The forex markets are steady in Asian session today as sentiment stabilized, following strong rebound in US stocks overnight. Dollar is currently the second strongest for the week, just next to Sterling. But no key level was taken out with the rebound in the last few days. The greenback would need to look into retail sales data today to draw some more strength. Meanwhile, Aussie and Kiwi are currently the worst performing ones for the week.

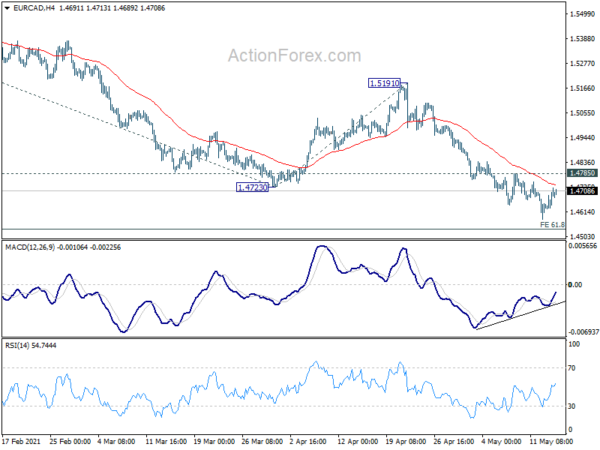

Technically, Canadian Dollar appears to be losing upside momentum after BoC governor warned of it’s strength. Focus in USD/CAD is back on 1.2265 resistance after it drew support from 1.2061 key long term support and recovered. Break of 1.2265 will indicate short term bottoming. Similarly, EUR/CAD lost momentum just ahead of 1.4536 fibonacci projection level. Break of 1.4785 resistance will indicate short term bottoming and bring rebound back towards 1.5191 resistance.

In Asia, at the time of writing, Nikkei is up 2.16%. Hong Kong HSI is up 0.95%. China Shanghai SSE is up 1.21%. Singapore Strait Times is down -0.29%. Japan 10-year JGB yield is down -0.0088 at 0.087. Overnight, DOW rose 1.29%. S&P 500 rose 1.22%. NASDAQ rose 0.72%. 10-year yield dropped -0.027 to 1.668.

BoC Macklem: Strong Canadian Dollar does create come risk

BoC Governor Tiff Macklem said yesterday that recent rise in commodity prices is “goods news for Canada. But a stronger Canadian Dollar “does create some risk.”

“If it moves a lot further, that could have a material impact on our outlook and it is something we have to take into account in our setting of monetary policy,” he added. Rise in the exchange rate could drag on exports. “If we’re less competitive, our export profile is weaker, that also probably means that our investment profile will be weaker,” he said.

Fed Waller talked down weak job and strong inflation data

Fed Governor Christopher Waller delivered his “two messages” in a speech yesterday. Firstly, “despite an unexpectedly weak jobs report, the U.S. economy is hitting the gas and continuing to make a very strong recovery from the severe COVID-19 recession.”

Secondly, “despite the unexpectedly high CPI inflation report yesterday, the factors putting upward pressure on inflation are temporary, and an accommodative monetary policy continues to have an important role to play in supporting the recovery.”

Waller continued to “expect the FOMC to maintain an accommodative policy for some time”. He added, “we need to see several more months of data before we get a clear picture of whether we have made substantial progress towards our dual mandate goals. ”

Fed Bullard: US is moving into expansion phase of business cycle

St. Louis Fed President James Bullard said in a presentation that the US economy is “poised to surpass the previous peak” in the current quarter. The US is “moving into the expansion phase of the business cycle”.

“Market-based inflation expectations have recovered from the lows reached during March 2020,” he added, likely encouraged by Fed’s new policy framework.

“TIPS-based breakeven inflation, based on CPI inflation measures, could move higher and still be consistent with a PCE inflation outcome modestly above the 2% target,” he said. “This would be a welcome development for the FOMC, as inflation has generally been below target for many years.”

New Zealand BusinessNZ PMI dropped to 58.3

New Zealand BusinessNZ PMI dropped to 58.3 in April, down from 63.6. Looking at some details, production dropped form 66.5 to 64.5. Employment dropped from 53.6 to 52.7. New orders dropped from 72.3 to 60.9. Finished stocks dropped from 55.4 to 55.2. Deliveries also dropped from 63.0 to 52.4.

BNZ Senior Economist, Craig Ebert stated that “firms’ commentary to April’s PMI noted improving conditions internationally, in addition to many global PMIs clearly pointing to economic activity expanding strongly in significant portions of the world right now”.

Looking ahead

ECB will release monetary policy meeting accounts. Later in the day, Canada will release manufacturing sales and wholesale sales. US will release retail sales, import price, industrial production, U of Michigan consumer sentiment, and business inventories.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 153.38; (P) 153.86; (R1) 154.25; More…

A temporary top is formed at 154.40 and intraday bias is turned neutral for the moment. Some consolidations could be seen in GBP/JPY but outlook stays bullish as long as 151.24 support holds. Above 154.40 will resume the larger up trend 156.59 key resistance, and then 61.8% projection of 133.03 to 153.39 from 149.03 at 161.61. However, break of 151.24 will suggest that deeper correction is underway, and turn bias back to the downside for 149.03 support first.

In the bigger picture, rise from 123.94 is seen as the third leg of the pattern from 122.75 (2016 low). Next target is 156.59 resistance (2018 high). Sustained break there should confirm long term bullish trend reversal. Next target is 61.8% retracement of 195.86 (2015 high) to 122.75 at 167.93. On the downside, break of 142.71 resistance turned support is needed to be the first sign of completion of the rise from 123.94. Otherwise, outlook will remain bullish even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing Index Apr | 58.4 | 63.6 | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Apr | 9.20% | 9.40% | 9.50% | 9.40% |

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:30 | CAD | Manufacturing Sales M/M Mar | 3.50% | -1.60% | ||

| 12:30 | CAD | Wholesale Sales M/M Mar | 1.00% | -0.70% | ||

| 12:30 | USD | Retail Sales M/M Apr | 0.50% | 9.70% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Apr | 0.90% | 8.40% | ||

| 12:30 | USD | Import Price Index M/M Apr | 0.60% | 1.20% | ||

| 13:15 | USD | Industrial Production M/M Apr | 0.90% | 1.40% | ||

| 13:15 | USD | Capacity Utilization Apr | 75.20% | 74.40% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index May P | 89.5 | 88.3 | ||

| 14:00 | USD | Business Inventories Mar | 0.30% | 0.50% |