Overall developments in the markets are unchanged as strong risk-on sentiments continue. Yen is currently the worst performer by a mile. Dollar, Euro and Swiss Franc are following behind. Sterling continue to stay strong together with commodity currencies. A focus today is on whether Germany ZEW economic sentiment and Eurozone GDP could give Euro a lift. Otherwise, the current trend should continue for the very near term.

Technically, 105.76 resistance in USD/JPY is a level to pay attention and break will resume the rebound from 102.58. That could help cushion Dollar’s decline elsewhere. However, rejection by this resistance could prompt some more downside in the greenback. In particular, USD/CHF’s breach of 0.8889 minor support is a sign of Dollar weakness but there is no clear follow through selling yet. EUR?USD’s break of 1.2148 minor resistance would resume the rebound from 1.1951 towards 1.2348 high.

In Asia, currently, Nikkei is up 1.73%. Hong Kong HSI is up 1.80%. Singapore Strait Times is up 0.27%. China is still on holiday. Japan 10-year JGB yield is up another 0.0060 at 0.086.

RBA Minutes: Some years before inflation and unemployment goals achieved

Minutes of RBA’s February 2 meeting noted that a number of major central banks had already announced extensions of their QE program. There was also a widespread expectation for RBA to extend its own. Hence, “if the Bank were to cease bond purchases in April, it was likely that there would be unwelcome significant upward pressure on the exchange rate.”

Outlook for the economy also indicated that it would be “some years before the goal of inflation and unemployment were achieved”. Hence, RBA decided to purchase an additional AUD 100B of Australian Government and states and territories after the current program completes in April.

On interest rate, the minutes reiterated that a negative policy rate is “extraordinarily unlikely”. Cash rate would be maintained at 10 basis points for “as long as necessary”. The conditions for a rate hike are not expected to be met “until 2024 at the earliest”.

BoJ Kuroda: Optimism over global outlook and vaccine rollouts behind surge in stock prices

BoJ Governor Haruhiko Kuroda told the parliament that “optimism over the global economic outlook and steady vaccine rollouts may be behind the recent surge in stock prices”. Nevertheless, he also warned that “global outlook remains highly uncertain and risks to Japan’s economy remained tilted to the downside. His comment came when Nikkei closed above 30k level for the first time in three decades.

Kuroda also noted that it’s premature to consider exiting the massive monetary stimulus measures, including ETF purchase. “It’s likely to take significant time to achieve our price target. As such, now is not the time to think about an exit including from our ETF buying,” he said.

Finance Minister Taro Aso also said, it’s not time to withdraw fiscal support. “The biggest issue now is when to shift from crisis-mode policy to fiscal restoration. In doing so, it’s important for such action to be coordinated,” he added.

Also from Japan, tertiary industry index dropped -0.4% mom in December, versus expectation of -0.6% mom.

HK HSI surges with global stocks, targeting 32255 next

Hong Kong HSI follows global stocks higher as it’s back from lunar new year holiday. It’s up 1.8% or 543 pts at the time of writing. For the near term outlook will stay bullish as long as the lower side of the gap at 29828.61 holds. Current up trend from 21139.26 should target 161.8% projection of 21139.26 to 26782.61 from 23124.25 at 32255.19 next.

As for the medium term, outlook will stay bullish as long as 28259.73 support holds. Corrective pattern from 33484.07 should have completed with three waves down to 21139.26. Considering the strong up side momentum as seen in weekly MACD, current rise is likely be resuming the long term up trend. We’re tentatively putting 100% projection of 18278.80 to 33484.07 from 21139.26 at 36344.53 as next medium term target.

Looking ahead

Germany ZEW economic sentiment and Eurozone GDP are the major focuses in European session. Later in the day, Canada foreign portfolio investment and US Empire State manufacturing will be featured.

EUR/USD Daily Outlook

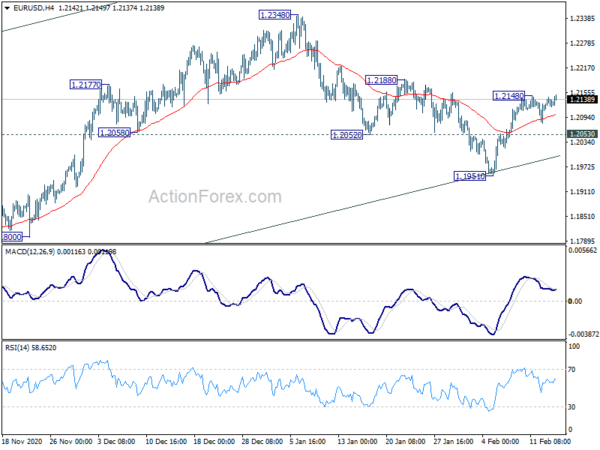

Daily Pivots: (S1) 1.2114; (P) 1.2130; (R1) 1.2142; More…

EUR/USD is staying in consolidations from 1.2148 temporary top and intraday bias remains neutral first. On the upside, break of 1.2148 will reaffirm the case that correction from 1.2348 has completed with three waves down to 1.1951. Intraday bias will be back on the upside for 1.2188 and then 1.2348 high. However, break of 1.2053 minor support will dampen this bullish case and bring retest of 1.1951 support instead.

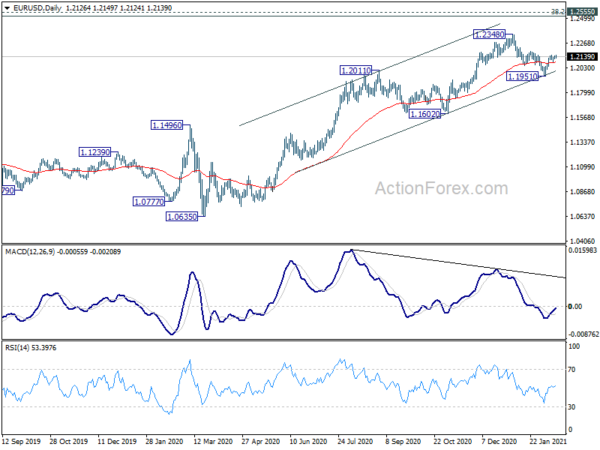

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | RBA Minutes | ||||

| 4:30 | JPY | Tertiary Industry Index M/M Dec | -0.40% | -0.60% | -0.70% | -0.60% |

| 9:00 | EUR | Italy Trade Balance (EUR) Jan | 6.77B | |||

| 10:00 | EUR | Germany ZEW Economic Sentiment Feb | 60 | 61.8 | ||

| 10:00 | EUR | Germany ZEW Current Situation Feb | -67 | -66.4 | ||

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Feb | 59.2 | 58.3 | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q4 P | -0.70% | -0.70% | ||

| 10:00 | EUR | Eurozone Employment Change Q/Q Q4 P | 1.00% | |||

| 13:30 | CAD | Foreign Portfolio Investment (CAD) Dec | 11.78B | |||

| 13:30 | USD | Empire State Manufacturing Index Feb | 5.5 | 3.5 |