Fed Chair Jerome Powell’s lack of concrete hint on action against rising nominal rates sent treasury yield higher, and stocks lower overnight. Dollar rode on risk aversion and jumped sharply higher. Nevertheless, the greenback’s rally was concentrated against Euro, Swiss Franc and Yen only. Sterling, Canadian, and Australian are indeed still rather resilient. In particular, Canadian Dollar was support by resumption of oil price rally after OPEC rolled over production cuts. Now, focus will turn to non-farm payrolls from the US later in the day.

Technically, rises in USD/CHF and USD/JPY are both accelerating upwards. EUR/USD’s breach of 1.1951 support also suggests resumption of corrective fall from 1.2348 as expected. Attention is turned to other Dollar pairs. Levels to watch included 1.3828 support in GBP/USD, 0.7691 temporary low in AUD/USD and 1.2742 temporary top in USD/CAD. As long as these levels hold, Dollar’s rally is considered just “half-hearted”.

In Asia, currently, Nikkei is down -0.96%. Hong Kong HSI is down -0.30%. China Shanghai SSE is down -0.34%. Singapore Strait Times is up 0.16%. Japan 10-year JGB yield is down -0.029 at 0.111. Overnight, DOW dropped -1.11%. S&P 500 dropped -1.34%. NASDAQ dropped -2.11%. 10-year yield rose 0.080 to 1.550.

US 10 year yield jumped as Fed Powell left no hint on operation twist

US treasury yields surged again while stocks tumbled overnight after Fed Chair Jerome Powell failed to provide any guidance on what Fed would do regarding recent sharp rise in long-term yields. That left markets wondering how far Fed would allow the yield curve to continue to steepen.

Powell noted that the climb in yield was “something that was notable and caught my attention”. He would be “concerned by disorderly conditions in markets or a persistent tightening in financial conditions that threatens the achievement of our goals”. Yet, Fed is looking at “a broad range of financial conditions,” rather than a single measure.

There were some speculations that Powell would hint on the possibility of an “Operation Twist” that concentrate on purchases on the longer-end. When asked about the topic, Powell just said “our current policy stance is appropriate”.

US 10-year yield rose 0.0080 to 1.550 overnight, but it’s held below last week’s high of 1.614 so far. Upside momentum in TNX remain rather firm from medium term point of view. Any “disorderly” movement could shoot TNX to 2% level rather quickly, which is close to 1.971 structural resistance and 61.8% retracement of 3.248 to 0.398 at 2.159.

NASDAQ completed HnS top, to lend strong support from 12074

NASDAQ closed down -2.11% or 274 pts to 12723.47 overnight. The strong break of 12983.05 neckline support confirmed the completion of head and should top reversal pattern as mentioned (ls: 13728.98, h: 14175.11, rs: 13601.33). here. More downside is expected for now, for minimum target at 100% projection of 14175.11 to 13003.98 from 13601.33 at 12430.20 and below.

Still, we’d maintain that cluster support at 12074.06 (61.8% retracement of 10822.57 to 14175.11 at 12103.24) is the key level. We’d expect strong support from there to contain down side and bring rebound (at least on first attempt). That could keep the pattern from 14174.11 as a correction to rise from 10822.57 only, and set the base for up trend resumption later.

However, sustained break of 12074.06 will argue that NASDAQ is already correcting the whole up trend from 6631.42. That would open up the case of deeper medium term correction through 10822.57 support.

Similarly, even though S&P 500 looks vulnerable for a deeper pull back, we’d expect strong support from 3588.11 to contain downside to bring rebound. But sustained break there would indicate the start of a deeper correction to the whole up trend from 2191.86.

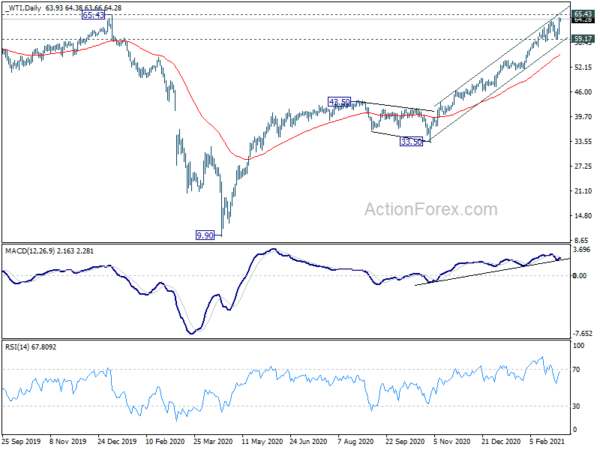

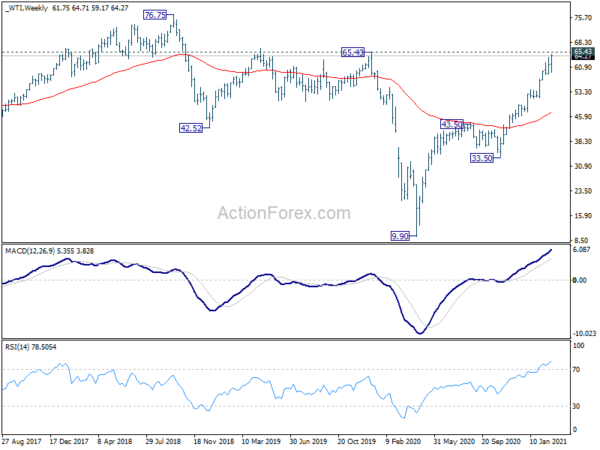

WTI oil resumes up trend as OPEC+ rolls over production cuts

OPEC+ agreed to largely roll over production cuts to the month of April, as announced yesterday. Russia and Kazakhstan were granted exemptions to increase their output by a small amount of 130k and 20k respectively.

At a press conference, Saudi energy minister Abdulaziz Bin Salman said the “jury is still out” on the future of the oil market. “When you have this unpredictability and uncertainty, I think there are choices you could make. I belong to the school of being conservative and taking things in a more precautionary way.

WTI crude oil resumed recent up trend by breaking through 63.70 resistance to as high as 64.71 so far. Next is key structural resistance at 65.43. We’d look for topping signal around this key resistance level. Break of 59.17 support would finally bring a long-overdue correction. Yet, firm break of 65.43 would extend the upstoppable up trend to next key resistance at 76.75 (2018 high).

BoJ Kuroda: Important to keep yield curve stably low

BoJ Governor Haruhiko Kuroda told the parliament today that “it’s important to keep the yield curve stably low for the time being.” The central bank allows 10-year JGB yield to move inside a band around 0% to “enhance bond market functions”. But given recent surge in yields, “much more debate” was needed before deciding to widen the band.

“It’s a difficult decision,” Kuroda said, “the economy remains under pressure from the COVID-19 pandemic.”

“We have been and must continue to buy ETFs flexibly,” he said. “We’ll discuss at the March review how specifically we could make our purchases more nimble”.

Australia AiG services rose to 55.8, but employment fell

Australia AiG Performance of Services rose 1.5 pts to 55.8 in February, highest since June 2018, as “recovery following the COVID-19 recession of 2020 gaining in strength”. Looking at some details, sales rose 5.5 pts to 65.7. New orders rose 3.6 pts to 58.4. However, employment dropped -13.2 to 42.7. Input prices rose slightly by 1.8 to 64.4. But selling prices jumped 11.2 to 56.2.

Ai Group Chief Executive, Innes Willox, said: ” While the continued improvement in conditions is heartening, employment fell in February following a strong recovery in the preceding months. Employers and employees will be hoping that the further growth in new orders recorded in February signals the continued recovery of sales and employment over the next few months.”

Looking ahead

Germany factory orders, France trade balance, Italy retail sales and Swiss foreign currency reserves will be featured in European session. But main focus will be on US non-farm payroll employment. US will also release trade balance. Canada will release trade balance and Ivey PMI.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1934; (P) 1.2001; (R1) 1.2039; More…

Intraday bias in EUR/USD is back on the downside as fall from 1.2442 resumes. Such decline is third leg of the corrective pattern from 1.2348. Break of 1.1951 will target 100% projection of 1.2348 to 1.1951 from 1.2242 at 1.1845. We’d look for bottoming signal there. But break of 1.2112 minor resistance is needed to signal short term bottoming. Meanwhile, firm break of 1.1845 will extend the correction to 38.2% retracement of 1.0635 to 1.2348 at 1.1694.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Services Feb | 55.8 | 54.3 | ||

| 07:00 | EUR | Germany Factory Orders M/M Jan | -1.00% | -1.90% | ||

| 07:45 | EUR | France Trade Balance (EUR) Jan | -3.4B | -3.4B | ||

| 08:00 | CHF | Foreign Currency Reserves (CHF) Feb | 896B | |||

| 09:00 | EUR | Italy Retail Sales M/M Jan | -0.60% | 2.50% | ||

| 13:30 | USD | Nonfarm Payrolls Feb | 148K | 49K | ||

| 13:30 | USD | Unemployment Rate Feb | 6.40% | 6.30% | ||

| 13:30 | USD | Average Hourly Earnings M/M Feb | 0.20% | 0.20% | ||

| 13:30 | USD | Trade Balance (USD) Jan | -67.5B | -66.6B | ||

| 13:30 | CAD | Trade Balance (CAD) Jan | -1.4B | -1.7B | ||

| 15:00 | CAD | Ivey PMI Feb | 49.2 | 48.4 |