Yen trades generally lower today following surging treasury yields and some firmness in stock markets. While it’s not yet a full risk-on market, sentiments are positive for now. Swiss Franc, Euro and Dollar also turn slightly softer. On the other hand, commodity currencies and Sterling are trading generally higher.

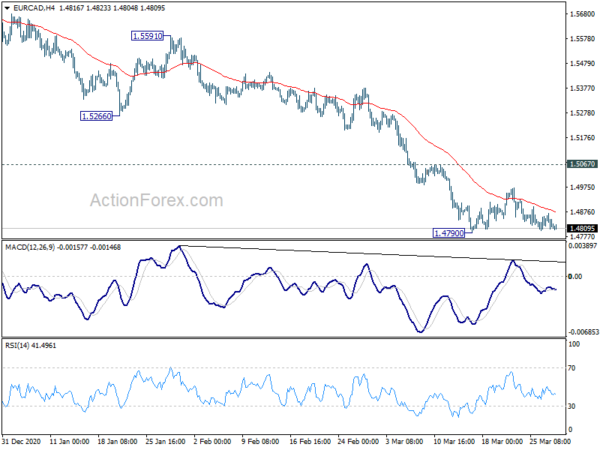

Technically, the downside breakout in EUR/GBP yesterday was a bit disappointing as it quickly recovered, as Sterling’s rally attempt faltered. Though Euro still looks rather vulnerable for now. In particular, EUR/CAD is set to test on 1.4790 low again and break there should confirm resumption of larger down trend. Developments in EUR/CAD would be an early indication of more broad based Euro selling.

In Asia, currently, Nikkei is up 0.07%. Hong Kong HSI is up 1.18%. China Shanghai SSE is up 0.59%. Singapore Strait Times is up 0.70%. Japan 10-year JGB yield is up 0.0123 at 0.082. Overnight, DOW rose 0.30%. S&P 500 dropped -0.09%. NASDAQ dropped -0.60%. 10-year yield rose 0.061 to 1.721.

BoJ Kuroda: Absolutely not that case of exiting ultra-loose policy

BoJ Governor Haruhiko Kuroda reiterated in an interview with the Japan Daily, the central bank had “absolutely no play” to stop ETF purchases, or unload its holdings. “We will continue to buy ETFs flexibly and in a nimble fashion, so it’s absolutely not the case that we are exiting ultra-loose monetary policy”, he added.

Separately from Japan, retail sales dropped -1.6% yoy in February, better than expectation of -2.8% yoy. That’s still the third straight month of annual decline. Unemployment rate was unchanged at 2.9%, better than expectation of a rise to 3.0%.

US yields jumped again on vaccination optimism

US long term treasury yields jumped again overnight, with 10-year yield closed up 0.061 at 1.721, 30-year yield gained 0.057 to 2.424. Sentiments were positive on vaccine rollouts and return-to-normal in the US. President Joe Biden announced that the “vast, vast majority of adults”, 90%, will be eligible for coronavirus vaccine by April 19. Participating pharmacies will also more than double to 40k.

10-year yield’s strong rally yesterday suggests that 1.585 near term support was defended well after last week’s retreat. While upside momentum diminished as seen in daily MACD, there is no sign of a change in up trend yet. Current rally is still on track to 2% handle, which is close t 1.971 resistance and 55 month EMA.

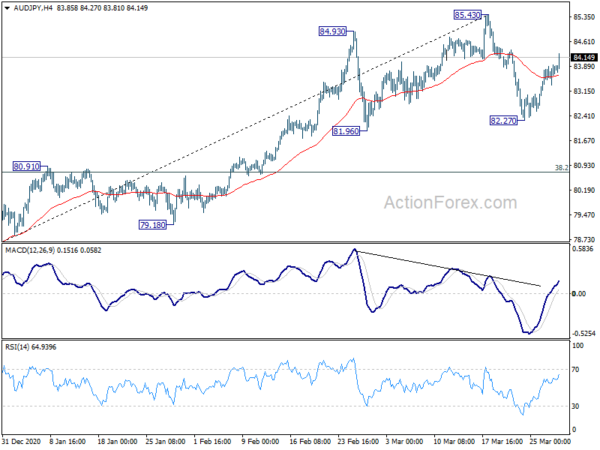

AUD/JPY and NZD/JPY following yields higher, to retest recent highs

Yen crosses are generally following treasury yields higher today. While USD/JPY is extending recent up trend and is set to take on 110 handle, some attention would also be on commodity Yen crosses.

AUD/JPY’s corrective pull back from 85.43 should have completed at 82.27 already, with strong break of 4 hour 55 EMA. Retest of 85.34 could be seen as the current rebound extends. But we’d be cautious on strong resistance from there to limit upside, at the first attempt. Price actions from 85.43 could be a near term corrective pattern with at least one more down leg. But even in that case, strong support should be seen from 38.2% retracement of 73.13 to 85.43 at 80.73 to contain downside. Sustained break of 85.43 would resume whole up trend form 59.89.

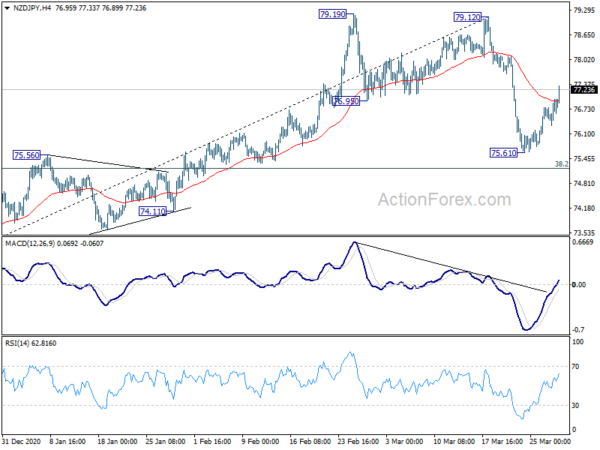

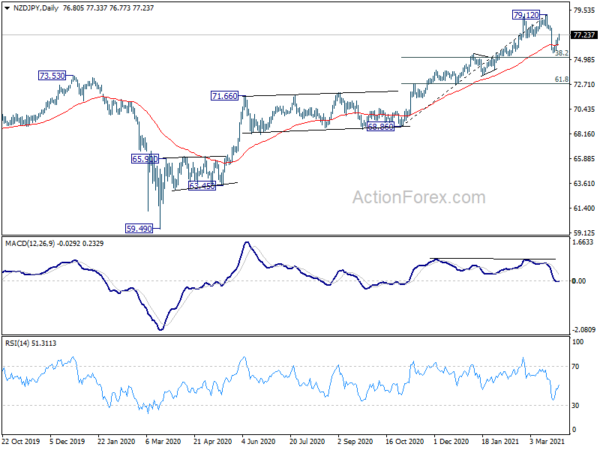

NZD/JPY’s picture is similar. Corrective pull back from 79.12 should have completed at 75.61. Stronger rebound could be seen back to retest 79.19/12 resistance. Yet, the corrective pattern might still extend with another falling leg, to take on 38.2% retracement of 68.86 to 79.12 at 75.20, before completion. Though, firm break of 79.12 will resume larger up trend form 59.49.

Germany import price index and CPI flash, Swiss KOF and Eurozone confidence indicators will be released in European session. Later in the day, US will release house price index and consumer confidence.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3729; (P) 1.3788; (R1) 1.3821; More….

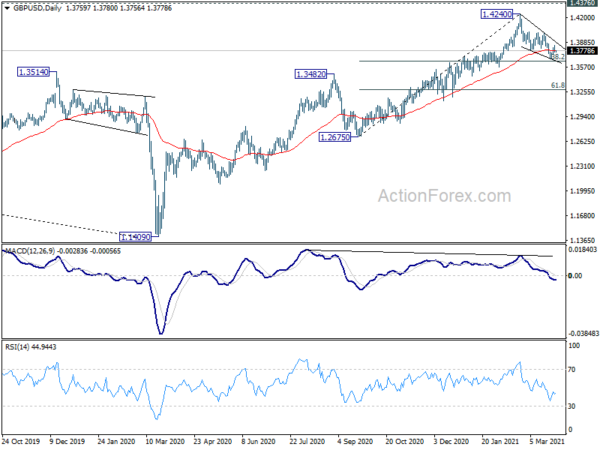

GBP/USD’s recovery lost momentum after hitting 1.3846 and intraday bias is turned neutral first. We’d still slightly favoring the case that corrective pull back from 1.4240 has completed with three waves down to 1.3669, ahead of 38.2% retracement of 1.2675 to 1.4240 at 1.3642. On the upside, break of 1.3846 will extend the rebound to 1.4000 resistance and then 1.4240 high.

In the bigger picture, rise from 1.1409 medium term bottom is in progress. Further rally would be seen to 1.4376 resistance and above. Decisive break there will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. On the downside, break of 1.3482 resistance turned support is needed to be first indication of completion of the rise. Otherwise, outlook will stay cautiously bullish even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Feb | -18.20% | 2.10% | 1.50% | |

| 23:30 | JPY | Unemployment Rate Feb | 2.90% | 3.00% | 2.90% | |

| 23:50 | JPY | Retail Trade Y/Y Feb | -1.50% | -2.80% | -2.40% | |

| 6:00 | EUR | Germany Import Price Index Y/Y Feb | 1.00% | -1.20% | ||

| 7:00 | CHF | KOF Leading Indicator Mar | 104.3 | 102.7 | ||

| 9:00 | EUR | Eurozone Economic Sentiment Mar | 96 | 93.4 | ||

| 9:00 | EUR | Eurozone Services Sentiment Mar | -14.5 | -17.1 | ||

| 9:00 | EUR | Eurozone Industrial Confidence Mar | 0 | -3.3 | ||

| 9:00 | EUR | Eurozone Consumer Confidence Mar F | -10.8 | -10.8 | ||

| 9:00 | EUR | Eurozone Business Climate Mar | -0.14 | |||

| 12:00 | EUR | Germany CPI M/M Mar P | 0.50% | 0.70% | ||

| 12:00 | EUR | Germany CPI Y/Y Mar P | 1.70% | 1.30% | ||

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Jan | 10.70% | 10.10% | ||

| 13:00 | USD | Housing Price Index M/M Jan | 1.30% | 1.10% | ||

| 14:00 | USD | Consumer Confidence Mar | 96 | 91.3 |