD | Building Permits M/M Apr | 4.80% | 17.90% | 19.20% | |

| 23:50 | JPY | Capital Spending Q1 | -7.80% | -9.00% | -4.80% | |

| 0:30 | JPY | Manufacturing PMI May F | 53 | 52.5 | 52.5 | |

| 1:30 | AUD | Current Account (AUD) Balance Q1 | 18.3B | 17.8B | 14.5B | 16.0B |

| 1:30 | AUD | Company Gross Operating Profits Q/Q Q1 | -0.30% | 3.60% | -6.60% | -4.80% |

| 1:30 | AUD | Building Permits M/M Apr | -8.60% | -10.10% | 17.40% | 18.90% |

| 1:45 | CNY | Caixin Manufacturing PMI May | 52 | 51.7 | 51.9 | |

| 4:30 | AUD | RBA Interest Rate Decision | 0.10% | 0.10% | 0.10% | |

| 6:30 | CHF | Real Retail Sales Y/Y Apr | 15.40% | 22.60% | ||

| 7:00 | CHF | GDP Q/Q Q1 | -0.50% | 0.30% | ||

| 7:30 | CHF | SVME PMI May | 70 | 69.5 | ||

| 7:45 | EUR | Italy Manufacturing PMI May | 62 | 60.7 | ||

| 7:50 | EUR | France Manufacturing PMI May F | 59.2 | 59.2 | ||

| 7:55 | EUR | Germany Manufacturing PMI May F | 64 | 64 | ||

| 7:55 | EUR | Germany Unemployment Change May | -9K | 9K | ||

| 7:55 | EUR | Germany Unemployment Rate May | 6.00% | 6.00% | ||

| 8:00 | EUR | Italy Unemployment Mar | 10.10% | 10.10% | ||

| 8:00 | EUR | Eurozone Manufacturing PMI May | 62.8 | 62.8 | ||

| 8:30 | GBP | Manufacturing PMI May F | 66.1 | 66.1 | ||

| 9:00 | EUR | Eurozone CPI Y/Y May P | 1.90% | 1.60% | ||

| 9:00 | EUR | Eurozone CPI Core Y/Y May P | 0.90% | 0.70% | ||

| 9:00 | EUR | Eurozone Unemployment Rate Apr | 8.10% | 8.10% | ||

| 12:30 | CAD | GDP M/M Mar | 1.00% | 0.40% | ||

| 13:30 | CAD | Manufacturing PMI May | 57.9 | 57.2 | ||

| 13:45 | USD | Manufacturing PMI May F | 61.5 | 61.5 | ||

| 14:00 | USD | ISM Manufacturing PMI May | 61 | 60.7 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid May | 86.1 | 89.6 | ||

| 14:00 | USD | ISM Manufacturing Employment May | 61.5 | 55.1 | ||

| 14:00 | USD | Construction Spending M/M Apr | 0.50% | 0.20% |