Yen selling takes center stage today, following strong rise in global treasury yields. In particular, US 10-year yield is trading at 0.99 at the time of writing, after hitting 1.037 earlier. Dollar remains generally pressured, and even the recovery against Yen is weak. The surprised contraction in ADP employment is definitely not giving the greenback any support. Australian and New Zealand Dollars are currently the strongest, followed by Euro.

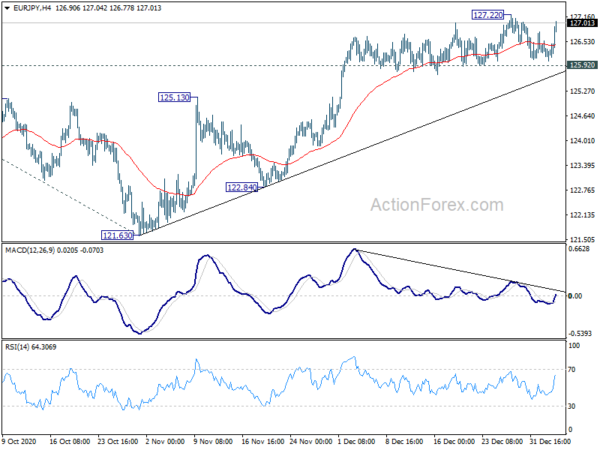

Technically, the rise in treasury yield prompted a relatively sharp pull back in Gold, hitting 1925.53. For now, we’re not expecting a break of 1906.74 resistance turned support. But break there could help signal some recovery in Dollar elsewhere. We’ll see. Before that, EUR/JPY could be a more immediate focus. Firm break of 127.07/22 resistance will resume larger rise from 114.42 to 128.67 medium term fibonacci resistance.

In Europe, currently, FTSE is up 2.86%. DAX is up 0.91%. CAC is up 0.67%. German 10-year yield is up 0.0206 at -0.551. Earlier in Asia, Nikkei dropped -0.38%. Hong Kong HSI rose 0.15%. China Shanghai SE rose 0.63%. Singapore Strait Times rose 0.12%. Japan 10-year JGB yield rose 0.0049 to 0.020.

US ADP jobs dropped -123k as pandemic impact intensifies

US ADP employment dropped -123k in December, much worse than expectation of 75k growth. By company size, large businesses cut -147k jobs. Medium business added 37k jobs while small businesses cut -13k. By sector, goods-producing companies cut -18k jobs while service-providing companies cut -105k jobs.

“As the impact of the pandemic on the labor market intensifies, December posted the first decline since April 2020,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The job losses were primarily concentrated in retail and leisure and hospitality.”

Eurozone PPI at 0.4% mom, -1.9% yoy in November

Eurozone PPI came in at 0.4% mom, -1.9% yoy in November, above expectation of 0.1% mom, -2.2% yoy. Industrial producer prices increased by 1.3% mom in the energy sector, by 0.3% mom for intermediate goods and by 0.1% mom for durable consumer goods, while prices remained stable for capital goods and non-durable consumer goods. Prices in total industry excluding energy increased by 0.1% mom.

EU PPI came in at 0.4% mom, -1.8% yoy. The highest increases in industrial producer prices were recorded in Denmark and France (both +1.7% mom), Estonia (+1.2% mom) and Romania (+1.1% mom), while the largest decreases were observed in Ireland (-1.4% mom), Slovakia (-0.7% mom) and Czechia (-0.5% mom).

Eurozone PMI composite finalized at 49.1, worse may be yet to come

Eurozone PMI Services was finalized at 46.4 in December, up from November’s 41.7. PMI Composite was finalized at 49.1, up from November’s 45.3. Looking at some member states, Ireland PMI Composite rose to 53.4, a 4-month high. Germany rose to 52.0, 2-month high. France rose to 49.5, 4-month high. Spain rose to 48.7, 5-month high. Italy rose to 43.0, 2-month high.

Chris Williamson, Chief Business Economist at IHS Markit said: “The eurozone economy contracted for a second successive month in December, deteriorating at a slightly faster rate than previously thought at the end of the year due to intensifying COVID-19 restrictions… Worse may be yet to come before things get better, especially as the latest survey data were collected before the news of the new – more contagious – strain of the virus…. The risk of a technical recession, with GDP also falling in the first quarter has therefore risen.

UK PMI composite finalized at 50.4, business optimism relatively upbeat on a 12-month horizon

UK PMI services was finalized at 49.9 in December, up from November’s 47.6, but still below 50 no-change threshold. PMI Composite was finalized at 50.4, edged from from November’s 49.0.

Tim Moore, Economics Director at IHS Markit: “With a third national lockdown underway, service providers will be braced for a sustained period of subdued UK economic conditions and deferred client spending in the first quarter of this year. However, business optimism on a 12-month horizon was relatively upbeat in December and reached its highest level for almost six years, underpinned by hopes that a successful vaccine roll-out will help to deliver a strong economic rebound in the second half of 2021.”

China Caixin PMI services dropped to 56.3, recovery to continue for several months

China Caixin PMI Services dropped to 56.3 in December, down from 57.8, missed expectation of 58.1. Markit said that business activity and new orders both increased at softest rates for three months. Though, optimism towards the year ahead edged up to highest since April 2011. The sharp rise in costs drove steepest increase in output charges for nearly 13 years.

PMI Composite dropped to 55.8, from a more than 10-year high of 57.5. Wang Zhe, Senior Economist at Caixin Insight Group said: “Looking ahead, we expect the post-epidemic economic recovery to continue for several months, and macroeconomic indicators will be stronger over the next six months due to the low bases in the first half of 2020. Entrepreneurs were confident about further improvement to the economy in the upcoming year.

“Meanwhile, we need to pay attention to the mounting pressure on costs brought by the increase in raw material prices and its adverse impact on employment, which is particularly important to figuring out how to exit the stimulus policies implemented during the epidemic.”

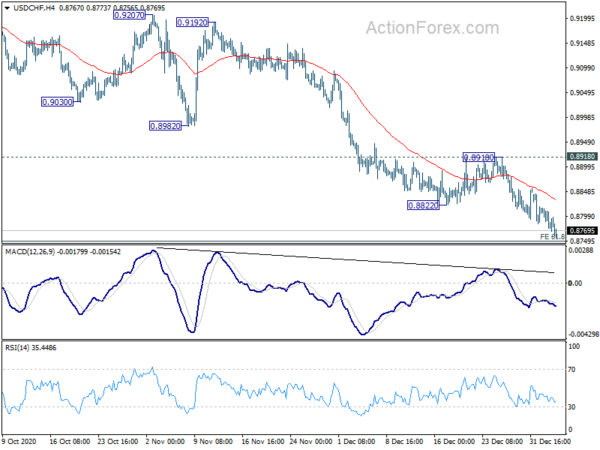

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8768; (P) 0.8792; (R1) 0.8809; More….

Intraday bias in USD/CHF remains on the downside for 61.8% projection of 0.9901 to 0.8998 from 0.9304 at 0.8746. Decisive break there will pave the way to long term projection level at 0.8639. In any case, outlook will remain bearish as long as 0.8918 resistance holds, even in case of strong recovery.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). There is no clear sign of completion yet. Next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. In any case, break of 0.9304 resistance is needed to signal medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | BRC Shop Price Index Y/Y Nov | -1.80% | -1.80% | ||

| 01:45 | CNY | Caixin Services PMI Dec | 56.3 | 58.1 | 57.8 | |

| 05:00 | JPY | Consumer Confidence Index Dec | 31.8 | 32.6 | 33.7 | |

| 08:45 | EUR | Italy Services PMI Dec | 39.7 | 45 | 39.4 | |

| 08:50 | EUR | France Services PMI Dec F | 49.1 | 49.2 | 49.2 | |

| 08:55 | EUR | Germany Services PMI Dec F | 47 | 47.7 | 47.7 | |

| 09:00 | EUR | Eurozone Services PMI Dec F | 46.4 | 47.3 | 47.3 | |

| 09:30 | GBP | Services PMI Dec | 49.4 | 49.9 | 49.9 | |

| 10:00 | EUR | PPI M/M Nov | 0.40% | 0.10% | 0.40% | |

| 10:00 | EUR | PPI Y/Y Nov | -1.90% | -2.20% | -2.00% | |

| 13:00 | EUR | Germany CPI M/M Dec P | 0.50% | 0.60% | -0.80% | |

| 13:00 | EUR | Germany CPI Y/Y Dec P | -0.30% | -0.20% | -0.30% | |

| 13:15 | USD | ADP Employment Change Dec | -123K | 75K | 307K | 304K |

| 14:45 | USD | Services PMI Dec F | 55.3 | 55.3 | ||

| 15:00 | USD | Factory Orders M/M Nov | 0.70% | 1.00% | ||

| 15:30 | USD | Crude Oil Inventories | -2.8M | -6.1M | ||

| 19:00 | USD | FOMC Minutes |