The strong rally in US treasury yield overnight pushed Dollar notably higher. The greenback is indeed the second strongest one for the week, just next to Sterling. Canadian Dollar is following closely with support by resilience in oil prices. ON the other hand, overall risk-on sentiment is keeping Yen under heavy selling pressured. Other currencies, including Swiss Franc, Aussie and Kiwi, are mixed for now.

Technically, while Dollar jumped, near term resistance levels against other major currencies are so far still intact. The levels include 1.2080 minor support in EUR/USD, 1.3865 minor support in GBP/USD, 0.7717 minor support in AUD/USD, 0.8939 minor resistance in USD/CHF and 1.2762 minor resistance in USD/CAD. We’d prefer to see these levels to be taken out to confirm the near term rebound in the greenback.

In Asia, currently, Nikkei is down -0.62%. Hong Kong HSI is up 0.65%. Singapore Strait Times is down -0.46%. Japan 10-year JGB yield is up 0.0179 at 0.098. China is still on holiday. Overnight, DOW rose 0.20%. S&P 500 dropped -0.06%. NASDASQ dropped -0.34%. 10-year yield rose 0.099 to 1.299.

US 10-yr yield hits 1.3, to target 1.43-1.48 next

US 10-year yield accelerated higher overnight and breached 1.3% for the first time in a year, before closing at 1.299, up 0.099. Reflation trade over the massive US stimulus package, together with loose Fed policy was a factor in driving funds out of treasuries. Also, there is increasing optimism of returning to normal with the pace of vaccine rollout, domestically and globally.

TNX’s solid break of 1.266 resistance is an important bullish development. Upside momentum is also accelerating with the medium term channel resistance taken out, with a gap up. The strong support from 55 week EMA is also a medium term bullish sign.

Now, further rally is expected as long as 1.131 support holds. We’re tentatively looking at key resistance zone between 1.429 and 38.2% retracement of 3.248 to 0.398 at 1.4867 at next target.

RBA Kent: Aussie could be 5% higher without RBA policy

RBA Assistant Governor Christopher Kent said in a speech that some factors have contributed to the appreciation of the Australian Dollar since November. The factors include “general improvement in the outlook for global growth” and a “marked increase in many commodity prices”.

Iron ore prices “has increased by around 40 per cent” since early November. And, “historical relationships with commodity prices would have implied a much larger appreciation of the Australian dollar than what’s actually occurred,” he added.

“While history only provides a rough guide, this difference suggests that the Bank’s policy measures have contributed to the Australian dollar being as much as 5 per cent lower than otherwise (in trade-weighted terms),” Kent said.

Australia leading index rose to 4.48% in Jan, points to above trend growth in 2021

Australia Westpac leading index rose from 4.24% to 4.48% in January. The data points to “above trend growth in the Australian economy through 2021”. Westpac expects 4% GDP growth in 2021, led by consumer spending, which contributes to around 3% to the overall growth rate.

As for RBA policy, Westpac expects the bond buying program to be extended beyond October. Yield curve control will be maintained through 2021. However, the Term Funding Facility will be “largely scaled back” after June.

Japan’s export surged 6.4% yoy in Jan, imports dropped -9.5% yoy

Japan’s export rose 6.4% yoy to JPY 5780B in January. By region, exports to China jumped a massive 37.5% yoy, largest annual gain since April 2010. Exports to the US, on the other hand, dropped -4.8% yoy. Imports dropped -9.5% yoy to JPY 6104B. Trade deficit came in at JPY -324B.

In seasonally adjusted term, exports rose 4.4% mom to JPY 6362B. Imports rose 6.9% mom to JPY 5969B. Trade surplus narrowed to JPY 393B, below expectation of JPY 480B.

Also from Japan, machine orders unexpectedly rose 5.2% mom in December, versus expectation of -6.2% mom decline.

Looking ahead

Inflation data will be the major focuses today. UK will release CPI, RPI and PPI. Canada will release CPI. US will release PPI too, plus retail sales, industrial production, business inventories and NAHB housing index. Fed will release FOMC minutes too.

AUD/USD Daily Report

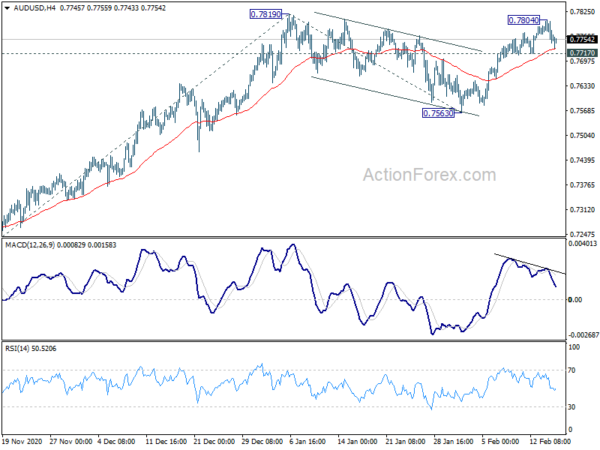

Daily Pivots: (S1) 0.7733; (P) 0.7769; (R1) 0.7793; More…

AUD/USD retreated after making a temporary top at 0.7804, ahead of 0.7819 high. Intraday bias is turned neutral first. Further rally is expected as long as 0.7717 minor support holds. Decisive break of 0.7819 will resume larger up trend from 0.5506, for 61.8% projection of 0.6991 to 0.7819 from 0.7563 at 0.8075. On the downside, break of 0.7717 minor support will delay the bullish case and extend the correction from 0.7819 with another fall, towards 0.7563 support.

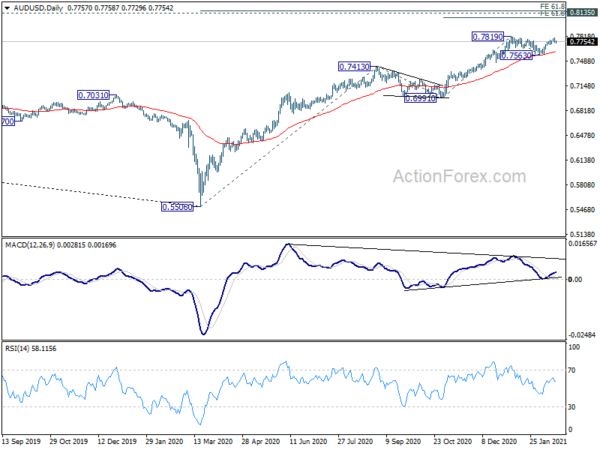

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Jan | 0.30% | 0.10% | ||

| 23:50 | JPY | Trade Balance (JPY) Jan | 0.39T | 0.48T | 0.48T | 0.51T |

| 23:50 | JPY | Machinery Orders M/M Dec | 5.20% | -6.20% | 1.50% | |

| 7:00 | GBP | CPI M/M Jan | -0.40% | 0.30% | ||

| 7:00 | GBP | CPI Y/Y Jan | 0.50% | 0.60% | ||

| 7:00 | GBP | Core CPI Y/Y Jan | 1.30% | 1.40% | ||

| 7:00 | GBP | RPI Y/Y Jan | 1.20% | 1.20% | ||

| 7:00 | GBP | RPI M/M Jan | 0.50% | 0.60% | ||

| 7:00 | GBP | PPI Input M/M Jan | 0.70% | 0.80% | ||

| 7:00 | GBP | PPI Input Y/Y Jan | 1.00% | 0.20% | ||

| 7:00 | GBP | PPI Output M/M Jan | 0.20% | 0.30% | ||

| 7:00 | GBP | PPI Output Y/Y Jan | -0.60% | -0.40% | ||

| 7:00 | GBP | PPI Core Output M/M Jan | 0.10% | |||

| 7:00 | GBP | PPI Core Output Y/Y Jan | 1.20% | |||

| 13:30 | CAD | CPI M/M Jan | -0.20% | |||

| 13:30 | CAD | CPI Y/Y Jan | 0.70% | |||

| 13:30 | CAD | CPI Common Y/Y Jan | 1.30% | |||

| 13:30 | CAD | CPI Median Y/Y Jan | ||||

| 13:30 | CAD | CPI Trimmed Y/Y Jan | ||||

| 13:30 | USD | Retail Sales M/M Jan | 1.10% | -0.70% | ||

| 13:30 | USD | Retail Sales ex Autos M/M Jan | 0.90% | -1.40% | ||

| 13:30 | USD | PPI M/M Jan | 0.40% | 0.30% | ||

| 13:30 | USD | PPI Y/Y Jan | 0.90% | 0.80% | ||

| 13:30 | USD | PPI Core M/M Jan | 0.20% | 0.10% | ||

| 13:30 | USD | PPI Core Y/Y Jan | 1.20% | 1.20% | ||

| 14:15 | USD | Industrial Production M/M Jan | 0.40% | 1.60% | ||

| 14:15 | USD | Capacity Utilization Jan | 74.80% | 74.50% | ||

| 15:00 | USD | Business Inventories Dec | 0.50% | 0.50% | ||

| 15:00 | USD | NAHB Housing Market Index Feb | 83 | 83 | ||

| 19:00 | USD | FOMC Minutes |