US stocks suffered steep selling overnight on sharp rally in treasury yields, and the selloff carried forward to Asian markets. Yen and Dollar ride on the turn in risk sentiments and rebounded, together with Dollar. Australian and New Zealand are in deep pull back, together with Sterling. Euro and Swiss Franc are mixed for the moment.

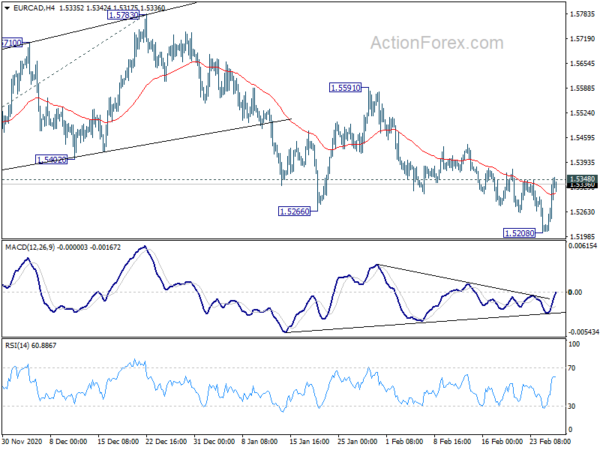

Technically, the rebound in Euro continues to be impressive, except versus Dollar. EUR/GBP’s break of 0.8953 resistance should confirm short term bottoming at 0.8537. EUR/AUD’s break of 1.5408 resistance should also indicate short term bottoming. Break of 1.5348 resistance in EUR/CAD would align the development with the above two crosses. Such developments could help cushion Euro’s decline versus Dollar and Yen.

In Asia, currently, Nikkei is down -3.01%. Hong Kong HSI is down -2.43%. China Shanghai SSE is down -1.84%. Singapore Strait Times is down -0.98%. Japan 10-year JGB yield is up 0.0135 at 0.166. Overnight, DOW dropped -1.75%. S&P 500 dropped -2.45%. NASDAQ dropped -3.52%. 10-year yield rose 0.129 to 1.518.

!0-yr yield breaks 1.5 after awful debt auctions, heading to 2%?

The fast acceleration in US yield was a major shocker to the markets overnight. Fed officials are generally unconcerned with recent rally. They even sounded upbeat about the development in the bond markets. But some analysts pointed to the poor demand in the “awful” bond auctions overnight. Now that 10-year yield is back above 1.5%, we might be looking at next level around 2%, if the the rally persists.

Kansas City Fed President Esther George said, “much of this increase likely reflects growing optimism in the strength of the recovery and could be viewed as an encouraging sign of increasing growth expectations.”

Atlanta Fed President Raphael Bostic said, “yields have definitely moved at the longer end, but right now I am not worried about that. We will keep an eye out. … I am not expecting that we will need to respond at this point in terms of our policy.”

St. Louis Fed President James Bullard said, “I think the rise in yields is probably a good sign so far because it does reflect better outlook for U.S. economic growth and inflation expectations which are closer to the committee’s inflation target,”

However, some analysts noted that the sharp rally in yield was a result of the “tepid”, awful”, and “brutal” debt auction. The USD 62B of 7-year notes auction showed poor demand, with bid-to-cover ratio of 2.04, the lowest on record.

10-year yield closed up 0.129 at 1.518 overnight. 1.429 support turned resistance was taken out already and the rally is still in acceleration mode. We might now be looking at the next level at 1.971 resistance, 55 month EMA at 1.997, or even 61.8% retracement of 3.248 to 0.398 at 2.159.

S&P 500 and DOW not looking bad despite pull back, NASDAQ vulnerable though

While US stocks suffered steep selloff overnight, the outlook isn’t generally that bad yet. S&P 500 is still holding well inside rising channel, and above 55 day EMA. The trend defining support of 3694.12 is indeed still a bit far away. So, outlook is staying bullish, in a way that rise from 3233.94 is still not under threat yet, not to mention the up trend from 2191.86. Though, bearish divergence condition in daily MACD is a warning.

NASDAQ is looking a little bit more vulnerable as it has already tested corresponding trend defining support of 12985.05. Firm break there will open up the case of deeper pull back towards 12074.06 resistance turned support. That could be an early warning of deeper correction in other indices.

But at the same time, let’s not forget that DOW just made a new record high earlier this week. It’s holding well above 55 day EMA, as well as 29837.30 support. The bearish divergence condition in daily MACD is not enough to indicate major topping yet. So overall, it’s still early to declare the arrival of medium-term scale correction in US stocks. Let’s wait and see.

On the data front

New Zealand trade deficit came in smaller than expected at NZD -626m in January. Australia private sector credit rose 0.2% mom in January versus expectation of 0.3% mom. Japan Tokyo CPI core dropped -0.3% yoy in February versus expectation of -0.4% yoy. Japan industrial production rose 4.2% mom in January versus expectation of 4.0% mom. Japan retail trade dropped -2.4% yoy in January versus expectation of -2.6% yoy.

Looking ahead, Swiss Q4 GDP, KOF leading indicator, Germany import price, France consumer spending and GDP will be featured in European session. Later in the day, US will release personal income and spending, whole sale inventories, goods trade balance, Chicago PMI. Canada will release IPPI and RMPI.

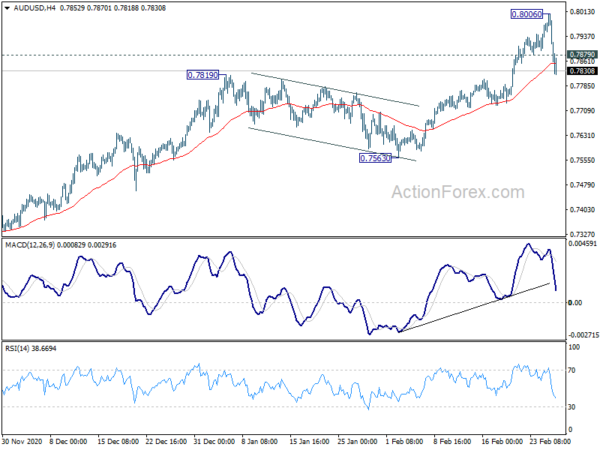

AUD/USD Daily Report

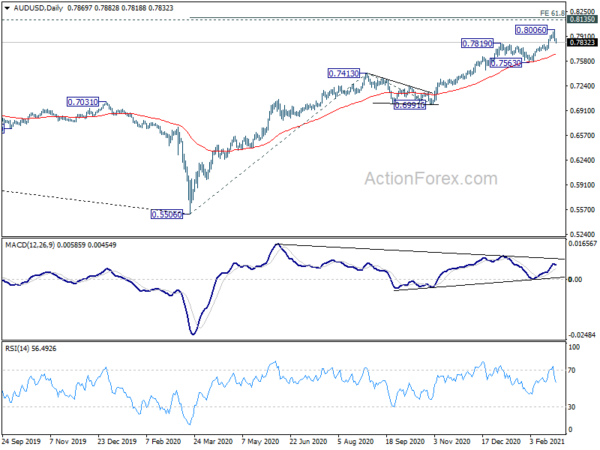

Daily Pivots: (S1) 0.7818; (P) 0.7913; (R1) 0.7966; More…

Intraday bias in AUD/USD is turned neutral with the current steep pull back. Some consolidations could be seen below 0.8006 and deeper fall cannot be ruled out. But outlook will stay bullish as long as 55 day EMA (now at 0.7669) holds. Up trend from 0.5506 is still in favor to continue and break of 0.8006 will target 0.8135 key long term resistance next.

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Jan | -626M | -630M | 17M | 69M |

| 23:30 | JPY | Tokyo CPI Core Y/Y Feb | -0.30% | -0.40% | -0.40% | |

| 23:50 | JPY | Industrial Production M/M Jan P | 4.20% | 4.00% | -1.00% | |

| 23:50 | JPY | Retail Trade Y/Y Jan | -2.40% | -2.60% | -0.20% | |

| 0:30 | AUD | Private Sector Credit M/M Jan | 0.20% | 0.30% | 0.30% | |

| 5:00 | JPY | Housing Starts Y/Y Jan | -3.1% | -2.50% | -9.00% | |

| 6:45 | CHF | GDP Q/Q Q4 | 0.10% | 7.20% | ||

| 7:00 | EUR | Germany Import Price Index M/M Jan | 0.30% | 0.60% | ||

| 7:45 | EUR | France Consumer Spending M/M Jan | 23% | |||

| 7:45 | EUR | France GDP Q/Q Q4 | -1.30% | |||

| 8:00 | CHF | KOF Leading Indicator Feb | 97 | 96.5 | ||

| 8:00 | CHF | GDP Q/Q Q4 | 0.10% | 7.20% | ||

| 13:30 | CAD | Industrial Product Price M/M Jan | 1.50% | |||

| 13:30 | CAD | Raw Material Price Index Jan | 3.50% | |||

| 13:30 | USD | Personal Income M/M Jan | 10.00% | 0.60% | ||

| 13:30 | USD | Personal Spending Jan | 0.70% | -0.20% | ||

| 13:30 | USD | PCE Price Index M/M Jan | 0.30% | 0.40% | ||

| 13:30 | USD | PCE Price Index Y/Y Jan | 1.10% | 1.30% | ||

| 13:30 | USD | Core PCE Price Index M/M Jan | 0.10% | 0.30% | ||

| 13:30 | USD | Core PCE Price Index Y/Y Jan | 1.40% | 1.50% | ||

| 13:30 | USD | Wholesale Inventories Jan P | 0.30% | |||

| 13:30 | USD | Goods Trade Balance (USD) Jan P | -83.0B | -82.5B | ||

| 14:45 | USD | Chicago PMI Feb | 61 | 63.8 | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Feb F | 76.4 | 76.2 |