Dollar’s rebound extends further today and remains firm entering into US session. Yen is following as the second strongest. Markets are paring back recent strong risk-on sentiment, on concern of near term deterioration in coronavirus spread and lockdowns. Commodity currencies are generally weakest for now, as led by Australian Dollar. European majors are mixed, with Swiss Franc on a slight lower hand.

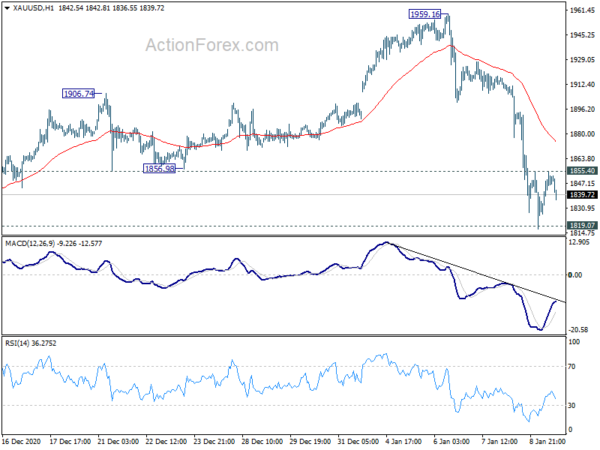

Technically, eyes remains on some near term levels in Dollar to confirm more broad-based buying. The levels include 1.3428 support in GBP/USD. 0.7641 support in AUD/USD. 0.8918 resistance in USD/CHF, and 1.2797 resistance in USD/CAD. Meanwhile, eyes will also be on 1855.40 minor resistance in Gold. As long as this resistance holds, we’d expect another fall to break through 1819.07 support before gold finds a bottom. But firm break of 1855.40 should suggest that selling climax is at least temporarily past. Dollar could also turn softer in this case.

In Europe, currently, FTSE is down -0.77%. DAX is down -0.86%. CAC is down -0.73%. Germany 10-year yield is flat at -0.518. Earlier in Asia, Hong Kong HSI rose 0.11%. China Shanghai SSE dropped -1.08%. Singapore Strait Times dropped -0.31%. Japan was on holiday.

Eurozone Sentix rose to 1.3, expectations jumped to new record high

Eurozone Sentix Investor Sentiment turned positive to 1.3 in January, up from -2.7, but missed expectation of 2.0. That’s nonetheless the highest since February 2020. Current situation index rose to -26.5, up from -30.3, highest since March 2020. Expectation index rose to 33.5, up from 29.3, an all-time high. Sentix said, “the main reason for the expectations, despite the renewed lockdown ex-tension in Germany, is probably the high hope for a successful vaccination campaign.”

“Nevertheless, we do not see the development so positively,” it added. “This is because the assessment of the situation has been showing a much flatter trend than the stormy expectations for months now. There is a potential for a temporary sobering up here, because investors seem to underestimate the danger that the economies are more damaged than the data seem to reflect and that this will only become visible when the restrictions are actually lifted.”

China CPI turned positive in Dec, PPI deflation flowed to -0.4% yoy

China’s CPI turned positive to 0.2% yoy, up from -0.50% yoy, above expectation of 0.1% yoy. Core CPI, excluding food and energy, stood at 0.4% yoy, down from 0.5% yoy.

“Ahead of New Year’s Day and the Spring Festival, consumer demand increased, and feed costs also rose,” said Dong Lijuan, a senior statistician at the NBS. “At the same time, affected by unusual weather and rising costs, the CPI turned from a decline into an increase.”

PPI dropped to -0.4% yoy in December, up from November’s -1.5% yoy, higher than expectation of -0.8% yoy. That’s also the slowest factory gate deflation since last February.

Suggested reading on China: China’s Inflation Surprised to Upside in December. Outlook Moderates amidst Fall in Pork Price

Australia retail sales rose 7.1% mom in Nov, up 2.6% excluding Victoria

Australia retail sales grew 7.1% mom in November, revised up from preliminary result of 7.0% mom, followed 1.4% mom rise in October. Ben James, Director of Quarterly Economy Wide Surveys, said: “The rise is led by Victoria (22.4%) as Melbourne retail stores were able to trade for a full month in November. Excluding Victoria, turnover rose 2.6%.”

Other states and territories to record an increase in turnover were Queensland (4.5%), New South Wales (2.3%), Western Australia (1.2%), Tasmania (3.4%), the Australian Capital Territory (2.5%), and the Northern Territory (2.2 per cent). The brief lockdown in South Australia (-0.2%) led to a relatively flat result, as falls in most industries were offset by a rise in food sales.

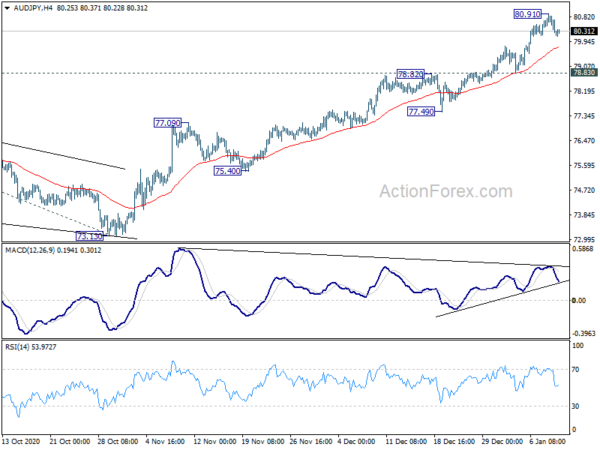

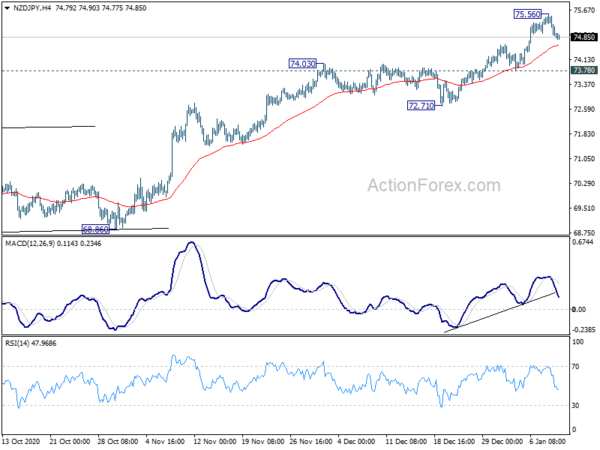

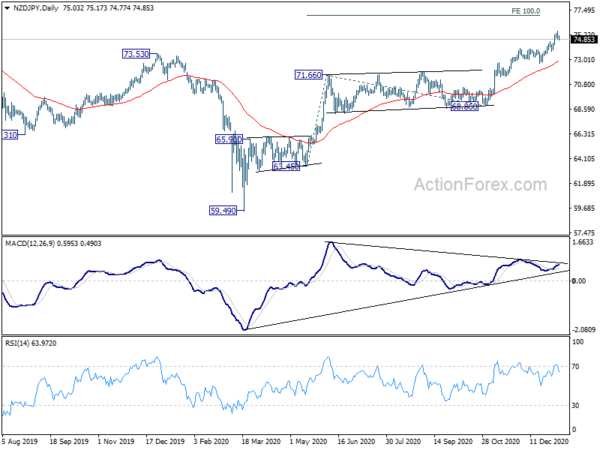

AUD/JPY and NZD/JPY retreat mildly, up trend still in force

Commodity Yen crosses trade mildly lower today and stock markets turn into consolidation and retreat mildly. AUD/JPY formed a temporary top at 80.91 and intraday bias is turned neutral for some consolidations. Though, downside should be contained by 78.83 support to bring another rally. We’d expect up trend from 59.89 to resume, sooner rather than later, by breaking through 80.91 to 61.8% projection of 59.89 to 78.46 from 73.13 at 84.60.

Similarly, NZD/JPY also turned into consolidation today, with a temporary top formed at 75.56. Downside of retreat should be contained by 73.78 support to bring rise resumption. We’d expect up trend from 59.49 to resume to 100% projection of 63.45 to 71.66 from 68.86, at 77.07, after the consolidations.

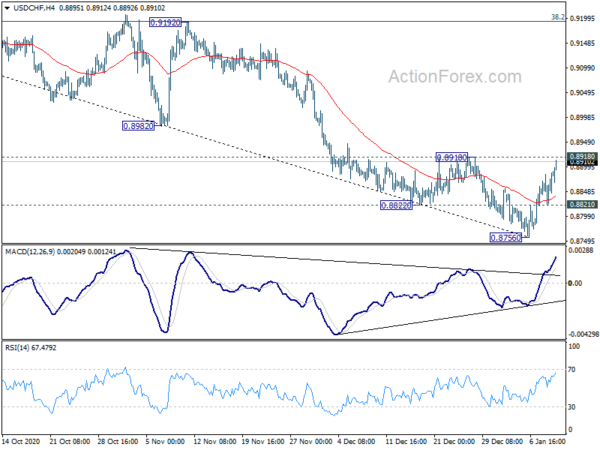

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8823; (P) 0.8854; (R1) 0.8884; More….

USD/CHF rebounds further today and focus is now immediately on 0.8918 resistance. Decisive break there will confirm short term bottoming at 0.8756. Intraday bias will be turned back to the upside for 0.8898/9294 resistance zone. On the downside, though, below 0.9921 minor support will indicate rejection by 0.8918. Intraday bias will be back on the downside for retesting 0.8756 low.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). There is no clear sign of completion yet. Next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. In any case, break of 0.9294 resistance is needed to signal medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | Retail Sales M/M Nov | 7.10% | 7.00% | 7.00% | |

| 1:30 | CNY | CPI Y/Y Dec | 0.20% | 0.10% | -0.50% | |

| 1:30 | CNY | PPI Y/Y Dec | -0.40% | -0.80% | -1.50% | |

| 9:30 | EUR | Eurozone Sentix Investor Confidence Jan | 1.3 | 2 | -2.7 | |

| 14:30 | CAD | BoC Business Outlook Survey |