The markets open a holiday-shortened week in a quiet note. Canadian Dollar is trading mildly lower, following retreat in oil prices. The giant container that blocks the Suez Canal, Ever Given, is finally starting to refloat, partly thanks to higher-than-usual spring tides. Elsewhere in the forex markets, Dollar and Yen are currently the firmer ones, but both stay inside Friday’s range. With a light economic calendar today, trading could remain subdued.

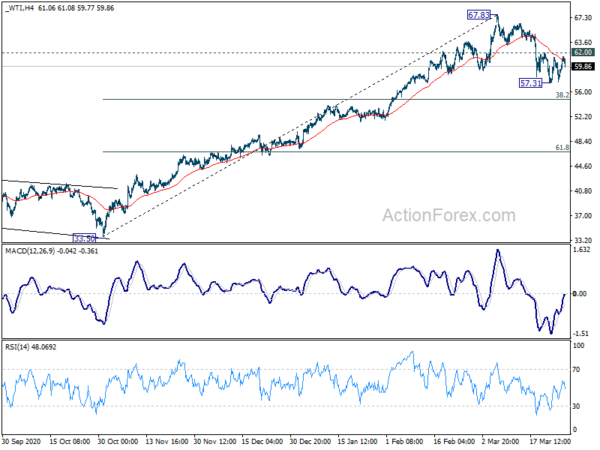

Technically, WTI crude oil turned sideway after hitting 57.31 last week. But recovery is limited below 62.00 resistance so far. Deeper fall is still in favor to 38.2% retracement of 33.50 to 67.83 at 54.71 before completing the correction from 67.83. That could drive the Canadian Dollar’s next move this week.

In Asia, currently, Nikkei is up 1.00%. Hong Kong HSI is up 0.27%. China Shanghai SSE is up 0.79%. Singapore Strait Times is up 0.62%. Japan 10-year JGB yield is up 0.0038 at 0.084.

BoJ opinions: Important to firmly continue with pandemic policy responses

In the Summary of Opinions of BoJ’s March 18-19 meeting, it’s said, “for the time being, it is important for the Bank to firmly continue with policy responses to the impact of COVID-19. The Bank should continue to provide support for financing, mainly of firms, and ensure stability in financial markets.”

BoJ’s policy actions decided at the meeting “have ensured the sustainability and nimbleness of policy measures that are necessary to achieve the price stability target”. And, it’s “desirable” for the framework to continue to be the basic guideline for “a few years to come”.

Long-term interest rates were allowed to move in a wider range of plus and minus 0.25%. “This flexibility is desirable since it prevents arbitrageurs and speculators who had lost their profit opportunities from exiting the bond market and helps maintain the price stabilization function in the market.”

The revision on ETFS purchases were made “to conduct purchases more effectively”. It’s necessary to “avoid a misunderstanding that the Bank has adopted a less accommodative stance on monetary policy.

The “inflation-overshooting commitment” implies that monetary easing will be continued for a “long period”. As a “deflationary risk” is a “matter of concern at present”, the commitment shows BoJ’s “strong stance that it will not head toward an exit easily.”

ECB chief economist Philip Lane said in a speech over the weekend, “there is a clear risk of self-fulfilling adverse dynamics taking hold through which uncertain economic prospects induce households, firms and governments to hold back on expenditure plans, leading to a decline in overall demand that validates the loss in confidence about the future.”

The risk is “compounded by the danger of real financial amplification channels by which lenders (banks or bond investors) become reluctant to lend and borrowers (households, firms or governments) become reluctant to take on debt because they fear that lower growth prospects would be amplified by declining creditworthiness and a tighter credit supply.”

Hence, “it is essential that the ECB acts as a stabilising force and boost confidence by committing to the preservation of favourable financing conditions.” The commitment is delivered through the “full set of monetary policy instruments, including low policy rate and forward guidance, the APP asset purchase program, the PEPP pandemic emergency purchase program, the calibration of the TLTRO III, and the collateral policies.

US ISM and NFP to highlight a holiday shortened week

US economic data will be the major focuses in a holiday shortened week, with consumer confidence, and ISM manufacturing featured. Also, non-farm payrolls employment will also be released. In addition to that, China PMIs, Japan Tankan survey and Eurozone CPI flash will also catch some attention.

Here are some highlights for the week:

- Monday: BoJ summary of opinions; UK M4 money supply, mortgage approvals.

- Tuesday: New Zealand building permits; Japan unemployment rate, retail sales; Germany import prices, CPI flash; Swiss KOF economic barometer; US house price index, consumer confidence.

- Wednesday: Japan industrial production housing starts; New Zealand ANZ business confidence; Australia building approvals; China PMIs; UK GDP final, current account; Germany unemployment; Swiss economic expectations; Eurozone CPI flash; Canada GDP; US ADP employment, Chicago PMI, pending home sales.

- Thursday: Australia AiG manufacturing, retail sales, trade balance; Japan Tankan survey, PMI manufacturing final; China Caixin PMI manufacturing; Germany retail sales; Swiss CPI, retail sales; Eurozone PMI manufacturing final; UK PMI manufacturing final; Canada building permits; PMI manufacturing; US jobless claims, ISM manufacturing, construction spending;

- Friday; US non-farm payrolls

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2562; (P) 1.2595; (R1) 1.2644; More….

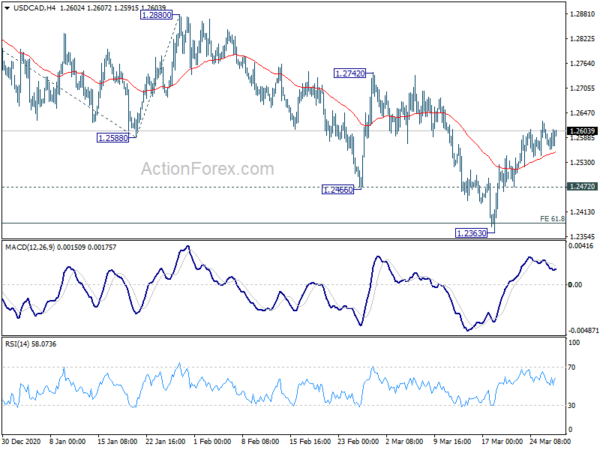

Intraday bias in USD/CAD remains neutral first. Rebound from 1.2363 could still extend higher. But outlook will remain bearish as long as 1.2742 resistance holds. On the downside, below 1.2472 minor support will bring retest of 1.2363 low. Firm break there will resume larger down trend from 1.4667. Next target is 100% projection of 1.3389 to 1.2588 from 1.2880 at 1.2079.

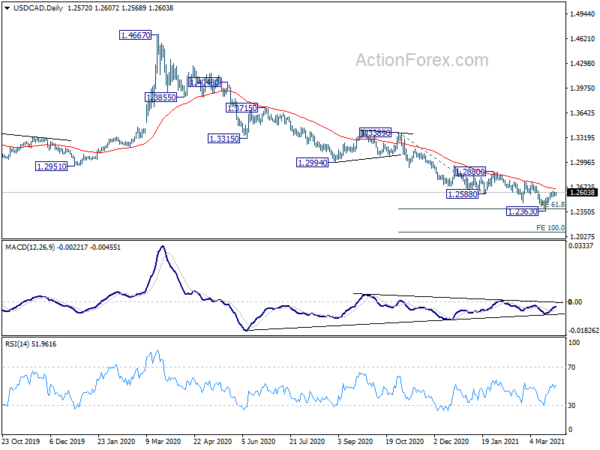

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Further decline should be seen back to 1.2061 (2017 low). In any case, break of 1.2994 support turned resistance resistance is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 08:30 | GBP | Mortgage Approvals Feb | 96K | 99K | ||

| 08:30 | GBP | M4 Money Supply M/M Feb | 0.60% | 0.70% |