Selloff in Euro against commodity currencies appear to be a main theme today, in otherwise mixed markets. Dollar seems not too bothered by the pull back in treasury yields overnight and stays generally inside last week’s range. Sterling is struggling to extend gain despite staying as the strongest one for the week. Yen and Swiss Franc are generally mixed.

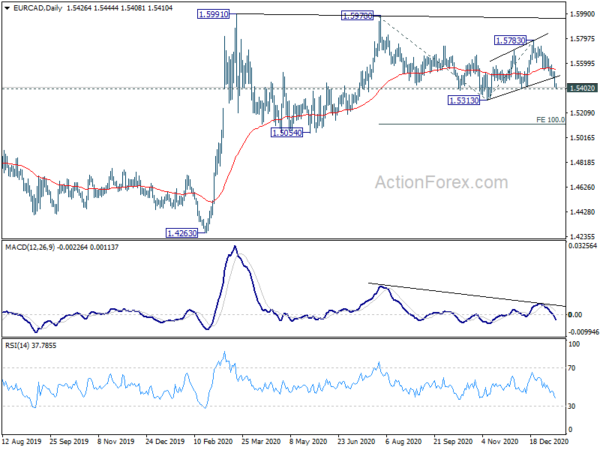

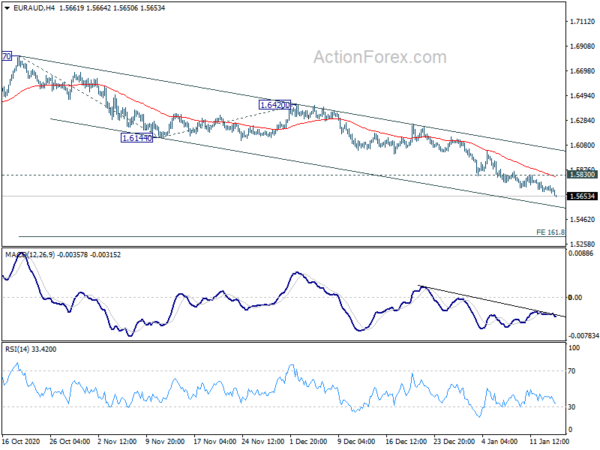

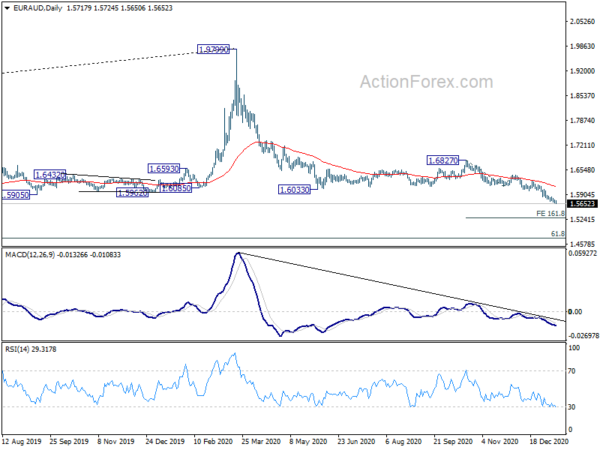

Technically, EUR/AUD’s down trend is picking up some downside momentum after getting through 1.5723 temporary low. 1.5315 projection level is the next downside target. EUR/CAD is also accelerating downwards after breaking near term channel support. Further break of 1.5402 support will solidify the case for resuming the pattern from 1.5978 through 1.5313 low. 0.8861 support in EUR/GBP will be a key to decide whether Euro’s selloff would intensify.

In Asia, Nikkei closed up 0.85%. Hong Kong HSI is up 0.75%. China Shanghai SSE is down -0.32%. Singapore Strait Times is up 0.56%. Japan 10-year JGB yield is up 0.0015 at 0.033. Overnight, DOW dropped -0.03%. S&P 500 rose 0.23%. NASDAQ rose 0.43%. 10-year yield dropped -0.050 to 1.088.

BoJ Kuroda: Stand ready to take additional easing steps without hesitation if needed

BoJ Governor Haruhiko Kuroda told branch managers in a quarterly meeting, “domestic economic conditions remain severe due to the impact of coronavirus infections at home and abroad but we have seen a pickup.”

“Japan’s economy is likely to improve as a trend as the impact from the pandemic gradually subsides, although the pace will be moderate as caution over COVID-19 persists,” he added.

“The BOJ will scrutinise the impact of the pandemic for the time being and stand ready to take additional easing steps without hesitation if needed,” he said.

Released from Japan, PPI dropped -2.0% yoy in December, above expectation of -2.2% yoy. Machinery orders rose 1.5% mom in November, well above expectation of -6.2% mom decline.

China’s exports rose 18.1% yoy in Dec, imports rose 6.5% yoy

In USD terms, China’s exports rose 18.1% yoy to USD 281.9B in December. Imports rose 6.5% yoy to USD 203.8B. Total trade rose 12.9% yoy to USD 485.7B. Trade surplus came in at USD 78.2B, above expectation of USD 72.0B.

For the whole 2020, exports rose 3.6% to USD 2591B. Imports dropped -1.1% to USD 2056B. Total trade rose 1.5% to USD 4646B. Trade surplus was at USD 535.0B.

Fed Brainard: Current pace of asset purchases remain appropriate for quite some time.

In a speech, Fed Governor Lael Brainard said that “given my baseline outlook, I expect that the current pace of purchases will remain appropriate for quite some time.” The outlook is “highly uncertain” and forecasts are “subject to revisions. The forward guidance is, thus, “outcome based and tied to realized progress on our goals.”

Looking ahead, “effective vaccines and additional fiscal support are important positive developments”. However, “the near-term outlook is challenging due to the resurgence of the pandemic, and the economy remains far from our goals.”

In particular, “the damage from COVID-19 is concentrated among already challenged groups”, she added. “The K-shaped recovery remains highly uneven, with certain sectors and groups experiencing substantial hardship.”

Fed Rosengren: Labor market to be stagnant before widespread vaccinations

Boston Fed President Eric Rosengren said in an interview that “labor market is going to be stagnant for the next couple months until we have much more widespread vaccinations.” But going into Q2, ” I’m hoping enough people are vaccinated that we can start spending, particularly in those areas where we haven’t been able to spend,” he added.

Some sectors are most impacted by the coronavirus pandemic, including accommodation, food and entertainment. Rosengren said they will need more fiscal support, until vaccines make it possible for consumers to return. In particular, a fiscal program that provides grants to struggling businesses maybe one of the most effective ways to support mid-sized companies.

Fed Clarida outlined six features of new policy framework

In a speech, Fed Vice Chair Richard Clarida outlined six features of the new framework adopted last fall.

- First, the lift off from the effective lower bound (ELB) interest rate was “delayed” until PCE inflation has risen to 2%, while other complementary conditions are met.

- Second, FOMC aims to achieve inflation moderately above 2% “for some time in the service of keeping longer-term inflation expectations well anchored at the 2 percent longer-run goal”.

- Third, monetary policy will “remain accommodative for some time after the conditions to commence policy normalization have been met.”

- Fourth, “policy will aim over time to return inflation to its longer-run goal, which remains 2 percent, but not below”.

- Fifth, inflation that averages 2 percent over time represents an ex ante aspiration of the FOMC, but not a time-inconsistent ex post commitment.

- Sixth, maximum employment is now defined as “the highest level of employment that does not generate sustained pressures that put the price-stability mandate at risk.”

Looking ahead

ECB monetary policy accounts is the only feature in European session. US will release jobless claims and import price index.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5687; (P) 1.5717; (R1) 1.5749; More…

Intraday bias in EUR/AUD stays on the downside as decline is accelerating downwards. Current down trend should target 161.8% projection of 1.6827 to 1.6144 from 1.6420 at 1.5315 next. On the upside, break of 1.5830 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, current development suggests that price actions from 1.9799 is developing into a deep correction, to long term up trend from 1.1602 (2012 low). Deeper fall would be seen to 61.8% retracement of 1.1602 to 1.9799 at 1.4733. Medium term outlook will remain bearish as long as 1.6827 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Dec | -2.00% | -2.20% | -2.20% | -2.30% |

| 23:50 | JPY | Machinery Orders M/M Nov | 1.50% | -6.20% | 17.10% | |

| 0:01 | GBP | RICS Housing Price Balance Dec | 65% | 61% | 66% | |

| 2:00 | CNY | Trade Balance (USD) Dec | 78.2B | 72.0B | 75.4B | |

| 2:00 | CNY | Imports (USD) Y/Y Dec | 6.50% | 4.50% | ||

| 2:00 | CNY | Exports (USD) Y/Y Dec | 18.10% | 21.10% | ||

| 2:00 | CNY | Trade Balance (CNY) Dec | 517B | 466B | 507B | |

| 2:00 | CNY | Imports (CNY) Y/Y Dec | -0.20% | -0.80% | ||

| 2:00 | CNY | Exports (CNY) Y/Y Dec | 10.90% | 14.90% | ||

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 13:30 | USD | Initial Jobless Claims (Jan 8) | 787K | |||

| 13:30 | USD | Import Price Index M/M Dec | 0.80% | 0.10% | ||

| 17:00 | USD | Natural Gas Storage | -130B |