Dollar stays generally weak entering into US session. But as risk appetite cools slightly, buying focus is turning to Swiss Franc and Yen. Euro is currently following the two as the next strongest. Canadian Dollar is following Dollar as second weakest, then Aussie and Kiwi.

Technically, focuses will be on 0.8925 support in USD/CHF and 104.39 support in USD/JPY. Break of these levels will confirm completion of the near term rebound, and bring retest of recent lows. But rebound from these levels will retain near term bullishness and could provide support to Dollar elsewhere.

In Europe, currently, FTSE is up 0.06%. DAX is down -0.43%. CAC is up 0.01%. Germany 10-year yield is up 0.0016 at -0.439. Earlier in Asia, Nikkei rose 0.40%. Hong Kong HSI rose 0.53%. China Shanghai SSE rose 2.01%. Singapore Strait Times rose 0.13%. Japan 10-year JGB yield closed flat at 0.07.

Italian yield drops to record low as Draghi wins backing from politicians and investors

Italy 10-year yield dropped to record low of 0.501% in early trading and remains low for the moment. Former ECB President Mario Draghi seemed to be winning confidence from a wide spectrum of political parties, as well as investors, for forming a new government.

Draghi will continue to meet with parties to get their backing. Yesterday, he reiterated that a common Euro-are budget will be one of his key priorities. He’s seen as someone who’s “pro-EU” and “pro-reform” at the same time, who could prompt a paradigm shift for the country.

Released in European session, Germany trade surplus narrowed to EUR 16.1B in December, below expectation of EUR 15.8B. Italy industrial output dropped -0.2% mom in December, below expectation of 21.% mom.

Australia NAB business confidence rose to 10, but conditions dropped to 7

Australia NAB business confidence rose from 5 to 10 in January. However, business conditions dropped from 16 to 7. Looking at some details, trading conditions dropped from 22 to 11. Profitability condition dropped from 13 to 9. Employment condition also dropped from 10 to 3.

“Business started the year on a more optimistic note, even as conditions eased from the strength we saw in December. Importantly, employment conditions remain in positive territory – so overall businesses are still expanding their workforce,” said Alan Oster, NAB Group Chief Economist. “The decline in conditions was broad-based across industries, except for a small improvement in recreation & personal services, which continues to make small gains as restrictions ease.”

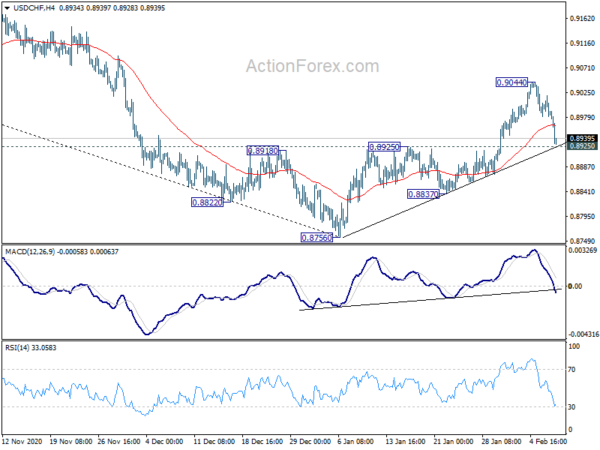

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8974; (P) 0.8997; (R1) 0.9012; More….

USD/CHF is still holding above 0.8925 resistance turned support despite steep retreat from 0.9044. Intraday bias stays neutral first. Another rise will remain in favor as long as 0.8925 holds. On the upside, break of 0.9044 will resume the rebound form 0.8756 short term bottom to 38.2% retracement of 0.9901 to 0.8756 at 0.9193. However, firm break of 0.8925 will indicate that the rebound has completed, and bring retest of 0.8756 low.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). There is no clear sign of completion yet. Next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. In any case, break of 0.9295 resistance is needed to signal medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Dec | -3.20% | -4.70% | -1.80% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Jan | 9.40% | 8.80% | 9.20% | |

| 0:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Jan | 7.10% | 4.80% | ||

| 0:30 | AUD | NAB Business Confidence Jan | 10 | 4 | ||

| 0:30 | AUD | NAB Business Conditions Jan | 7 | 14 | ||

| 2:00 | NZD | RBNZ Inflation Expectations Q/Q Q1 | 1.89% | 1.59% | ||

| 7:00 | EUR | Germany Trade Balance(EUR) Dec | 16.1B | 15.8B | 16.4B | |

| 9:00 | EUR | Italy Industrial Output M/M Dec | -0.20% | 2.10% | -1.40% | |

| 11:00 | USD | NFIB Business Optimism Index Jan | 95 | 98.7 | 95.9 |