Yen and Dollar remain the worst performing ones for today with markets generally in risk-on mode. Investors are awaiting US Treasury nominee Janet Yellen’s Senate hearing for more information on the her stance on fiscal stimulus and Dollar exchange rate. Though, buying focuses turned from commodity currencies to Euro and Swiss Franc. Australian Dollar is still strong but Canadian Dollar is starting to lag behind.

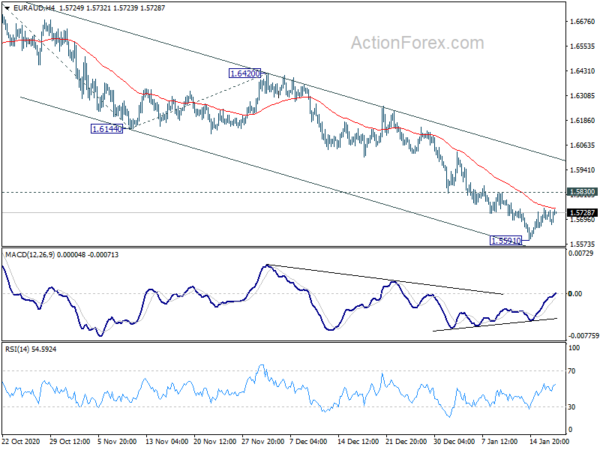

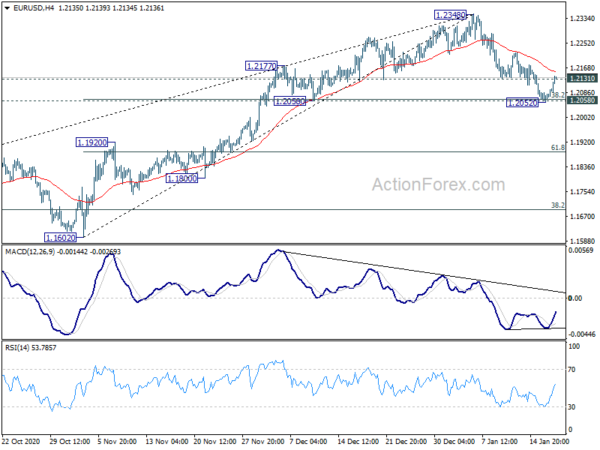

Technically, EUR/USD’s break of 1.2131 minor resistance, and EUR/JPY’s break of 125.91 resistance, suggest that the pull back from these two pairs have completed. Though, the recovery in EUR/GBP and EUR/AUD is still relatively weak. In particular, we’re still expecting 1.5830 minor resistance in EUR/AUD to hold, with another decline through 1.5591 at sooner or later. We’ll see if Aussie could take back the driving seat in the next move.

In Europe, currently, FTSE is up 0.11%. DAX is up 0.25%. CAC is up 0.08%. Germany 10-year yield is up 0.0107 at -0.514. Earlier in Asia, Nikkei rose 1.39%. Hong Kong HSI rose 2.70%. China Shanghai SSE dropped -0.83%. Singapore Strait Times rose 0.18%. Japan 10-year JGB yield dropped -0.0026 to 0.047.

German ZEW rose to 61.8, despite uncertainty about further course of lockdown

German ZEW economic sentiment rose to 61.8 in January, up from 55.0, above expectation of 60.0. Current situation index edged up to -66.4, from -66.5, above expectation of -68.0. Eurozone economic sentiment rose to 58.3, up from 54.4, above expectation of 45.5. Eurozone current situation dropped -3.2 pts to -78.9.

“Despite the uncertainty about the further course of the lockdown, the economic outlook for the German economy has improved slightly. The results of the ZEW Financial Market Survey in January show that export expectations in particular have risen significantly,” comments ZEW President Professor Achim Wambach.

Also released, Germany CPI was finalized at 0.5% mom, -0.3% yoy in December. Italy trade surplus narrowed to EUR 6.77B in November. Eurozone current account surplus widened to EUR 34.6B in November. Swiss PPI came in at 0.5% mom, -2.3% yoy in December.

New Zealand NZIER business sentiment further improved in Q4

The latest NZIER Quarterly Survey of Business Opinion showed a net 15% of business expect a deterioration in general economic conditions over the coming months. That’s notable improvement from Q3’s 38% and the worst reading of 68% during the most pessimistic period in March 2020.

On companies’s own activity, a net 1% reported reduced demand. NZIER said This measure suggests a rebound in annual GDP growth to around 2 percent at the end of 2020 from the lockdown lows in mid-2020.

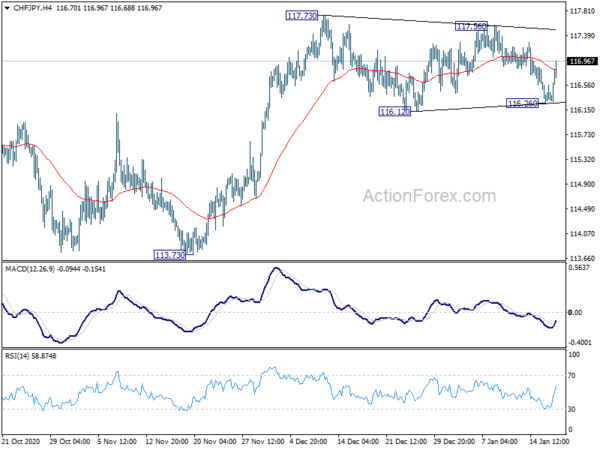

CHF/JPY rebounds from 55 D EMA, Yen to underperform further

CHF/JPY rebounds strongly today, following broad based selloff in Yen, and to a lesser extend the Franc. Overall development suggests the Yen could underperform the Franc, for the near term at least.

Strong support seen in 55 day EMA suggests underlying near term bullishness. Also, the price actions from 117.73 so far are clearly a three wave correction pattern, affirming the bullish view too. The focus would likely be back on 117.56/86 resistance zone soon. Decisive break there should confirm medium term up trend resumption.

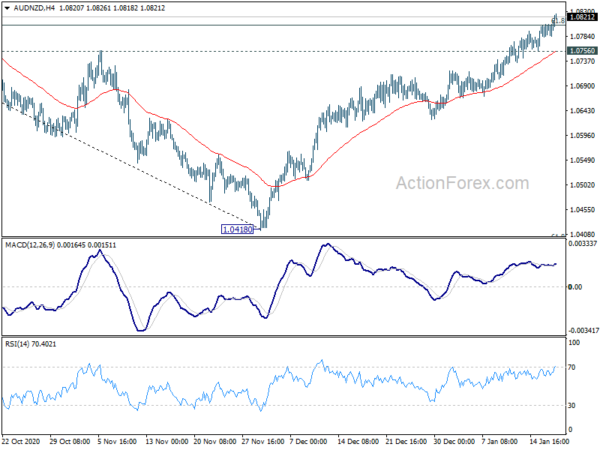

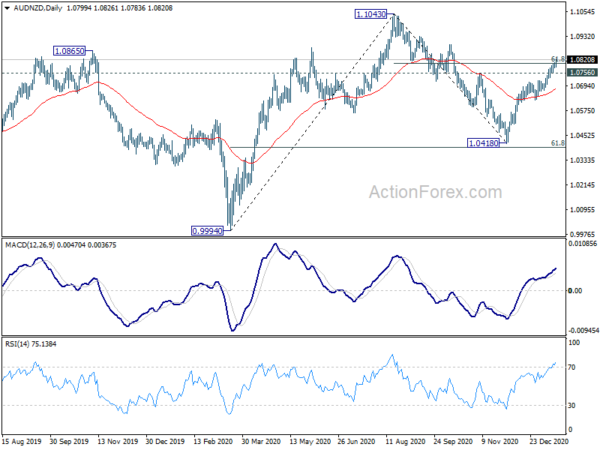

AUD outperforming NZD and CAD as risk-on mode back

As markets are back in risk-on mode, Australian Dollar is outperforming other commodity currencies for now. In particular, AUD/NZD extends the rally from 1.0418 today and breaks 61.8% retracement of 1.1043 to 1.0418 at 1.0804. Near term outlook will now stay bullish as long as 1.0756 support holds. Current rise would target a test on 1.1043 high.

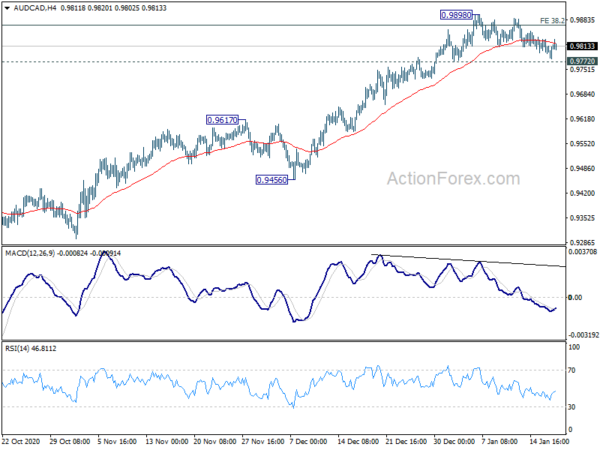

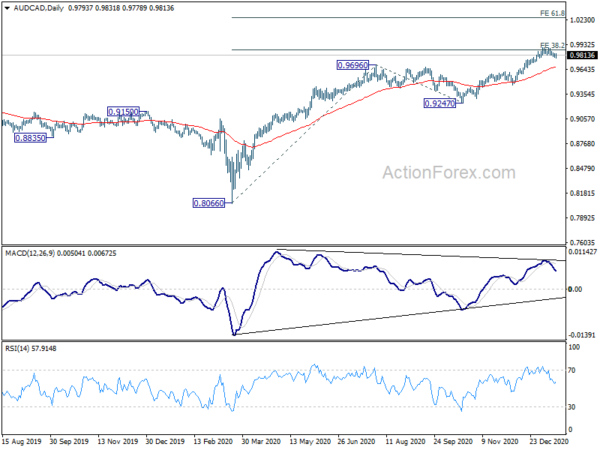

AUD/CAD’s rally stalled after hitting 0.9898. Yet, subsequent consolidation is contained by 0.9772 support so far, keeping near term outlook bullish. Break of 0.9898 will resume the rise from 0.8066 to 61.8% projection of 0.8066 to 0.9696 from 0.9247 at 1.0254. Though, break of 0.9772 will indicate short term topping and bring deeper pull back. Canadian Dollar would outperform in this case.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2059; (P) 1.2073; (R1) 1.2092; More…

IEUR/USD’s break of 1.2131 minor resistance suggests that pull back from 1.2348 has completed at 1.2052. That came after expected support from 1.2058 cluster support (38.2% retracement of 1.1602 to 1.2348 at 1.2063). Intraday bias is turned back to the upside for retesting 1.2348 high. However, on the downside, sustained break of 1.2058 will target 61.8% retracement at 1.1887.

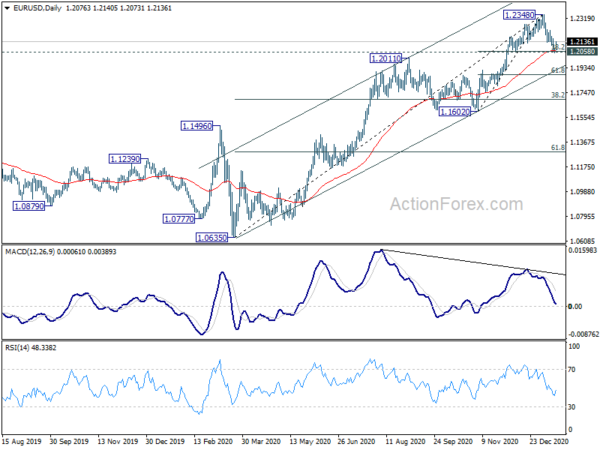

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | NZIER Business Confidence Q/Q Q4 | -6 | -40 | ||

| 07:00 | EUR | Germany CPI M/M Dec F | 0.50% | 0.50% | 0.50% | |

| 07:00 | EUR | Germany CPI Y/Y Dec F | -0.30% | -0.30% | -0.30% | |

| 07:30 | CHF | Producer and Import Prices M/M Dec | 0.50% | 0.10% | -0.10% | |

| 07:30 | CHF | Producer and Import Prices Y/Y Dec | -2.30% | -2.70% | ||

| 09:00 | EUR | Italy Global Trade Balance (EUR) Nov | 6.77B | 7.57B | ||

| 09:00 | EUR | Eurozone Current Account (EUR) Nov | 34.6B | 26.6B | ||

| 10:00 | EUR | Germany ZEW Economic Sentiment Jan | 61.8 | 60 | 55 | |

| 10:00 | EUR | Germany ZEW Current Situation Jan | -66.4 | -68 | -66.5 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Jan | 58.3 | 45.5 | 54.4 | |

| 13:30 | CAD | Manufacturing Sales M/M Nov | -0.60% | -0.20% | 0.30% | 0.20% |

| 13:30 | CAD | Wholesale Sales M/M Nov | 0.70% | 0.90% | 1.00% |