Yen and Swiss Franc are trading stronger together with Dollar today, as stock markets are pulling back slightly. On the other hand, New Zealand Dollar is leading other commodity currencies lower. US President-elect Joe Biden’s new spending package was generally ignored by investors. Instead, worse than expected US data is weighing sentiments down slightly. For the week, Sterling remains the strongest, followed by Yen. Kiwi is the worst so far, followed by Euro.

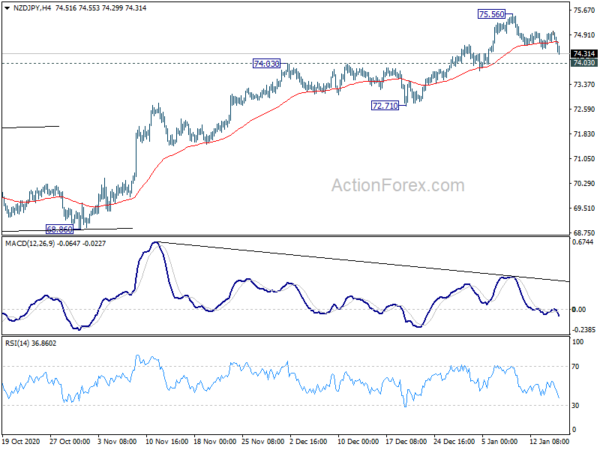

Technically, a focus for today and next week would be the strength of Yen’s rebound. EUR/JPY’s break of 126.03 support is a sign of underlying Yen strength. Break of 140.31 resistance in GBP/JPY would indicate rejection by 142.71 resistance and bring deeper fall. Break of 74.03 resistance turned support would also confirm short term topping at 75.56, on bearish divergence condition in 4 hour MACD. That should start a deeper correction through 72.71 support next.

In Europe, currently, FTSE is down -0.84%. DAX is down -0.95%. CAC is down -1.07%. Germany 10-year yield is up 0.008 at -0.538. Earlier in Asia, Nikkei dropped -0.62%. Hong Kong HSI rose 0.27%. China Shanghai SSE rose 0.01%. Singapore Strait Times rose 0.16%. Japan 10-year JGB yield rose 0.0031 to 0.036.

US retail sales dropped -0.7% mom, ex-auto sales dropped -1.4% mom

US retail sales dropped -0.7% mom to USD 540.9B in December, much worse than expectation of 0.0% mom rise. Ex-auto sales dropped -1.4% mom, well below expectation of -0.1% mom. Ex-gasoline sales dropped -1.2% mom. Ex-auto, ex-gasoline sales dropped -2.1% mom.

PPI came in at 0.3% mom, 1.8% yoy, matched expectation. Core PPI was at 0.1% mom, 1.2% yoy, below expectation of 0.2% mom, 1.3% yoy.

Empire State general business condition index was dropped to 3.5, below expectation of 5.7.

UK GDP dropped -2.6% mom in Nov, services as main drag

UK GDP dropped -2.6% mom in November, better than expectation of -4.0% mom. That’s the first decline since six consecutive monthly increases. GDP was back to -8.5% below the levels seen in pre-pandemic February. Also, GDP dropped -8.9% in the 12 months to November, comparing with the annual decline of -6.8% to October.

Services was the main drag on growth, down -3.4% mom due to restrictions. Services was -9.9% below February’s level. Production dropped -0.1% mom, at -4.7% below February’s level. Construction rose 1.9% mom, at 0.6% above February’s level.

Also released, goods trade deficit widened to GBP -16.0B in November, versus expectation of GBP -11.1B.

UK NIESR projects -3.4% GDP contraction in Q1

NIESR estimated a 0.9% growth in UK GDP in Q4 of 2020, implying a total contraction of -9.8% for the whole year. With tight restrictions and some post-Brexit adjustment, Q1 is forecast to have negative growth on -3.4%. It added, “the short-term negative economic impact of lockdowns should be outweighed by the potential positive long-term health and economic impacts from controlling the virus and restoring confidence.”

“Today’s ONS data confirm a significant slowdown in the last quarter of 2020, despite November’s lockdown in England clearly having a far smaller effect than the first. Surveys and high frequency indicators suggest that recovery from the Covid-19 shock was weak even before a third lockdown become necessary in January. Temporary and permanent adjustments post-Brexit transition period are likely to also weigh on growth in the early part of 2021, but the vaccine roll-out provides some encouragement for consumption and investment in the second half of 2021 and beyond. The economic impact of the lockdowns is clearly negative in the short-term but will be significantly positive in the medium term if successful in controlling the virus and restoring confidence.” Rory Macqueen Principal Economist – Macroeconomic Modelling and Forecasting

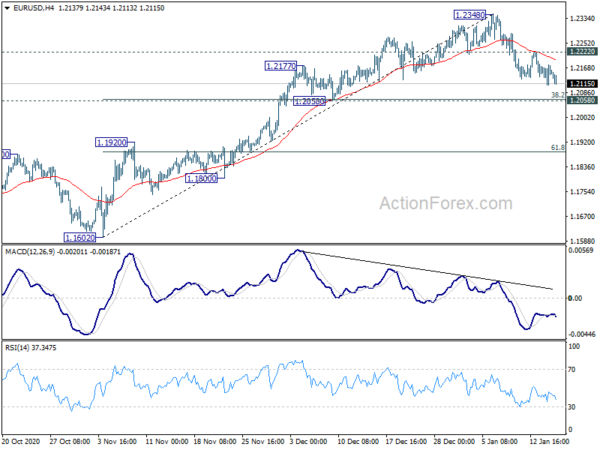

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2118; (P) 1.2148; (R1) 1.2185; More…

No change in EUR/USD’s outlook at this point. With 1.2222 minor resistance intact, correction from 1.2348 could extend lower. But downside should be contained by 1.2058 cluster support (38.2% retracement of 1.1602 to 1.2348 at 1.2063) to bring rebound. Break of 1.2222 minor resistance will bring retest of 1.2348 high. However, firm break of 1.2058 will target 61.8% retracement at 1.1887.

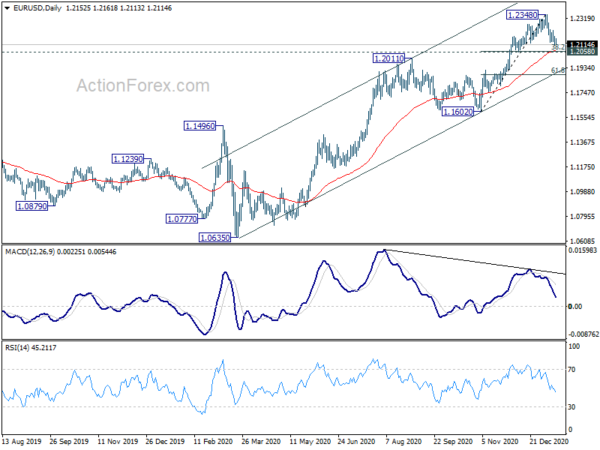

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | Tertiary Industry Index M/M Nov | -0.70% | 0.30% | 1.00% | 1.60% |

| 07:00 | GBP | GDP M/M Nov | -2.60% | -4.00% | 0.40% | 0.60% |

| 07:00 | GBP | Index of Services (3M/3M) Nov | 3.70% | 2.50% | 9.70% | |

| 07:00 | GBP | Manufacturing Production M/M Nov | 0.70% | 0.70% | 1.70% | |

| 07:00 | GBP | Manufacturing Production Y/Y Nov | -3.80% | -5.20% | -7.10% | |

| 07:00 | GBP | Industrial Production M/M Nov | -0.10% | 0.40% | 1.30% | |

| 07:00 | GBP | Industrial Production Y/Y Nov | -4.70% | -4.30% | -5.50% | |

| 07:00 | GBP | Goods Trade Balance (GBP) Nov | -16.0B | -11.1B | -12.0B | |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Nov | 25.1B | 22.3B | 25.9B | 25.2 B |

| 13:30 | GBP | NIESR GDP Estimate Dec | 0.90% | 1.50% | 4.10% | |

| 13:30 | USD | Empire State Manufacturing Index Jan | 3.5 | 5.7 | 4.9 | |

| 13:30 | USD | Retail Sales M/M Dec | -0.70% | 0.00% | -1.10% | -1.40% |

| 13:30 | USD | Retail Sales ex Autos M/M Dec | -1.40% | -0.10% | -0.90% | -1.30% |

| 13:30 | USD | PPI M/M Dec | 0.30% | 0.30% | 0.10% | |

| 13:30 | USD | PPI Y/Y Dec | 0.80% | 0.80% | 0.80% | |

| 13:30 | USD | PPI Core M/M Dec | 0.10% | 0.20% | 0.10% | |

| 13:30 | USD | PPI Core Y/Y Dec | 1.20% | 1.30% | 1.40% | |

| 14:15 | USD | Industrial Production M/M Dec | 0.40% | 0.40% | ||

| 14:15 | USD | Capacity Utilization Dec | 73.50% | 73.30% | ||

| 15:00 | USD | Michigan Consumer Sentiment Jan P | 79.2 | 80.7 | ||

| 15:00 | USD | Business Inventories Nov | 0.40% | 0.70% |