The forex markets are staying in mixed consolidative mode in Asian session. Australian Dollar trades mildly higher following strong, record making, export data. But that’s offset by Melbourne’s return to pandemic restriction, on masks and gatherings. Dollar turns weaker as Asian stocks rebound, together with Yen and Canadian. European majors are generally firm.

Technically, focus is back on whether Dollar is resuming recent fall, in particular against Euro. EUR/USD would have another taken on 1.2244 temporary top again today, and break will resume recent rise from 1.1703 towards 1.2348 high. Similarly, eyes will also be on whether GBP/USD would follow and have a take on 1.4240 key near term resistance.

In Asia, at the time of writing, Nikkei is up 0.63%. Hong Kong HSI is up 1.26%. China Shanghai SSE is up 1.60%. Singapore Strait Times is up 0.50%. 10-year JGB yield is down -0.0066 at 0.075. Overnight, DOW rose 0.54%. S&P 500 rose 0.99%. NASDAQ rose 1.41%. 10-year yield dropped -0.024 to 1.608.

Fed Bullard: We’re not quite there yet

St. Louis Fed President James Bullard said yesterday that “we’re not quite there yet” to scale back the monetary stimulus. Vaccinations are bringing the economy “closer and closer” to the pre-pandemic state. “I think there will come a time when we can talk more about changing the parameters of monetary policy, I don’t think we should do it when we’re still in the pandemic,” he added.

Bullard also said, “we’ll see if the demand really flows through to a lasting increase in inflation or if this is just temporary. I think it’s mostly temporary but then some of it will flow through to inflation expectations.” He expected inflation to rise above 2% in 2021 and into 2022.

Fed George not inclined to dismiss inflation signals

Kansas City Fed President Esther George said she’s “not inclined to dismiss today’s pricing signals or to be overly reliant on historical relationships and dynamics in judging the outlook for inflation.” But she didn’t explicitly indicated whether she’s ready to adjust monetary policy for now.

“The structure of the economy changes over time, and it will be important to adapt to new circumstances rather than adhere to a rigid formulation of policy reactions,” she said. “With a tremendous amount of fiscal stimulus flowing through the economy, the landscape could unfold quite differently than the one that shaped the thinking”.

BoE Bailey: Transitory inflation developments have few direct medium term implications

BoE Governor Andrew Bailey told the parliament’s Treasury Committee that the “transitory developments” inflation should have “few direct implications for inflation over the medium term”. Though, policymakers are still “going to have to be looking at the entrails of the inflation evidence very carefully from now onwards.”

MPC member Michael Saunders also said, long term inflation is “likely to continue to be restrained for some time by spare capacity in the labour market, with relatively weak underlying wage growth and subdued service sector inflation”.

On the other hand, Chief Economist Andy Haldane emphasized, “the situation we need to avoid like the plague is one where inflation expectations adjust before we do, or where we wait for proof positive that effects on inflation are not transitory before acting.”

Australia exports rose to record high in Apr, on metalliferous ores

According preliminary estimates, Australia export of goods rose AUD 13m (0% mom) to AUD 35.95B in April, hitting a record high. Import of goods dropped AUD -1.9B, (-7% mom) to AUD 25.81B. Trade surplus widened to AUD 10.14B, up from March’s AUD 8.23B, the third highest on record.

ABS said, “following strong exports in March 2021, metalliferous ores increased another 1 per cent in April 2021 to record a historic high of $16.5 billion, driving record high exports”. The increase in coal exports was driven by thermal coal, up $203 million, with an increase of $116 million to India. Australian coal exports to India have been steadily rising since mid-2020, following a substantial reduction in Chinese demand for Australian coal.

Looking ahead

Germany Ifo business climate is the main focus in European session. Germany GDP final and UK public sector net borrowing will also be featured. Later in the day, US will release house price index, new home sales and consumer confidence.

AUD/USD Daily Report

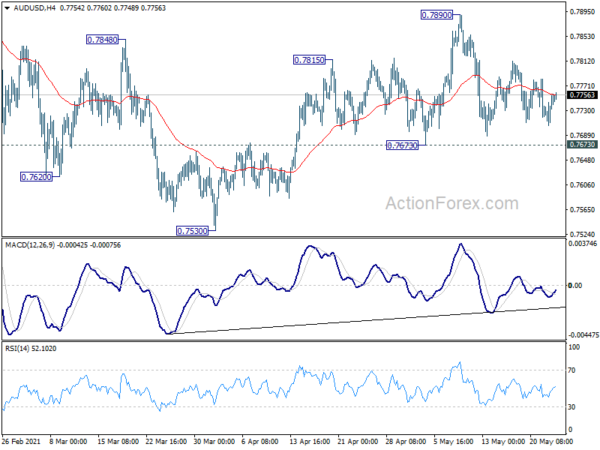

Daily Pivots: (S1) 0.7720; (P) 0.7739; (R1) 0.7772; More…

AUD/USD recovers mildly today but stays in range below 0.7890. Intraday bias remains neutral for the moment, and further rise will remain mildly in favor as long as 0.7673 support holds. On the upside, break of 0.7890 resistance will resume the rally from 0.7530 to retest 0.8006 high. On the downside, break of 0.7673 will suggest that correction from 0.8006 is extending with another falling leg. Intraday bias will be turned back to the downside for 0.7530 support and possibly below.

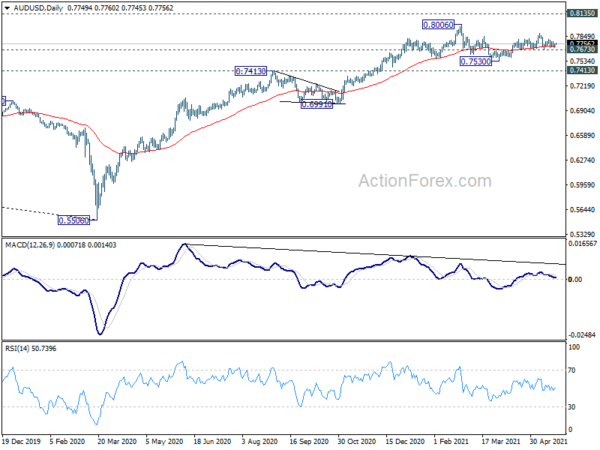

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Apr | 34.2B | 27.3B | ||

| 06:00 | EUR | Germany GDP Q/Q Q1 F | -1.70% | -1.70% | ||

| 08:00 | EUR | Germany IFO Business Climate May | 98.1 | 96.8 | ||

| 08:00 | EUR | Germany IFO Current Assessment May | 95.5 | 94.1 | ||

| 08:00 | EUR | Germany IFO Expectations May | 101 | 99.5 | ||

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Mar | 11.70% | 11.90% | ||

| 13:00 | USD | Housing Price Index M/M Mar | 1.40% | 0.90% | ||

| 14:00 | USD | Consumer Confidence May | 119.9 | 121.7 | ||

| 14:00 | USD | New Home Sales Apr | 950K | 1021K | ||

| 14:00 | USD | Richmond Fed Manufacturing Index May | 19 | 17 |