Dollar is generally firm today while selling focus turned to Australian Dollar, and other commodity currencies. It’s unsure what’s the exact catalyst for the selloff in Aussie. But recent pull back in copper price is likely one of the reasons at least. Euro, Yen and Swiss Franc, recover, except versus the greenback. Main focus will now turn to US ISM manufacturing, before entering into a long-weekend.

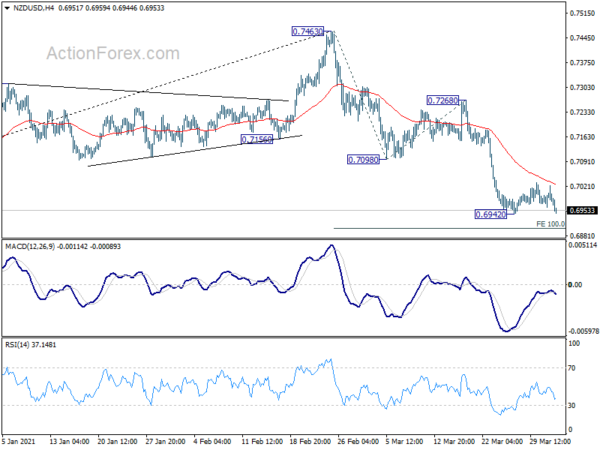

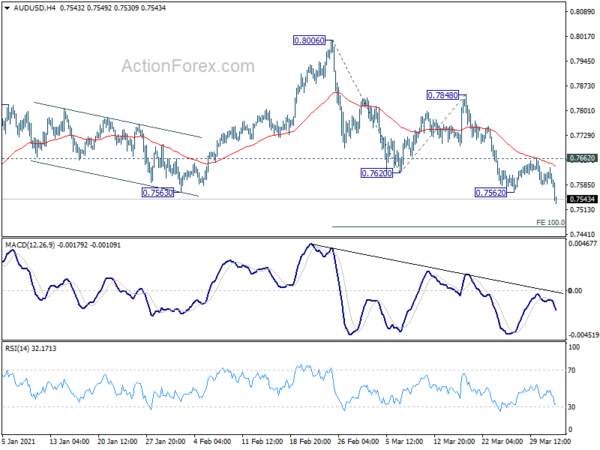

Technically, AUD/USD’s break of 0.7562 temporary low confirms resumption of correction from 0.8006. Next target is 100% projection of 0.8006 to 0.7620 from 0.7848 at 0.7462. NZD/USD is also eyeing 0.6942 temporary low. Break there will resume the corrective decline from 0.7463, for 100% projection of 0.7463 to 0.7098 from 0.7268 at 0.6903. The movements in both pairs could reinforces each other.

In Asia, Nikkei closed up 0.72%. Hong Kong HSI is up 1.11%. China Shanghai SSE is up 0.52%. Singapore Strait Times is up 0.28%. Japan 10-year JGB yield is up 0.0077 at 0.106, back above 0.1 handle. Overnight, DOW dropped -0.26%. S&P 500 rose 0.36%. NASDAQ rose 1.54%. 10-year yield rose 0.020 to 1.746.

Japan Tankan large manufacturing index rose to 5 in Q1, highest since Q3 2019

Japan Tankan Large Manufacturing Index rose to 5 in Q1, up from -10, above expectation of 0. That’s also the highest level since Q3 2019. Non-Manufacturing Index rose to -1, up from -5, above expectation of -5. Large Manufacturing Outlook rose to 4, up from -8, matched expectations. Non-Manufacturing Outlook rose to -1, up from -6, above expectation of -2. All industry Capex rose 3.0%, above expectation of 1.4%.

Also released, PMI Manufacturing was finalized at 52.7 in March, up from February’s 51.4. Usamah Bhatti, Economist at IHS Markit, said: “The Japanese manufacturing sector continued to gather some positive momentum at the end of the first quarter of 2021… Beyond the immediate future, Japanese manufacturers were confident that output would continue to rise over the coming 12 months… Currently, IHS Markit estimates that industrial production in Japan will grow 7.7% in 2021, yet this does not fully recover the output lost in 2020.”

China Caixin PMI manufacturing dropped to 50.6, growing inflationary pressure

China Caixin Manufacturing PMI dropped to 50.6 in March, down from 50.9, missed expectation of 51.0. Markit noted that production increased again amid further uptick in sales. Export orders rose for the first time in three months. Inflationary pressures also picked up.

Australia AiG manufacturing rose to 59.9 in Mar, highest since 2018

Australia AiG Performance of Manufacturing Index rose to 59.9 in March, up from 58.8. That’s the highest level since March 2018, and indicates a sixth consecutive month of strong recovery. Looking at some details, production dropped -8.6 to 57.2. Employment rose 8.2 to 66.0. New orders rose 3.6 to 63.5. Exports dropped -2.8 to 51.3. Input prices dropped -2.8 to 71.3. Selling prices rose 8.5 to 59.7.

Australia exports dropped -1% mom in Feb, imports rose 5%

Australia goods and services exports dropped -1% mom to AUD 38.93B in February. Goods and services imports rose 5% mom to AUD 31.40B. Trade surplus came in at AUD 7.53B, down form January’s AUD 9.62B, below expectation of AUD 9.40B.

Retail sales dropped -0.8% mom in February, revised up from preliminary reading of -1.1% mom.

Looking ahead

Swiss will release CPI and retail sales. Germany will release retail sales and PMI manufacturing final. Eurozone and UK will release PMI manufacturing final too. Later in the day, Canada will release building permits and PMI manufacturing. US will release ISM manufacturing and construction spending.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7576; (P) 0.7607; (R1) 0.7625; More…

AUD/USD’s corrective fall from 0.8006 resumes by breaking 0.7562 and hits as low as 0.7530 so far. Intraday bias is back on the downside for 100% projection of 0.8006 to 0.7620 from 0.7848 at 0.7462. We’ll look for strong support from there to bring rebound. On the upside, break of 0.7662 minor resistance will turn bias to the upside for 0.7848 resistance.

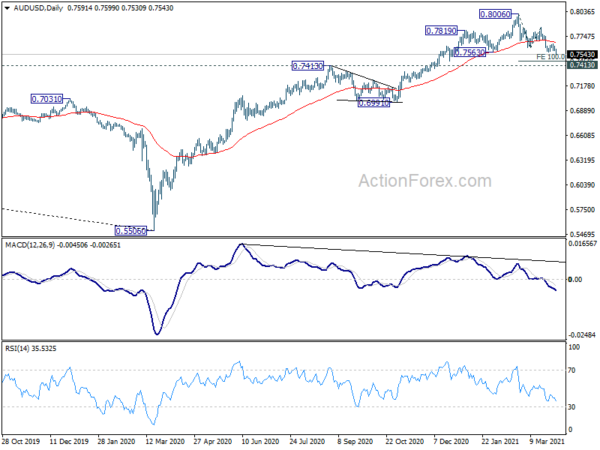

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Mfg Index Mar | 59.9 | 58.8 | ||

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q1 | 4 | 4 | -8 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q1 | -1 | -2 | -6 | |

| 23:50 | JPY | Tankan Large Manufacturing Index Q1 | 5 | 0 | -10 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q1 | -1 | -5 | -5 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q1 | 3.00% | 1.40% | -1.20% | |

| 00:30 | JPY | Jibun Bank Manufacturing PMI Mar F | 52.7 | 52.0 | 52.0 | |

| 00:30 | AUD | Retail Sales M/M Feb | -0.80% | -1.10% | -1.10% | 0.30% |

| 00:30 | AUD | Trade Balance(AUD) Feb | 7.53B | 9.40B | 10.14B | 9.62B |

| 01:45 | CNY | Caixin Manufacturing PMI Mar | 50.6 | 51 | 50.9 | |

| 06:00 | EUR | Germany Retail Sales M/M Feb | 2.00% | -4.50% | ||

| 06:30 | CHF | Real Retail Sales Y/Y Feb | -0.50% | |||

| 06:30 | CHF | CPI M/M Mar | 0.40% | 0.20% | ||

| 06:30 | CHF | CPI Y/Y Mar | -0.30% | -0.50% | ||

| 07:45 | EUR | Italy Manufacturing PMI Mar | 59.7 | 56.9 | ||

| 07:50 | EUR | France Manufacturing PMI Mar F | 58.6 | 58.8 | ||

| 07:55 | EUR | Germany Manufacturing PMI Mar F | 66.6 | 66.6 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Mar F | 62.4 | 62.4 | ||

| 08:30 | GBP | Manufacturing PMI Mar F | 57.9 | 57.9 | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Mar | -39.10% | |||

| 12:30 | CAD | Building Permits M/M Feb | -1.50% | 8.20% | ||

| 12:30 | USD | Initial Jobless Claims (Mar 26) | 678K | 684K | ||

| 13:30 | CAD | Manufacturing PMI Mar | 54.8 | |||

| 13:45 | USD | Manufacturing PMI Mar | 59.2 | 59.0 | ||

| 14:00 | USD | ISM Manufacturing PMI Mar | 61 | 60.8 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Mar | 80 | 86 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Mar | 53 | 54.4 | ||

| 14:00 | USD | Construction Spending M/M Feb | -1.00% | 1.70% | ||

| 14:30 | USD | Natural Gas Storage | -20B | -36B |