USD/JPY’s near term correction accelerates lower today and the development drags down other Yen crosses too. There is no apparent reason for the rush into Yen. Stocks, yields, metals, and oil are all steady for now. We’ll monitor if the Yen’s rally is a prelude to some other developments in the markets. For now, Kiwi and Aussie are following Yen as next strongest. Euro is following Dollar as second weakest for today.

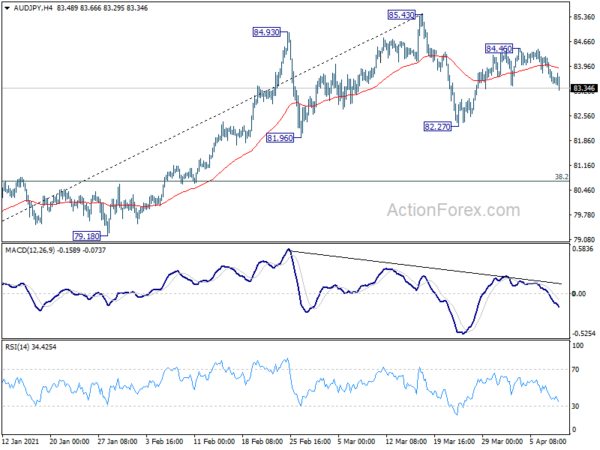

Technically, EUR/JPY’s break of 129.63 minor support suggests that consolidation from 130.65 is extending with a third leg, down back towards 128.28 support. Similar development is seen in AUD/JPY, which is extending the corrective pattern from 85.43 towards 82.27 support. NZD/JPY should also be extending the corrective pattern form 79.12 with a third leg back towards 75.61 support.

In Europe, FTSE is up 0.45%. DAX is up 0.02%. CAC is up 0.36%. Germany 10-year yield is down -0.010 at -0.329. Earlier in Asia, Nikkei dropped -0.07%. Hong Kong HSI rose 1.16%. China Shanghai SSE rose 0.08%. Singapore Strait Times dropped -0.29%. Japan 10-year JGB yield closed flat at 0.101.

US initial jobless claims rose to 744k, continuing claims down to 3.73m

US initial jobless claims rose 16k to 744k in the week ending April 3, well above expectation of 650k. Four-week moving average of initial claims rose 2.5k to 723.75k.

Continuing claims dropped -16k to 3734k, lowest level since March 2020. Four-week moving average of continuing claims dropped -105.75k to 3862k.

ECB accounts: Conducting PEPP purchase at a significantly higher pace in Q2 was proportionate

In the accounts of March ECB monetary policy meeting, it’s noted that the decision to conduct PEPP purchases at a “significantly higher pace” during Q2 was “proportionate in the light of the ECB’s mandate, balancing increased optimism about the medium-term outlook against the considerable uncertainty that still prevailed in the shorter term.”

The decisions would “send a strong signal that the Governing Council wanted to lean against the tightening of financing conditions”. Yet, it was remarked that the Governing Council needed to “avoid giving the impression of being overly focused on sovereign yields or reacting mechanically to a set of indicators of financing conditions.”

Overall, there was “wide agreement” in the council that purchase pace needed to “take into account a joint assessment of the favourability of current financing conditions and the inflation outlook”. The council would undertake a “quarterly” joint assessment of financing conditions and the inflation outlook in order to determine the pace of purchases needed to keep financing conditions favourable.

Eurozone PPI at 0.5% mom, 1.5% yoy in Feb

Eurozone PPI came in at 0.5% mom, 1.5% yoy in February, versus expectation of 0.6% mom, 1.4% yoy. For the month, industrial producer prices increased by 1.2% for intermediate goods, by 0.3% in the energy sector and for non-durable consumer goods, by 0.2% for durable consumer goods and by 0.1% for capital goods. Prices in total industry excluding energy increased by 0.6%.

EU PPI came in at 0.7% mom, 1.6% yoy. For the month, the highest increases in industrial producer prices were recorded in Greece and Luxembourg (both +2.8%), Belgium (+2.4%) and Lithuania (+2.0%), while the only decreases were observed in Ireland, (-9.7%), Spain (-1.5%) and Portugal (-0.5%).

Also released, Germany factory orders rose 1.2% mom in February versus expectation of 1.0% mom. France trade deficit widened to EUR -5.2B in February, versus expectation of EUR -3.8B. Swiss foreign currency reserves rose to CHF 930B in March.

UK PMI construction rose to 61.7 in Mar, highest since 2014

UK PMI Construction rose to 61.7 in March, up sharply from 53.3, well above expectation of 55.0. That’s the strongest reading since September 2014. Markit also said there was robust growth in all major categories of construction activity. Rise in commercial work was fastest for six-and-a-half years. Job creation also accelerated to 27-month high.

Tim Moore, Economics Director at IHS Markit: “March data revealed a surge in UK construction output as the recovery broadened out from house building to commercial work and civil engineering… Improving confidence among clients in the commercial segment was a key driver of growth.. The increasingly optimistic UK economic outlook has created a halo effect on construction demand and the perceived viability of new projects.”

New Zealand ANZ business confidence dropped to -8.4, stresses and strains starting to show

New Zealand ANZ Business confidence dropped to -8.4 in April, down from -4.1. Own activity outlook dropped slightly to 16.4, down from 16.6. Looking at more details, export intensions rose from 4.5 to 6.6. Investment intentions rose form 11.9 to 12.4. Cost expectations rose from 73.3 to 75.1. Employment intentions dropped slightly from 14.4 to 14.1. Profit expectations dropped notably from -0.6 to -4.3.

ANZ said: “The stresses and strains in the New Zealand economy are starting to show…. rising costs are an economy-wide issue…. It’s inflationary, but not growth-friendly, so the RBNZ will look through it as long as it appears transitory.”

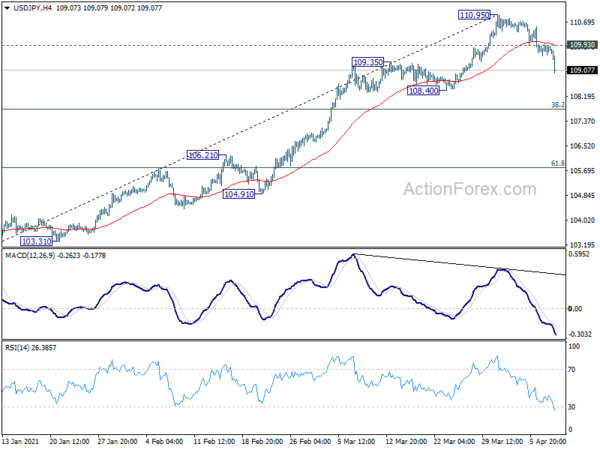

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.63; (P) 109.78; (R1) 109.99; More…

USD/JPY’s correction from 110.95 short term top accelerates lower today. Deeper fall would be seen to 108.40 support and possibly below. But downside should be contained by 38.2% retracement of 102.58 to 110.95 at 107.75 to bring rebound. On the upside, above 109.93 minor resistance will turn intraday bias back to the upside for retesting 110.95 high first.

In the bigger picture, current development suggests that the corrective down trend from 118.65 (Dec 2016) has completed at 101.18. Firm break of 112.22 resistance should confirms this bullish case. A medium term up trend could then has started for 100% projection of 101.18 to 111.71 from 102.58 at 113.11 and then 161.8% projection at 119.61. However, rejection by 111.71, followed by sustained trading below 55 day EMA (now at 107.61), will dampen the bullish view and keep medium term outlook neutral first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Mar | 59.00% | 53.90% | 52.00% | 54.00% |

| 23:50 | JPY | Current Account (JPY) Feb | 1.79T | 1.02T | 1.50T | |

| 01:00 | NZD | ANZ Business Confidence Apr P | -8.4 | 0 | -4.1 | |

| 05:00 | JPY | Eco Watchers Survey: Current Mar | 49 | 41.3 | ||

| 05:00 | JPY | Consumer Confidence Index Mar | 36.1 | 35.6 | 33.8 | |

| 06:00 | EUR | Germany Factory Orders M/M Feb | 1.20% | 1.00% | 1.40% | |

| 06:45 | EUR | France Trade Balance (EUR) Feb | -5.2B | -3.8B | -3.9B | -4.2B |

| 07:00 | CHF | Foreign Currency Reserves (CHF) Mar | 930B | 914B | ||

| 08:30 | GBP | Construction PMI Mar | 61.7 | 55 | 53.3 | |

| 09:00 | EUR | Eurozone PPI M/M Feb | 0.50% | 0.60% | 1.40% | 1.70% |

| 09:00 | EUR | Eurozone PPI Y/Y Feb | 1.50% | 1.40% | 0.00% | 0.40% |

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:30 | USD | Initial Jobless Claims (Apr 2) | 744K | 650K | 719K | 728K |

| 14:30 | USD | Natural Gas Storage | 22B | 14B |