Dollar recovers in early US session as sluggish ADP job growth drags down stock futures. Additionally, treasury yields are having a mild rebound. At this point, Sterling is following as the strongest followed the day, then Canadian. New Zealand Dollar is leading Australian Lower, followed by Swiss Franc and Yen. Eyes will now be on the movements in yields, and the reactions and stocks and overall sentiments.

Technically, USD/JPY’s breach of 106.95 temporary top suggests that recent rally might be ready to resume. At the same time, USD/CHF is attempting a take on 0.9192 temporary top too. On the other hand, AUD/USD retreats ahead of 0.7844 minor resistance while USD/CAD recovers ahead of 1.2586 minor support. The greenback appears to be finding momentum to rebound against commodity currencies. Though, break of theses two levels, if accompanied by strength in stocks, would likely send Dollar lower elsewhere again.

In Europe, currently, FTSE is up 0.39%. DAX is up 0.23%. CAC is up 0.24%. Germany 10-year yield is up 0.041 at -0.308. Earlier in Asia, Nikkei rose 0.51%. Hong Kong HSI rose 2.70%. China Shanghai SSE rose 1.95%. Singapore Strait Times rose 0.89%. Japan 10-year JGB yield dropped -0.0061 to 0.124.

US ADP employment grew only 117k, sluggish recovery across the board

US ADP private employment grew only 117k in February, below expectation of 168k. BY company size, small businesses added 32k jobs, medium businesses added 57k, large businesses added 28k. By sector, goods-producing jobs contracted -14k. Service-providing jobs grew 131.

“The labor market continues to post a sluggish recovery across the board,” said Nela Richardson, chief economist, ADP. “We’re seeing large-sized companies increasingly feeling the effects of COVID-19, while job growth in the goods producing sector pauses. With the pandemic still in the driver’s seat, the service sector remains well below its pre-pandemic levels; however, this sector is one that will likely benefit the most over time with reopenings and increased consumer confidence.”

ECB de Cos: Increase in long term nominal rates may have negative impacts

ECB Governing Council member Pablo Hernandez de Cos said today, “the increases in long-term nominal interest rates have not been accompanied by increases of the same magnitude in long-term inflation expectations. This may have a negative impact on economic activity and thus inflation.” “These developments underline the importance of avoiding premature increases in nominal interest rates,” he added.

Instead, “in a setting where inflation expectations are well below our aim, a decrease in real interest rates would have made a greater contribution to the recovery and helped achieve this aim,” he said. “The need to maintain very accommodative financing conditions is justified because we are a long way from achieving our inflation aim.”

Eurozone PPI at 1.4% mom, 0.0% yoy in Jan

Eurozone PPI came in at 1.4% mom, 0.0% yoy in January, versus expectation of 1.0% mom, -0.4% yoy. For the month, industrial producer prices increased by 3.5% mom in the energy sector, by 1.2% mom for intermediate goods, by 0.4% mom for capital goods and for durable consumer goods and by 0.1% mom for non-durable consumer goods. Prices in total industry excluding energy increased by 0.8% mom.

EU PPI came in at 1.4% mom, 0.0% yoy. For the month, the industrial producer prices increased in all Member States for which data are available. The highest increases were recorded in Ireland (+10.0% mom), Spain (+3.4% mom) and Denmark (+3.3% mom).

Eurozone PMI composite finalized at 48.8, on course for a double-dip recession

Eurozone PMI Services was finalized at 45.7 in February, up slightly from January’s 45.4. PMI Composite was finalized at 48.8, up from January’s 47.8. Looking at some member states, Italy PMI Composite rose to 7-month high at 51.4. Germany came in at 51.1.. France dropped to 3-month low at 47.0. Spain and Ireland were also in contraction, at 45.1 and 42.7 respectively.

Chris Williamson, Chief Business Economist at IHS Markit said: “A fourth successive monthly drop in business activity puts the eurozone economy on course for a double-dip recession… it’s becoming clear that many virus-fighting measures will need to be in place for some time to come, in part due to the slow vaccine roll-out. This could extend the drag on the economy from the pandemic into the second half of the year and subdue the pace of recovery.

“A key question will be the extent to which these containment measures will limit the supply of goods and services at a time of recovering demand, as this will in turn determine pricing power in coming months and affect how long the current bout of sharply rising prices will persist.”

UK PMI services finalized at 49.5, composite at 49.6

UK PMI Services was finalized at 49.5 in February, up sharply from January’s 39.5. Markit said business activity was almost stable in the second month of lockdown. There was slowest drop in staffing numbers since the pandemic began. Also, optimism continued to rise in response to vaccine roll out. PMI Composite was finalized at 49.6, up from January’s 41.2.

Tim Moore, Economics Director at IHS Markit: “UK service sector activity was relatively stable in February and so it appears that the third national lockdown has seen limited spillovers to parts of the economy beyond the scope of government mandated closures… Tighter restrictions on international travel meant that export sales remained an area of weakness for the service economy… Higher fuel bills and shipping costs pushed up operating expenses in February. Service providers have mostly absorbed pressure on margins from rising input costs over the past 12 months, but their latest increase in average charges was the fastest since the start of the pandemic”.

Australia GDP grew 3.1% qoq in Q4, strong terms of trade

Australia GDP grew 3.1% qoq in Q4, above expectation of 2.5% qoq. Growth slowed slightly from Q3’s 3.4% qoq. Over the year, GDP dropped -1.1% yoy. Terms of trade rose 4.7% qoq off the back of higher export prices, particularly for iron ore. Terms of trade contributed to a 4.2% increase in nominal GDP, strongest rise since Q3 1983.

Head of National Accounts at the ABS, Michael Smedes said: “Despite the two consecutive quarters of strong growth, economic activity remained 1.1 per cent lower than recorded in the 2019 December quarter.” This is the first time in the over sixty year history of the National Accounts that GDP has grown by more than 3.0 per cent in two consecutive quarters.

Also released, Australia AiG Performance of Construction dropped -0.2 pts to 57.4 in February. New Zealand building permits rose 2.1% mom in January.

China Caixin PMI services dropped to 51.5, recovery further weakened

China Caixin PMI Services dropped to 51.5 in February, down from 52.0, slightly below expectation of 51.6. Markit noted that services activity growth eased to ten-month low. There was softer increase in total new work amid renewed drop in export sales. Nevertheless, confidence regarding the 12-month business outlook remained robust. PMI Composite dropped to 51.7, down from 52.2.

Wang Zhe, Senior Economist at Caixin Insight Group said: “To sum up, the momentum of manufacturing and services recovery further weakened. Overseas demand was sluggish and the job market was under higher pressure. Inflationary pressure continued to grow. Despite these headwinds, manufacturers and service providers were still optimistic. The confidence mainly came from the experience in fighting the pandemic over the past year, as well as the expectation that winter Covid-19 flare-ups were coming to an end. Also, companies were confident in the future outlook for their new products.

BoJ Kataoka: It’s hard now to foresee inflation powerfully heading towards 2%

Goushi Kataoka, the most dovish BoJ board member, said “it’s hard now to foresee inflation powerfully heading towards our 2% target.”

“in order to prevent Japan’s economy from falling into deflation, further policy coordination of both fiscal and monetary policy is needed,” he added. “It was necessary for the BOJ to strengthen its policy commitment by relating the forward guidance for policy rates to price targets.”

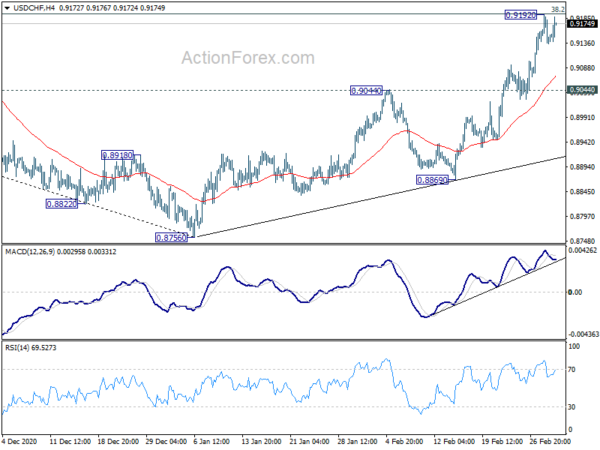

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9122; (P) 0.9158; (R1) 0.9180; More….

Intraday bias in USD/CHF remains neutral as consolidations from 0.9192 temporary top could still extend. But overall, But further rally is expected as long as 0.9044 resistance turned support holds. Sustained break of 38.2% retracement of 0.9901 to 0.8756 at 0.9193 will target 0.9295 resistance. Firm break there will carry larger bullish implications and target 61.8% retracement at 0.9464 next.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). There is no clear sign of completion yet. Next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. In any case, break of 0.9295 resistance is needed to signal medium term bottoming. Otherwise, outlook will remain bearish in case of rebound. Firm break of 0.9295, though, will be an early sign of medium term bullish reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Construction Feb | 57.4 | 57.6 | ||

| 21:45 | NZD | Building Permits M/M Jan | 2.10% | 4.90% | 5.10% | |

| 00:01 | GBP | BRC Shop Price Index Y/Y Jan | -2.40% | -2.20% | ||

| 00:30 | AUD | GDP Q/Q Q4 | 3.10% | 2.50% | 3.30% | 3.40% |

| 01:45 | CNY | Caixin Services PMI Feb | 51.5 | 51.6 | 52 | |

| 07:30 | CHF | CPI M/M Feb | 0.20% | 0.40% | 0.10% | |

| 07:30 | CHF | CPI Y/Y Feb | -0.50% | -0.30% | -0.50% | |

| 08:45 | EUR | Italy Services PMI Feb | 48.8 | 46.5 | 44.7 | |

| 08:50 | EUR | France Services PMI Feb F | 45.6 | 43.6 | 43.6 | |

| 08:55 | EUR | Germany Services PMI Feb F | 45.7 | 46.8 | 45.9 | |

| 09:00 | EUR | Eurozone Services PMI Feb F | 45.7 | 44.7 | 44.7 | |

| 09:30 | GBP | Services PMI Feb F | 49.5 | 49.7 | 49.7 | |

| 10:00 | EUR | Eurozone PPI M/M Jan | 1.40% | 1.00% | 0.80% | |

| 10:00 | EUR | Eurozone PPI Y/Y Jan | 0.00% | -0.40% | -1.10% | |

| 13:15 | USD | ADP Employment Change Feb | 117K | 168K | 174K | 195K |

| 13:30 | CAD | Building Permits M/M Jan | 8.20% | 1.00% | -4.10% | -4.40% |

| 14:45 | USD | Services PMI Feb F | 58.9 | 58.9 | ||

| 15:00 | USD | ISM Services PMI Feb | 58.7 | 58.7 | ||

| 15:00 | USD | ISM Services Employment Index Feb | 51.7 | 55.2 | ||

| 15:30 | USD | Crude Oil Inventories | -1.3M | 1.3M | ||

| 19:00 | USD | Fed’s Beige Book |