Dollar recovers broadly today even though Fed officials sung a chorus emphasizing patience in monetary policy. Canadian Dollar is also firm with help from rebound in oil prices. On the other hand, Australian Dollar is trading generally lower together with Kiwi. Nevertheless, for the week so far, Sterling remains the strongest one, as UK GDP data is awaited.

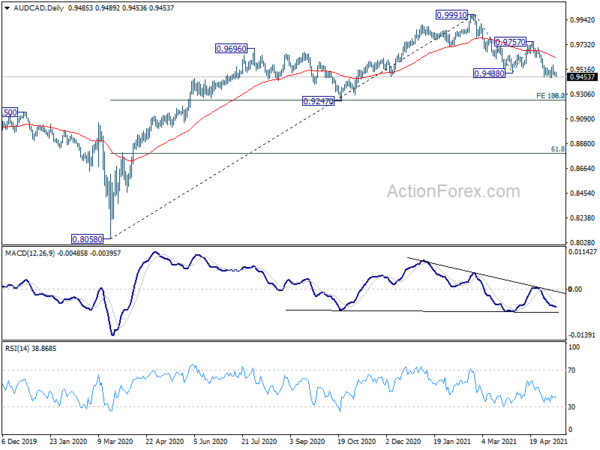

Technically, it’s too early to say that Dollar is turning around the corner. We’d at least want to see break of 4 hour 55 EMA in EUR/USD at 1.2091 and 4 hour 55 EMA in USD/CHF at 0.9076, to give us some confidence on the sustainability of the rebound. Meanwhile, Canadian Dollar continues to outperform other commodity currencies. Break of 0.9447 temporary low will resume the fall from 0.9991 to 0.9247 cluster support.

In Asia, at the time of writing, Nikkei is down -0.59%. Hong Kong HSI is up 0.22%. China Shanghai SSE is up 0.11%. Singapore Strait Times is down -0.28%. Japan 10-year JGB yield is up 0.0078 at 0.084. Overnight, DOW dropped -1.36%. S&P 500 dropped -0.87%. NASDAQ dropped -0.09%. 10-year yield rose 0.022 to 1.624.

NASDAQ could build a base after late rebound

While US stocks tumbled sharply initially overnight, the late rebound in NASDAQ was rather impressive. It drew support from just above 61.8% retracement of 12397.05 to 14211.57 at 13090.19 and rebounded, closing down just -0.09%. There is prospect of building a base at current levels.

Overall, current fall from 14211.57 is seen as the third leg of the consolidation pattern from 14175.11. Sustained break of 55 H EMA (now at 13607.86) will argue that the leg has completed and bring retest of 14211.57 high. Though, another fall through 13090.19 will bring deeper fall to 12397.05 key support.

Fed Harker: Recovery is still a work in progress

Philadelphia Fed President Patrick Harker said in a speech, “we’ll keep the federal funds rate very low and continue making more than $100 billion in monthly Treasury bond and mortgage-backed securities purchases. While the economic situation is improving, recovery is still a work in progress, and there’s no reason to withdraw support yet.

“With so much fiscal support and monetary accommodation, there is some upside risk to increased inflation, and we will continue to monitor that closely. But for now, I’m forecasting 2.3 percent headline inflation for 2021 with core inflation at 2 percent,” he added.

Later he added, inflation is “not only a number”, but also “the rate of change”. He said 3% is probably the maximum inflation he would like to see. But he’d be more comfortable with inflation at around 2.5%. “We don’t want inflation to run out of control,” he said.

Fed Brainard: Weak job data underscores the value of patience

Fed Governor Lael Brainard said that the weak April NFP report “reminds us that realized outcomes can diverge from forward projections and underscores the value of patience”. Also, “to the extent that supply chain congestion and other reopening frictions are transitory, they are unlikely to generate persistently higher inflation on their own.”

“Remaining patient through the transitory surge associated with reopening will help ensure that the underlying economic momentum that will be needed to reach our goals as some current tailwinds shift to headwinds is not curtailed by a premature tightening of financial conditions,” she said.

Fed Bullard: It’s too early to talk taper here

St. Louis Fed President James Bullard told CNBC, “I think it’s too early to talk taper here”. And, “we’re going to let the chair open that discussion when he thinks it’s appropriate.”

“We’re not quite out of the pandemic yet,” he added. “Once we get out of the pandemic, then I think it will be time to look at whether monetary policy can change.”

“I don’t think you really want to change policy while you’re still in the pandemic tunnel. Even though you can sort of see the end of the tunnel, we’re not there yet, and we’ve got to push hard till we get all the way to the end,” he said.

ECB Knot expects more than 4% growth over the full year

ECB Governing Council member Klaas Knot said yesterday, “we can take comfort that the euro area in the coming months will take the exact same trajectory, services will also pick up, we expect more than 4% growth over the full year.” Further, he added, “I would argue that there is still significant upside risk actually, and that has to do with pent-up demand.”

“Traditionally we have been very conservative within the ECB, assuming in our baseline projections that the savings rate would just return to its pre-corona level, that there would be no pent-up demand taking place,” Knot said. “I personally think that’s a bit of an overly conservative assumption.”

Nevertheless, inflation is still too low and ECB would need to provide abundant support even if the PEPP purchases end in 2022. “The only thing we are talking about is rotation from emergency support to other forms of unconventional support,” he said, “we will still have the old asset purchase programme, we will still have the negative interest rates in place and most importantly, the targeted longer-term refinancing operations to the banks.”

Looking ahead

UK GDP, productions and trade balance are the main focus in European session. Germany will release CPI final while Eurozone will release industrial production. Later in the day, US CPI will take center stage.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.4106; (P) 1.4137; (R1) 1.4169; More…

A temporary top is formed at 1.4165 with 4 hour MACD crossed below signal line. Intraday bias in GBP/USD is turned neutral for some consolidations. But further rise is expected as long as 1.4008 resistance turned support holds. on the upside, break of 1.4165 will resume the rally from 1.3668 to retest 1.4240 high. Firm break there will resume larger up trend from 1.1409 low for 1.4376 long term resistance next. however, firm break of 1.4008 will delay the bullish case and extend the corrective pattern from 1.4240 with another falling leg.

In the bigger picture, as long as 1.3482 resistance turned support holds, up trend from 1.1409 should still continue. Decisive break of 1.4376 resistance will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. However, firm break of 1.3482 support will argue that the rise from 1.1409 has completed and bring deeper fall to 1.2675 support and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 05:00 | JPY | Leading Economic Index Mar P | 98.7 | |||

| 06:00 | EUR | Germany CPI M/M Apr | 0.70% | 0.70% | ||

| 06:00 | EUR | Germany CPI Y/Y Apr | 2.00% | 2.00% | ||

| 06:00 | GBP | GDP M/M Mar | 1.30% | 0.40% | ||

| 06:00 | GBP | GDP Q/Q Q1 P | 0.50% | 1.30% | ||

| 06:00 | GBP | Industrial Production M/M Mar | 1.00% | 1.00% | ||

| 06:00 | GBP | Industrial Production Y/Y Mar | 2.80% | -3.50% | ||

| 06:00 | GBP | Manufacturing Production M/M Mar | 1.00% | 1.30% | ||

| 06:00 | GBP | Manufacturing Production Y/Y Mar | 3.80% | -4.20% | ||

| 06:00 | GBP | Goods Trade Balance (GBP) Mar | -14.5B | -16.4B | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Mar | 0.60% | -1.00% | ||

| 12:30 | USD | CPI M/M Apr | 0.20% | 0.60% | ||

| 12:30 | USD | CPI Y/Y Apr | 3.60% | 2.60% | ||

| 12:30 | USD | CPI Core M/M Apr | 0.30% | 0.30% | ||

| 12:30 | USD | CPI Core Y/Y Apr | 2.30% | 1.60% | ||

| 13:00 | GBP | NIESR GDP Estimate (3M) Apr | -1.80% | -1.50% | ||

| 14:30 | USD | Crude Oil Inventories | -8.0M |