Risk-on sentiments continue in Asian session today with Nikkei hitting 30-year higher, while oil prices are also back at pre-pandemic level. Yen and Swiss Franc are currently the weakest one, together with Euro. On the other hand, commodity currencies are leading the way up naturally. Dollar and Sterling are mixed in between.

Technically, EUR/USD is pressing 1.2052 support turned resistance for now. Firm break there will confirm near term bottoming and bring stronger rebound. But rejection by the resistance could prompt another round of selloff in Euro. On the other hand, GBP/USD is on track to take on 1.3758 resistance and break will resume larger up trend, and could indicate some more Dollar weakness ahead. The interplay is something to note for the early part of the week.

In Asia, Nikkei is currently up 1.99%. Hong Kong HSI is up 0.44%. China Shanghai SSE is up 0.98%. Singapore Strait Times is up 0.86%. Japan 10-year JGB yield is up 0.007 at 0.067.

US Yellen: A long way to dig out the deep hole in job market

US Treasury Secretary Janet Yellen told said over the weekend the job market is “stalling”. “We’re in a deep hole with respect to the job market and a long way to dig out,” she added. It could take until 2025 for the US market to recovery without adequate support. But the administration’s USD 1.9T stimulus ” will generate will create demand for workers.”

“As Treasury secretary, I have to worry about all of the risks to the economy,” Yellen added. “And the most important risk is that we leave workers and communities scarred by the pandemic and the economic toll that it’s taken, that we don’t do enough to address the pandemic and the public health issues, that we don’t get our kids back to school.”

Fitch affirmed Japan’s rating at A with negative outlook

Fitch affirmed Japan’s sovereign credit rating at “A”, with a “negative outlook”. The rating agency said that “balance the strengths of an advanced and wealthy economy, with correspondingly robust governance standards and public institutions, against weak medium-term growth prospects and very high public debt.”

On the one hand, “strong external finances are underpinned by a persistent current account surplus, a large net external creditor position, and the yen’s reserve currency status.” But the negative outlook was retained, “given continued downside risks to the macroeconomic and fiscal outlook from the coronavirus shock.”

Also, Fitch expected BoJ to maintain the currency monetary policy stance over the coming year. “The BOJ’s policies entail longer-term risks to the central bank’s balance sheet, particularly the purchase of ETFs and fluctuations in underlying equity prices,” it added.

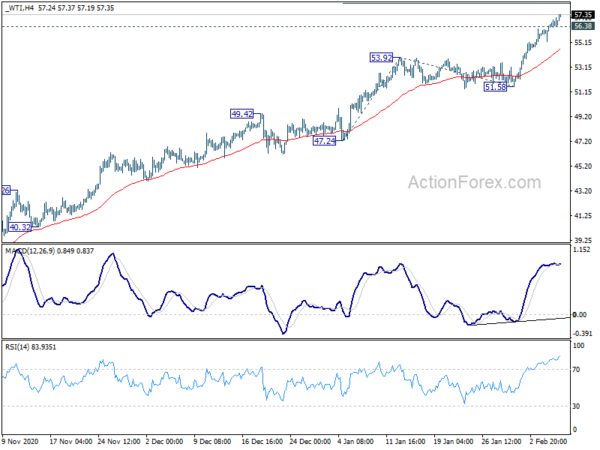

WTI continues up trend on supply cut and recovery hope, on track to 58.26

WTI crude oil’s up trend continues and hits as high as 57.37 so far. Oil is now back at pre-pandemic level, partly supported by Saudi Arabia’s move on extra supply cuts in February and March. Traders are also betting on a strong recovery ahead with mass vaccine rolls out.

WTI is on track to 100% projection of 47.24 to 53.92 from 51.58 at 58.26. Reaction to this projection level will indicate the underlying momentum for further upside acceleration. Sustained break would likely bring even quicker rally to 161.8% projection at 62.38.

Break of 56.38 minor support will bring some consolidations. But wouldn’t be any change in the up trend as long as 53.92 resistance turned support holds.

CAD/JPY probably in upside acceleration, targeting 85 projection level

CAD/JPY continued it’s uptrend, on the back on strong oil price and risk-on sentiments. 81.91 key medium term resistance is finally considered firmly taken out, while rise from 72.80 resumed. The solid support from rising 55 day EMA is clearly bullish. At the same time, daily MACD also suggests that the cross is building up side momentum for some acceleration.

Next short to medium term target is 100% projection of 74.76 to 91.91 from 77.91 at 85.06. Also, note that the down trend from 91.62 (2017 high) should have completed at 73.80. Sustained break of 84.74 structural resistance could open up long term rise towards 91.62.

A relatively light week ahead

The upcoming week is relatively light in terms of economic events. Some focuses will be on Eurozone investor confidence, Australia NAB business confidence and consumer confidence; US U of Michigan consumer sentiment too. There would also be inflation data from the US, Japan, Swiss and China. Finally, UK GDP would be the the high point of the week on Friday. Here are some highlights:

- Monday: Japan current account; Swiss unemployment rate; German industrial production; Eurozone Sentix investor confidence.

- Tuesday: Japan labor cash earnings, M2 money supply; Australia NAB business confidence; New Zealand inflation expectations; Germany trade balance; UK BRC retail sales monitor.

- Wednesday: Japan PPI; Australia Westpac consumer sentiment; China CPI, PPI; Germany CPI final; France industrial production; US CPI.

- Thursday: Australia MI inflation expectations; US jobless claims.

- Friday: New Zealand BusinessNZ manufacturing index; UK GDP, production, trade balance; Swiss CPI; Canada wholesale sales; U of Michigan consumer sentiment.

AUD/USD Daily Report

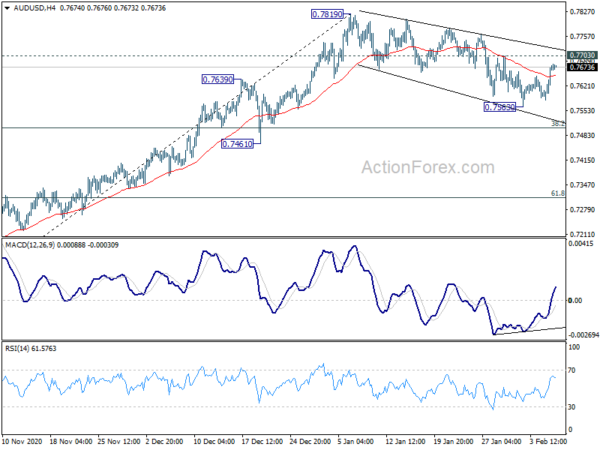

Daily Pivots: (S1) 0.7614; (P) 0.7647; (R1) 0.7710; More…

Intraday bias in AUD/USD remains neutral a this point. On the upside, break of 0.7703 minor resistance will argue that the correction from 0.7819 has completed. Intraday bias will be turned back to the upside for retesting 0.7819 high. In case of another fall, downside should be contained by 38.2% retracement of 0.6991 to 0.7819 at 0.7503 to bring rebound.

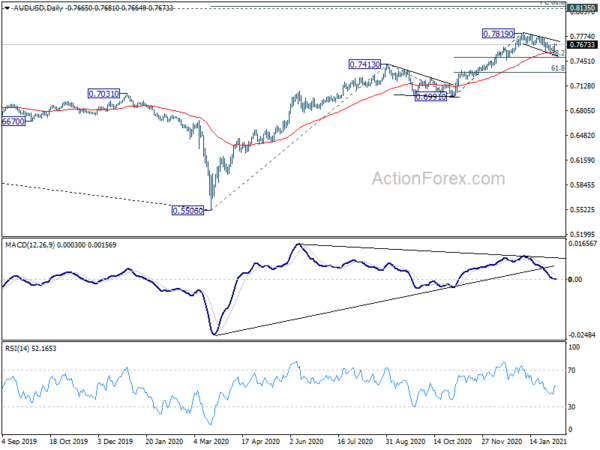

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Jan | 6.10% | 6.10% | 6.20% | |

| 23:50 | JPY | Current Account (JPY) Dec | 2.28T | 2.21T | 2.34T | |

| 5:00 | JPY | Eco Watchers Survey: Current Jan | 31.2 | 30.5 | 35.5 | |

| 6:45 | CHF | Unemployment Rate Jan | 3.40% | 3.40% | ||

| 7:00 | EUR | Germany Industrial Production M/M Dec | 0.30% | 0.90% | ||

| 9:30 | EUR | Eurozone Sentix Investor Confidence Feb | 4.1 | 1.3 |