Dollar and Yen are both under pressure again today, as broad based risk sentiments improved. In particular, the volatile Nikkei managed to close up more than 2%. New Zealand Dollar is leading other commodity currencies higher too. But Canadian Dollar and Sterling are the strongest ones for the week at this point. The Loonie is lifted by WTI oil price, which is back above 66 handle. Sterling is booted by reopening optimism and slightly better than expected job data.

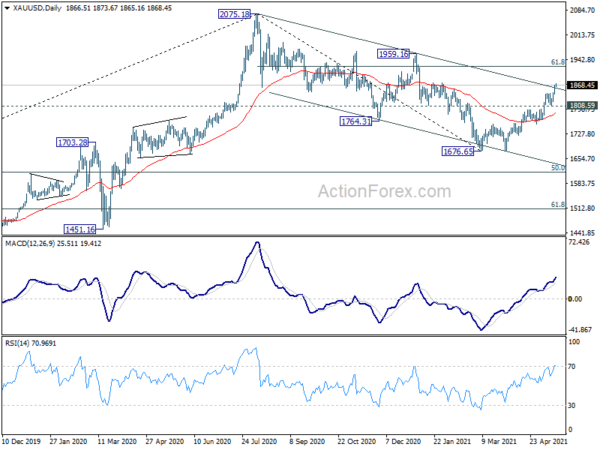

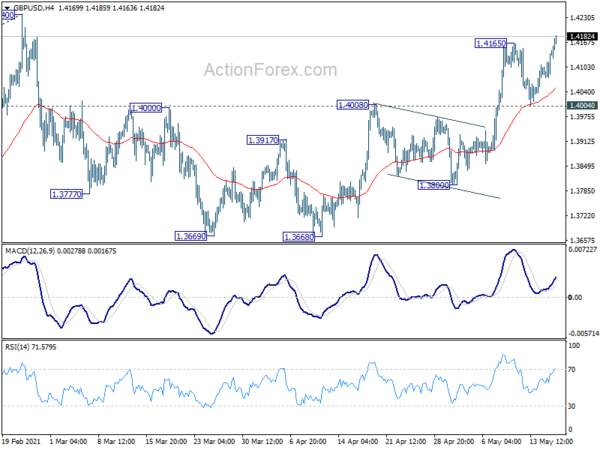

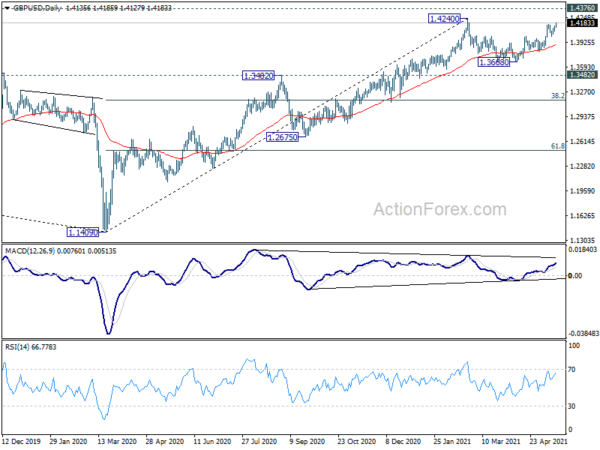

Technically, GBP/USD’s break of 1.4165 resistance now puts focus on 1.4240 high. Firm break there will resume larger up trend from 1.1409. EUR/USD also looks ready to break through 1.2181 temporary top to retest 1.2348 high too. Similarly, USD/CHF is also ready to break through 0.8984 temporary low towards 0.8756 key support. Affirming dollar bearish developments, Gold broke above medium term falling channel yesterday. Now, we’d see if gold can sustain above the channel resistance to confirm completion of whole correction from 2075.18, at 1676.65.

In Asia, Nikkei closed up 2.09%. Hong Kong HSI is up 1.25%. China Shanghai SSE is up 0.06%. Singapore Strait Times is up 1.70%. Japan 10-year JGB yield is down -0.0011 at 0.079. Overnight, DOW dropped -0.16%. S&P 500 dropped -0.25%. NASDAQ dropped -0.38%. 10year yield rose 0.005 to 1.640.

UK unemployment rate edged lower to 4.8% in March

UK unemployment dropped to 4.8% in the three months to March, down from 4.9%, better than expectation of 4.9%. Unemployment rate remained 0.8% higher than pre-pandemic period of December 2019 to February 2020. Employment rate was estimated at 75.2%, -1.4% below pre-pandemic level. Average earnings including bonus rose 4% 3moy, below expectation of 4.6% 3moy. Average earnings excluding bonus rose 4.6% 3moy, matched expectations. Claimant count dropped -15.1k in April.

BoE Vlieghe: Monetary policy requires focusing on medium term outlook

BoE MPC member Gertjan Vlieghe said yesterday that inflation is likely to overshoot the 2% target later this year, due to temporary bottlenecks and base effects. Though, “the fact that we’re going to have, or we’re likely to have, temporarily high growth rates and temporarily high inflation in the coming months, is not the main concern of monetary policy,” he said.

“Instead, monetary policy will focus on returning to inflation sustainably to its target, which requires focusing on the medium term outlook,” he added.

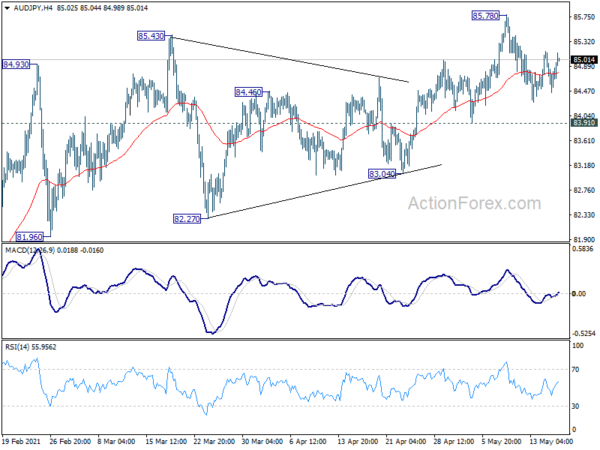

AUD/JPY recovers after RBA minutes, still bounded in consolidations

Minutes of RBA’s May 4 meeting reiterated that rate hike was unlikely “until 2024 at the earliest”. Members would “consider whether to retain the April 2024 bond as the target bond for the 3-year yield target or to shift to the next maturity” in July.

Concerning QE, the members suggested they were “willing to undertake further bond purchases if doing so would assist with progress towards the Bank’s goals of full employment and inflation”. All actions are dependent on incoming economic data.

However, given that unemployment rate (5.6%) has stayed markedly above RBA’s long-term target of 4-4.5%, the central bank would likely extend QE with another AUD 100B at the July meeting.

More in RBA:

- RBA Minutes Reaffirmed Likelihood of QE Expansion in July

- RBA May Board Minutes Highlight Financial Conditions and Data Flow

Australian Dollar trades mildly higher earlier today, mainly due to broad based risk sentiment. AUD/JPY is struggling in range below 85.78, as consolidation continues. There is no change in the bullish outlook with 83.91 support intact. Upside break through 85.78 is in favor, and up trend from 59.89 should then target 90.29 long term structural resistance.

However, break of 83.91 support will delay the bullish case. AUD/JPY could have a deeper correction towards 55 week EMA (now at 79.33) first, before resuming the up trend at a later stage.

Japan GDP contracted -1.3% qoq in Q1, CHF/JPY in healthy up trend

Japan GDP contracted -1.3% qoq in Q1, slightly worse than expectation of -1.2% qoq. In annualized term, GDP contacted -5.1%, versus expectation of -4.6%. Looking at some details, capital expenditure dropped -1.4% qoq versus expectation of 1.1% qoq. External demand dropped -0.2% qoq, matched expectations. Private consumption dropped -1.4% qoq, better than expectation of -2.0% qoq. Price index dropped -0.2% yoy, below expectation of -0.1% yoy.

Yen continues to trade as one of the weakest for the month, along with Dollar. In particular, we’d like to point out that CHF/JPY’s medium term rally remains in force, which could give extra pressure to Yen. As long as 119.96 support holds, we’re expect the current rise from 106.71, as the third leg of the pattern from 101.66 (2016.06), to continue to 100% projection of 101.66 to 118.59 from 106.71 at 123.64.

Looking ahead

Eurozone trade balance and GDP will be the main feature in European session. US will release housing starts and building permits later in the day.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.4096; (P) 1.4121; (R1) 1.4165; More…

GBP/USD’s break of 1.4165 confirms resumption of rise from 1.3668. Intraday bias is back on the upside to retest 1.4240 high. Firm break there will also resumption whole up trend from 1.1409 to 1.4376 key resistance next. On the downside, break of 1.4004 support is needed to signal short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, as long as 1.3482 resistance turned support holds, up trend from 1.1409 should still continue. Decisive break of 1.4376 resistance will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. However, firm break of 1.3482 support will argue that the rise from 1.1409 has completed and bring deeper fall to 1.2675 support and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q Q1 P | -1.30% | -1.20% | 2.80% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 P | -0.20% | -0.10% | 0.30% | |

| 1:30 | AUD | RBA Minutes | ||||

| 4:30 | JPY | Tertiary Industry Index M/M Mar | 1.10% | -0.10% | 0.30% | |

| 6:00 | GBP | Claimant Count Rate Apr | 7.20% | 7.30% | 7.20% | |

| 6:00 | GBP | Claimant Count Change Apr | -15.1K | 10.1K | ||

| 6:00 | GBP | ILO Unemployment Rate (3M) Mar | 4.80% | 4.90% | 4.90% | |

| 6:00 | GBP | Average Earnings Including Bonus 3M/Y Mar | 4.00% | 4.60% | 4.50% | |

| 6:00 | GBP | Average Earnings Excluding Bonus 3M/Y Mar | 4.60% | 4.60% | 4.40% | |

| 8:00 | EUR | Italy Trade Balance (EUR) Mar | 4.75B | |||

| 9:00 | EUR | Eurozone Trade Balance (EUR) Mar | 20.3B | 18.4B | ||

| 9:00 | EUR | Eurozone GDP Q/Q Q1 P | -0.60% | -0.60% | ||

| 9:00 | EUR | Eurozone Employment Change Q/Q Q1 P | 0.10% | 0.30% | ||

| 12:30 | USD | Housing Starts Apr | 1.71M | 1.74M | ||

| 12:30 | USD | Building Permits Apr | 1.77M | 1.76M |