Asian markets open the week generally higher today, shrugging off the steep selloff in the US on Friday. Australian and New Zealand Dollar firm up mildly. But Sterling is so far the better one, as markets await BoE’s affirmation on not using negative rates. Dollar, and Euro turn softer together with Swiss Franc. Gold trades mildly higher but struggles to breakout from near term range. WTI oil is also staying in sideway trading.

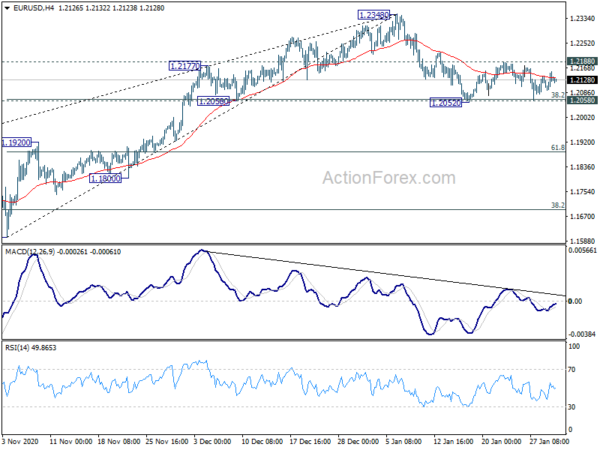

Technically, we’d continue to pay attention to EUR/USD, which is bounded in range of 1.2052/2188. Breakout from there could give a strong indication on whether Dollar is heading to next. Yen’s recovery is too weak to warrant bottoming. EUR/JPY could also have a take on 127.48 resistance, and break there would resume larger rally from 114.42.

In Asia, currently, Nikkei is up 1.29%. Hong Kong HSI is up 1.91%. China Shanghai SSE is up 0.10%. Singapore Strait Times is down -0.05%. Japan 10-year JGB yield is up 0.0030 at 0.059, pretty firm.

China Caixin PMI manufacturing dropped to 51.5, dragged by subdued overseas demand

China Caixin PMI Manufacturing dropped to 51.5 in January, down from 53.0, missed expectation of 52.7. That’s also the lowest reading in seven months. Markit said that production and new orders both expanded at notably slower rates at the start of the year. There was fresh decline in new export business. Input costs and output prices both rose sharply.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the manufacturing sector continued to recover in January, but the momentum of both supply and demand weakened, dragged by subdued overseas demand. The gauge for future output expectations was the lowest since May last year though it remained in positive territory, showing manufacturing entrepreneurs were still worried about the sustainability of the economic recovery. In addition, the weakening job market and the sharp increase in inflationary pressure should not be ignored.”

Released over the weekend, the official PMI manufacturing dropped to 51.3 in January, down from 51.9, below expectation of 51.5. PMP non-manufacturing dropped sharply to 52.4, down from 55.7, missed expectation of 55.1.

Japan PMI manufacturing finalized at 49.8, but short-term prospects turning a corner

Japan PMI Manufacturing was finalized at 49.8 in January, slightly down from December’s 50.0.

Usamah Bhatti, Economist at IHS Markit, said: “The Japanese manufacturing sector slipped back into contraction territory at the start of the year… as a rise in COVID-19 infections and issuance of a state of emergency dampened operating conditions… Manufacturers indicated a renewed fall in output levels… firms were further discouraged to replace voluntary leavers in the sector as staffing levels reduced.

“Nonetheless, the short-term prospects for the Japanese manufacturing sector appear to be turning a corner, with firms reporting a stable level of new orders. Businesses were also optimistic that the pandemic would subside over the coming year, triggering a wider economic recovery in Japan which would boost output levels. IHS Markit estimates industrial production will grow 7.1% in 2021, although this is from a lower base and does not fully recover the output lost in 2020.”

Australia AiG manufacturing rose to 55.3, 5 of 6 sectors reported positive conditions

Australia AiG Performance of Manufacturing rose to 55.3, up from 52.1, indicating a stronger improvement in conditions over the summer holiday period. Five of the six manufacturing sectors reported positive trading conditions (results over 50 in trend terms), with the strongest results reported from manufacturers in machinery & equipment and chemicals, pharmaceuticals, cleaning, rubber, petroleum & related products.

Also released, TD securities inflation gauge rose 0.2% mom in January.

RBA and BoE to lead an extremely busy week

Two central banks will meet this week. RBA would likely paint a more upbeat economic forecasts, with upgrades on growth and employment projections. The central bank clearly indicated that interest will remain at 0.1% for the next three years, and there shouldn’t be any change. A question is whether RBA would pre-announce an extension to the quantitative easing program, or hold it until April.

BoE is widely expected to keep interest rate at 0.10% and asset purchase target at GBP 895B. New economic projections will be released in the “Super Thursday” event. Recent comments from Governor Andrew Bailey suggested that it’s likely to cut interest rate further into negative territory. With Brexit risks cleared, and the arrival of vaccines, the need for negative rates is also drastically reduced. Markets would be eager to get some affirmation on this view from BoE.

The first week of February is also extremely busy in terms of economic data releases. There are something that could move the markets every day. Here are some highlights for the week:

- Monday: Australia AiG manufacturing, MI inflation gauge; Japan PMI manufacturing final; China Caixin PMI manufacturing; Germany retail sales; Swiss retail sales, PMI manufacturing; Eurozone PMI manufacturing final, unemployment rate; UK PMI manufacturing final, mortgage approvals, M4 money supply; Canada PMI manufacturing; US ISM manufacturing, construction spending.

- Tuesday; RBA rate decision; Japan monetary base; Eurozone GDP.

- Wednesday: New Zealand employment; Australia AiG construction, building approvals; China Caixin PMI services; Eurozone PMI services final; CPI flash, PPI; UK PMI services final; US ADP employment, ISM services.

- Thursday: New Zealand building permits, ANZ business confidence; Australia NAB business confidence, trade balance; Swiss SECO consumer climate; ECB bulletin, Eurozone retail sales’; UK PMI construction, BoE rate decision, US jobless claims, non-farm productivity, factory orders.

- Friday; Australia AiG services, retail sales, RBA monetary policy statement; Japan leading indicators; Germany factory orders, France trade balance; Swiss foreign currency reserves; Canada employment, trade balance, Ivey PMI; US non-farm payrolls, trade balance.

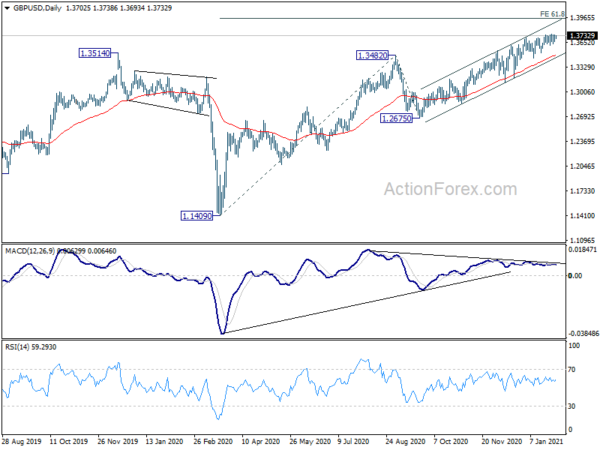

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3653; (P) 1.3702; (R1) 1.3748; More….

Intraday bias in GBP/USD remains neutral for the moment and some more consolidations could be seen. Further rise is expected with 1.3608 support intact. On the upside, break of 1.3758 will extend the whole up trend from 1.1409 to 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956 next. On the downside, however, break of 1.3608 support will now suggest short term topping, on bearish divergence condition in 4 hour MACD. Intraday bias will be turned back to the downside for deeper pull back.

In the bigger picture, rise from 1.1409 medium term bottom is in progress. Further rally would be seen to 1.4376 resistance and above. On the downside, break of 1.2675 support is needed to indicate completion of the rise. Otherwise, outlook will stay cautiously bullish even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Manufacturing Jan | 55.3 | 52.1 | ||

| 0:00 | AUD | TD Securities Inflation M/M Jan | 0.20% | 0.50% | ||

| 0:30 | JPY | Manufacturing PMI Jan F | 49.8 | 49.8 | 49.7 | |

| 1:45 | CNY | Caixin Manufacturing PMI Jan | 51.5 | 52.7 | 53 | |

| 7:00 | EUR | Germany Retail Sales M/M Dec | -2.30% | 1.90% | ||

| 7:30 | CHF | Real Retail Sales Y/Y Dec | 1.50% | 1.70% | ||

| 8:30 | CHF | SVME PMI Jan | 56.5 | 58 | ||

| 8:45 | EUR | Italy Manufacturing PMI Jan | 52.4 | 52.8 | ||

| 8:50 | EUR | France Manufacturing PMI Jan F | 51.5 | 51.5 | ||

| 8:55 | EUR | Germany Manufacturing PMI Jan F | 57 | 57 | ||

| 9:00 | EUR | Italy Unemployment Dec | 9.00% | 8.90% | ||

| 9:00 | EUR | Eurozone Manufacturing PMI Jan F | 54.7 | 54.7 | ||

| 9:30 | GBP | Mortgage Approvals Dec | 100K | 105K | ||

| 9:30 | GBP | Manufacturing PMI Jan F | 52.9 | 52.9 | ||

| 9:30 | GBP | M4 Money Supply M/M Dec | 1.00% | 0.80% | ||

| 10:00 | EUR | Eurozone Unemployment Rate Dec | 8.30% | 8.30% | ||

| 14:30 | CAD | Manufacturing PMI Jan | 57.9 | |||

| 14:45 | USD | Manufacturing PMI Jan F | 59.1 | 59.1 | ||

| 15:00 | USD | ISM Manufacturing PMI Jan | 59.5 | 60.7 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Jan | 72 | 77.6 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Jan | 51.5 | |||

| 15:00 | USD | ISM Manufacturing New Orders Index Jan | 67.9 | |||

| 15:00 | USD | Construction Spending M/M Dec | 0.70% | 0.90% |