The financial markets some what stabilized mildly after the selloff triggered by the terrorist attack in Spain and drama in the White House. At the time of writing, FTSE is trading down -0.1% while DAX is down -0.4%. US futures point to a flat open. In the currency markets, Dollar is trading broadly down today, but for the week, it’s still in black against Euro and Sterling. The Pound will most likely end the week as the weakest. Commodity currencies are holding the ground even though yen surged since yesterday. In particular, Canadian Dollar is helped by positive inflation data. In other markets, Gold finally takes out 1300 handle today as buying gains steam.

White House remains a major focus

The markets continue to watch and be sensitive to the developments in the White House. For now, Gary Cohn, a key force behind Trump’s tax reform program is staying despite the resignation rumor. But there are growing voices of disapproval from US President Donald Trumps’ own party. One of the most respected Senate Republicans Bob Corker criticized that Trump "has not yet been able to demonstrate the stability nor some of the competence that he needs to demonstrate in order to be successful." Corker went further and said hat Trump "has not demonstrated that he understands the character of this nation. He has not demonstrated that he understands what has made this nation great". Corker also called for "radical changes" to take place at the White House".

UK will release Brexit papers next week

In UK, it’s reported Prime Minister Theresa May’s government is going to publish papers next week, detailing the Brexit approach. Two documents will be featured on Monday. One of them will focus on the way to treat confidential EU information obtained before Brexit. The other one will focus on making available the goods placed on supply chains in EU after Brexit. There would also be another paper dealing with how the Brexit deal should be enforced and how disputed would be resolved. This could be a controversial one as UK will likely oppose to EU’s proposal of using the European Court of Justice. The papers could lay out some ground for the next round of negotiation in the week of August 28.

Canada CPI rose to 1.2% yoy

Canada headline CPI rose 0.0% mom, 1.2% yoy in July, in line with consensus. That compares to June’s -0.1% mom, 1.0% yoy. Core CPI common was unchanged at 1.4% yoy. Core CPI trim rose to 1.3% yoy. Core CPI median rose to 1.7% yoy. The uptick in headline CPI was the first since January, thanks to higher gasoline price. While inflation is still way off BoC’s target of 2%, it’s possibly picking up momentum again. BoC is clear that it’s open to further rate hike depending on data. And more incoming positive growth and inflation data could prompt policy makers to consider another hike later in the year or early next year.

Released elsewhere, German PPI rose 0.2% mom, 2.3% yoy in July. Eurozone current account surplus narrowed to EUR 21.2b in June.

On the data front

German PPI and Eurozone current account are the main features in European session. Canada CPI is the main focus later in the day and U of Michigan confidence will be featured.

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.2618; (P) 1.2650; (R1) 1.2714; More….

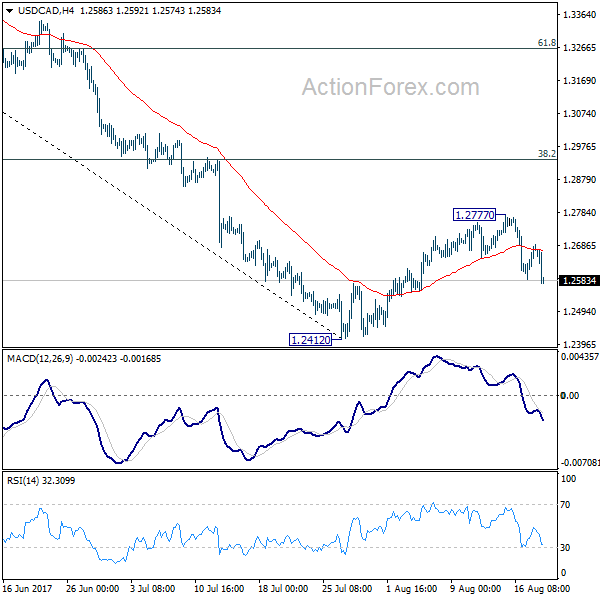

USD/CAD’s decline from 1.2777 extends today after brief recovery was rejected by 4 hour 55 EMA. As noted before, corrective rise from 2.2412 should have completed at 1.2777 already. Intraday bias stays on the downside for retesting 1.2412 low. Break there will resume the larger decline and target next long term fibonacci level at 1.2048. On the upside, above 1.2777 will extend the recovery. But we’d expect upside to be limited by 38.2% retracement of 1.3793 to 1.2412 at 1.2940 to bring fall resumption.

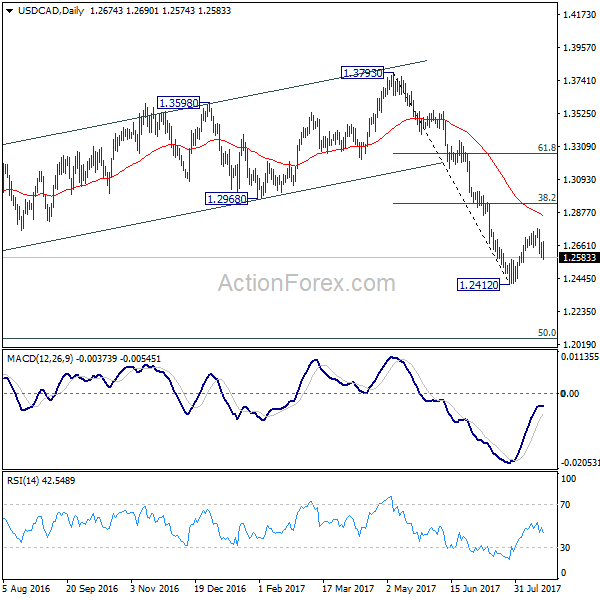

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. Such corrective fall is still expected to extend to 50% retracement of 0.9406 to 1.4869 at 1.2048. At this point, we’d look for strong support from there to contain downside and bring rebound. Nonetheless, on the upside, sustained break of 1.2968, 38.2% retracement of 1.3793 to 1.2412 at 1.2940 will be the first sign of completion of the correction and will turn focus back to 1.3793 key resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | German PPI M/M Jul | 0.20% | 0.00% | 0.00% | |

| 06:00 | EUR | German PPI Y/Y Jul | 2.30% | 2.20% | 2.40% | |

| 08:00 | EUR | Eurozone Current Account (EUR) Jun | 21.2B | 27.3B | 30.1B | 30.5B |

| 12:30 | CAD | CPI M/M Jul | 0.00% | 0.00% | -0.10% | |

| 12:30 | CAD | CPI Y/Y Jul | 1.20% | 1.20% | 1.00% | |

| 12:30 | CAD | CPI Core – Common Y/Y Jul | 1.40% | 1.40% | ||

| 12:30 | CAD | CPI Core – Trim Y/Y Jul | 1.30% | 1.20% | ||

| 12:30 | CAD | CPI Core – Median Y/Y Jul | 1.70% | 1.60% | ||

| 14:00 | USD | U. of Michigan Confidence Aug P | 94 | 93.4 |