Dollar rebound in early US session after much stronger than expected PCE inflation data. Though, at this point, Canadian Dollar remains slightly firmer, as supported by GDP data. Yen is also recovering with mild retreat in German and Japan yields, as well as mild risk aversion. European majors are, on the other hand, the weaker ones for today. Mixed GDP data from Eurozone is not providing much support to Euro.

Technically, focus will now be back on some minor resistance levels in Dollar, to see if it’s ready for a stronger rebound when markets come back in May. Levels to note include 1.2055 minor support in EUR/USD, 0.7676 minor support in AUD/USD and 0.9180 minor resistance in USD/CHF.

In Europe, at the time of writing, FTSE is up 0.32%. DAX is up 0.28%, CAC is down -0.04%. Germany 10-year yield is down -0.0148 at -0.205. Earlier in Asia, Nikkei dropped -0.83%. Hong Kong HSI dropped -1.97%. China Shanghai SSE dropped -0.81%. Singapore Strait Times dropped -0.10%. Japan 10-year JGB yield closed flat at 0.095.

US PCE price index surged to 2.3% yoy in Mar, core CPI jumped to 1.8% yoy

US personal income rose 21.1% mom, or USD 4.21T, in March, above expectation of 20.0% mom. Spending rose USD 4.2% mom, or USD 616B, above expectation of 3.8% mom.

Headline PCE inflation accelerated sharply to 2.3% yoy, up from 1.5% yoy, well above expectation of 1.6% yoy. Core PCE inflation also jumped to 1.8% yoy, up from 1.4% yoy, above expectation of 1.8% yoy.

Canada GDP grew 0.4% mom in Feb, 10th straight monthly rise

Canada GDP grew 0.4% mom in February, slightly below expectation of 0.5% mom. That’s the 10th consecutive month of growth. But total economic activity was still about -2% below pre-pandemic level in February 2020. Preliminary information indicates that growth will continue in March with 0.9% mom rise in real GDP.

Looking at some details, services-producing industries were up 0.6%, while goods-producing industries contracted (-0.2%) for the first time since April. Overall, 14 of the 20 industrial sectors expanded in February.

Also released, IPPI rose 1.6% mom in March versus expectation of 1.5% mom. RMPI rose 2.3% mom versus expectation of 2.0% mom.

Eurozone GDP contracted -0.6% qoq in Q1, EU down -0.4% qoq

Eurozone GDP dropped -0.6% qoq in Q1, better than expectation of -0.8% qoq. EU GDP contracted -0.4% qoq. Annually, Eurozone GDP dropped -1.8% yoy while EU contracted -1.7% qoq.

Among the Member States for which data are available for the first quarter 2021, Portugal (-3.3%) recorded the highest decrease compared to the previous quarter, followed by Latvia (-2.6%) and Germany (-1.7%), while Lithuania (+1.8%) and Sweden (+1.1%) recorded the highest increases. The year on year growth rates were negative for all countries except for France (+1.5%) and Lithuania (+1.0%).

Also released, Eurozone CPI accelerated to 1.6% yoy in April, up from 1.3% yoy, matched expectations. Looking at the main components of energy is expected to have the highest annual rate in April (10.3%, compared with 4.3% in March), followed by services (0.9%, compared with 1.3% in March), food, alcohol & tobacco (0.7%, compared with 1.1% in March) and non-energy industrial goods (0.5%, compared with 0.3% in March).

Eurozone unemployment rate dropped to 8.1% in March, down from 8.2%, better than expectation of 8.3%. EU unemployment dropped to 7.3%, down from 7.4%.

Germany GDP dropped -1.7% qoq in Q1, worse than expected

Germany GDP contracted -1.7% qoq in Q1, worse than expectation of -1.5% qoq. Comparing to Q1 2020, GDP was down a price-adjusted -3.3%, and a price-and-calendar-adjusted -3.0%. Comparing to pre-pandemic Q4 2019, GDP was down -4.9%.

Destatis said, “the coronavirus crisis caused another decline in economic performance at the beginning of 2021”. And, “this affected household consumption in particular, while exports of goods supported the economy.”

France GDP rose 0.4% qoq in Q1, still -4.4% below pre-pandemic level

France GDP rose 0.4% qoq in Q1, much better than expectation of 0.4% qoq. Though, GDP is still -4.4% below the pre-pandemic level in Q4 2019.

Looking at some details, final internal demand (excluding inventory changes) made a positive contribution to GDP growth (+0.9 points after −3.0 points in the previous quarter). Gross fixed capital formation (GFCF) intensified its dynamic (+2.2% after +1.3%) and households’ consumption expenditure picked up slightly (+0.3%), after a strong decline in the previous quarter (−5.7%).

Exports declined (–1.5%) more than imports (–0.1%). Overall, foreign trade made a negative contribution to GDP growth this quarter: –0.4 points, after +1.2 points in the previous quarter. Contribution of inventory changes to the growth of the GDP was null this quarter (+0.0 points after +0.4 points in Q4 2020).

Swiss KOF rose to record 134, strong economic boost in near future

Swiss KOF Economic Barometer rose for the second month in a row, from 117.8 to 134.0 in April. That’s also the highest level on record, surpassing the previous historical high reached after the financial crisis in 2010. KOF said, “unless the virus takes another volte, economic development is likely to get a strong boost in the near future.

Also from Swiss, retail sales rose 22.6% yoy in March, well above expectation of -5.4% yoy fall.

Japan industrial production rose 2.2% in Mar, PMI manufacturing finalized at 3-yr high in Apr

Japan’s Industrial production rose 2.2% mom in March, much better than expectation of -2.0% mom decline. According to survey by the Ministry of Economy, Trade and Industry, output is expected to rise another 8.4% in April, and then 4.3% in May. Unemployment rate dropped to 2.6%, down from 2.9%, better than expectation of 2.9%. Housing start rose 1.5% yoy, versus expectation of -7.4% yoy. Consumer confidence dropped to 34.7, down from 36.1, above expectation of 34.0. In Tokyo, CPI core slowed to 0.0% yoy, down from 0.3% yoy, missed expectation of 0.3% yoy.

PMI Manufacturing was finalized at 53.6 in April, up from March’s 52.7. That’s the strongest reading since April 2018. Usamah Bhatti, Economist at IHS Markit, said: “Japanese manufacturers continued to report a positive outlook for activity in the medium term. Close to 36% of panellists estimated that output levels would rise over the coming year. This was in line with the current IHS Markit forecast for industrial production to grow 7.7% in 2021, although this does not fully recover the output lost to the pandemic in 2020.”

China Caixin PMI manufacturing rose to 51.9, price pressures to limit policy choices

China’s official NBS PMI Manufacturing dropped to 51.1 in April, down form 51.9, below expectation of 51.4. NBS PMI Non-Manufacturing dropped to 54.9, down from 56.3, below expectation of 52.6. “Some surveyed companies report that problems such as chip shortages, problems in international logistics, a shortage of containers, and rising freight rates are still severe,” NBS statistician Zhao Qinghe said.

Caixin PMI Manufacturing rose to 51.9, up from 50.6, above expectation of 50.9. Wang Zhe, Senior Economist at Caixin Insight Group said: “Policymakers have expressed concerns about rising commodity prices on several occasions and urged adjusting raw material markets and easing businesses’ cost pressure. In the coming months, rising raw material prices and imported inflation are expected to limit policy choices and become a major obstacle to the sustained economic recovery.”

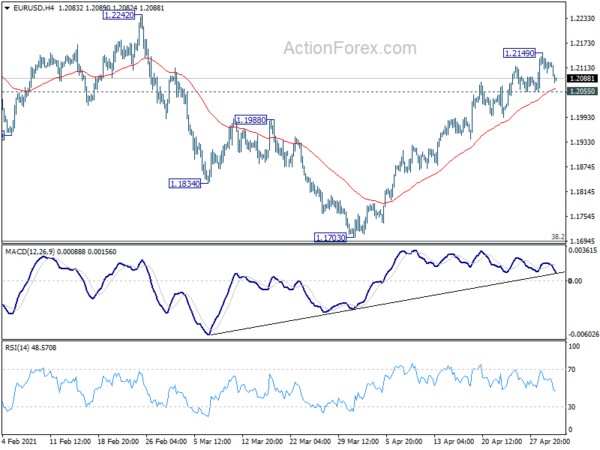

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2099; (P) 1.2124; (R1) 1.2147; More….

Intraday bias in EUR/USD is turned neutral with today’s retreat. Some consolidations could be seen first, but further rally is expected as long as 1.2055 minor support holds. Above 1.2149 will resume the rise from 1.1703 to 1.2242/2348 resistance zone. Though, break of 1.2055 will bring deeper pull back to 55 day EMA (now at 1.1981) and possibly below.

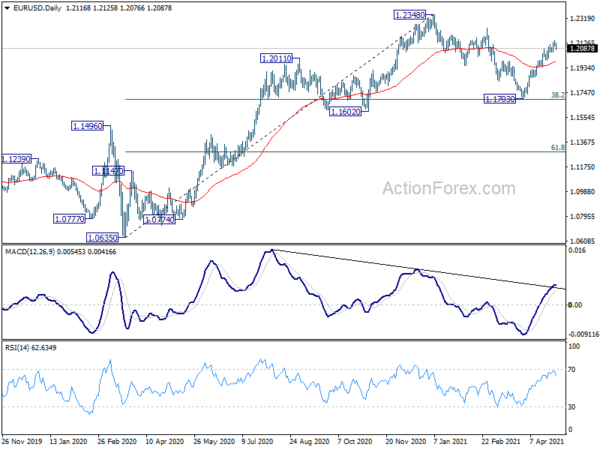

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. However, sustained break of 1.1602 will argue that whole rise from 1.10635 has completed. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Apr | 0.00% | 0.30% | 0.30% | |

| 23:30 | JPY | Unemployment Rate Mar | 2.60% | 2.90% | 2.90% | |

| 23:50 | JPY | Industrial Production M/M Mar P | 2.20% | -2.00% | -1.30% | |

| 00:30 | JPY | Jibun Bank Manufacturing PMI Apr F | 53.6 | 53.3 | 53.3 | |

| 01:00 | CNY | NBS Manufacturing PMI Apr | 51.1 | 51.4 | 51.9 | |

| 01:00 | CNY | Non-Manufacturing PMI Apr | 54.9 | 52.6 | 56.3 | |

| 01:30 | AUD | Private Sector Credit M/M Mar | 0.40% | 0.10% | 0.20% | |

| 01:30 | AUD | PPI Q/Q Q1 | 0.40% | 0.30% | 0.50% | |

| 01:30 | AUD | PPI Y/Y Q1 | 0.20% | 0.80% | -0.10% | |

| 05:00 | JPY | Housing Starts Y/Y Mar | 1.50% | -7.40% | -3.70% | |

| 05:00 | JPY | Consumer Confidence Index Apr | 34.7 | 34 | 36.1 | |

| 05:30 | EUR | France GDP Q/Q Q1 P | 0.40% | 0.00% | -1.40% | |

| 06:30 | CHF | Real Retail Sales Y/Y Mar | 22.60% | -5.40% | -6.30% | -6.60% |

| 07:00 | CHF | KOF Leading Indicator Apr | 134 | 119.8 | 117.8 | |

| 08:00 | EUR | Germany GDP Q/Q Q1 P | -1.70% | -1.50% | 0.30% | |

| 08:00 | EUR | Italy GDP Q/Q Q1 P | -0.40% | -0.40% | -1.90% | -1.80% |

| 09:00 | EUR | Eurozone GDP Q/Q Q1 P | -0.60% | -0.80% | -0.70% | |

| 09:00 | EUR | Eurozone CPI Y/Y Apr P | 1.60% | 1.60% | 1.30% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Apr P | 0.80% | 0.90% | 0.90% | |

| 09:00 | EUR | Eurozone Unemployment Rate Mar | 8.10% | 8.30% | 8.30% | 8.20% |

| 12:30 | CAD | Raw Material Price Index Mar | 2.30% | 2.00% | 6.60% | |

| 12:30 | CAD | Industrial Product Price M/M Mar | 1.60% | 1.50% | 2.60% | |

| 12:30 | CAD | GDP M/M Feb | 0.40% | 0.50% | 0.70% | |

| 12:30 | USD | Personal Spending M/M Mar | 4.20% | 3.80% | -1.00% | |

| 12:30 | USD | Personal Income M/M Mar | 21.10% | 20.00% | -7.10% | -7.00% |

| 12:30 | USD | PCE Price Index M/M Mar | 0.50% | 0.30% | 0.20% | |

| 12:30 | USD | PCE Price Index Y/Y Mar | 2.30% | 1.60% | 1.60% | 1.50% |

| 12:30 | USD | Core PCE Price Index M/M Mar | 0.40% | 0.30% | 0.10% | |

| 12:30 | USD | Core PCE Price Index Y/Y Mar | 1.80% | 1.80% | 1.40% | |

| 12:30 | USD | Employment Cost Index Q1 | 0.90% | 0.80% | 0.70% | |

| 13:45 | USD | Chicago PMI Apr | 64.6 | 66.3 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Apr F | 86.5 | 86.5 |