Dollar edges lower today but there is no follow through selling so far, in quiet markets. Still, the greenback is set to end the week as the worst performer, followed by Canadian and Swiss Franc. Sterling dipped notably earlier today but quickly recovered. Australian and New Zealand Dollar are soft, consolidation this week’s gains, as both are the strongest performers for the week.

Technically, Gold’s rally extends today and breaches 1780 handle. Rise from 1677.69 short term bottom is on track for 38.2% retracement of 2075.18 to 1676.65 at 1828.88. The question is, whether such rise in gold could help EUR/USD breaks through 1.1988 resistance and 1.2 handle decisively.

In Europe, currently, FTSE is up 0.57%. DAX is up 1.14%. CAC is up 0.53%. Germany 10-year yield is up 0.023 at -0.266. Earlier in Asia, Nikkei rose 0.14%. Hong Kong HSI rose 0.61%. China Shanghai SSE rose 0.81%. Singapore Strait Times rose 0.53%. 10-year JGB yield dropped -0.0004 to 0.090.

Little reaction to US and Canada data

US housing starts rose to 1.74m annualized rate in March, above expectation of 1.62m. Building permits rose to 1.77m, versus expectation of 1.75m. From Canada, foreign portfolio investment rose to CAD 8.52B in February. Wholesale sales dropped -0.7% mom in February, versus expectation of -0.5% mom. Markets have little reaction to the data.

Eurozone CPI finalized at 1.3% yoy in March, EU at 1.7% yoy

Eurozone CPI was finalized at 1.3% yoy in March, up from February’s 0.9% yoy. The highest contribution to the annual euro area inflation rate came from services (+0.57%), followed by energy (+0.43%), food, alcohol & tobacco (+0.24%) and non-energy industrial goods (+0.09%).

EU CPI was finalized at 1.7% yoy, up from February’s 1.3% yoy. The lowest annual rates were registered in Greece (-2.0%), Portugal, Malta, Ireland and Slovenia (all 0.1%). The highest annual rates were recorded in Poland (4.4%), Hungary (3.9%), Romania and Luxembourg (both 2.5%). Compared with February, annual inflation fell in three Member States, remained stable in three and rose in twenty one.

Eurozone exports dropped -5.5 yoy in Feb, imports dropped -2.7% yoy

In February, Eurozone exports of goods to the rest of the world dropped -5.5% yoy to EUR 178.6B. Imports from the rest of the world dropped -2.7% yoy to EUR 161.0B. Trade surplus came in at EUR 17.7B, down from EUR 23.4B a year ago. Intra-Eurozone trade rose 1.7% yoy to EUR 164.8B.

In seasonally adjusted terms, Eurozone exports dropped -2.5% mom. Imports rose 3.4% mom. Trade surplus narrowed to EUR 18.4B, below expectation of EUR 25.4B. Intra-Eurozone trade rose from EUR 5.4B to EUR 168.4B.

China GDP grew record 18.3% yoy in Q1, March data strong

China’s GDP grew a record 18.3% yoy in Q1, but missed expectation of 18.8% yoy slightly. The data was distorted by the low base as the economy was choked by the outbreak of coronavirus in Wuhan last year, which quickly spread to the world, and it’s still spreading. Nevertheless, the annual growth was still the strongest since record began in 1992.

March economic data was solid too. Retail sales rose 34.2% yoy versus expectation of 27.2%. Industrial production rose 14.1% yoy, missed expectation of 15.6% yoy. Fixed asset investment rose 25.6% ytd yoy, above expectation of 25.3%. Overall, the economy is on track to beat the government’s annual target of 6% GDP growth.

BoJ Kuroda: It’s still possible to achieve 2% inflation target

BoJ Governor Haruhiko Kuroda reiterated to the parliament today that there is no need to change the 2% inflation target. He expected inflation to be negative for now due to the impacts of the pandemic. But consumer prices will “rebound thereafter, gradually accelerate the pace of increase.” “It will take time, but it’s still possible to achieve our 2% inflation target,” he said.

Kuroda also said he hoped to deepen the debate with global central bankers on the role of monetary policy in addressing climate change. “There are many factors we need to take into account, such as how this will affect distribution of resources,” he said. “We hope to deepen debate in international meetings. I’m not saying we won’t think about possibilities at all.”

New Zealand BusinessNZ manufacturing rose to 63.6 on strong production and new orders

New Zealand BusinessNZ Performance of Manufacturing Index jumped 9.4 pts to 63.6 in March, highest since the survey began in 2002. Looking at some details, production jumped from 58.4 to 66.8. Employment jumped from 50.2 to 53.5. New orders rose from 58.0 to 72.5.

BusinessNZ’s executive director for manufacturing Catherine Beard said “The two major sub-index values of Production (66.8) and New Orders (72.5) were the main drivers of the March result, with the latter experiencing its first post 70-point value. This does indicate a swift shift in demand over a relatively short time, which may indicate a move towards previously shelved projects and business ventures that have now been given the green light”.

EUR/USD Mid-Day Outlook

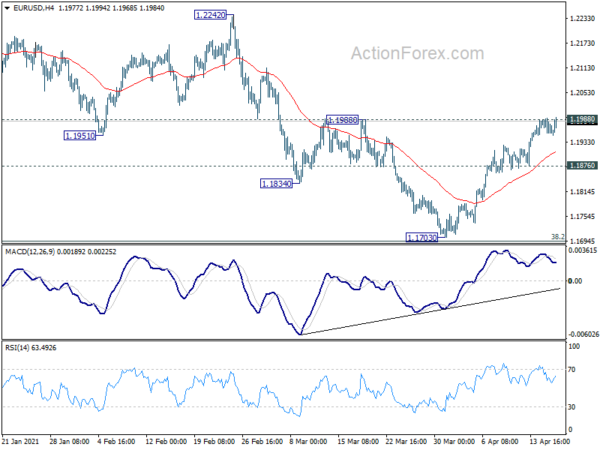

Daily Pivots: (S1) 1.1950; (P) 1.1972; (R1) 1.1987; More….

No change in EUR/USD’s outlook as focus stays on 1.1988 resistance. Decisive break there should affirm the case that correction from 1.2348 has completed at 1.1703. Further rally should then be seen to retest 1.2242/2348 resistance zone. On the downside, below 1.1876 minor support will dampen the bullish case, and turn bias back to the downside for 38.2% retracement of 1.0635 to 1.2348 at 1.1694.

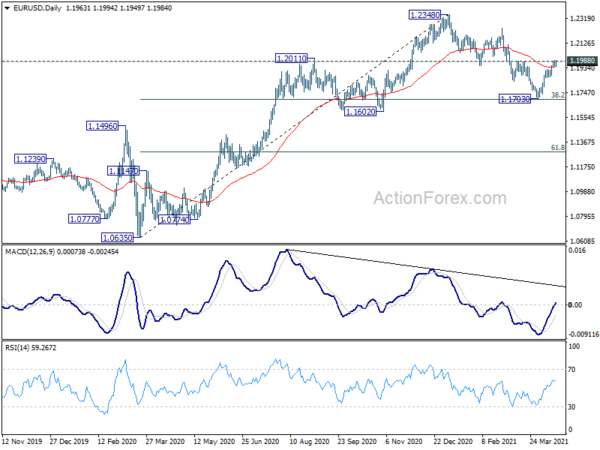

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. However, sustained break of 1.1602 will argue that whole rise from 1.10635 has completed. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing Mar | 63.6 | 51.3 | 53.4 | |

| 02:00 | CNY | GDP Y/Y Q1 | 18.30% | 18.80% | 6.50% | |

| 02:00 | CNY | Retail Sales Y/Y Mar | 34.20% | 27.20% | 33.80% | |

| 02:00 | CNY | Industrial Production Y/Y Mar | 14.10% | 15.60% | 35.10% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Mar | 25.60% | 25.30% | 35.00% | |

| 06:30 | CHF | Producer and Import Prices Y/Y Mar | -0.20% | -0.10% | -1.10% | |

| 06:30 | CHF | Producer and Import Prices M/M Mar | 0.60% | 0.10% | 0.00% | |

| 08:00 | EUR | Italy Trade Balance (EUR) Feb | 4.75B | 1.59B | 1.58B | |

| 09:00 | EUR | Eurozone Trade Balance (EUR) Feb | 18.4B | 25.4B | 24.2B | |

| 09:00 | EUR | Eurozone CPI Y/Y Mar F | 1.30% | 1.30% | 1.30% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Mar F | 0.90% | 0.90% | 0.90% | |

| 12:30 | USD | Housing Starts Mar | 1.74M | 1.62M | 1.42M | 1.46M |

| 12:30 | USD | Building Permits Mar | 1.77M | 1.75M | 1.72M | 1.72M |

| 12:30 | CAD | Foreign Portfolio Investment in Canadian Securities Feb | 8.52B | 6.05B | 1.27B | |

| 12:30 | CAD | Wholesale Sales M/M Feb | -0.70% | -0.50% | 4.00% | |

| 14:00 | USD | Michigan Consumer Sentiment Index Apr P | 88.9 | 84.9 |