Dollar and Yen are both recapturing some ground as risk appetite cools slightly in European session. Still, US stocks futures point to more record runs today while yields are firm. We’ll see if the greenback to ride on the trend to resume near term rebound. Canadian Dollar is currently the stronger commodity currencies, as supported by oil prices. Sterling turns weaker after failing to break through a near term resistance level against Dollar.

Technically, GBP/USD appears to be backing off from 1.3758 resistance while EUR/GBP is extending recovery. We’ll see if EUR/USD could ride on this to break through 1.2052 support turned resistance decisively, to indicate completion of near term correction. 0.7703 minor resistance in AUD/USD will also be a level to watch. Break will argue that near term correction from 0.7819 resistance has completed and bring retest of this high.

In Europe, currently, FTSE is up 1.03%. DAX is up 0.36%. CAC is up 0.75%. Germany 10-year yield is up 0.020 at -0.426. Earlier in Asia, Nikkei rose 2.12%. Hong Kong HSI rose 0.11%. China Shanghai SSE rose 1.03%. Singapore Strait Times rose 0.84%. Japan 10-year JGB yield rose 0.0104 to 0.070.

Eurozone Sentix dropped to -0.2, EU economy losing touch with other regions of the world

Eurozone Sentix Investor Confidence dropped to -0.2 in February, down from 1.3, missed expectation of 4.1. Current situation index dropped slightly to -27.4, down from -26.5. Expectations index dropped to 31.5, down from 33.5.

- German Investor Confidence dropped from 9.2 to 8.6. Expectations rose from -15.8 to -15.5, highest since March 2020. Expectations dropped from 37.5 to 35.8.

- US Investor Confidence rose from 10.7 to 18.0, highest since February 2020. Current situation rose from -11.3 to -2.8, highest since March 2020. Expectations rose from 35.3 to 41.0, all-time high.

- Japan Investor confidence rose from 13.6 to 16.1, highest since October 2018. Current situation rose from -5.0 to -1.8, highest since February 2020. Expectations rose from 34.0 to 35.5, highest since April 2004.

Sentix said, “the EU order debacle and the resulting slower pace of vaccination are weighing on the mind and exposing the bureaucratic deficits in Euroland. As a result, the EU economy is losing touch with the other regions of the world, which are continuing their recovery course in the month of February.”

It also warned, “a permanent prolongation of the lockdown could become a problem because the difference between expectation and the current situation (the so-called expectation gap) is extremely high! There is a potential for a temporary disillusionment here. Fatal would be in any case a repeated demolition of the expectation component. The consequence would be a renewed recession.”

Also released, Germany industrial production was flat mom in December, below expectation of 0.3% mom. Swiss unemployment rose to 3.5% in January, above expectation of 3.4%.

Nikkei resumes up trend to 30-yr high, 30k handle next

Nikkei rose 2.21%, or 609.31 pts, to close at 29388.50 today, highest level in 30 years. The up trend from 16358.19 has just resumed. The index was contained well above rising 55 day EMA in the prior pull back, suggesting that some upside acceleration could be seen. Focus will be on whether daily MACD could break through the trend line resistance in next move, as well as the reaction to medium term channel resistance.

But in any case, outlook will stay bullish for now as long as 27619.80 support holds. 30k psychological level is the next target. But real obstacle is 100% projection of 6994.89 to 24129.34 from 16358.19.

Gold recovers after hitting 1784, but outlook stays bearish for another fall

Gold’s fall from 1959.16 resumed by break through 1810.07 support and hit as low as 1784.67. But a temporary bottom was formed there and gold recovered. Some sideway trading could be seen but upside should be limited well below 1875.59 resistance to bring fall resumption. Below 1784.67 will target 1764.31 next.

Overall, the corrective fall from 2075.18 is still in progress and could extend to 38.2% retracement of 1160.17 to 2075.18 at 1725.64 before completion.

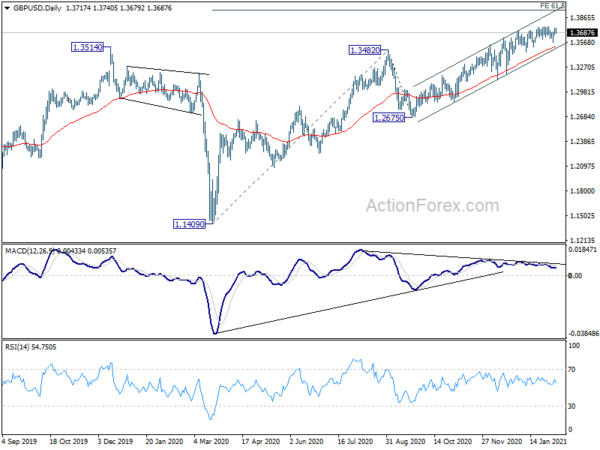

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3685; (P) 1.3713; (R1) 1.3764; More….

GBP/USD fails to break through 1.3758 resistance and retreats. Intraday bias stays neutral and some more consolidations could be seen. Further rally is expected with 1.3564 support intact. On the upside, break of 1.3758 will extend the up trend from 1.1409 to 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956 next. On the downside, break of 1.3564 support will turn bias to the downside for deeper correction instead.

In the bigger picture, rise from 1.1409 medium term bottom is in progress. Further rally would be seen to 1.4376 resistance and above. On the downside, break of 1.2675 support is needed to indicate completion of the rise. Otherwise, outlook will stay cautiously bullish even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Jan | 6.10% | 6.10% | 6.20% | |

| 23:50 | JPY | Current Account (JPY) Dec | 2.28T | 2.21T | 2.34T | |

| 5:00 | JPY | Eco Watchers Survey: Current Jan | 31.2 | 30.5 | 35.5 | |

| 6:45 | CHF | Unemployment Rate Jan | 3.50% | 3.40% | 3.40% | |

| 7:00 | EUR | Germany Industrial Production M/M Dec | 0.00% | 0.30% | 0.90% | |

| 9:30 | EUR | Eurozone Sentix Investor Confidence Feb | -0.2 | 4.1 | 1.3 |