Dollar trades broadly lower this week so far, following the strong record close in stocks overnight. Nevertheless, Yen and, to a larger extent, Swiss Franc are not following the selloff much. Commodity currencies are trading broadly higher together with Sterling. Aussie yawns RBA rate decision, which provided nothing new to the markets.

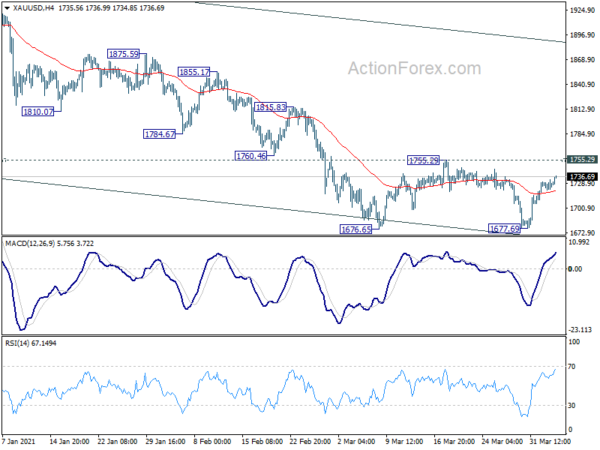

Technically, the case is building up for broad based selling in Dollar. EUR/USD’s break of 1.1804 minor resistance suggests short term bottoming. More importantly, that’s the first sign that whole correction from 1.2348 has completed. AUD/USD is now pressing 0.7662 minor resistance while USD/CAD is also pressing 1.2519 minor support. Break of these levels will solidify Dollar’s weakness. Also, attention would also be on whether Gold could break through 1755.29 resistance to complete a double bottom reversal pattern (1676.65, 1677.69).

In Asia, Nikkei is currently down -1.13%. Hong Kong is still on holiday. China Shanghai SSE is down -0.17%. Singapore Strait Times is down -0.33%. Japan 10-year JGB yield is down -0.0118 at 0.109, but stays above 0.1 handle. Overnight, DOW rose 1.13%. S&P 500 rose 1.4%. NASDAQ rose 1.67%. 10-year yield rose 0.006 to 1.720.

RBA stands pat, recovery well under way but price pressures subdued

RBA kept monetary policy settings unchanged as widely expected, including cash rate and 3-year yield target at 0.10%. Also, parameters of the Term Funding Facility and asset purchases are maintained.

The central bank reiterated that recovery in Australia is “well under way and is stronger than had been expected”. Recovery is “expected to continue, with above-trend growth this year and next”. But wage and price pressures are “subdued” and are expected to “remain so for some time”. Underlying inflation is expected to “remain below 2 per cent over the next few years”.

It also kept the pledge to “maintaining highly supportive monetary conditions until its goals are achieved”. Conditions for a rate hike is not expected to be met “until 2024 at the earliest”.

China Caixin PMI services rose to 54.3, economy continued to recover

China Caixin PMI Services rose to 54.3 in March, up from 51.5, above expectation of 51.7. Markit noted that business activity and sales both rose at quicker rates. Employment returned to growth. Business confidence also hit highest for over a decade amid hopes of post pandemic recovery. PMI composite also picked up to 53.1, from February’s 51.7.

Wang Zhe, Senior Economist at Caixin Insight Group said: “To sum up, the economy continued to recover from the epidemic…. The recovery in manufacturing slowed for the fourth straight month, whereas for services, it expanded at a much faster pace… More attention still needs to be paid to inflation going forward. Input costs and output prices in the services and manufacturing sectors have been rising for several months, reflecting growing inflationary pressure. This has restricted the room for future policy changes and is not conducive to a sustained economic recovery in the post-epidemic period

From Japan, labor cash earnings dropped -0.2% yoy in February, versus expectation of -1.5% yoy. Household spending dropped -6.6% yoy, versus expectation of -5.0% yoy.

S&P 500, DOW hit new record as up trend continue

US stocks surged sharply overnight, with S&P 500 and DOW closing at new record highs. S&P 500 rose 1.44% or 58.04 to 4077.91. It’s now close to 61.8% projection of 2191.86 to 3588.11 from 3233.94 at 4096.82. Based on current momentum, this projection is more likely to be taken out decisively than not. In that case, sustained trading above 4096.82 will confirm strong underlying medium term momentum, and pave the way to 100% projection at 4630.19. In any case, for now, outlook will stay bullish as long as 3853.50 support holds.

DOW has already taken out equivalent level, 61.8% projection of 18213.65 to 29199.35 from 26143.77 at 32932.93. S&P 500’s reaction to 4096.82 would help double confirm DOW’s medium term upside momentum. We’re looking at 100% projection at 37129.47 as next target. In any case, DOW will stay bullish as long as 32071.41 support holds.

Fed Mester: We’ll see a very strong second half of the year

Cleveland Fed President Loretta Mester said in a CNBC interview that “we’ll see a very strong second half of the year”. However, ” we are still far from our policy goals,” referring Fed’s dual mandate.

The March non-farm payrolls report was a “great” one. But Mester added, “we need more of them coming our way.” “I think we need to be very deliberately patient in our approach to monetary policy.”

Mester was not concerned with this year’s rise in treasury yields. “I think the higher bond yields are quite understandable in the context of the improvement in the economic outlook. The increase has been an orderly increase,” she said. “So I’m not concerned at this point with the rise in yields. I don’t think there’s anything for the Fed to react to.”

Looking ahead

Italy unemployment will be released in European session. Eurozone will release Sentix investor confidence and unemployment rate.

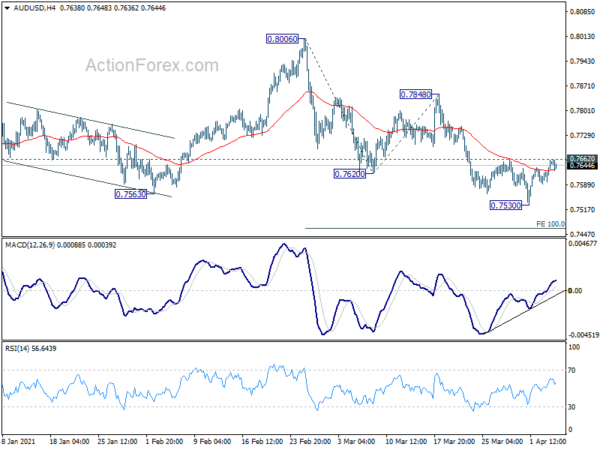

AUD/USD Daily Report

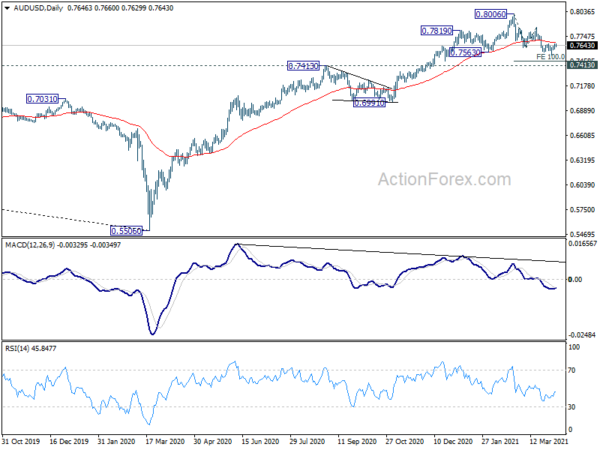

Daily Pivots: (S1) 0.7614; (P) 0.7637; (R1) 0.7675; More…

Intraday bias in AUD/USD remains neutral for the moment. On the upside, break of 0.7622 minor resistance will suggest short term bottoming at 0.7530, on bullish convergence condition in 4 hour MACD. Intraday bias will be turned back to the upside for 0.7848 resistance. Break there should confirm completion of the correction form 0.8006. On the downside, break of 0.7530 will extend the correction to 100% projection of 0.8006 to 7620 from 0.7848 at 0.7462. We’ll look for strong support from there to bring rebound.

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Feb | -0.20% | -1.50% | -0.80% | |

| 23:30 | JPY | Overall Household Spending Y/Y Feb | -6.60% | -5.00% | -6.10% | |

| 1:45 | CNY | Caixin Services PMI Mar | 54.3 | 51.7 | 51.5 | |

| 4:30 | AUD | RBA Interest Rate Decision | 0.10% | 0.10% | 0.10% | |

| 8:00 | EUR | Italy Unemployment Jan | 8.80% | 9.00% | ||

| 8:30 | EUR | Eurozone Sentix Investor Confidence Apr | 6.7 | 5 | ||

| 9:00 | EUR | Eurozone Unemployment Rate Feb | 8.10% | 8.10% |