The sharp turn in risk sentiments overnight pushed “safe-haven” currencies generally higher. Among them, Dollar is currently outperforming both Swiss Franc and Yen. On the other hand, Australian Dollar is leading other commodity currencies lower. Euro and Sterling are mixed, with the Pound having a slight upper hand.

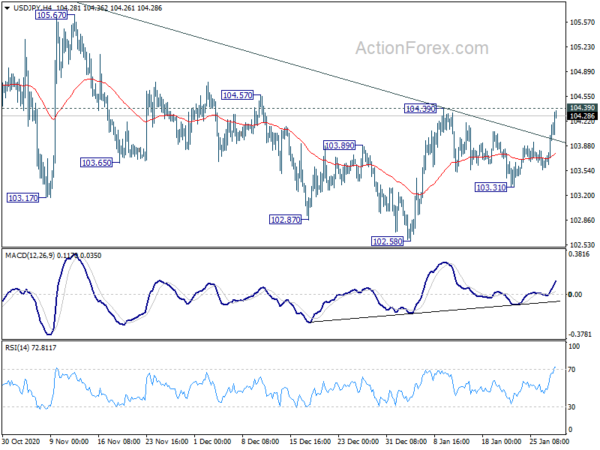

Technically, the movements are mainly centered around commodity currency pairs. AUD/USD’s break of 0.7641 suggests that larger downward correction is underway. Similarly, USD/CAD’s break of 1.2798 resistance also confirmed short term bottoming. Though, EUR/USD will need to break through 1.2052 support decisively to confirm Dollar’s underlying strength. Or at least, USD/JPY needs to break through 104.59 resistance firmly too.

In Asia, currently, Nikkei is down -1.58%. Hong Kong HSI is down -1.91%. China Shanghai SSE is down -1.51%. Singapore Strait Times is down -1.12%. Japan 10-year JGB yield is down -0.003 at 0.040. Overnight, DOW dropped -2.05%. S&P 500 dropped -2.57%. NASDAQ dropped -2.61%. 10-year yield dropped -0.026 to 1.014.

FOMC provided reality check, DOW and TNX tumbled but no change in up trend yet

US stocks markets suffered the steepest decline since October after Fed give investors a reality check on the state of the economy. FOMC kept monetary policy unchanged, and reiterated: “The path of the economy will depend significantly on the course of the virus, including progress on vaccinations. The ongoing public health crisis continues to weigh on economic activity, employment, and inflation, and poses considerable risks to the economic outlook.”

Chair Jerome Powell admitted, “the risks are in the near term, frankly”. The economy was still a long way from a full recovery while “the whole focus on (stimulus) exit is premature.” Though, “several developments point to an improved outlook for later this year”, with vaccine rollouts.

More on Fed:

- Fed Indicated that QE Tapering is Premature and Bar to Adjust Policy is High

- Thoughts on the January 27 FOMC Meeting

- FOMC Recap: Dollar Rallies, Stocks Unenthused As Powell Holds The Line

DOW dropped -633.87 pts, or -2.05%, to close at 30303.17 overnight. While the pull back was deep, DOW is still staying above 55 day EMA (now as 30098.59) for now. More importantly, 29881.82 near term support remains intact, keeping outlook bullish. DOW could indeed rebound from the current level and stage another rally to extend the up trend from 18213.65.

10-year yield also extended near term correction, closed down -0.026 at 1.014. While deeper fall cannot be ruled out, TNX is also close to a key support. 55 day EMA (now at 0.9629), which is close to channel support, should provide the floor.

Dollar index in head and shoulder bottom, but still capped by 91.01 resistance

While Dollar rose broadly overnight, Dollar Index was still kept below 91.01 resistance, as well ass 55 day EMA (now at 90.93). Similarly, EUR/USD is holding above 1.2058 support while USD/JPY is still kept below 104.59 resistance.

The condition of near term reversal is building further up, considering the head and shoulder bottom pattern. Still firm break of 91.01 is needed to confirm the start of a near term rally (be it a corrective rise or the start of an up trend). In that case, DXY would tentatively be looking at 94.74 resistance as a target to test. Rejection by 91.01 will bring another fall through 89.20 before bottoming.

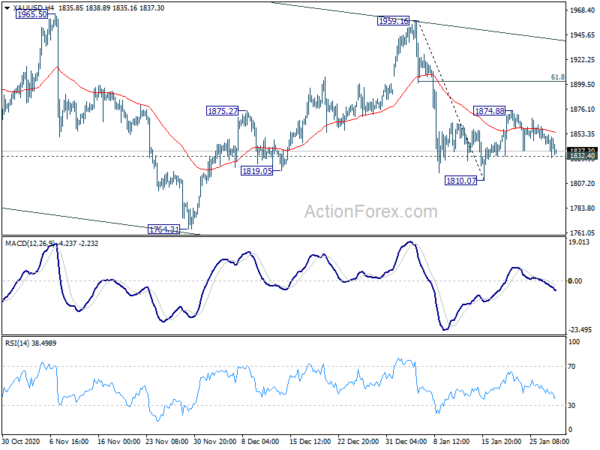

Gold down mildly but holding on to 1832 support

Gold weakened mildly following Dollar’s strength but still stays above 1832.40 support. Outlook is unchanged that price actions from 1810.07 is seen as a corrective move, even though another rise cannot be ruled out. Firm break of 1832.40 will bring retest of 1810.07. Break will resume whole fall from 1959.10.

The decline from 1959.16 is seen as the third leg of the corrective pattern from 2075.18. Deeper fall is expected through 1764.31 before completing the pattern.

New Zealand exports dropped -2.7% yoy in Dec, imports rose 4.2% yoy

New Zealand goods exports dropped -2.7% yoy or NZD 149m to NZD 5.3B in December. Imports rose 4.2% yoy or NZD 213m to NZD 5.3B. Monthly trade surplus came in at NZD 17m, well below expectation of NZD 800m.

Exports to China was down NZD -97m, up to USA, EU, Australia and Japan. Imports from China was up NZD 273m, from AU was up NZD 81m, but down from EU, USA and Japan.

From Australia, import price index dropped -1.0% qoq in Q4, versus expectation of -0.9% qoq. From Japan, retail sales dropped -0.3% yoy in December, versus expectation of -0.4% yoy.

Looking ahead

Swiss trade balance, Germany CPI and Eurozone confidence indicators are featured in European session. Later in the day, US will release GDP, jobless claims, trade balance, and new home sales. Canada will release building permits.

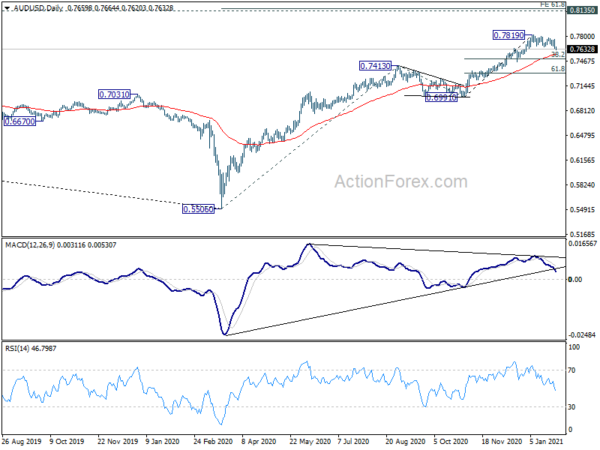

AUD/USD Daily Report

Daily Pivots: (S1) 0.7617; (P) 0.7690; (R1) 0.7737; More…

AUD/USD’s break of 0.7641 resistance turned support now suggests that deeper correction is underway. Intraday bias is back on the downside for 38.2% retracement of 0.6991 to 0.7819 at 0.7503. Overall, the up trend from 0.5506 would remain intact as long as 0.7413 resistance turned support holds. Another rise is still in favor at a later stage to 61.8% projection of 0.5506 to 0.7413 from 0.6991 at 0.8170.

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Dec | 17M | 800M | 252M | 290M |

| 23:50 | JPY | Retail Trade Y/Y Dec | -0.30% | -0.40% | 0.60% | |

| 0:30 | AUD | Import Price Index Q/Q Q4 | -1.00% | -0.90% | -3.50% | |

| 7:00 | CHF | Trade Balance (CHF) Dec | 4.23B | 4.46B | ||

| 10:00 | EUR | Eurozone Economic Sentiment Indicator Jan | 88.7 | 90.4 | ||

| 10:00 | EUR | Eurozone Services Sentiment Jan | -17.7 | -17.4 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Jan | -7.2 | -7.2 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Jan F | -15.5 | -15.5 | ||

| 10:00 | EUR | Eurozone Business Climate Jan | -0.41 | |||

| 13:00 | EUR | Germany CPI M/M Jan P | 0.50% | 0.50% | ||

| 13:00 | EUR | Germany CPI Y/Y Jan P | 0.70% | -0.30% | ||

| 13:30 | CAD | Building Permits M/M Dec | 12.90% | |||

| 13:30 | USD | Initial Jobless Claims (Jan 22) | 875K | 900K | ||

| 13:30 | USD | GDP Annualized Q4 P | 4.20% | 33.40% | ||

| 13:30 | USD | GDP Price Index Q4 P | 2.30% | 3.70% | ||

| 13:30 | USD | Wholesale Inventories Dec P | 0.00% | |||

| 13:30 | USD | Goods Trade Balance (USD) Dec P | -83.4B | -84.8B | ||

| 15:00 | USD | New Home Sales Dec | 860K | 841K | ||

| 15:30 | USD | Natural Gas Storage | -187B |