Sentiments appear to be weighed down by the upstoppable rally in treasury yields again today. At the time of writing, US 10-year yield is trading above 1.75 handle while Germany 10-year bund yield is at -0.25. US futures point to lower open, with weakness seen particular in NASDAQ again. Dollar stabilized from yesterday’s post FOMC selloff and recovers broadly. Sterling is so far resilient after BoE revealed nothing special. Swiss Franc and Euro are currently the weakest for today, followed by commodity currencies.

Technically, one thing to is that Dollar is holding on near term support level against both Euro and Sterling despite yesterday’s sell-off. That is, EUR/USD and GBP/USD are kept below near term minor resistance at 1.1989 and 1.4016 respectively. Focus could now be back to 1.1834 temporary low and 1.3777. Break of these levels will bring stronger rebound in the greenback.

In Europe, currently, FTSE is down -0.19%. DAX is up 0.95%. CAC is up 0.01%. Germany 10-year yield is up 0.035 at -0.253. Earlier in Asia, Nikkei rose 1.01%. Hong Kong HSI rose 1.28%. China Shanghai SSE rose 0.51%. Singapore Strait Times rose 0.90%. Japan 10-year JGB yield rose 0.0133 to 0.107.

US initial jobless claims rose to 770k, continuing claims dropped to 4.12m

US initial jobless claims rose 45k to 770k in the week ending March 13, above expectation of 770k. Four-week moving average of initial claims dropped -16k to 746k. Continuing claims dropped -18k to 4124k in the week ending March 6. Four-week moving average of continuing claims dropped -99k to 4225k.

Philly Fed manufacturing outlook rose to 51.8 in February, up from 23.1, well above expectation of 24.5. That’s the highest point in nearly 50 years.

From Canada, new housing price index rose 1.9% mom in February versus expectation of 0.5% mom. ADP employment dropped -100.8k in February.

BoE stands pat, financial conditions broadly unchanged

BoE kept Bank Rate unchanged at 0.10%, and asset purchase target at GBP 895B as widely expected. Both decisions are made by unanimous 9-0 vote. It doesn’t intend to tighten monetary policy ” at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably. The MPC also stands ready to “take whatever additional action” if inflation outlook weakens.

Since the time of February’s Monetary Policy, advanced economy longer-term government bond yields have “risen rapidly” to similar levels before the pandemic. But an “aggregated measure of UK financial conditions has been broadly unchanged”. At the same time, rates of Covid infections and hospitalizations have “fallen markedly” across the UK and vaccination is proceeding at a rapid pace.

The plans for easing of restriction maybe consistent with a “slightly stronger outlook” for consumption growth in Q2. Labor market slack has remained “higher than implied by the 5.1% LSF unemployment rate. CPI inflation is expected to return to 2% target in spring, reflecting recent in creases in energy prices. But these developments should have “few direct implications” for medium term inflation.

ECB Lagarde: Medium term risk more balanced but near term downside risks remain

In the hearing of a European Parliament committee, ECB President Christine Lagarde said risks surrounding Eurozone growth outlook over the “medium term” have become “more balanced” owing to better prospects for the global economy and progress in vaccination campaigns. Though, downside risk remain in the “near term”, mainly related to spread of “virus mutations” and implications of ongoing pandemic.

She added that inflation has picked up over recent months mainly on “some transitory factors”, and some volatility is expected through 2021. But the factors are expected to “fade out early next year”. Price pressure would “increase some what this year due to “supply constraints and recovery in domestic demand”. But these pressures will “remain subdued overall”.

On the issue of treasury yields, Lagarde said, “the increase in risk-free market interest rates and sovereign bond yields that we have observed since the start of the year could spur a tightening in the wider set of financing conditions… Therefore, if sizeable and persistent, increases in those market interest rates, when left unchecked, may become inconsistent with countering the downward impact of the pandemic on the projected path of inflation.”

Hence, ECB announced to significantly increase the pace of PEPP purchases over the next quarter. “Purchases will be implemented flexibly according to market conditions and always with a view to preventing a tightening of financing conditions that is inconsistent with countering the downward impact of the pandemic on the projected path of inflation”.

Eurozone exports dropped -11.4% yoy, imports dropped -14.1% yoy in Jan

Eurozone exports to rest of the world dropped -11.4% yoy to EUR 163.1B in January. Exports to rest of the world dropped -14.1% yoy to EUR 156.8B. Trade surplus rose EUR 1.5B over the year to EUR 6.3B. Intra Eurozone trade dropped -3.9% yoy to EUR 159.7B.

In seasonally adjusted term, Eurozone exports dropped -2.8% mom while imports dropped -1.3% mom. Trade surplus shrank to EUR 24.2B, below expectation of EUR 28.3B.

Swiss PPI came in at 0.0% mom, -1.1% yoy in February. Trade surplus narrowed to CHF 3.7B in February.

Australia employment rose 88.7k in Feb, back at pre-pandemic level

Australia employment rose 88.7k in February, well above expectation of 31.5k. Full-time jobs grew 89.1k while part-time jobs dropped -0.5k. Unemployment rate dropped -0.5% to 5.8%, much lower than expectation of 6.3%. Participation rate rose 0.1% to 66.1%. Monthly hours worked rose 102m hours to 1.665m.

Bjorn Jarvis, head of labour statistics at the ABS, said “The strong employment growth this month saw employment rise above 13 million people, and was 4,000 people higher than March 2020.”

New Zealand GDP contracted -1.0% qoq in Q4, a mixed picture at industry level

New Zealand GDP dropped -1.0% qoq in Q1, much worse than expectation of 0.1% qoq. Goods-producing industries dropped -3.2% qoq. Services industries rose a mere 0.1% qoq. Primary industries dropped -0.6% qoq. GDP per capital dropped -1.2% qoq. Over the year to December 2020, annual GDP declined -2.9%.

“Activity in the December quarter shows a mixed picture – some industries are down, but others have held up or risen, despite the ongoing impact of COVID,” national accounts senior manager Paul Pascoe said. At the industry level 7 out of 16 industries declined. The two largest contributors to the drop were construction, and retail trade and accommodation.

EUR/USD Mid-Day Outlook

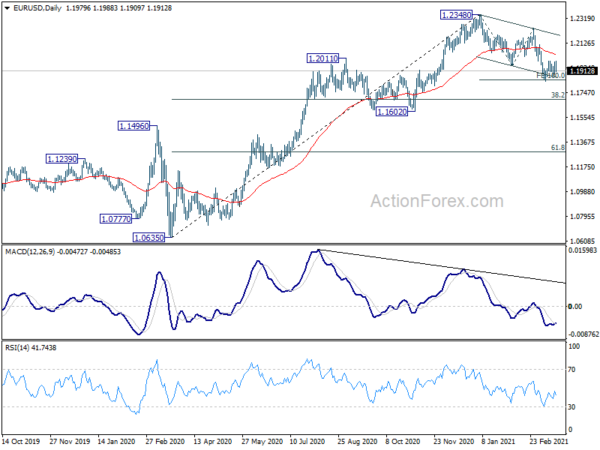

Daily Pivots: (S1) 1.1916; (P) 1.1951; (R1) 1.2015; More….

EUR/USD is still staying in range of 1.1834/1989 and intraday bias remains neutral for the moment. On the upside, break of 1.1989 will resume the rebound form 1.1834 for 55 day EMA (now at 1.2039). Sustained trading above 55 day EMA will indicate completion of correction from 1.2348 and bring retest of this high. On the downside, however, break of 1.1834 will extend the correction from 1.2348 to 38.2% retracement of 1.0635 to 1.2348 at 1.1694.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | GDP Q/Q Q4 | -1.00% | 0.10% | 14.00% | 13.90% |

| 00:30 | AUD | Employment Change Feb | 88.7K | 31.5K | 29.1K | 29.5K |

| 00:30 | AUD | Unemployment Rate Feb | 5.80% | 6.30% | 6.40% | 6.30% |

| 07:00 | CHF | Trade Balance (CHF) Feb | 3.70B | 4.10B | 5.05B | 4.98B |

| 07:30 | CHF | Producer and Import Prices M/M Feb | 0.00% | 0.30% | ||

| 07:30 | CHF | Producer and Import Prices Y/Y Feb | -1.10% | -2.10% | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Jan | 24.2B | 28.3B | 27.5B | |

| 12:00 | GBP | BoE Interest Rate Decision | 0.10% | 0.10% | 0.10% | |

| 12:00 | GBP | BoE Asset Purchase Facility | 895B | 895B | 895B | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 12:30 | CAD | ADP Employment Change Feb | -100.8K | -231.2K | -65.8K | |

| 12:30 | CAD | New Housing Price Index M/M Feb | 1.90% | 0.50% | 0.70% | |

| 12:30 | USD | Initial Jobless Claims (Mar 12) | 770K | 700K | 712K | 725K |

| 12:30 | USD | Philadelphia Fed Manufacturing Mar | 51.8 | 24.5 | 23.1 | |

| 14:30 | USD | Natural Gas Storage | -21B | -52B |