Yen buying accelerates today as selloff in commodity currencies intensified. New Zealand Dollar is trading as the worst, by some distance, followed by Aussie. Canadian Dollar is dragged down by decline in oil prices, while Sterling is also pressured after poor job data. On the other hand, Dollar is following Yen as the second strongest, then Euro. Fed chair Powell will testifies today, but unlikely to offer anything more than his usual “balanced” rhetorics.

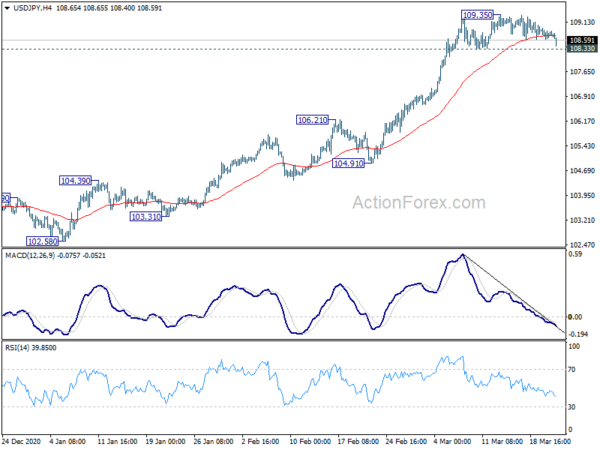

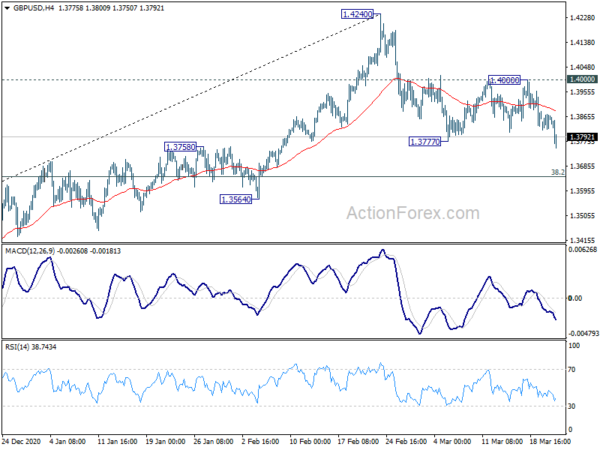

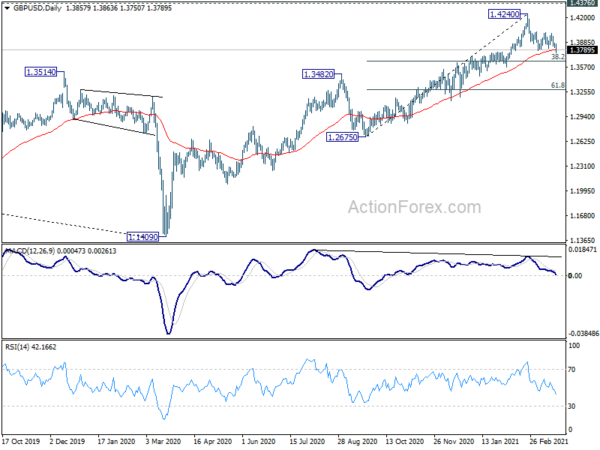

Technically, one focus now is on USD/JPY, with today’s decline. Break of 108.33 minor support will bring deeper near term correction, and could drag other Yen crosses lower. GGBP/USD’s break of 1.3777 suggests resumption of the corrective fall from 1.4240. Another focus is now on 0.8638 minor resistance in EUR/GBP and break will revive the case of near term bottoming.

In Europe, currently, FTSE is down -0.17%. DAX is down -0.11%. CAC is down -0.39%. Germany 10-year yield is down -0.032 at -0.338. Earlier in Asia, Nikkei dropped -0.61%. Hong Kong HSI dropped -1.34%. China Shanghai SSE dropped -0.93%. Singapore Strait Times rose 0.12%. Japan 10-year JGB yield dropped -0.0011 to 0.081.

Fed Kaplan expecting rate hike in 2022

Dallas Fed President Robert Kaplan said in a CNBC interview said his economic forecast has “improved meaningfully”. He’s expecting 6.5% GDP growth this year while unemployment rate would fall back to 4.5%.

He will advocate for scaling back stimulus after “seeing real outcomes, not just forecasts”. But still, he’s forecast for removing accommodation is “more aggressive than the median Fed official. He’s expecting Fed to start hiking interest rates in 2022.

ECB Lane: The parameters of Europe’s fiscal debate moved with US stimulus

ECB chief economist Philip said there will be “positive spillovers” from the USD 1.9T pandemic relief package from the US. The significant package will “boost global GDP, will boost exports from the euro area”.

“Of course, the initial impact was visible more in the financial market, but over time, as this stimulus gets rolled out, it will be a significant engine for the world economy,” he added.

In Europe, “we have 19 fiscal policies and then we have the joint fiscal action,” Lane said. “The parameters of the fiscal debate have clearly moved with the US decision. And it is an important issue for European policymakers to reflect upon.”

UK claimant count surged 86.6k in Feb, unemployment rate dropped to 5% in Jan

UK claimant count jumped sharply by 86.6k in February, much larger than expectation of 9k. That represented a 3.3% monthly increase. It’s also 116.3%, or 1.4m, above the level a year ago in March 2020.

In the three months to January, unemployment rate dropped -0.1% to 5.0%, better than expectation of 5.2%. That’s still 1.1% higher than a year earlier. Total number of weekly hours worked dropped -83.1m hours to 968.0m.

Japan cabinet office: Exports increasing at a slower pace

In the March monthly economic report, Japan’s Cabinet office maintained that the economy “shows weakness in some component” as it’s picking up in a “severe situation due to the pandemic. In particular, export assessment was downgraded from “increasing to “increasing at a slower pace recently”.

Other assessments were generally unchanged, with private consumption in a “weak tone”, business investments “showing movements of picking up”, industrial production is “picking up, corporate profits are “picking up as a whole”, employment shows “steady movements” in some are but weakness remains. Consumer prices were flat.

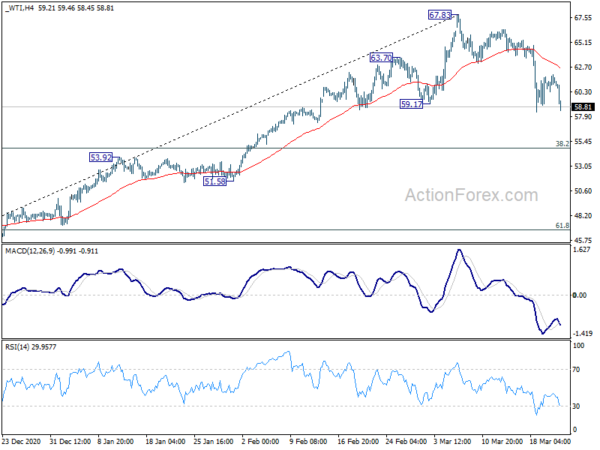

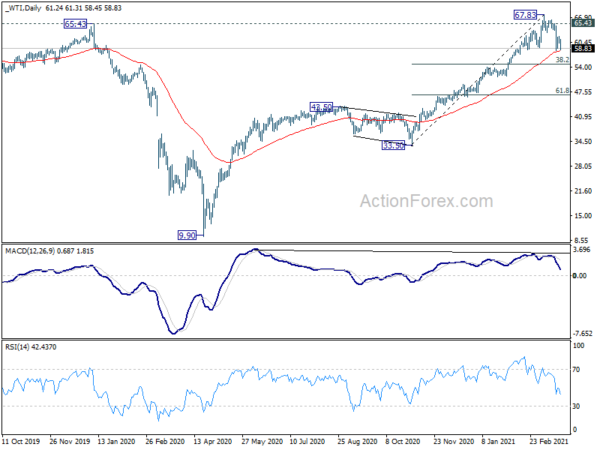

WTI dives back below 60, below holding above 55 D EMA

WTI crude oil drops sharply today and it’s back below 60 handle. It’s weighed down by renewed concerns over return to lockdown in Europe, as well as slow vaccine roll outs.

Nevertheless, WTI is still holding above last week’s low at 58.31 for now. We’d continue to wait and see if it could defend 55 day EMA (now at 58.23) for the second time. Rebound from the current level will maintain near term bullishness, for extending medium term up trend through 65.43 structural resistance.

However, sustained break of the 55 day EMA will indicate that WTI is in a medium term correction. Deeper fall should be seen to 38.2% retracement of 33.50 to 67.83 at 54.71 at least, before the correction completes.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3830; (P) 1.3854; (R1) 1.3889; More….

GBP/USD’s break of 1.3777 support suggests resumption of correction from 1.4240. Intraday bias is mildly on the downside for 38.2% retracement of 1.2675 to 1.4240 at 1.3642. We’d expect strong support from there to bring rebound. On the upside, break of 1.4000 resistance will bring retest of 1.4240. However, sustained break of 1.3564 will bring deeper fall to 1.3842 key resistance turned support.

In the bigger picture, rise from 1.1409 medium term bottom is in progress. Further rally would be seen to 1.4376 resistance and above. Decisive break there will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. On the downside, break of 1.3482 resistance turned support is needed to be first indication of completion of the rise. Otherwise, outlook will stay cautiously bullish even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | GBP | Claimant Count Change Feb | 86.6K | 9.0K | -20K | -20.8K |

| 07:00 | GBP | Claimant Count Rate Feb | 7.50% | 7.20% | ||

| 07:00 | GBP | ILO Unemployment Rate (3M) Jan | 5.00% | 5.20% | 5.10% | |

| 07:00 | GBP | Average Earnings Excluding Bonus 3M/Y Jan | 4.20% | 4.40% | 4.10% | |

| 07:00 | GBP | Average Earnings Including Bonus 3M/Y Jan | 4.80% | 5.00% | 4.70% | |

| 12:30 | USD | Current Account (USD) Q4 | -188B | -189B | -179B | -181B |

| 14:00 | USD | New Home Sales Feb | 880K | 923K |