Euro hesitates initially after ECB kept monetary policies unchanged today as widely expected. Markets seem to be unsure about the relatively slight revision in 2018 and 2019 inflation projections. Nonetheless, the overall cautious yet positive tone in president Mario Draghi’s press conference is giving the common currency some support. EUR/JPY took out 121.32 resistance earlier today and stays firm. EUR/AUD is also extending recent rebound. At the same time, while EUR/USD rebounds, it’s bounded in recent range of 1.0493/0630 and maintains a neutral outlook. EUR/GBP breached 0.8694 temporary top earlier today but lack follow through momentum. Euro traders would likely turn their focus back to politics once the impact from ECB fades.

As planned, monthly asset purchase size will be lowered to EUR 60b starting April, down from current EUR 80b. The asset purchase program (APP) will run till December 2017. Main refinancing rate is held at 0.00% while deposit rate is kept at -0.4%. ECB stayed open to further easing and noted that "we stand ready to increase our asset purchase programme in terms of size and/or duration."

Growth and inflation projection revised up

In the introductory statement to press conference, ECB president Mario Draghi acknowledged the increase in "headline inflation" and attributed that "largely on account of rising energy and food price inflation." Inflation would likely stay around 2% level "in the coming months. However, he also pointed out that "underlying inflation pressures continue to remain subdued." And ECB will look through the changes "if judged to be transient".

In the updated staff macroeconomic projections ECB projects headline HICP to hit 1.7% in 2017, 1.6% in 2018 and 1.7% in 2019. 2017 projection was significantly revised up. But for 2018, that was just a "slight revision" while 2019 projection was unchanged.

ECB now sees GDP to grow 1.8% in 2017, 1.7% in 2018 and 1.6% in 2019. There were "slight" upward revision in 2017 and 2018. Draghi also noted that "the risks surrounding the euro area growth outlook have become less pronounced, but remain tilted to the downside and relate predominantly to global factors."

US initial claims jumped 20k, stayed low

US initial jobless claims rose 20k to 243k in the week ended March 4, above expectation of 237k. The four week moving average rose to 236.5k, up from 234.25k. That, nonetheless, marketed the 105 straight week of sub 300k reading, the longest streak since 1970. Continuing claims dropped 6k to 2.06m in the week ended February 25. Challenger report showed -40% yoy drop in planned layoffs in February. Import price index rose 0.2% mom in February. Released from Canada new housing price index rose 0.1% mom in January. Capacity utilization rate rose to 82.2% in Q4.

Oil Slump drags down commodity currencies

Commodity currencies are generally weak today. In particular, Canadian dollar is dragged down by weakness in oil price. WTI’s fall accelerates this week and broke 50 handle to as low as 48.79 so far. The DOE/EIA reported yesterday that total crude oil and petroleum products stocks dropped -2.38 mmb to 1346.83 mmb in the week ended March 3. Crude oil inventory soared 8.21 mmb to 528.39 mmb with stock-builds seen in ALL of 5 PADDs. Cushing stock gained 0.87 mmb to 64.4 mmb while utilization rate dropped -0.1% to 85.9%. For refined oil products, gasoline inventory sank -6.56 mmb to 249.33 mmb although demand gained 6.7% to 9.27M bpd. Production increased 4.1% to 9.84M bpd while imports slumped -47.07% to 0.24M bpd during the week. Distillate inventory dropped -2.68 mmb to 16153 mmb as demand soared 7.29% to 4.09M bpd. Production increased 0.38% to 4.77M bpd while imports jumped 26.67% to 0.27M bpd during the week.

Elsewhere…

Japan labor cash earnings rose 0.5% yoy in January. Machine tool orders rose 9.1% yoy in February. China CPI dropped sharply to 0.8% yoy in February. PPI rose to 7.8% yoy.

Swiss unemployment rate was unchanged at 3.3% in February.

EUR/JPY Mid-Day Outlook

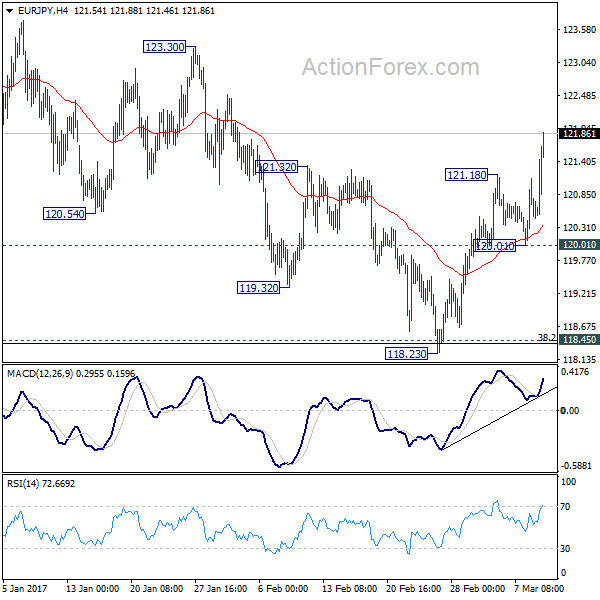

Daily Pivots: (S1) 120.01; (P) 120.56; (R1) 121.11; More…

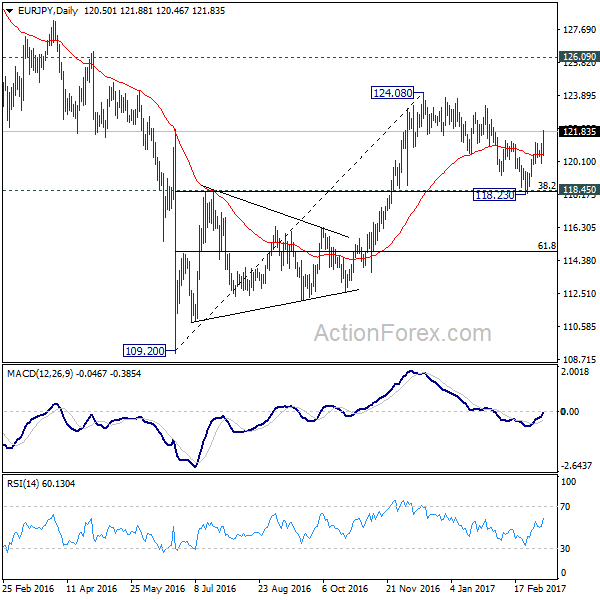

EUR/JPY’s strong rally today and break of 121.32 resistance firstly confirms resumption of rise from 118.23. More importantly, this should confirm completion of the corrective fall from 124.08, after defending 118.45 cluster support (38.2% retracement of 109.20 to 124.08 at 118.39). Intraday bias is now back on the upside for a test on 123.30/124.08 resistance zone. Break will extend larger rally from 109.20 to next key resistance at 126.09. On the downside, break of 120.01 support is now needed to indicate completion of the rise from 118.23. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, price actions from 109.20 medium term bottom are seen as part of a medium term corrective pattern from 149.76. Strong rebound from 118.45 resistance turned support suggests that it’s still in progress. Break of 124.08 will target 126.09 key resistance level. We’d be cautious on strong resistance there to limit upside. However, sustained break there will be a strong sign of medium term momentum and could target 141.04 resistance next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | JPY | Labor Cash Earnings Y/Y Jan | 0.50% | 0.30% | 0.10% | 0.50% |

| 00:01 | GBP | RICS House Price Balance Feb | 24% | 23% | 25% | 24% |

| 01:30 | CNY | CPI Y/Y Feb | 0.80% | 1.80% | 2.50% | |

| 01:30 | CNY | PPI Y/Y Feb | 7.80% | 7.50% | 6.90% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Feb P | 9.10% | 3.50% | ||

| 06:45 | CHF | Unemployment Rate Feb | 3.30% | 3.30% | 3.30% | |

| 12:30 | USD | Challenger Job Cuts Y/Y Feb | -40.00% | -38.80% | ||

| 12:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | 0.00% | |

| 13:30 | CAD | Capacity Utilization Rate Q4 | 82.20% | 82.60% | 81.90% | |

| 13:30 | CAD | New Housing Price Index M/M Jan | 0.10% | 0.10% | 0.10% | |

| 13:30 | USD | Import Price Index M/M Feb | 0.20% | 0.10% | 0.40% | |

| 13:30 | USD | Initial Jobless Claims (MAR 04) | 243K | 237k | 223k | |

| 15:30 | USD | Natural Gas Storage | -59B | 7B |