Sterling continues to trade as the strongest one for the week, as focus turns to UK retail sales and PMIs. Upside surprises there could give the Pound another lift. Australian Dollar is keeping itself close as second strongest for now. On the other hand, Yen and Swiss France are staying as the weakest, followed by Euro. Dollar and Canadian Dollar are both mixed.

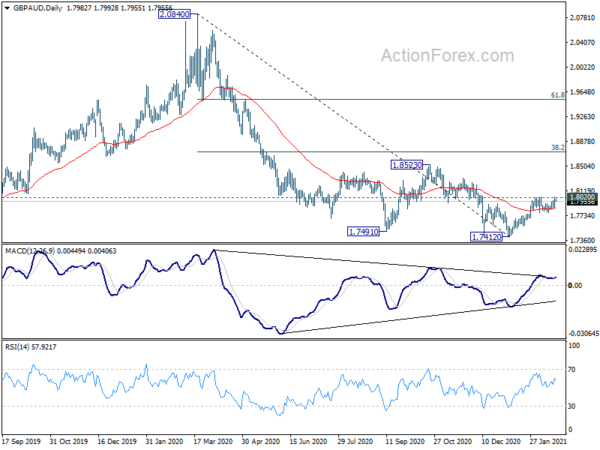

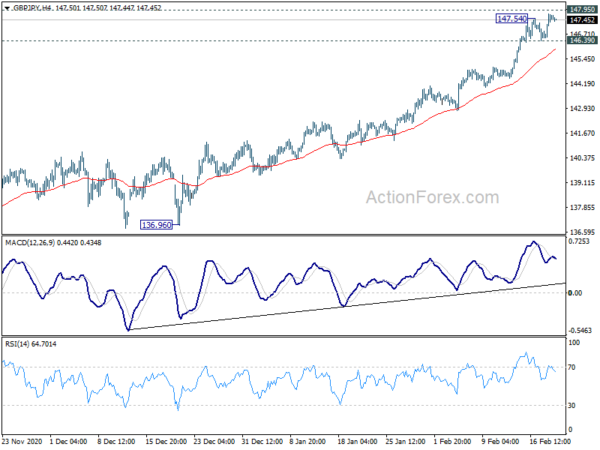

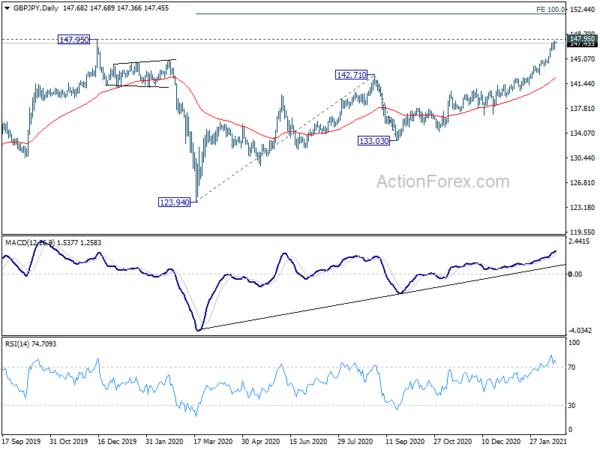

Technically, the Pound appears to be in acceleration mode at the moment. EUR/GBP breaks 0.8670 support without any hesitation. Next target is 0.8533 projection level. GBP/USD is on track to 1.4376 long term resistance. GBP/CAD is on track to retest 1.8052 medium term resistance. One focus is whether GBP/JPY would break through 147.95 medium term resistance decisively. Another focus is whether GBP/AUD would break through 1.8020 resistance to resume the rebound from 1.7412 towards 1.8523 resistance.

In Asia, Nikkei is currently down -0.80%. Hong Kong HSI is down -0.48%. China Shanghai SSE is up 0.12%. Singapore Strait Times is down -1.07%. Japan 10-year JGB yield is up 0.0066 at 0.100. Overnight, DOW dropped -0.38%. S&P 500 dropped -0.44%. NASDAQ dropped -0.72%. 10-year yield dropped -0.014 to 1.287.

Japan CPI core rose to -0.6% yoy in Jan, CPI core-core turned positive to 0.1% yoy

Japan CPI core (ex-food) climbed back to -0.6% yoy in January, up from -1.0% yoy, above expectation of -0.7% yoy. All item CPI also rose to -0.6% yoy, up from -1.2% yoy. CPI core-core (ex-food and energy) turned positive to 0.1% yoy, up from -0.4% yoy.

BoJ is set to review its monetary policy tools in March, to make the massive stimulus program “more sustainable and effective”. It’s reported that the central bank could replace some numerical guidelines for ETF purchases. A source to Reuters noted that “to make the BOJ’s policy sustainable, it needs to avoid buying too much ETFs when doing so is unnecessary”.

Japan PMI manufacturing rose to 50.6, but services dropped to 45.8

Japan PMI Manufacturing rose to 50.6 in February, up from 49.8, indicating a renewed improvement in the manufacturing sector. PMI Services, however, dropped to 45.8, down from 46.1. PMI Composite rose to 47.6, up from 47.1.

Usamah Bhatti, Economist at IHS Markit, said: “Latest flash PMI data signalled a further decline in business activity. New orders also fell solidly, led by weaker domestic demand. The latest data pointed to some brighter spots. New export orders stabilised… Employment levels expanded slightly… Input price inflation continued at a similar pace to January. Businesses were optimistic that business conditions would improve in the coming 12 months.

Australia PMI composite dropped to 54.4, strong employment, higher inflationary pressure supply chain disruption

Australia PMI Manufacturing dropped to 56.6 in February, down from 57.2. PMI Services dropped to 54.1, down from 55.6. PMI Composite dropped to 54.4, down from 55.9.

Andrew Harker, Economics Director at IHS Markit, said: “A key positive from the flash PMI data for Australia is the strongest pace of job creation since late-2018…. On a less positive note, growth in the economy has been accompanied by stronger inflationary pressures… Another factor potentially putting the brakes on growth, particularly in the manufacturing sector, is the ongoing disruption to supply chains amid global shipping problems which showed no sign of letting up.”

Australia retail sales rose 0.6% mom in Jan, NSW led the rise but Queensland dropped

Australia retail sales rose 0.6% mom in January, below expectation of 2.0% mom. All states and territories rose, except for Queensland. NSW led the rises, up 1.0%, as Greater Sydney saw COVID-19 restrictions eased in January. Queensland saw a fall of 1.5%, with COVID-19 restrictions in Brisbane leading to falls

Ben James, Director of Quarterly Economy Wide Surveys, said: “There continues to be variations in retail sales between states and territories, as COVID-19 restrictions are tightened or eased in different parts of the country.”

From New Zealand, PPI input slowed to 0.0% qoq in Q4, PPI output turned positive to 0.4% qoq.

Looking ahead

The economic calendar is very busy today. Germany will release PPI and PMIs. France will release PMIs. Swiss will release industrial production. Eurozone will release PMIs and current account. UK will release retail sales and PMIs.

Later in the day, Canada will release retail sales. US will release PMIs and existing home sales.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 146.88; (P) 147.34; (R1) 148.12; More…

GBP/JPY’s rally resumes after brief retreat and intraday bias is back on the upside. Sustained break of 147.95 structural resistance will carry larger bullish implications. Up trend from 123.94 should then target 100% projection of 123.94 to 142.71 from 133.03 at 151.80 next. On the downside, though, break of 146.39 minor support will indicate short term topping, and turn bias to the downside for pull back.

In the bigger picture, rise from 123.94 is seen as the third leg of the sideway pattern from 122.75 (2016 low). Break of 147.95 will target 156.59 resistance (2018 high). On the downside, break of 133.03 support is needed to confirm completion of the rise from 123.94. Otherwise, further rise will remain in favor even in case of pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | PPI Input Q/Q Q4 | 0.00% | 0.60% | ||

| 21:45 | NZD | PPI Output Q/Q Q4 | 0.40% | -0.30% | ||

| 22:00 | AUD | CBA Manufacturing PMI Feb P | 56.6 | 57.2 | ||

| 22:00 | AUD | CBA Services PMI Feb P | 54.1 | 55.6 | ||

| 23:30 | JPY | National CPI Core Y/Y Jan | -0.60% | -0.70% | -1.00% | |

| 0:01 | GBP | GfK Consumer Confidence Feb | -23 | -27 | -28 | |

| 0:30 | AUD | Retail Sales M/M Jan P | 0.60% | 2.00% | -4.10% | |

| 0:30 | JPY | Jibun Bank Manufacturing PMI Feb P | 50.6 | 49.7 | 49.8 | |

| 7:00 | EUR | Germany PPI M/M Jan | 0.70% | 0.80% | ||

| 7:00 | EUR | Germany PPI Y/Y Jan | 0.20% | 0.20% | ||

| 7:00 | GBP | Retail Sales M/M Jan | -1.00% | 0.30% | ||

| 7:00 | GBP | Retail Sales Y/Y Jan | 2.90% | |||

| 7:00 | GBP | Retail Sales ex-Fuel M/M Jan | -0.50% | 0.40% | ||

| 7:00 | GBP | Retail Sales ex-Fuel Y/Y Jan | 6.40% | |||

| 7:00 | GBP | Public Sector Net Borrowing (GBP) Jan | 33.4B | |||

| 7:30 | CHF | Industrial Production Y/Y Q4 | -5.10% | |||

| 8:15 | EUR | France Manufacturing PMI Feb P | 51 | 51.6 | ||

| 8:15 | EUR | France Services PMI Feb P | 47 | 47.3 | ||

| 8:30 | EUR | Germany Manufacturing PMI Feb P | 56.5 | 57.1 | ||

| 8:30 | EUR | Germany Services PMI Feb P | 46.5 | 46.7 | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Feb P | 54.4 | 54.8 | ||

| 9:00 | EUR | Eurozone Services PMI Feb P | 44.5 | 45.4 | ||

| 9:00 | EUR | Eurozone Current Account (EUR) Dec | 22.0B | 24.6B | ||

| 9:30 | GBP | Manufacturing PMI Feb P | 54 | 54.1 | ||

| 9:30 | GBP | Services PMI Feb P | 40.5 | 39.5 | ||

| 13:30 | CAD | Retail Sales M/M Dec | 1.30% | |||

| 13:30 | CAD | Retail Sales ex Autos M/M Dec | 2.10% | |||

| 14:45 | USD | Manufacturing PMI Feb P | 58.5 | 59.2 | ||

| 14:45 | USD | Services PMI Feb P | 57.5 | 58.3 | ||

| 15:00 | USD | Existing Home Sales Jan | 6.56M | 6.76M | ||

| 15:00 | USD | Existing Home Sales Change M/M Jan | -2.70% | 0.70% |