Canadian Dollar surges broadly overnight after BoC’s hawkish tapering. Yet, it’s currently still one of the weakest for the week together with Dollar. The post-meeting buying was not enough to turn the Loonie into black against others yet. As for today, markets are rather quiet so far. US stocks staged a strong rebound overnight, which could set the base for more record highs before weekly close. Positive sentiment was somewhat carried on to Asia. Euro is mixed, awaiting ECB rate decision.

Technically, the recovery in Dollar in the past two day is so far corrective. We’d expect selloff to resume sooner or later, likely following new record runs in US stocks. Focus for the rest of the week will be on 1.2079 temporary top in EUR/USD< 1.4008 in GBP/USD, 0.7815 in AUD/USD and 0.9127 in USD/CHF.

In Asia, at the time of writing, Nikkei is up 1.98%. Hong Kong HSI is up 0.46%. China Shanghai SSE is down -0.05%. Singapore Strait Times is up 0.80%. Japan 10-year JGB yield is down -0.0042 at 0.071. Overnight, DOW rose 0.93%. S&P 500 rose 0.93%. NADSSAQ rose 1.19%. 10-year yield rose 0.002 to 1.564.

CAD surges on hawkish BoC tapering

Canadian Dollar surged overnight after BoC delivered a hawkish tapering of QE purchases. Weekly asset purchases will reduce to CAD3B/week, from CAD4B/week previously. Meanwhile, it also upgraded the economic assessments for both the country and the world. Policymakers now expect the spare capacity to be fully absorbed by 2H22.

More on BoC:

- BOC Tapers QE Program and Delivers Upbeat Economic Outlook

- The Bank of Canada Tapers QE Program, Sees Economic Slack Being Absorbed in the Second Half of 2022

- BoC Slows Bond Buying as Economic Outlook Improves

- CAD surges after BoC, a look at EUR/CAD, CAD/JPY

- (BOC) Bank of Canada will hold current level of policy rate until inflation objective is sustainably achieved, adjusts quantitative easing program

Australia NAB business confidence rose to 17 in Q1, economic recovery built further momentum

Australia NAB quarterly business confidence rose to 17 in Q1, up from 15. Business conditions rose from 11 to 17. Business condition for next 3 months rose form 19 to 26. Business conditions for next 12 months rose form 24 to 31. Next 12-month capex plans rose from 31 to 34, highest level since mid 1990s.

Alan Oster, NAB Group Chief Economist: “The survey suggests that the economic recovery built further momentum in Q1. What is particularly welcome is that the improvement is broad-based with conditions and confidence improving in most industries and are at an above-average level in all. Moreover, the lift in trading conditions and profitability over the last two quarters is now being translated into the Survey’s employment indicator”.

ECB meeting is a major focus for today, but expectations are rather low. No change in monetary policy is expected. Also, updated economic projections will not be released until June.

ECB in focus, Euro lacks upside momentum except versus Dollar

Even though US yields continued their march higher, European yields have stabilized since the central bank announced to accelerated significantly the pace of PEPP purchases back in mid-march. ECB will likely reiterate that the increase in PEPP purchases will continue until June. The question is whether there would be hints on scaling back the monthly purchases after that.

Here are some previews:

- ECB Preview – Looking for Hints on PEPP Destiny

- ECB to Stay the Course But Euro Spike Could be Worrisome

- ECB Preview: Christine Lagarde Will Have To Kick The Can Down The Tightrope

- ECB Preview: An Appetizer For The June Meeting

- ECB Meeting in Focus

Euro has been relatively firm this month, up against most except Swiss Franc and Kiwi. Yet, upside momentum is disappointing so far. There is follow through buying, even against Yen. Price actions against Sterling Aussie are corrective in a down trend setting. The better performance is seen against Dollar only.

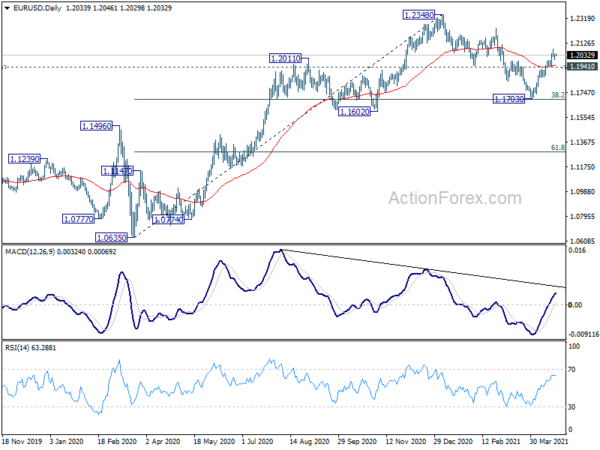

At this point, as long as 1.1941 support holds, we’re still expecting EUR/USD’s rebound from 1.1703 to continue to retest 1.2242/2348 resistance zone. But that would more likely be due to Dollar’s own weakness.

Elsewhere

Swiss will release trade balance today. Canada will release new housing price index. US will release jobless claims and existing home sales.

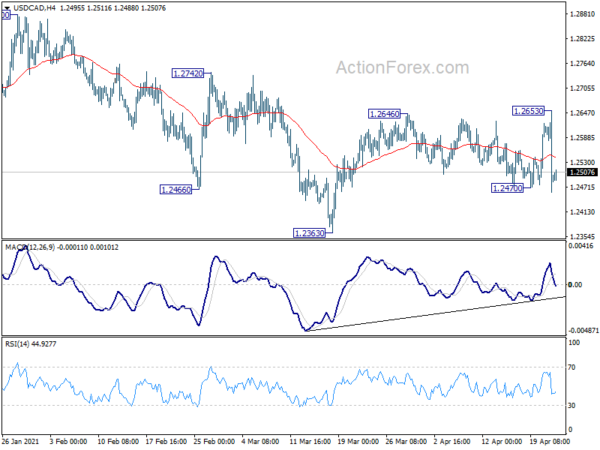

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2420; (P) 1.2536; (R1) 1.2613; More…

USD/CAD reversed sharply after edging higher to 1.2653 yesterday. Strong resistance was seen again from 55 day EMA, keeping near term outlook bearish. With break of 1.2470 minor support, intraday bias is now back on the downside for retesting 1.2363 low. Break there will resume the down trend from 1.4667. Nevertheless, firm break of 1.2653, with sustained trading above 55 day EMA, will indicate that it’s now in a larger scale rebound, towards 1.2742 resistance first.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Further decline should be seen back to 1.2061 (2017 low). In any case, break of 1.2994 support turned resistance resistance is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | NAB Business Confidence Q1 | 17 | 14 | 15 | |

| 6:00 | CHF | Trade Balance (CHF) Mar | 4.12B | 3.70B | ||

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | CAD | New Housing Price Index M/M Mar | 1.80% | 1.90% | ||

| 12:30 | USD | Initial Jobless Claims (Apr 16) | 642K | 576K | ||

| 14:00 | USD | Existing Home Sales Mar | 6.20M | 6.22M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Apr P | -11 | -11 | ||

| 14:30 | USD | Natural Gas Storage | 61B |