Swiss Franc’s selloff is a major focus in the forex markets today, in particular, as it breaks through a key support level against Sterling. The development somewhat drags down the Euro too. The Pound and Dollar are currently the stronger ones while commodity currencies are mixed. Stock markets are stabilizing with rebounds from Asia to US futures. Gold and WTI oil continue sideway trading. But Silver steals the show with strong upside acceleration.

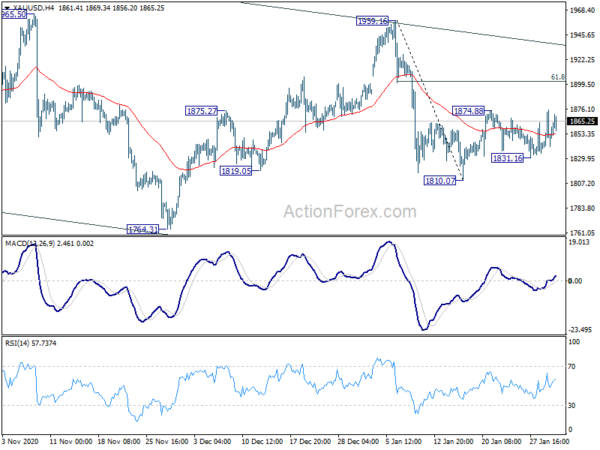

Technically, USD/CHF’s break of 0.8925 resistance is a bullish signal and focus will turn to EUR/USD. Break there will solidify some near term bearishness and extend the correction from 1.2348. EUR/GBP might be giving a hand in pressing the Euro down. But it needs to breaks through 0.8799 projection support to build up downside momentum. At the same, we’ll see if Gold could finally break through 1874.88 resistance to extend the corrective recovery from 1810.07.

In Europe, currently, FTSE is up 1.21%. DAX is up 1.47%. CAC is up 1.40%. Germany 10-year yield is up 0.0055 at -0.509. Earlier in Asia, Nikkei rose 1.55%. Hong Kong HSI rose 2.15%. China Shanghai SSE rose 0.64%. Singapore Strait Times dropped -0.21%. Japan 10-year JGB yield rose 0.0036 to 0.061.

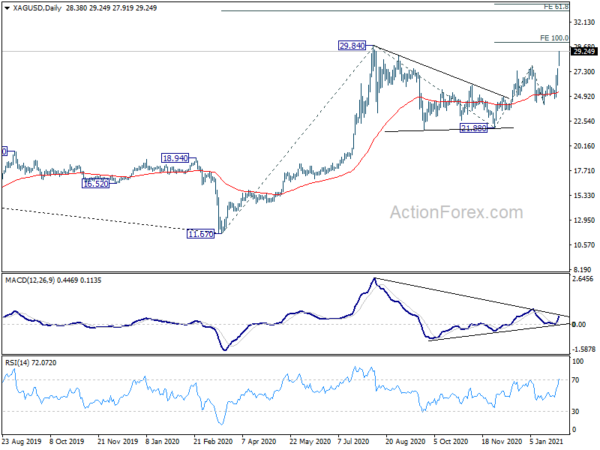

Silver accelerating towards 30 after gap up, next is 33.1

Silver’s rally accelerates after gapping up today and hits as high as 29.22 so far. The strong break of 27.91 resistance confirms resumption of near term rise from 21.88. Next target is 100% projection of 21.88 to 27.91 from 24.12 at 30.15, which is close to 29.84 high.

We’re indeed looking at resumption of whole medium term up trend from 11.67, as consolidation pattern from 29.84 has apparently completed at 21.88. Decisive break of 29.84/30.15 will confirm this bullish case. Stronger upside acceleration should then be seen to 61.8% projection of 11.67 to 29.84 from 21.88 at 33.10.

Eurozone unemployment rate unchanged at 8.3% in Dec, EU unemployment at 7.5%

Eurozone unemployment rate was unchanged at 8.3% in December, matched expectations. EU unemployment rate was also unchanged at 7.5% Eurostat estimated that 16 million men and women in the EU, of whom 1367 million in the Eurozone, were unemployed in December 2020. Compared with November, the number of persons unemployed increased by 67000 in the EU and by 55000 in the Eurozone.

Eurozone PMI manufacturing finalized at 54.8, solid expansion continued

Eurozone PMI Manufacturing was finalized at 54.8 in January, down from December’s 55.2. Markit said the marked gains in new orders and output sustained. But delivery delays intensified, leading to rapid rise in purchase prices. Looking at some member states, the Netherlands hit 28-month high at 58.8. Germany retreated to 4-month low at 47.1. Italy hit 34-month high at 55.1. Australia hit 26-month high at 54.2. France recovered to 6-month-high at 51.6. But Spain contracted at 49.3, 7-month low.

Chris Williamson, Chief Business Economist at IHS Markit said: “Eurozone manufacturing output continued to expand at a solid pace at the start of 2021, though growth has weakened to the lowest since the recovery began as new lockdown measures and supply shortages pose further challenges to producers across the region… While future prospects brightened, with manufacturers’ optimism striking a three-year high in January to sound a reassuring note of confidence at the start of the year, any potential delays to the vaccine roll-outs will add an additional layer of uncertainty to the outlook.”

From Germany, retail sales dropped -9.6% mom in December, versus expectation of -2.3% mom. Swiss retail sales rose 4.7% yoy in December versus expectation of 1.5% yoy. Swiss SVME PMI rose to 59.4 in January, versus expectation of 56.5.

UK PMI manufacturing finalized at 54.1, near-record supply-chain disruptions

UK PMI Manufacturing was finalized at 54.1 in January, down from December’s 3 year-high of 57.5. Markit said supply chains were stretched by Brexit and COVID restrictions. Input cost and selling price inflation both accelerated.

Rob Dobson, Director at IHS Markit: “A mixture of harsher COVID-19 restrictions and Brexit led to near-record supply-chain disruptions, lower exports and increased costs… The hope is that the current constraints will start to ease once COVID-19 restrictions are lifted, vaccines are rolled out and ports, suppliers and manufacturers adapt to the new trading environment post-Brexit. If so, supply, demand and production bottlenecks should slowly work through the system and growth will not be knocked too far off course through 2021. However, there is no swift end in sight to these headwinds, and the longer the current circumstances remain the greater the potential damage to the sector and its suppliers.”

Also from UK, mortgage approvals dropped to 103k in December versus expectation of 100k. M4 money supply rose 0.7% mom in December, versus expectation of 1.0% mom.

China Caixin PMI manufacturing dropped to 51.5, dragged by subdued overseas demand

China Caixin PMI Manufacturing dropped to 51.5 in January, down from 53.0, missed expectation of 52.7. That’s also the lowest reading in seven months. Markit said that production and new orders both expanded at notably slower rates at the start of the year. There was fresh decline in new export business. Input costs and output prices both rose sharply.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the manufacturing sector continued to recover in January, but the momentum of both supply and demand weakened, dragged by subdued overseas demand. The gauge for future output expectations was the lowest since May last year though it remained in positive territory, showing manufacturing entrepreneurs were still worried about the sustainability of the economic recovery. In addition, the weakening job market and the sharp increase in inflationary pressure should not be ignored.”

Released over the weekend, the official PMI manufacturing dropped to 51.3 in January, down from 51.9, below expectation of 51.5. PMP non-manufacturing dropped sharply to 52.4, down from 55.7, missed expectation of 55.1.

Japan PMI manufacturing finalized at 49.8, but short-term prospects turning a corner

Japan PMI Manufacturing was finalized at 49.8 in January, slightly down from December’s 50.0.

Usamah Bhatti, Economist at IHS Markit, said: “The Japanese manufacturing sector slipped back into contraction territory at the start of the year… as a rise in COVID-19 infections and issuance of a state of emergency dampened operating conditions… Manufacturers indicated a renewed fall in output levels… firms were further discouraged to replace voluntary leavers in the sector as staffing levels reduced.

“Nonetheless, the short-term prospects for the Japanese manufacturing sector appear to be turning a corner, with firms reporting a stable level of new orders. Businesses were also optimistic that the pandemic would subside over the coming year, triggering a wider economic recovery in Japan which would boost output levels. IHS Markit estimates industrial production will grow 7.1% in 2021, although this is from a lower base and does not fully recover the output lost in 2020.”

Australia AiG manufacturing rose to 55.3, 5 of 6 sectors reported positive conditions

Australia AiG Performance of Manufacturing rose to 55.3, up from 52.1, indicating a stronger improvement in conditions over the summer holiday period. Five of the six manufacturing sectors reported positive trading conditions (results over 50 in trend terms), with the strongest results reported from manufacturers in machinery & equipment and chemicals, pharmaceuticals, cleaning, rubber, petroleum & related products.

Also released, TD securities inflation gauge rose 0.2% mom in January.

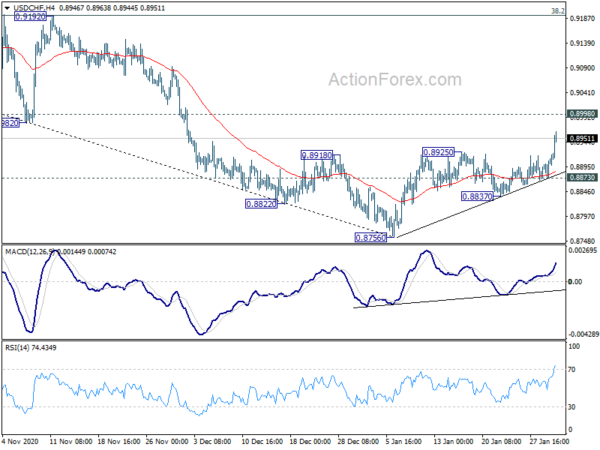

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8886; (P) 0.8899; (R1) 0.8923; More….

USD/CHF’s rebound from 0.8756 resumes by taking out 0.8925 resistance and hits as high as 0.8963 so far. Intraday bias is back on the upside for 0.8998 support turned resistance next. Decisive break there will argue that fall from 0.9901 has completed. Stronger rally would be seen to 38.2% retracement of 0.9901 to 0.8756 at 0.9193. On the downside, break of 0.8873 minor support will turn bias back to the downside for retesting 0.8756 low instead.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). There is no clear sign of completion yet. Next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. In any case, break of 0.9295 resistance is needed to signal medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Manufacturing Jan | 55.3 | 52.1 | ||

| 0:00 | AUD | TD Securities Inflation M/M Jan | 0.20% | 0.50% | ||

| 0:30 | JPY | Manufacturing PMI Jan F | 49.8 | 49.8 | 49.7 | |

| 1:45 | CNY | Caixin Manufacturing PMI Jan | 51.5 | 52.7 | 53 | |

| 7:00 | EUR | Germany Retail Sales M/M Dec | -9.60% | -2.30% | 1.90% | |

| 7:30 | CHF | Real Retail Sales Y/Y Dec | 4.70% | 1.50% | 1.70% | |

| 8:30 | CHF | SVME PMI Jan | 59.4 | 56.5 | 58 | |

| 8:45 | EUR | Italy Manufacturing PMI Jan | 55.1 | 52.4 | 52.8 | |

| 8:50 | EUR | France Manufacturing PMI Jan F | 51.6 | 51.5 | 51.5 | |

| 8:55 | EUR | Germany Manufacturing PMI Jan F | 57.1 | 57 | 57 | |

| 9:00 | EUR | Italy Unemployment Dec | 9.00% | 9.00% | 8.90% | 8.80% |

| 9:00 | EUR | Eurozone Manufacturing PMI Jan F | 54.8 | 54.7 | 54.7 | |

| 9:30 | GBP | Mortgage Approvals Dec | 103K | 100K | 105K | |

| 9:30 | GBP | Manufacturing PMI Jan F | 54.1 | 52.9 | 52.9 | |

| 9:30 | GBP | M4 Money Supply M/M Dec | 0.70% | 1.00% | 0.80% | |

| 10:00 | EUR | Eurozone Unemployment Rate Dec | 8.30% | 8.30% | 8.30% | |

| 14:30 | CAD | Manufacturing PMI Jan | 57.9 | |||

| 14:45 | USD | Manufacturing PMI Jan F | 59.1 | 59.1 | ||

| 15:00 | USD | ISM Manufacturing PMI Jan | 59.5 | 60.7 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Jan | 72 | 77.6 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Jan | 51.5 | |||

| 15:00 | USD | ISM Manufacturing New Orders Index Jan | 67.9 | |||

| 15:00 | USD | Construction Spending M/M Dec | 0.70% | 0.90% |