The financial markets are trading in mixed mode today. European stock indices are mixed while US futures point to slightly lower open. Sentiments are slightly on the risk-off side on coronavirus concerns, but selloff is so far relatively shallow. There is also no clear momentum for Yen and Dollar to extend the rebound yet. Canadian Dollar has little reaction to the surge in March inflation data. It’s quietly waiting for BoC tapering announcement and new economic projections.

Technically, one focus to watch is 129.56 minor support in EUR/JPY. Break there will open up the case for deeper pull back to 128.28 support. The accompanying reactions in EUR/USD and USD/JPY would even be more interesting. Break of 1.1941 minor support in EUR/USD will bring deeper fall to 1.1703 retest 1.1703 low. Firm break of 107.75 fibonacci support in USD/JPY would signal near term bearish reversal.

In Europe, at the time of writing, FTSE is up 0.11%. DAX is down -0.27%. CAC is up 0.30%. Germany 10-year yield is down -0.0099 at -0.268. Earlier in Asia, Nikkei dropped -2.03%. Hong Kong HSI dropped -1.76%. China Shanghai SSE closed flat. Singapore Strait Times dropped -1.16%. Japan 10-year JGB yield dropped -0.0096 to 0.075.

Canada CPI jumped to 2.2% yoy in March, accentuated by base-year effects

Canada CPI accelerated to 2.2% yoy in March, up from February’s 1.1% yoy, slightly below expectation of 2.3% yoy. CPI common rose to 1.5% yoy, up from 1.3% yoy , above expectation of 1.4% yoy. CPI median rose to 2.1% yoy, up from 2.0% yoy, matched expectations. CPI trimmed rose to 2.2% yoy, up from 1.9% yoy, above expectation of 2.0% yoy.

StatCan said price growth in March 2021 was “accentuated by what is known as base-year effects, originating in March 2020. “As the upward impact of these temporary base-year effects will influence the 12-month movement over the next few months, the historical movements affecting current growth trends will be examined.”

UK CPI accelerated to 0.7% yoy, core CPI rose to 1.1% yoy

UK CPI accelerated to 0.7% yoy in March, up from 0.4% yoy , matched expectations. Core CPI also accelerated to 1.1% yoy, up from 0.9% yoy, above expectation of 1.0% yoy. “The rate of inflation increased with petrol prices rising and clothes recovering from the falls seen in February,” Office for National Statistics official Jonathan Athow said.

Also released, RPI accelerated to 1.5% yoy in March. PPI input came in at 1.3% mom, 5.9% yoy. PPI output was at 0.5% mom, 1.9% yoy. PPI output core was at 0.4% mom, 1.7% yoy.

Australia retail sales rose 1.4% mom in Mar, led by Victoria and Western Australia

Australia retail sales rose 1.4% mom, or AUD 423.9m, in March. Over the year, sales was up 2.3% yoy. The rises were led by Victoria (4%) and Western Australia (5.5%), with both states rebounding from COVID-19 lockdown restrictions during February. Queensland, which saw COVID-19 restrictions impact March 2021, saw a minor fall.

New Zealand CPI rose 0.8% qoq, 1.5% yoy in Q1

New Zealand CPI rose 0.8% qoq in Q1, matched expectations. Annually, CPI accelerated to 1.5% yoy, up from 1.4% yoy. Looking at some details, the rises in prices were led by transport, which rose 3.9% qoq, biggest quarterly rise in over a decade. Rent prices rose 1.0% qoq, biggest quarterly rise in a year.

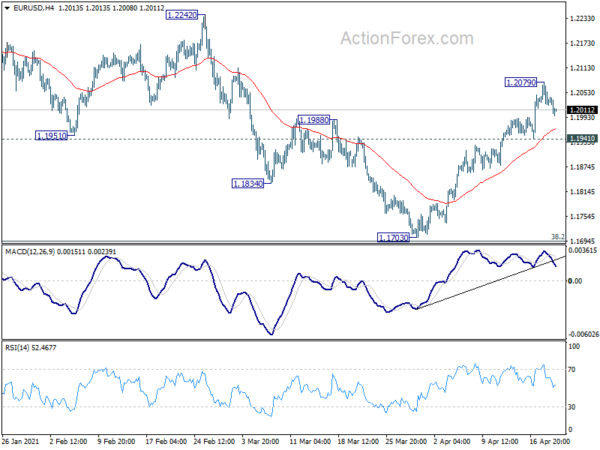

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2013; (P) 1.2046; (R1) 1.2070; More….

A temporary top is formed at 1.2079 in EUR/USD and intraday bias is turned neutral first. But further rally is expected as long as 1.1941 support holds. As noted before, correction from 1.2348 should have completed with three waves down to 1.1703. Break of 1.2079 will target 1.2442/2348 resistance zone. However, break of 1.1941 will argue that the rebound from 1.1703 has completed, and turn bias back to the downside for this support.

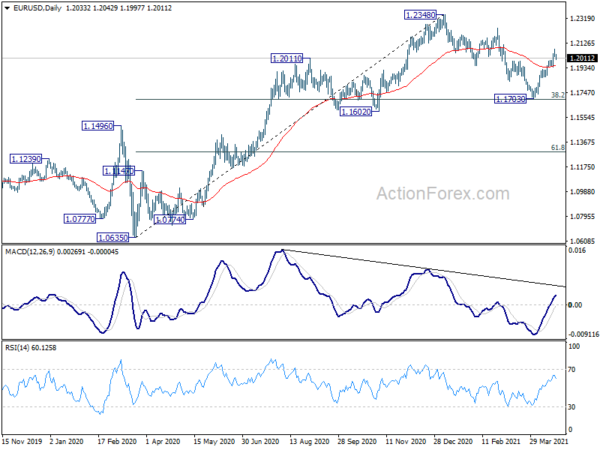

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. However, sustained break of 1.1602 will argue that whole rise from 1.10635 has completed. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | CPI Q/Q Q1 | 0.80% | 0.80% | 0.50% | |

| 22:45 | NZD | CPI Y/Y Q1 | 1.50% | 1.00% | 1.40% | |

| 00:30 | AUD | Westpac Leading Index M/M Mar | 0.38% | 0.02% | ||

| 01:30 | AUD | Retail Sales M/M Mar P | 1.40% | 0.80% | -0.80% | |

| 06:00 | GBP | CPI M/M Mar | 0.30% | 0.30% | 0.10% | |

| 06:00 | GBP | CPI Y/Y Mar | 0.70% | 0.70% | 0.40% | |

| 06:00 | GBP | Core CPI Y/Y Mar | 1.10% | 1.00% | 0.90% | |

| 06:00 | GBP | RPI M/M Mar | 0.30% | 0.30% | 0.50% | |

| 06:00 | GBP | RPI Y/Y Mar | 1.50% | 1.50% | 1.40% | |

| 06:00 | GBP | PPI Input M/M Mar | 1.30% | 0.60% | 0.90% | |

| 06:00 | GBP | PPI Input Y/Y Mar | 5.90% | 2.60% | 2.60% | 3.30% |

| 06:00 | GBP | PPI Output M/M Mar | 0.50% | 0.30% | 0.60% | 0.70% |

| 06:00 | GBP | PPI Output Y/Y Mar | 1.90% | 1.70% | 0.90% | |

| 06:00 | GBP | PPI Core Output M/M Mar | 0.40% | 0.10% | 0.30% | |

| 06:00 | GBP | PPI Core Output Y/Y Mar | 1.70% | 1.40% | 1.70% | |

| 12:30 | CAD | CPI M/M Mar | 0.50% | 0.60% | 0.50% | |

| 12:30 | CAD | CPI Y/Y Mar | 2.20% | 2.30% | 1.10% | |

| 12:30 | CAD | CPI Common Y/Y Mar | 1.50% | 1.40% | 1.30% | |

| 12:30 | CAD | CPI Median Y/Y Mar | 2.10% | 2.10% | 2.00% | |

| 12:30 | CAD | CPI Trimmed Y/Y Mar | 2.20% | 2.00% | 1.90% | |

| 14:00 | CAD | BoC Rate Decision | 0.25% | 0.25% | ||

| 14:30 | USD | Crude Oil Inventories | -3.7M | -5.9M | ||

| 15:00 | CAD | BoC Press Conference |