Euro weakens notably today as recovery momentum diminished quickly. Dollar is not gaining much, though, as commodity currencies trade broadly higher with new wave of buying. Australian Dollar is once again leading others. Canadian Dollar shrugs off weaker than expected inflation reading, and await BoC rate decision and the next move in oil price. In other markets, Gold has a wild ride today but stays in range established range after all. WTI crude oil looks ready to resume recent up trend.

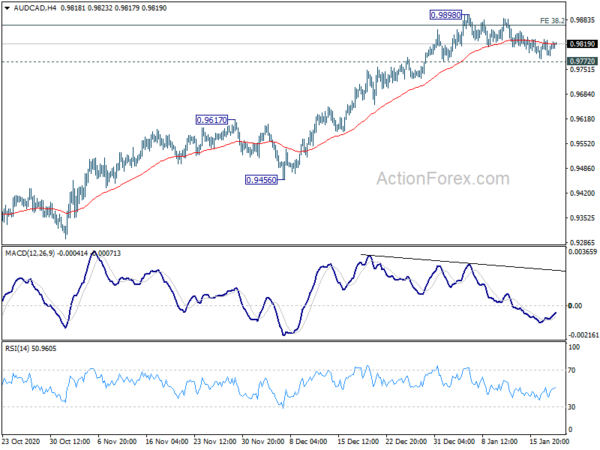

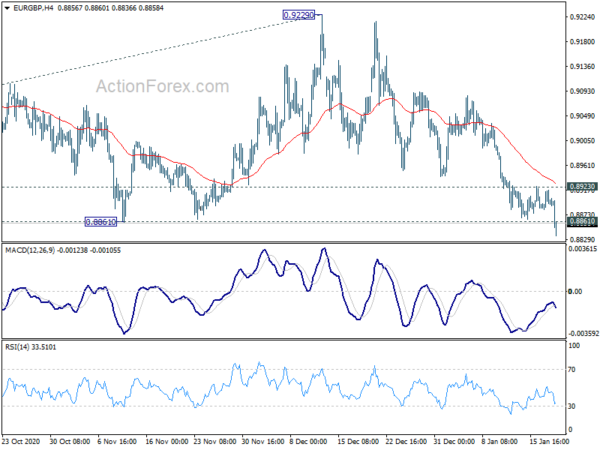

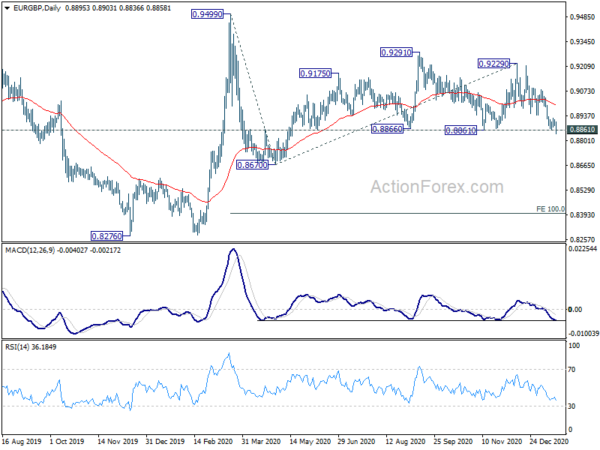

Technically, EUR/GBP’s break of 0.8861 support is a sign of underlying weakness in Euro. Eyes will be on 0.5591 support in EUR/AUD and 1.5313 support in EUR/CAD. Decisive break of these level will bring down trend resumption, and solidify Euro’s selloff. If that happens, attention could also be on how AUD/CAD would break out from recent range of 0.9772/9898, to gauge the relative strength.

In Europe, currently, FTSE is up 0.01%. DAX is up 0.73%. CAC is up 0.38%. Germany 10-year yield is flat at -0.524. Earlier in Asia, Nikkei dropped -0.38%. Hong Kong HSI rose 1.08%. China Shanghai SSE rose 0.47%. Singapore Strait Times rose 0.10%. 10-year JGB yield dropped -0.0068 to 0.040.

Canada CPI slowed to 0.7% yoy in Dec, below expectations

Canada CPI slowed to 0.7% yoy in December, down from 1.0% yoy, missed expectation of 1.0% yoy. CPI common dropped to 1.3% yoy, down from 1.5% yoy, missed expectation of 1.5% yoy. CPI median dropped to 1.8% yoy, down from 1.9% yoy, missed expectation of 1.9% yoy. CPI trimmed also dropped to 1.6% yoy, down from 1.7% yoy, missed expectation of 1.7% yoy.

UK CPI rose to 0.60% yoy in Dec, core CPI rose to 1.4% yoy

UK CPI rose to 0.6% yoy in December, up from 0.3% yoy, above expectation of 0.5% yoy. CPI core rose to 1.4% yoy, up from 1.1% yoy, above expectation of 1.3% yoy. RPI also rose to 1.2% yoy, up from 0.9% yoy, above expectation of 1.1% yoy.

Also released, PPI came in at 0.8% mom, 0.2% yoy. PPI output at 0.3% mom, -0.4% yoy.

Eurozone CPI finalized at -0.3% yoy in Dec, core CPI at 0.2% yoy

Eurozone CPI was finalized at -0.3% yoy in December, at that level for the fourth consecutive month. CPI core was finalized at 0.2% yoy. The highest contribution came from services (+0.30%), followed by food, alcohol & tobacco (+0.25%), non-energy industrial goods (-0.14%) and energy (-0.68%).

EU CPI was finalized at 0.3% yoy, up from prior month’s 0.2% yoy. The lowest annual rates were registered in Greece (-2.4%), Slovenia (-1.2%) and Ireland (-1.0%). The highest annual rates were recorded in Poland (3.4%), Hungary (2.8%) and Czechia (2.4%). Compared with November, annual inflation fell in nine Member States, remained stable in eight and rose in ten.

Also released, Germany PPI came in at 0.8% mom, 0.2% yoy in December, much higher than expectation of 0.3% mom, -0.3% yoy.

Australia Westpac consumer sentiment dropped -4.5%, still healthy

Australia Westpac Consumer Sentiment dropped -4.5% to 107 in January, down from 112.0. The fall came in where there was domestic border closures, emergence of coronavirus clusters in some states and the sharp upswing in infections globally. Overall, “it still points to healthy consumer sentiment”.

Regarding RBA’s next meeting on February 2, Westpac said the board “seems almost certain to maintain its current policy stance”. The central bank decided in November the intention to purchase AUD 100B in government and semi-government bonds. Markets would be interested in any guidance in respect to the program, which is set to end at the end of April. Westpac expects a second program of AUD 100B afterwards.

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.8879; (P) 0.8899; (R1) 0.8914; More…

EUR/GBP’s break of 0.8861 support suggests that corrective rebound from 0.8670 has completed. Sustained trading below this support will confirm and target 0.8670 support next. On the downside, though, break of 0.8923 minor resistance will dampen this bearish case and turn bias back to the upside for rebound first.

In the bigger picture, we’re seeing the price actions from 0.9499 as developing into a corrective pattern. That is, up trend from 0.6935 (2015 low) would resume at a later stage. This will remain the favored case as long as 0.8276 support holds. Decisive break of 0.9499 will target 0.9799 (2008 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Jan | -4.50% | 4.10% | ||

| 07:00 | EUR | Germany PPI M/M Dec | 0.80% | 0.30% | 0.20% | |

| 07:00 | EUR | Germany PPI Y/Y Dec | 0.20% | -0.30% | -0.50% | |

| 07:00 | GBP | CPI M/M Dec | 0.30% | 0.30% | -0.10% | |

| 07:00 | GBP | CPI Y/Y Dec | 0.60% | 0.50% | 0.30% | |

| 07:00 | GBP | Core CPI Y/Y Dec | 1.40% | 1.30% | 1.10% | |

| 07:00 | GBP | RPI M/M Dec | 0.60% | 0.60% | -0.30% | |

| 07:00 | GBP | RPI Y/Y Dec | 1.20% | 1.10% | 0.90% | |

| 07:00 | GBP | PPI Input M/M Dec | 0.80% | 0.70% | 0.20% | 0.40% |

| 07:00 | GBP | PPI Input Y/Y Dec | 0.20% | 1.00% | -0.50% | -0.30% |

| 07:00 | GBP | PPI Output M/M Dec | 0.30% | 0.30% | 0.20% | 0.30% |

| 07:00 | GBP | PPI Output Y/Y Dec | -0.40% | -0.60% | -0.80% | -0.60% |

| 07:00 | GBP | PPI Core Output M/M Dec | 0.10% | 0.00% | 0.10% | |

| 07:00 | GBP | PPI Core Output Y/Y Dec | 1.20% | 0.90% | 1.00% | |

| 09:30 | GBP | DCLG House Price Index Y/Y Nov | 7.60% | 5.80% | 5.40% | |

| 10:00 | EUR | Eurozone CPI Y/Y Dec F | -0.30% | -0.30% | -0.30% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec F | 0.20% | 0.20% | 0.20% | |

| 13:30 | CAD | CPI M/M Dec | -0.20% | 0.00% | 0.10% | |

| 13:30 | CAD | CPI Y/Y Dec | 0.70% | 1.00% | 1.00% | |

| 13:30 | CAD | CPI Common Y/Y Dec | 1.30% | 1.50% | 1.50% | |

| 13:30 | CAD | CPI Median Y/Y Dec | 1.80% | 1.90% | 1.90% | |

| 13:30 | CAD | CPI Trimmed Y/Y Dec | 1.60% | 1.70% | 1.70% | |

| 15:00 | USD | NAHB Housing Market Index Jan | 86 | 86 | ||

| 15:00 | CAD | BoC Interest Rate Decision | 0.25% | 0.25% | ||

| 16:15 | CAD | BoC Press Conference |