While NASDAQ and S&P 500 closed at new records overnight, there is no follow through risk-on buying in Asian session. Investors are generally still cautious ahead of Fed meeting. Dollar recovers in general but upside momentum is very weak. Canadian is extending gains and is now leading other commodity currencies slightly. Yen is mixed, having little reaction to BoJ rate decision and economic projections.

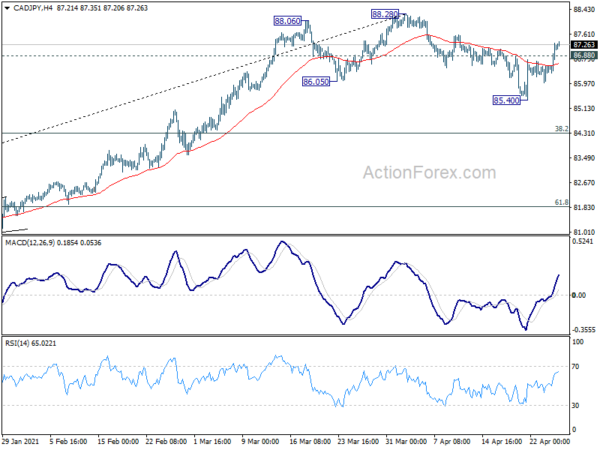

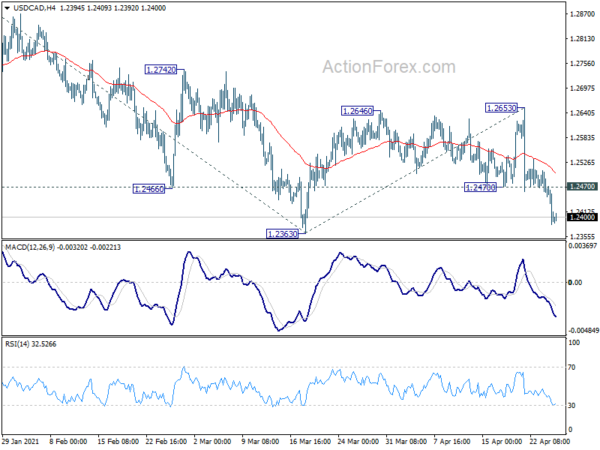

Technically, Canadian Dollar is now a focus for today. CAD/JPY’s break of 86.88 minor resistance suggests that correction form 88.28 has completed at 85.40 already. Retest of 88.28 should be seen next and break will resume larger up trend. EUR/CAD is now eyeing 1.4949 minor support. Break there will confirm completion of corrective rebound from 1.4723 and bring retest of this low. USD/CAD is also close to 1.2363 low and break will resume larger down trend from 1.4667.

In Asia, at the time of writing, Nikkei is down -0.16%. Hong Kong HSI is down -0.15%. China Shanghai SSE is down -0.54%. Singapore Strait Times is up 0.15%. Japan 10-year JGB yield is up 0.008 at 0.083. Overnight, DOW dropped -0.18%. S&P 500 rose 0.18%. NASDAQ rose 0.87%. 10-year yield rose 0.003 to 1.570.

BoJ stands pat, continue to closely monitor impacts of pandemic

BoJ kept monetary policy unchanged today as widely expected. Under the yield curve control framework, short-term policy interest rate is held at -0.1%. 10-year JGB yield target is kept at around 0%. The central bank will continue to purchase ETFs and J-REITS with upper limits of about JPY 12T and JPY 180B respectively. CP and Corporate bonds purchases will continue with upper limit of JPY 20Y until the end of September 2021.

BoJ also pledged to continue with QQE with Yield Curve Control “as long as it is necessary” and “continue expanding the monetary base” until core CPI exceeds 2% target in a “stable manner”. It will also “closely monitor” of the impact of COVID-19 and “will not hesitate to take additional easing measures if necessary”.

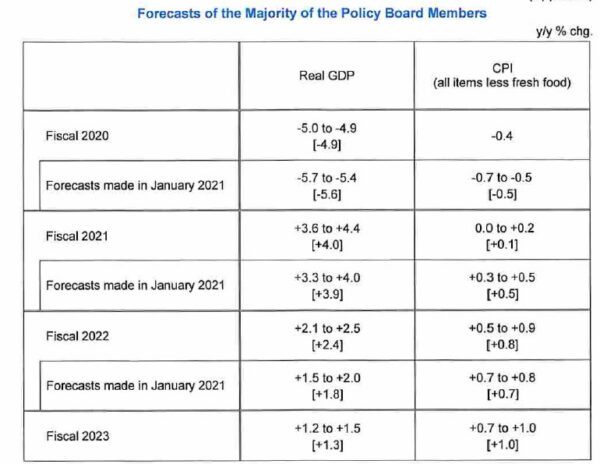

BoJ upgrades GDP forecasts on strong domestic and external demand

In the Outlook for Economic Activity and Prices, BoJ said, “the economy is likely to recover” with as impact of COVID-19 wanes gradually. Thereafter, it is projected to “continue growing with a virtuous cycle from income to spending intensifying”.

GDP growth forecasts were revised higher, “on the back of stronger domestic and external demand”. CPI forecast for fiscal 2021 was lowered “due to the effects of reduction in mobile phone charges”. But outlook is “highly unclear”. The assumption that impact of COVID-19 will “almost subside” in the middle of the projection period “entail high uncertainties.

In the new economic projections, Fiscal 2021 GDP forecast was raised slightly to 4.0%, up from January’s 3.9%. Fiscal 2022 GDP forecast was raised to 2.4%, from 1.8%. GDP growth is projected to to slow to 1.3% in fiscal 2023.

CPI forecast was downgraded to 0.1% in 2021, from 0.5%. But for fiscal 2022, CPI forecast was upgraded to 0.8%, from 0.7%. CPI is projected to rise further to 1.0% in fiscal 2023.

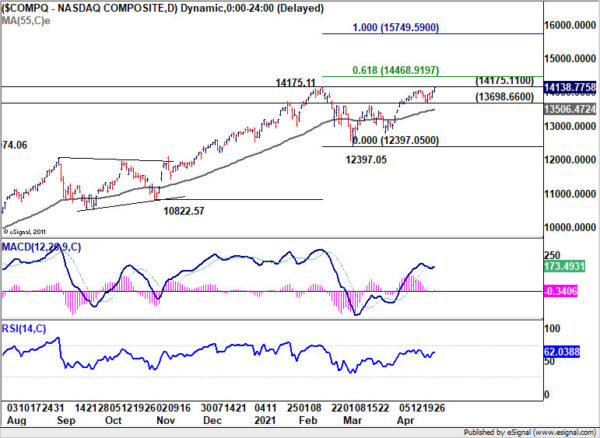

NASDAQ closed at record, but more resistance levels ahead

NASDAQ closed at new record at 14138.77 overnight (S&P 500 also closed at record 4187.62), but was short of intraday record at 4175.11. Further rise is in favor in NASDAQ for now, nonetheless, as long as 13698.66 support holds. Based on current momentum, it should at least breach 14175.11.

The major near term test is from 61.8% projection of 10822.57 to 14175.11 from 12397.05 at 14468.91. Firm break there will confirm underlying medium term up side momentum, and pave the way to 100% projection at 15749.59. However, rejection by 14468.91, followed by break of 13698.66 support, will extend the corrective pattern from 14175.11 with another fall, before completion.

Looking ahead

US will release S&P Case-Shiller 20 cities house price, house price index, and consumer confidence.

USD/CAD Daily Outlook

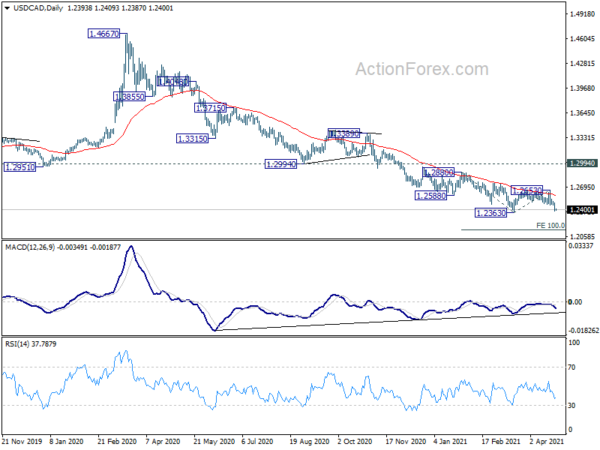

Daily Pivots: (S1) 1.2353; (P) 1.2422; (R1) 1.2460; More…

Intraday bias in USD/CAD remains on the downside for retesting 1.2363 low. Decisive break there will resume larger down trend from 1.4667. Next target will be 100% projection of 1.2880 to 1.2363 from 1.2653 at 1.2136. On the upside, though, break of 1.2470 minor resistance will delay the bearish case and extend the consolidation from 1.2363 with another rising leg.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Further decline should be seen back to 1.2061 (2017 low). In any case, break of 1.2994 support turned resistance resistance is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 3:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 3:00 | JPY | BoJ Press Conference | ||||

| 13:00 | USD | S&P/CS Composite-20 Home Price Indices Y/Y Feb | 11.80% | 11.10% | ||

| 13:00 | USD | Housing Price Index M/M Feb | 1.00% | 1.00% | ||

| 14:00 | USD | Consumer Confidence Apr | 112 | 109.7 |