Yen and Dollar are under selling pressure today on strong risk-on markets. Nikkei closed above 30k handle for the first time in 30 years, as lifted by stronger than expected GDP data. Swiss Franc is following closely as third weakest. Sterling, is currently the best performer, on optimism of return to normal with vaccine rollouts. Australian Dollar is leading other commodity currencies higher too. But Canadian Dollar somewhat lags behind despite strong, accelerating oil price.

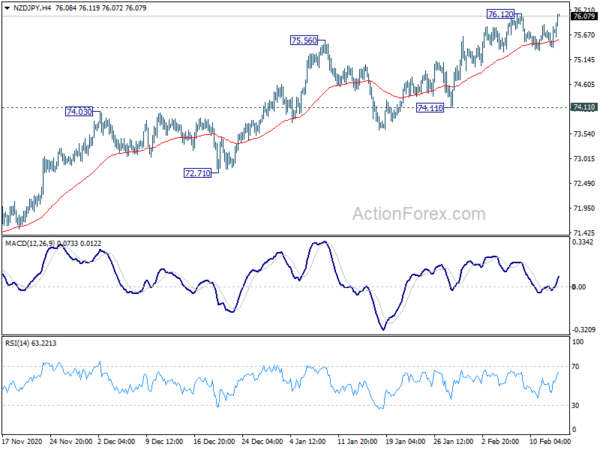

Technically, GBP/JPY is on track to retest 147.95 key structural resistance as rally continues. AUD/JPY is also on track to 84.60 projection level. EUR/JPY’s break of 127.48 resistance confirms earlier than expected up trend resumption. CAD/JPY takes out 82.69 resistance decisively to resume larger up trend form 73.80. A focus is now on when NZD/JPY would follow and break through 76.12 temporary top.

In Asia, Nikkei closed up 1.9% at 30084. Japan 10-year JGB yield is up 0.0153 at 0.079. Singapore Strait Times is Up 0.29%. Hong Kong and China are both on holiday.

Japan GDP grew 12.7% annualized, 3.0% qoq in Q4, well above expectations

Japan’s GDP grew 12.7% annualized in Q4, well above expectation of 9.5%. On quarterly terms, GDP grew 3.0% qoq, beat expectation of 2.3% qoq. Looking at some details, private consumption rose 2.2% qoq, above expectation of 1.8% qoq. Capital expenditure rose 4.5% qoq, above expectation of 2.6% qoq. External demand rose 1.0% qoq, matched expectations. Price index, however, rose just 0.2% yoy, missed expectation of 0.5% yoy.

Economy Minister Yasutoshi Nishimura said that the set of data showed the economy’s capacity on recovery. Nevertheless, consumer spending remained below average. Exports could also weaken if the coronavirus infections prompts more restrictions in other markets like Europe. The country is not out of the woods yet.

Also from Japan, industrial production was finalized at -1.0% mom in December.

New Zealand BusinessNZ services dropped to 47.9, generally negative

New Zealand BusinessNZ Performance of Services dropped -1.2 pts to 47.9 in January, signal deeper contraction. The index was also well below long term average of 53.8 for the survey. Looking at some details, activity/sales dropped from 51.0 to 46.4. Employment dropped from 52.8 to 46.9. New orders, though, improved from 50.9 to 53.7.

BusinessNZ chief executive Kirk Hope said that the January result was generally negative when examined more deeply. “Looking at the comments made by respondents, the ongoing trend of contraction was typified by the influences of the Xmas period, ongoing COVID-19 related issues (including freight challenges) and a slower return to business as usual post holidays”.

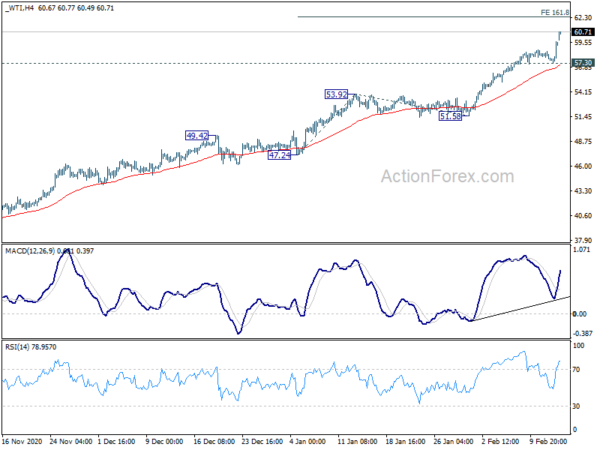

WTI breaks 60 on Yemen clashes, accelerating towards 62.3

WTI oil gaps up today and surges to as high as 60.77 so far, breaking 60 psychological level. Buying was triggered by tension in Middle East. Dozens were killed in heavy clashes in Yemen between the country’s internationally recognized government and Iran-backed Houthi rebels. Additionally, sentiments were generally lifted by optimism of returning to normal with global vaccinations.

WTI is now clearly in upside acceleration mode targeting 161.8% projection of 47.24 to 53.92 from 51.58 at 62.38. Break there will put 65.43 key structural resistance in focus. In any case, outlook will now stay bullish as long as 57.30 support holds, even in case of deep retreat.

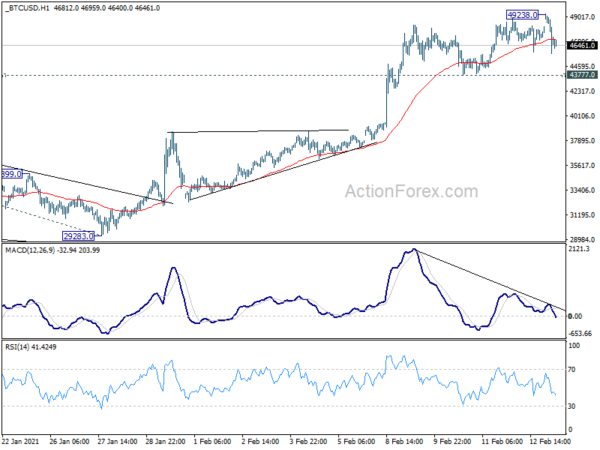

Bitcoin fails 50k again, more consolidations first

Bitcoin hits as high as 49238 in early trading but was rejected below 50k handle once again. As noted before, upside momentum is unconvincing with bearish divergence condition in hourly MACD. Even in case of another rally attempt, we’d expect 50k to limit upside for now and more consolidation is likely for the next few days.

Though, downside should be contained by 43777 support to set the stage for up trend resumption later in the week. Current rise should target 100% projection of 17629 to 41964 from 29283 at 53618 after clearing 50k handle. But a break of 43777 will bring deeper correction first.

Calendar in full speed with PMI, sentiment, inflation, production and retail sales

The economic calendar is back in full speed this week. Activity and sentiment indicators would likely catch most attention, including German ZEW and PMIs from Japan, Australia, Eurozone, UK. US will also release regional Fed surveys and PMIs. Inflation data are another focus for UK, Canada, Japan and New Zealand. Backward looking data are also featured with production from Eurozone and US, as well as retail sales from US, Australia, Canada, and UK. On central bank activities, RBA and ECB will release meeting minutes.

Here are some highlights for the week:

- Monday: Japan GDP; Eurozone industrial production, trade balance; Canada manufacturing sales.

- Tuesday: RBA minutes; Japan tertiary industry activity Eurozone GDP, employment; German ZEW economic sentiment; Canada foreign securities purchases; US Empire State manufacturing index.

- Wednesday: Japan trade balance, machinery orders; UK CPI, RPI, PPI; Canada CPI; US retail sales, PPI, industrial production, business inventories, NAHB housing index.

- Thursday: Australia employment; Swiss trade balance; ECB meeting accounts; Canada ADP employment, new housing price index; US jobless claims, building permits and housing starts, import prices, Philly Fed survey.

- Friday: New Zealand PPI; Australia PMIs, retail sales; Japan CPI, PMI manufacturing; Germany PPI; Eurozone PMIs, current account; UK retail sales, PMIs; Canada retail sales; US PMIs, existing home sales.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 126.99; (P) 127.15; (R1) 127.32; More….

EUR/JPY rises to as high as 127.59 so far today and break of 127.48 indicates resumption of whole up trend from 114.42. Intraday bias in back on the upside for 128.67 long term fibonacci level next. Sustained break there will confirm medium term upside momentum and target 100% projection of 121.63 to 127.48 from 125.07 at 130.92 next. On the downside, break of 126.97 minor support will turn bias neutral and bring some consolidations first.

In the bigger picture, rise from 114.42 is seen as a medium term rising leg inside a long term sideway pattern. Further rise is expected as long as 125.07 support holds. Next target is 61.8% retracement of 137.49 (2018 high) to 114.42 at 128.67. Sustained trading above there will indicate solid upside momentum and target 137.49 next. This will remain the favored case as long as 121.63 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q Q4 P | 3.00% | 2.30% | 5.30% | |

| 23:50 | JPY | GDP Deflator Y/Y Q4 P | 0.20% | 0.50% | 1.20% | |

| 0:01 | GBP | Rightmove House Price Index M/M Feb | 0.50% | -0.90% | ||

| 4:30 | JPY | Industrial Production M/M Dec F | -1.00% | -1.60% | -1.60% | |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Dec | 22.3B | 25.1B | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Dec | -0.60% | 2.50% | ||

| 13:30 | CAD | Manufacturing Sales M/M Dec | 0.20% | -0.60% |