Extremely higher volatility was seen in the markets overnight, with the steep decline in stocks and rally in yields. Bitcoin also had a free fall. Negative sentiments continue in Asia with major indexes trading in deep red. In the currency markets, Australia and New Zealand Dollars are under most selling pressure, followed by Yen. Dollar did extended the near term recovery slightly, but upside momentum is relatively weak. Sterling and Canadian Dollar are still the strongest for the week.

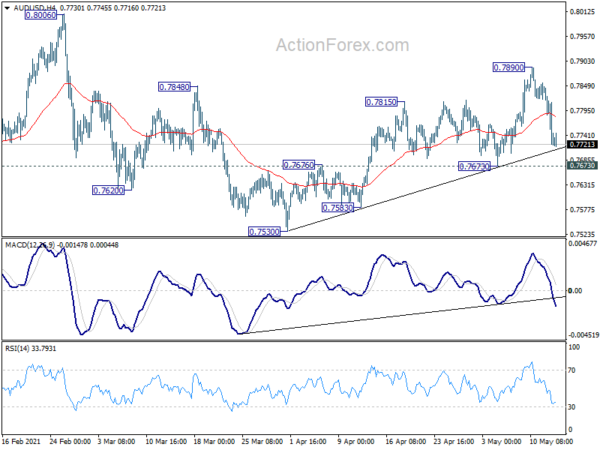

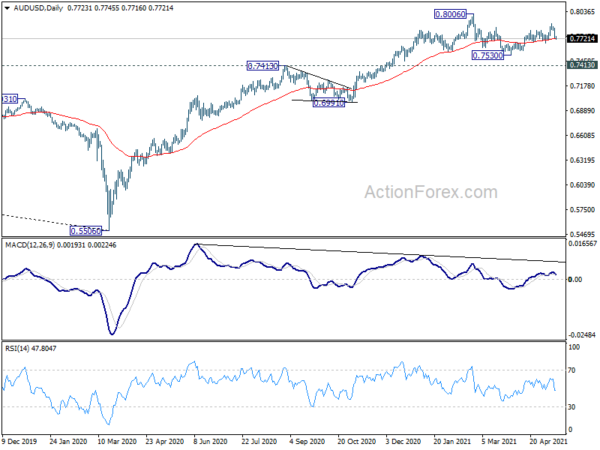

Technically, we’d continue pay attention to Dollar pairs. Levels to watch include 1.1985 support in EUR/USD, 1.4008 support in GBP/USD, 0.7673 support in AUD/USD, 0.9163 resistance in USD/CHF, and 1.2265 resistance in USD/CAD. Dollar will need to break through these levels to confirm that it has bottomed for the near term. Otherwise, selling could come back any time.

In Asia, at the time of writing, Nikkei is down -1.82%. Hong Kong HSI is down -0.92%. China Shanghai SSE is down -0.74%. Singapore Strait Times is down -0.67%. Japan 10-year JGB yield is up 0.0090 at 0.089. Overnight, DOW dropped -1.99%. S&P 500 dropped -2.14%. NASDAQ dropped -2.67%. 10-year yield rose 0.071 to 1.695.

Strong US inflation prompted deep selloff in DOW and strong rise in yield

US stocks tumbled sharply overnight after the big upside surprise in consumer inflation reading. Technically, while the pull back in stocks was deep, there is no threat to the up trend yet. However, the simultaneous strong rise is 10-year yield is worth a note. Correction in stocks could extend much deeper depending on the power of 10-year yield’s next move, after break through 1.765 resistance level.

A short term top should be formed in DOW at 35091.56 with a break of 33687.01 support. The index should gyrated further to 55 day EMA (now at 33221.06) and below. But we’d still expect strong support from medium term channel at around 32500 to contain down side and bring rebound. Overall up trend from 18213.65 is expected to continue and resume at a later stage.

The strong of yesterday’s rally in 10-year yield suggests that it could finally be ready to resume the medium term up trend. Focus would now be on 1.765 resistance for the coming trading days. Firm break there will extend the rise from 0.504. Next target is the resistance zone between 1.971 and 61.8% retracement of 3.248 to 0.398 at 2.159. For now, we’d expect strong resistance from there to limit upside. If that’s the case, we won’t expect drastic reversal in stocks. However, it would be another story if this 1.97/2.16 zone is taken out firmly.

BoE Haldane: It’s time to start start tightening the tap

In an article to the Daily Mail, BoE chief economist Andy Haldane said, “with the economy bouncing back, and with inflation risks on the rise, now is the time to start tightening the tap to avoid the risk of a future inflationary flood.”. He voted to “begin throttling back the degree of support provided to the economy” at last week’s MPC meeting. And he emphasized that’s just “gently taking our foot off the accelerator”, rather than, “slamming on the brakes”.

“By the end of this year, inflation is likely to be above its 2 per cent target, largely due to the temporary effects of higher energy prices,” he explained. “At that point, the UK economy is likely to be growing rapidly above its potential. This momentum in the economy, if sustained, will put persistent upward pressure on prices, risking a more protracted – and damaging – period of above-target inflation. This is not a risk that can be left to linger if the inflation genie is not, once again, to escape us.”

BoJ Kuroda: Important to respond to pandemic’s impact for now

BoJ Governor Haruhiko Kuroda told the parliament today that “economic activity will remain below pre-pandemic levels for the time being.” Also, “risks to the economic outlook are skewed to the downside.” Nevertheless, the economy as a whole is picking up momentum thanks to robust exports and productions.

“We’ll take into account the effects and cost of our policy, and aim to achieve moderate inflation accompanied by growth in corporate profits, jobs and wages,” he said. “It’s important to respond to the pandemic’s impact for the time being” by maintaining the central bank’s ultra-loose monetary policy.

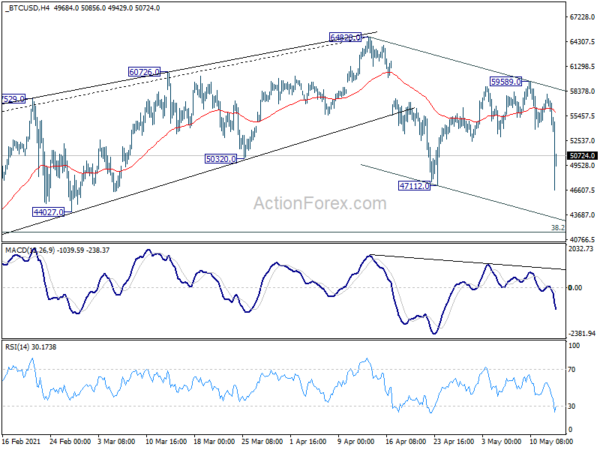

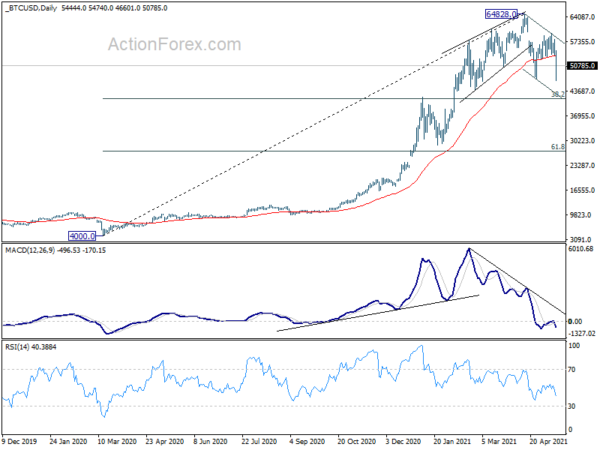

Bitcoin dives on Tesla halt, correction to extend to 41k

Bitcoin was in free fall overnight after Tesla said it has suspended vehicle purchases using the crypto-currency. “We are concerned about rapidly increasing use of fossil fuels for bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel,” Chief executive Elon Musk tweeted. “Cryptocurrency is a good idea on many levels and we believe it has a promising future, but this cannot come at great cost to the environment.”

The sharp decline wasn’t much a surprise technically. Bitcoin is now in it’s third leg of the corrective pattern from 64828. Minimum target of 47112 support was actually met already. Though, there is no sign of bottoming and further fall should be seen. The corrective pattern might complete only after testing 38.2% retracement of 4000 to 64828 at 41591, which is close to the top of prior range of 20283/41964.

On the data front

Japan bank lending rose 4.8% yoy in April. Current account surplus narrowed to JPY 1.7T in March. UK RICS house price balance rose to 75 in April. Looking ahead, US jobless claims and PPI are the main focuses of the day.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7683; (P) 0.7764; (R1) 0.7809; More…

AUD/USD’s pull back from 0.7890 extended lower, but stays above 0.7673 support. Intraday bias remains neutral and another rise remains in favor. On the upside, break of 0.7890 will resume the rise from 0.7530 to retest 0.8006 high. However, break of 0.7673 should extend the correction from 0.8006 with another falling leg. Intraday bias will be turned back to the downside for 0.7530 support.

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Apr | 75% | 55% | 59% | 54% |

| 23:50 | JPY | Bank Lending Y/Y Apr | 4.80% | 6.30% | ||

| 23:50 | JPY | Current Account (JPY) Mar | 1.70T | 1.79T | 1.84T | |

| 05:00 | JPY | Eco Watchers Survey: Current Apr | 49 | |||

| 12:30 | USD | Initial Jobless Claims (May 7) | 487K | 498K | ||

| 12:30 | USD | PPI M/M Apr | 0.30% | 1.00% | ||

| 12:30 | USD | PPI Y/Y Apr | 6.00% | 4.20% | ||

| 12:30 | USD | PPI Core M/M Apr | 0.20% | 0.70% | ||

| 12:30 | USD | PPI Core Y/Y Apr | 3.10% | 3.10% | ||

| 14:30 | USD | Natural Gas Storage | 74B | 60B |