The markets remain generally quiet today, awaiting FOMC rate decision. Sterling regains much of the ground lost earlier in the week. Canadian Dollar is also firm, in particular against other commodity currencies. On the other hand, Swiss Franc is paring some of yesterday’s gains, while Aussie and Kiwi turn week. Dollar and Euro mixed for the moment. Stocks are bounded in very tight range. Though, US 10-year yield appears to be a bit impatient, trading up 0.05 above 1.66 at the time of writing.

Technically, Dollar pairs are the major focuses for the rest of the session. Ranges to pay attention to are 1.1834-1.1989 in EUR/USD, 1.3777-1.4016 in GBP/USD, 0.7620-0.7837 in AUD/USD, 0.9233-0.9323 in USD/CHF and 108.33-109.35 in USD/JPY. Some synchronized breakouts in these pairs are needed to confirm Dollar’s movement.

in Europe, currently, FTSE is down -0.49%. DAX is down -0.02%. CAC is down -0.12%. Germany 10-year yield is up 0.038 at -0.295, back above -0.3 handle. Earlier in Asia, Nikkei dropped -0.02%. Hong Kong HSI rose 0.02%. China Shanghai SSE dropped -0.01%. Singapore Strait Times rose 0.13%. Essentially, all major Asian indices ended flat. Japan 10-year JGB yield dropped -0.0058 to 0.93.

Here are some suggested readings on FOMC:

- FOMC Preview – Expect to See Upgrade in GDP Growth Projections

- The Calm Before The Fed Storm?

- Fed: Might Some Members Push Forward Their Rate Hike Expectations?

- While Waiting For The FOMC Tonight

- What To Expect From This Week’s Fed Meeting

- FOMC Meeting Preview: Will Inflation Spook the Fed?

- March Flashlight for the FOMC Blackout Period: No Major Policy Changes but Perhaps Some Technical Tweaks

- Historical Lessons About U.S. Inflation: Is Meaningfully Higher Inflation Looming?

Canada CPI rose to 1.1% yoy, ex-gasoline down to 1.0% yoy

Canada CPI accelerated to 1.1% yoy in February, up from 1.0% yoy, but missed expectation of 1.3% yoy. Excluding gasoline, CPI slowed to 1.0% yoy, down from 1.3% yoy. CPI Common was unchanged at 1.3% yoy, missed expectation of 1.4% yoy. CPI median was unchanged at 2.0% yoy, matched expectations, CPI trimmed rose to 1.9% yoy, up from 1.8% yoy, below expectation of 1.8% yoy.

From the US, housing starts dropped to 1.42m annualized rate in February, below expectation of 1.57m. Building permits dropped to 1.68m, missed expectation of 1.72m.

GCEE: Germany GDP to contract -2% in Q1, grow 3.1% in 2021

Germany’s Council of Economic Experts (GCEE) lowered 2021 GDP forecasts to 3.1%, as Germany remained “firmly in the grip of the coronavirus pandemic”. GDP is expected to contract -2% in Q1 as a result of the renewed rise in infection rates in Autumn 2020, and the restrictions currently in place. GDP is expected to grow 4.1% in 2022. Economic output is likely to return to its pre-crisis level at the turn of the year 2021/2022. Eurozone GDP is forecast to grow 4.1% in 2021 and 4.2% in 2022.

“The greatest risk to the German economy is posed by a potential third wave of infections, especially if it were to lead to restrictions or even plant closures in industry,” says council member Volker Wieland.

“For Germany to reach the EU target of vaccinating 70% of the population by the end of September 2021, the current number of daily vaccinations in vaccination centers must be increased by 50%. In addition, this would require general practitioners and specialists to be involved in the vaccination,” states council member Veronika Grimm.

Eurozone CPI finalized at 0.9% yoy in Feb, EU at 1.3% yoy

Eurozone CPI was finalized at 0.9% in February, unchanged from January’s figure. Core CPI was finalized at 1.1% yoy, down from January’s 1.4% yoy. The highest contribution to the annual euro area inflation rate came from services (+0.55 percentage points, pp), followed by food, alcohol & tobacco (+0.29 pp), non-energy industrial goods (+0.26 pp) and energy (-0.15 pp).

EU CPI was finalized at 1.3% yoy, up from January’s 1.2% yoy. The lowest annual rates were registered in Greece (-1.9%), Slovenia (-1.1%) and Cyprus (-0.9%). The highest annual rates were recorded in Poland (3.6%), Hungary (3.3%) and Romania (2.5%). Compared with January, annual inflation fell in ten Member States, remained stable in three and rose in fourteen

Japan exports contracted -4.5% yoy in Feb, first decline in three months

Japan’s export dropped -4.5% yoy to JPY 6038B in February, much worse than expectation of -0.5% yoy. That’s also the first decline in exports in three months. Exports to China slowed sharply to 3.4% yoy, partly due to lunar new year holidays. Exports to US dropped -14.0% yoy. dragged down by automobiles, airplane parts and motors.

Imports rose 11.8% yoy to JPY 5821B, slightly below expectation of 11.9% yoy. That’s, nonetheless, the first annual increase in exports in 22 months due to pickup in domestic demand, restocking of inventory and rises in crude oil and resources prices. Trade surplus came in at JPY 217B.

In seasonally adjusted terms, exports dropped -4.7% mom. Imports rose 4.7% mom. Trade balanced turned into JPY -0.04T deficit, smaller than expectation of JPY -0.20T.

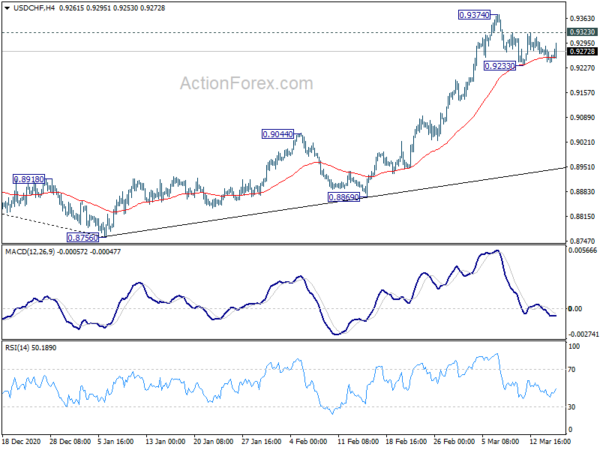

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9231; (P) 0.9259; (R1) 0.9275; More….

USD/CHF recovers mildly after hitting 4 hour 55 EMA, but stays in tight range. Intraday bias remains neutral first. On the downside, break of 0.9233 will bring deeper correction. But overall outlook will stay bullish as long as 0.9044 resistance turned support holds. On the upside, above 0.9323 minor resistance will bring retest of 0.9374 high.

In the bigger picture, current development argues that fall from 1.0237 has completed at 0.8756, on bullish condition in daily and weekly MACD. Current rally from 0.8756 should target 0.9901 resistance first. Break there will target 1.0237/0342 resistance zone in the medium term. This will now remain the favored case as long as 0.9044 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Current Account (CAD) Q4 | -2.70B | -2.85B | -3.52B | -3.62B |

| 23:30 | AUD | Westpac Leading Index M/M Feb | 0.00% | 0.30% | -0.10% | |

| 23:50 | JPY | Trade Balance (JPY) Feb | -0.04T | -0.20T | 0.39T | 0.55T |

| 10:00 | EUR | Eurozone CPI Y/Y Feb F | 0.90% | 0.90% | 0.90% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Feb F | 1.10% | 1.10% | 1.10% | 1.40% |

| 12:30 | CAD | CPI M/M Feb | 0.50% | 0.40% | 0.60% | |

| 12:30 | CAD | CPI Y/Y Feb | 1.10% | 1.30% | 1.00% | |

| 12:30 | CAD | CPI Common Y/Y Feb | 1.30% | 1.40% | 1.30% | |

| 12:30 | CAD | CPI Median Y/Y Feb | 2.00% | 2.00% | 1.40% | 2.00% |

| 12:30 | CAD | CPI Trimmed Y/Y Feb | 1.90% | 2.00% | 1.80% | |

| 12:30 | USD | Housing Starts Feb | 1.42M | 1.57M | 1.58M | |

| 12:30 | USD | Building Permits Feb | 1.68M | 1.72M | 1.88M | 1.89M |

| 15:30 | USD | Crude Oil Inventories | 2.8M | 13.8M | ||

| 18:00 | USD | Fed Interest Rate Decision | 0.25% | 0.25% | ||

| 18:30 | USD | FOMC Press Conference |