New Zealand and Australian Dollar accelerates lower today as selloff in Asian stocks intensify. The development came on renewed concern over the third wave of coronavirus infections in Europe and return to lockdown. News regarding vaccines were also negative, as Hong Kong temporarily suspended Pfizer/BioNTech vaccination. Technically, Hong Kong HSI also completed a head and shoulder top, triggering additional selling pressure. Yen continues to be the biggest winner this week, followed by Dollar and Euro.

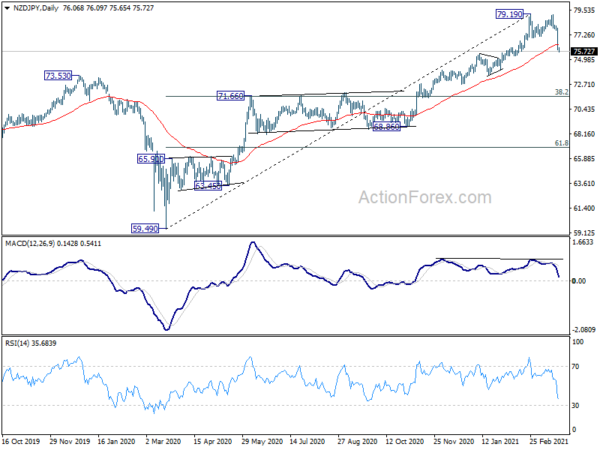

Technically, NZD/JPY’s strong break of 55 day EMA now suggests that it could be corrective the whole up trend from 59.49. The bearish tone is set for deeper fall towards 71.66 cluster support (38.2% retracement of 59.49 to 79.19 at 71.66) later in Q2. Eyes will now be on corresponding 55 day EMA at 81.99 in AUD/JPY, to double confirm the overall trend.

In Asia, currently, Nikkei is down -1.41%. Hong Kong HSI is down -1.83%. China Shanghai SSE is down -1.22%. Singapore Strait Times is down -0.15%. Japan 10-year JGB yield is down -0.0116 at 0.069, farther away from 0.1% handle now. Overnight, DOW dropped -0.94%. S&P 500 dropped -0.76%. NASDAQ dropped -1.12%. 10-year yield dropped -0.046 to 1.638.

Brainard: Fed’s approach implies resolution patience

Fed Governor Lael Brainard said in a speech that the FOMC’s current approach implies “resolute patience while the gap closes between current conditions and the maximum-employment and average inflation outcomes in the guidance.”

The “preemptive approach” calls for reduction of accommodation when unemployment rate nears the estimated neutral rate, in anticipation of higher inflation risks. But the current “patient” approach enables “the labor market to continue to improve and inflation expectations to become re-anchored at 2 percent.”

While outlook has “brightened considerably”, the economy remains “far from our goals” with jobs nearly 10 million below pre-COVID level, and inflation persistently below 2%. “It will take some time to achieve substantial further progress,” she added.

Fed Bullard: Continuing to see interest rate near zero through 2023

St. Louis Fed President James Bullard said yesterday that right now “it is looking good” as “we are coming to the end of the war here” with the pandemic. He forecast US GDP to grow 6.5% this year, while unemployment rate will fall to 4.5%. He also expects inflation to climb to 2.5%.

But, “I’d like to see actual data come in that verifies this forecast and verifies the idea that it’s going to be a very strong year for the U.S. economy,” he added. “We are still in a crisis. It could go the wrong way. So we really want to get the pandemic behind us before we start contemplating changes.”

“I am continuing to see us near zero (on interest rate) through 2023,” Bullard said.

BoC Gravelle: Dialing back asset purchases doesn’t mean hitting the brakes

BoC Deputy Governor Toni Gravelle reiterated in a speech that as the policymakers “continue to gain confidence in the strength of the recovery”, the central bank will “gradually adjust the pace of our QE purchases”. There will be a new full economic projection at the April policy decision.

But Gravelle also emphasized, “moderating the pace of purchases while adding to our holdings would simply mean that we are still adding stimulus through QE but at a slower pace. It would not mean we are removing stimulus. We would be easing our foot off the accelerator, not hitting the brakes.

Even at the point where the bond holdings are “largely stable”, he said, “the accumulated amount of GoC bond holdings would still represent a significant amount of stimulus in the system.

BoK Lee: Growth trend likely to be stronger than projected

Bank of Korea Governor Lee Ju-yeol said “the trend of growth is likely to be stronger than previously projected.” Nevertheless, “because real economic activity hasn’t returned to its potential level, and as the economy isn’t fully back on its feet from the shocks of COVID-19, our assessment is that the situation doesn’t warrant adjustments in policy stance.”

“It would be an important task to prepare in advance how we should normalize easing measures taken until now in an orderly fashion, if growth and inflation conditions improve,” Lee said.

Japan PMI composite ticked up to 48.3, subdued business but strong employment

Japan PMI Manufacturing rose slightly to 52.0 in march, up from 51.4, above expectation of 51.3. PMI services improved slightly to 46.5, up from 46.3. PMI Composite edged up to 48.3, from 48.2.

Usamah Bhatti, Economist at IHS Markit, said: “Activity at Japanese private sector businesses remained subdued… one positive note was private sector firms in Japan recording the strongest increase in employment levels since January 2020… private sector companies were optimistic that business conditions would improve in the year ahead… Positive sentiment stemmed from the expectation that the lifting of state of emergency measures and broader restrictions as vaccinations roll out would trigger a recovery in demand in both domestic and external markets.”

Australia PMI composite rose to 56.2, rounds off a strong quarter, but inflation a concern

Australia PMI Manufacturing rose slightly to 57.0 in March, up from 56.9. PMI Services jumped to 56.2, up from 53.4. PMI Composite also rose to 56.2, up from 53.7.

Pollyanna De Lima, Economics Associate Director at IHS Markit, said: “The latest results rounded off a strong quarter for the private sector, the best since the second quarter of 2017… Inflation remains an area of concern, with March data showing the strongest rise in input costs in the survey history…. Supply-chain disruption was cited by panellists as the main driver of inflation, a factor that also restricted business optimism towards growth prospects.”

New Zealand goods exports dropped -8.5% yoy in Feb, imports down -1.1% yoy

New Zealand goods exports dropped -8.5% yoy in February to NZD 4.5B. Imports dropped -1.1% yoy to NZD 4.3B. Monthly trade surplus came in at NZD 181m, turned from January’s NZD -647m deficit, largely matched expectations.

Exports to China was up NZD 369m, but down to other major trading partners including US, EU, Australia and japan. Imports from China, Australia and Japan were up, but down from EU and US.

Looking ahead

The economic calendar is rather busy today. UK CPI and PPI, PMIs will be featured in European session. Eurozone will also release PMIs. US will release durable goods orders later in the day, with PMIs and oil inventories too.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7579; (P) 0.7663; (R1) 0.7709; More…

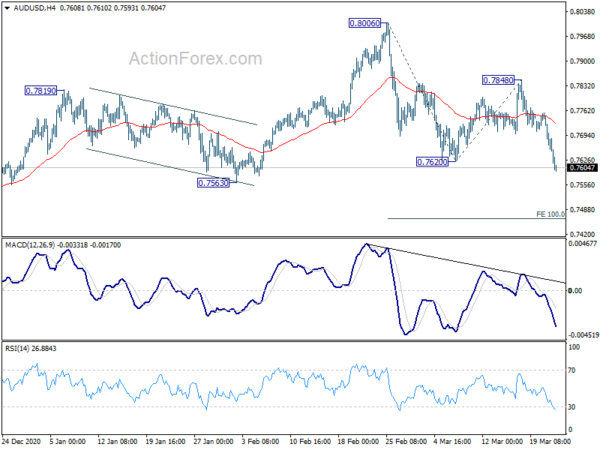

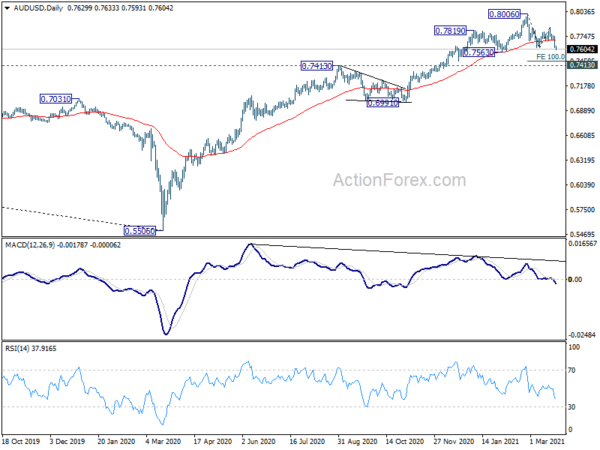

AUD/USD’s correction from 0.8006 extends lower today. Intraday bias in back on the downside for 100% projection of 0.8006 to 0.7620 from 0.7848 at 0.7462. We’ll look for strong support from there to bring rebound. However, note that AUD/USD has also completed a head and should top (ls: 0.7819; h: 0.8006; rs: 0.7848). Firm break of 0.7462 will argue that it’s correcting whole up trend from 0.5506. For now, risk will stay on the downside as long as 0.7848 resistance holds, in case of recovery.

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Feb | 181M | 180M | -626M | -647M |

| 22:00 | AUD | CBA Manufacturing PMI Mar P | 57 | 56.9 | ||

| 22:00 | AUD | CBA Services PMI Mar P | 56.2 | 53.4 | ||

| 23:50 | JPY | BoJ Minutes | ||||

| 23:50 | JPY | Corporate Service Price Index Y/Y Feb | -0.10% | -0.50% | -0.50% | -0.40% |

| 00:30 | JPY | Manufacturing PMI Mar P | 52 | 51.3 | 51.4 | |

| 07:00 | GBP | CPI M/M Feb | 0.50% | -0.20% | ||

| 07:00 | GBP | CPI Y/Y Feb | 0.80% | 0.70% | ||

| 07:00 | GBP | Core CPI Y/Y Feb | 1.40% | 1.40% | ||

| 07:00 | GBP | RPI M/M Feb | 0.50% | -0.30% | ||

| 07:00 | GBP | RPI Y/Y Feb | 1.40% | 1.40% | ||

| 07:00 | GBP | PPI Input M/M Feb | 0.50% | 0.70% | ||

| 07:00 | GBP | PPI Input Y/Y Feb | 0.60% | 1.30% | ||

| 07:00 | GBP | PPI Output M/M Feb | 0.20% | 0.40% | ||

| 07:00 | GBP | PPI Output Y/Y Feb | -0.40% | -0.20% | ||

| 07:00 | GBP | PPI Core Output M/M Feb | 0.00% | 0.30% | ||

| 07:00 | GBP | PPI Core Output Y/Y Feb | 1.40% | 1.40% | ||

| 08:15 | EUR | France Manufacturing PMI Mar P | 56.1 | 56.1 | ||

| 08:15 | EUR | France Services PMI Mar P | 45.5 | 45.6 | ||

| 08:30 | EUR | Germany Manufacturing PMI Mar P | 60.9 | 60.7 | ||

| 08:30 | EUR | Germany Services PMI Mar P | 46.3 | 45.7 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Mar P | 57.9 | 57.9 | ||

| 09:00 | EUR | Eurozone Services PMI Mar P | 46.1 | 45.7 | ||

| 09:30 | GBP | Manufacturing PMI Mar P | 55 | 55.1 | ||

| 09:30 | GBP | Services PMI Mar P | 51 | 49.5 | ||

| 09:30 | GBP | DCLG House Price Index Y/Y Jan | 8.10% | 8.50% | ||

| 12:30 | USD | Durable Goods Orders Feb | 1.00% | 3.40% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation Feb | 0.50% | 1.30% | ||

| 13:45 | USD | Manufacturing PMI Mar P | 59.4 | 58.6 | ||

| 13:45 | USD | Services PMI Mar P | 60.2 | 59.8 | ||

| 14:00 | USD | Fed’s Chair Powell testifies | ||||

| 14:30 | USD | Crude Oil Inventories | 1.4M | 2.4M | ||

| 15:00 | EUR | Eurozone Consumer Confidence Mar P | -15 | -15 |