Dollar, Yen and Swiss Franc strength again today, as dragged down by the decline in European stocks. DOW future is also losing -300pts at the time of writing. Sentiments are slightly weighed down by UK’s plan to impose tougher border measures. Germany slashed this year’s growth forecasts. Commodity currencies turned softer, following overall risk sentiments. Focus will now turn to FOMC statement and press conference.

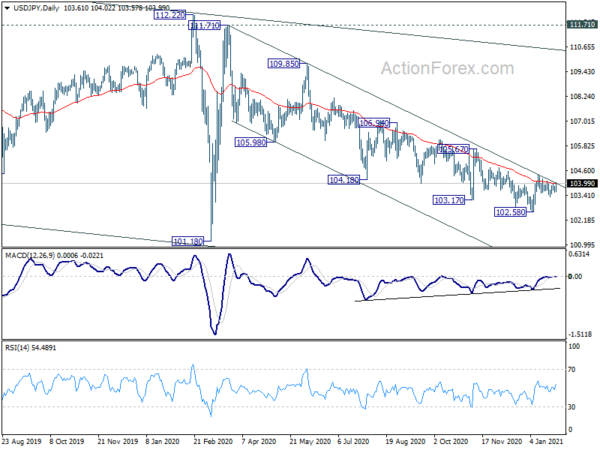

Technically, it should be noted that EUR/USD, USD/CHF, AUD/USD and USD/CAD are all staying in familiar range. GBP/USD once against lost momentum after initial rally attempt. But EUR/GBP continues to press 0.8828 temporary low, without giving up. The interesting one now is USD/JPY. While it’s still in range of 103.31/104.39, it’s pressing a near term channel resistance. Taking out of the channel with conviction will carry bullish implications.

In Europe, currently, FTSE is down -1.43%. DAX is down -2.06%. CAC is down -1.72%. German 10-year yield is down -0.0150 at -0.544. Earlier in Asia, Nikkei rose 0.31%. Hong Kong HSI dropped -0.32%. China Shanghai SSE rose 0.11%. Singapore Strait Times rose 0.45%. Japan 10-year JGB yield rose 0.0088 to 0.043.

US durable goods orders rose 0.2% mom in Dec, ex-transport orders rose 0.7% mom

US durable goods orders rose 0.2% mom to USD 245.3B in December, well below expectation of 1.0% mom rise. Ex-transport orders rose 0.7% mom, above expectation of 0.5% mom. Ex-defense orders rose 0.5% mom. Machinery rose 2.4% mom.

Fed is widely expected to keep monetary policy unchanged today. Despite recent resurgence in coronavirus infections and the economic impact, roll-out of more fiscal stimulus and positive vaccination progress would keep policy makers in a wait-and-see mode. Federal funds rate will be held at 0-0.25% while asset purchase will continue at current pace of USD 120B per month. Chair Jerome Powell would likely re-emphasize that Fed is in no position to even start discussing tapering of quantitative easing yet.

Here are some suggested readings:

- FOMC Preview – Cautious about Economic Weakness but Fiscal Stimulus should lend Support

- Fed Meets: A Non-Event or the Start of a Brewing Dilemma?

- FOMC Meeting Preview: USD/JPY In Focus As Powell Holds Fire

- The Economic Outlook: What Could Possibly Go Wrong?

- January Flashlight for the FOMC Blackout Period

ECB Knot: There is still room to cut rates

ECB Governing Council member Klaas Knot said today that “there is still room to cut rates… But of course that would have to be seen in conjunction with our overall monetary stance which is determined by a multiplicity of tools.”

He was “cautiously optimistic” about recovery in 2021. But relatively lower production in the Eurozone would limit inflation. “It has to be seen how that will play out, before we can start talking about normalizing interest rates.”

Knot added that ECB would monitor the strength of Euro closely. “If it were to become too dominant, in terms of threatening to derail our inflation objective, then of course we would have the tools available to counter that.”

Germany slashed 2021 growth forecast to 3% on second lockdown

German government slashed 2021 growth forecast to 3%, sharply down from last autumn’s projection of 4.4%, due to the second round of coronavirus lockdown.

Economy Minister Peter Altmaier emphasized, “we are currently seeing a flattening of the number of infections, which is giving hope… We must therefore not gamble away what has been achieved,.”

He also noted that the recovery picture is “divided”, “while industry currently continues to be robust, the service sector is badly affected.”

Germany Gfk consumer confidence dropped to -15.6, facing challenges in Q1

Germany Gfk consumer confidence for February dropped to -15.6, down from -7.5, well below expectation of -7.8. In January, economic expectations dropped from 4.4 to 1.3. Income expectations dropped from 3.6 to -2.9. Propensity to buy dropped sharply from 36.6 to 0.0.

Rolf Bürkl, consumer expert at GfK: “Consumer sentiment is facing difficult challenges in the first quarter of this year. If it is to recover sustainably, infection rates will need to decrease more than they have to date so that the measures can be relaxed significantly. This means that we will need to wait a while before we see the recovery that many had been hoping for this year.”

BoJ Kuroda: Frequency and size of ET purchases fallen sharply recently

BoJ Governor Haruhiko Kuroda said the central bank’s ETF buying is not distorting the Tokyo stock market. “We are buying ETFs as part of a comprehensive monetary easing framework. We have no plans now to end the framework or our ETF purchases,” he said.

“The frequency of our ETF buying has fallen sharply recently, as well as the size of each purchase,” Kuroda said. “We’re buying flexibly looking at market developments.”

Australia CPI rose 0.9% qoq in Q4, driven by tobacco and childcare

Australia CPI rose 0.9% qoq in Q4, above expectation of 0.7% qoq. Annually, CPI accelerated from 0.7% yoy to 0.9% yoy, above expectation of 0.7% yoy. RBA trimmed mean CPI came in at 0.4% qoq, 1.2% yoy. Weighted mean CPI was at 0.5% qoq, 1.4% yoy.

Head of Prices Statistics at the ABS, Michelle Marquardt said: “The December quarter CPI was primarily impacted by an increase in tobacco excise and the introduction, continuation and conclusion of a number of government schemes, including childcare fee subsidies and home building grants.”

Australia NAB business conditions rose to 14, employment turned positive

Australia NAB Business Conditions rose to 14 in December, up from 7. That’s the fourth consecutive month of improvement, and highest level since late 2018. Looking at some details, Employment improved notably from -4 to 9, first positive reading since the start of the coronavirus pandemic. Trading conditions rose from 15 to 20, but profitability dropped from 13 to 11.

Business Confidence dropped to 4 in December, down from 13, as confidence pulled back in New South Wales, Victoria and Queensland, partly reflecting the outbreak in Sydney through December.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 103.51; (P) 103.67; (R1) 103.78; More..

USD/JPY’s rebound from 103.31 extends higher today but stays below 104.39 resistance. Intraday bias remains neutral first. On the upside, break of 104.39 and sustained trading above the channel resistance will argue that the down trend from 111.71 has finally completed. Stronger rise would be seen to 105.67 resistance for confirmation. On the downside, break of 103.31 will retain near term bearishness and bring retest of 102.58 low.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. On the upside, break of 105.67 resistance is needed to be the first signal of medium term reversal. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Dec | 0.10% | 0.50% | 0.70% | |

| 00:30 | AUD | NAB Business Conditions Dec | 14 | 9 | 7 | |

| 00:30 | AUD | NAB Business Confidence Dec | 4 | 12 | 13 | |

| 00:30 | AUD | CPI Q/Q Q4 | 0.90% | 0.70% | 1.60% | |

| 00:30 | AUD | CPI Y/Y Q4 | 0.90% | 0.70% | 0.70% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Q/Q Q4 | 0.40% | 0.40% | 0.40% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Y/Y Q4 | 1.20% | 1.20% | 1.20% | |

| 07:00 | EUR | Germany Gfk Consumer Confidence Feb | -15.6 | -7.8 | -7.3 | -7.5 |

| 13:30 | USD | Durable Goods Orders Dec | 0.20% | 1.00% | 1.00% | |

| 13:30 | USD | Durable Goods Orders ex Transportation Dec | 0.70% | 0.50% | 0.40% | |

| 15:30 | USD | Crude Oil Inventories | 1.6M | 4.4M | ||

| 19:00 | USD | Fed Interest Rate Decision | 0.25% | 0.25% | ||

| 19:30 | USD | FOMC Press Conference |